BofA On Stock Market Valuations: A Case For Calm

Table of Contents

BofA's Key Arguments for a Calmer Market Outlook

BofA's optimistic outlook rests on several key pillars, each supported by extensive research and data analysis. Let's delve into their core arguments:

Moderating Inflation and its Impact: BofA's analysis points towards a significant moderation in inflation. While inflation remains a concern, the trend suggests a peak may have been reached.

- Evidence of Slowing Inflation: Recent CPI and PPI data indicate a slowing pace of price increases. This is supported by declining commodity prices and easing supply chain pressures.

- Anticipated Federal Reserve Actions: BofA anticipates the Federal Reserve will continue to raise interest rates, but at a slower pace than previously projected. This measured approach aims to curb inflation without triggering a sharp economic downturn.

- Potential Impact on Corporate Earnings: While higher interest rates can impact borrowing costs, BofA believes the anticipated moderation in inflation will positively impact corporate profit margins, leading to more resilient earnings.

Resilient Corporate Earnings: Despite economic headwinds, BofA notes remarkable resilience in corporate earnings. Many sectors are demonstrating surprising strength, defying initial recessionary predictions.

- Key Sectors Showing Strength: The technology and energy sectors, among others, have shown robust earnings growth. This indicates underlying strength in the economy that may offset some negative factors.

- Expected Profit Margins: While profit margins may be squeezed slightly by higher interest rates and input costs, BofA forecasts these will remain healthy enough to support stock valuations.

- Factors Contributing to Earnings Resilience: Strong consumer demand in some areas, effective cost-cutting measures implemented by companies, and strategic investments are cited as major contributors to earnings resilience.

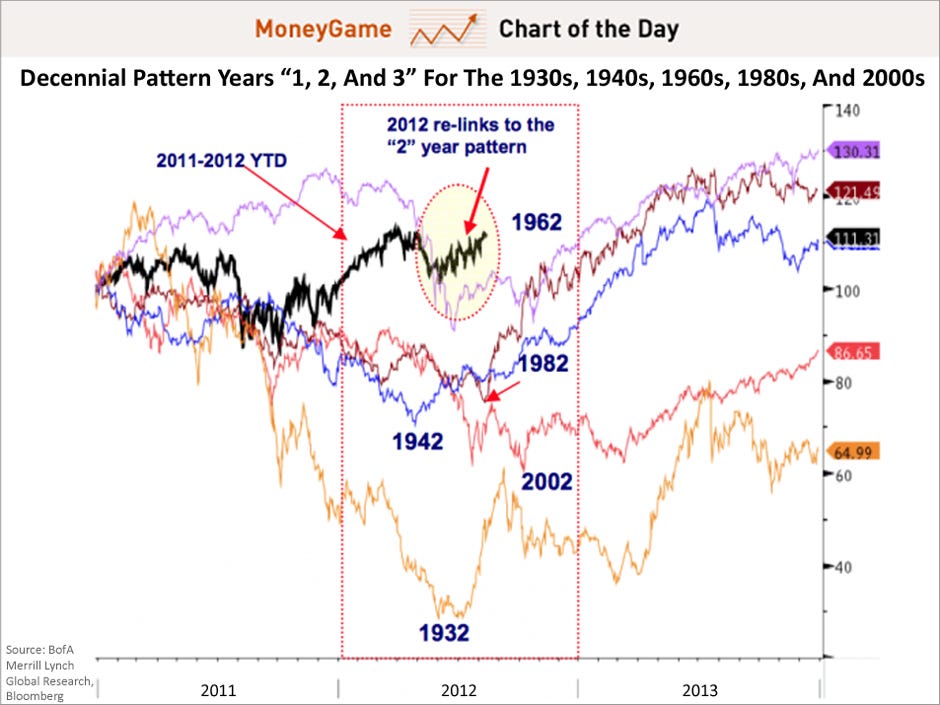

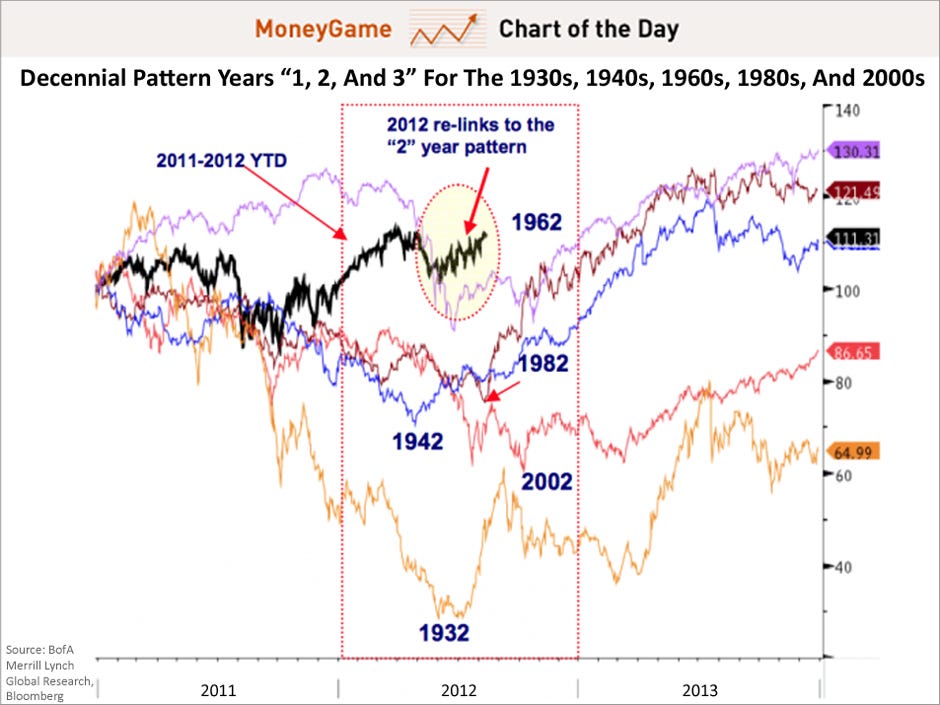

Valuation Metrics and Their Implications: BofA utilizes various valuation metrics to assess the current market. Their analysis suggests that while some sectors might appear richly valued, the overall market is not drastically overvalued, especially when considering long-term growth prospects.

- Specific Valuation Metrics Used: BofA employs multiple metrics, including Price-to-Earnings (P/E) ratios, Price-to-Sales (P/S) ratios, and other relevant indicators, to establish a comprehensive valuation picture.

- Comparison to Historical Averages: BofA's analysis compares current valuations to historical averages, suggesting that while not necessarily cheap, current valuations are not exceptionally high compared to past market cycles.

- BofA's Interpretation of the Data: Based on their comprehensive analysis, BofA concludes that the current market valuations are largely reflective of the underlying economic fundamentals and long-term growth potential.

Addressing Potential Market Risks

While BofA presents a relatively optimistic outlook, it's crucial to acknowledge potential risks that could impact stock market valuations.

Geopolitical Uncertainty and its Influence: The ongoing war in Ukraine, rising geopolitical tensions, and global instability remain significant sources of uncertainty.

- BofA's Assessment of These Risks: BofA acknowledges these risks but believes their impact on overall market valuations will likely be contained, especially if inflation continues to moderate.

- Potential Mitigating Factors: The resilience of certain sectors and the adaptability of global economies could help mitigate the impact of geopolitical events.

- Strategies for Navigating Uncertainty: BofA suggests diversifying investments across different asset classes and geographies to reduce exposure to specific geopolitical risks.

Interest Rate Hikes and Their Effects: Further interest rate increases by the Federal Reserve could negatively impact corporate borrowing costs and potentially slow economic growth.

- BofA's Forecast for Interest Rates: BofA anticipates further rate hikes, but at a more gradual pace as inflation cools.

- The Potential Effect on Borrowing Costs: Higher interest rates will undoubtedly increase borrowing costs for businesses, potentially slowing down investment and expansion plans.

- Implications for Businesses and Investors: Businesses might need to adjust their strategies in response to higher borrowing costs, while investors should consider the impact on the valuation of companies with high debt levels.

Potential for Recession: While BofA doesn't predict a certain recession, they acknowledge the possibility and its potential impact on the stock market.

- BofA’s Probability Assessment of a Recession: BofA assigns a probability to a recession but notes this is subject to ongoing economic data and unexpected events.

- The Likely Severity: Even if a recession occurs, BofA anticipates it will be relatively mild compared to previous downturns.

- How It Could Influence Investment Strategies: A potential recession would likely necessitate adjusting investment strategies to favor more defensive sectors and possibly increasing cash holdings.

BofA's Recommended Investment Strategies

Based on their analysis, BofA advocates for a calm and measured approach to investing.

Long-Term Investing as a Key Strategy: BofA emphasizes the importance of a long-term perspective when it comes to investing.

- Advantages of Long-Term Investing: Long-term investing allows investors to ride out short-term market fluctuations and benefit from the long-term growth potential of the market.

- Mitigating Short-Term Volatility: A long-term focus reduces the emotional impact of short-term market volatility.

- Focusing on Fundamental Analysis: Rather than reacting to daily market news, BofA advises investors to focus on conducting thorough fundamental analysis of companies and sectors.

Diversification and Risk Management: Diversification across asset classes and risk management remain cornerstones of a robust investment strategy.

- Asset Allocation Strategies Recommended by BofA: BofA likely suggests diversifying across various asset classes, including stocks, bonds, and potentially alternative investments, to mitigate overall portfolio risk.

- Techniques for Managing Portfolio Risk: Techniques like rebalancing, stop-loss orders, and hedging strategies can be used to manage portfolio risk.

- Hedging Strategies: BofA may recommend specific hedging strategies to protect against potential market downturns.

Conclusion:

BofA's analysis presents a compelling case for a calmer market outlook, highlighting the resilience of corporate earnings, moderating inflation, and the crucial role of long-term investment strategies. While acknowledging potential risks, their assessment suggests that the current market is not drastically overvalued and offers opportunities for long-term growth. Don't let market volatility dictate your investment decisions. Understand BofA's perspective on stock market valuations and build a robust long-term investment strategy today! For a deeper dive into their research and recommendations, explore BofA's official reports and publications.

Featured Posts

-

The Canadian Dollar A Complex Picture In The Global Currency Market

Apr 24, 2025

The Canadian Dollar A Complex Picture In The Global Currency Market

Apr 24, 2025 -

Analyzing The Canadian Dollars Performance Against Global Currencies

Apr 24, 2025

Analyzing The Canadian Dollars Performance Against Global Currencies

Apr 24, 2025 -

Bitcoin Price Surge Trumps Actions And Fed Policy Impact

Apr 24, 2025

Bitcoin Price Surge Trumps Actions And Fed Policy Impact

Apr 24, 2025 -

Us Stock Futures Surge Trumps Powell Comments Boost Markets

Apr 24, 2025

Us Stock Futures Surge Trumps Powell Comments Boost Markets

Apr 24, 2025 -

Stock Market Rally Futures Soar On Trumps Commitment To Powell

Apr 24, 2025

Stock Market Rally Futures Soar On Trumps Commitment To Powell

Apr 24, 2025