BofA On Stock Market Valuations: A Case For Investor Calm

Table of Contents

BofA's Key Findings on Stock Market Valuations

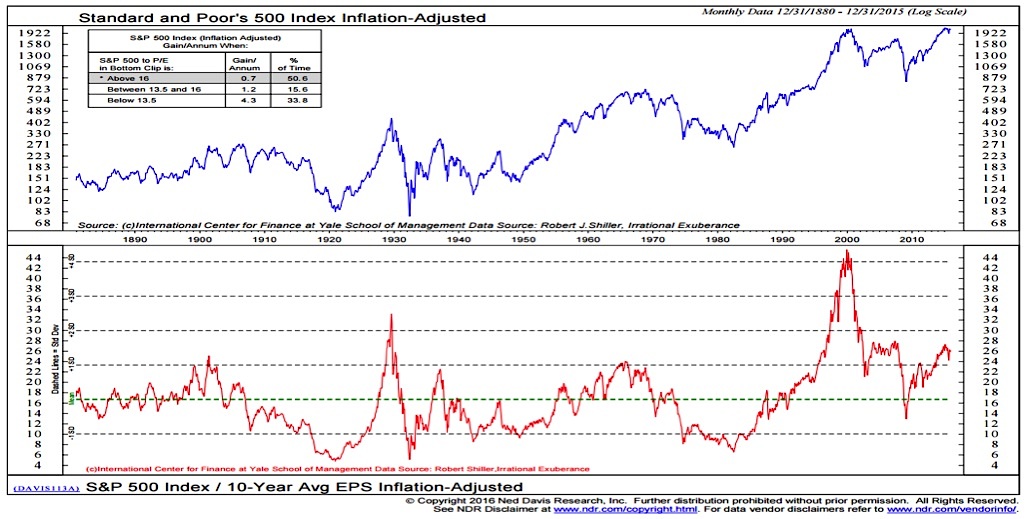

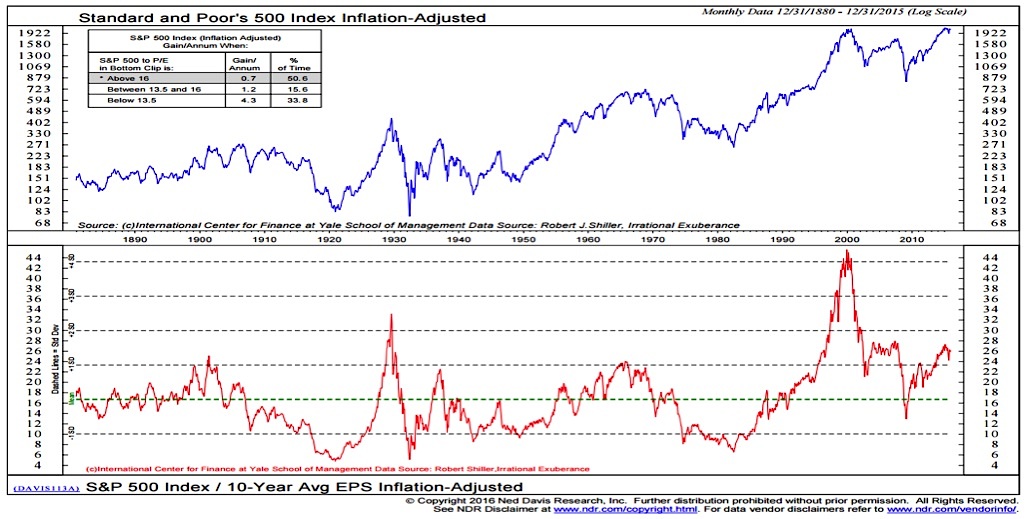

BofA's recent report on stock market valuations presents a nuanced view, arguing against extreme pessimism. While acknowledging the challenges posed by macroeconomic factors, BofA's analysis suggests that current valuations, while not necessarily cheap, are not wildly overinflated either. Their assessment relies on several key metrics.

- Specific data points: BofA cites a relatively moderate price-to-earnings ratio (P/E) for the S&P 500, suggesting that while not historically low, it's not at alarmingly high levels compared to previous economic cycles. They also considered the cyclically adjusted price-to-earnings ratio (CAPE), finding it to be within a reasonable range considering the current economic climate. Furthermore, dividend yields are showing a level of attractiveness compared to bond yields for some sectors.

- Specific sectors/indices: The report highlights that certain sectors, such as technology and healthcare, might present better value than others, like energy, which has seen significant price appreciation in recent years. The analysis likely looked at various indices, including the S&P 500, Nasdaq Composite, and potentially sector-specific indices to arrive at their overall conclusions.

- Investment strategies: BofA’s suggested strategies are likely focused on diversification and a long-term approach, potentially recommending a balanced portfolio approach including both equities and fixed-income instruments.

Understanding the Context: Macroeconomic Factors and Their Impact

BofA's analysis of stock market valuations wouldn't be complete without considering the broader macroeconomic context. Several factors significantly influence stock prices.

- Inflation and stock valuations: High inflation erodes purchasing power and can lead to higher interest rates, negatively impacting stock valuations as investors demand higher returns. BofA likely factored in current and projected inflation rates into their models.

- Interest rate hikes and investment attractiveness: Interest rate hikes by central banks increase borrowing costs, making it more expensive for businesses to invest and potentially slowing economic growth. This can reduce corporate earnings and put downward pressure on stock prices. BofA's assessment would consider the impact of expected future interest rate changes on discount rates used in valuation models.

- Recession risks and valuations: The potential for a recession is a major concern for investors. A recession typically leads to lower corporate earnings and decreased stock valuations. BofA likely incorporated various recessionary scenarios into their analysis to assess the potential impact on stock prices. This may have involved stress testing different valuation models under various economic conditions.

Why BofA's Assessment Suggests Investor Calm

BofA's relatively optimistic outlook isn't based on ignoring the risks; rather, it stems from a careful assessment of the current situation and a long-term perspective.

- Justification for calm: The bank's assessment suggests that current market corrections, while potentially painful in the short term, are not necessarily indicative of a major market crash. The valuation metrics used suggest that the market isn't drastically overvalued, leaving room for potential growth in the future.

- Potential for long-term growth: BofA likely points to the potential for long-term growth driven by technological advancements, demographic shifts, and global economic expansion, arguing that market dips present opportunities for long-term investors.

- Acknowledged risks: While suggesting a relatively calm approach, BofA certainly acknowledges the risks. Geopolitical uncertainty, persistent inflation, and the potential for a deeper recession are undoubtedly included in their risk assessments.

Practical Implications for Investors

Based on BofA's assessment, investors should consider the following:

- Portfolio adjustments: Maintaining a diversified portfolio is crucial. Based on BofA's sector-specific insights, investors may want to review their holdings and consider rebalancing their portfolios towards sectors identified as potentially undervalued.

- Risk management strategies: Employing appropriate risk management strategies, such as dollar-cost averaging or stop-loss orders, can help mitigate potential losses during market downturns.

- Diversification and asset allocation: Maintain a well-diversified portfolio across different asset classes (stocks, bonds, real estate, etc.) to reduce overall portfolio risk. Asset allocation should reflect your individual risk tolerance and investment goals.

Conclusion: Maintaining Investor Calm in Light of BofA's Stock Market Valuation Analysis

BofA's report on stock market valuations offers a reasoned and balanced perspective, suggesting that while challenges exist, current valuations don't necessarily warrant extreme panic. Their analysis highlights that while macroeconomic headwinds are present, certain metrics suggest the market is not drastically overvalued. Maintaining a long-term perspective, focusing on diversification, and employing sound risk management are key takeaways. Understanding BofA's perspective on stock market valuations is crucial for maintaining investor calm. Review the full BofA report and consult with a financial advisor to create a personalized investment plan that aligns with your long-term objectives. Remember, a well-informed investment strategy is the foundation of successful long-term investing, even amidst market volatility.

Featured Posts

-

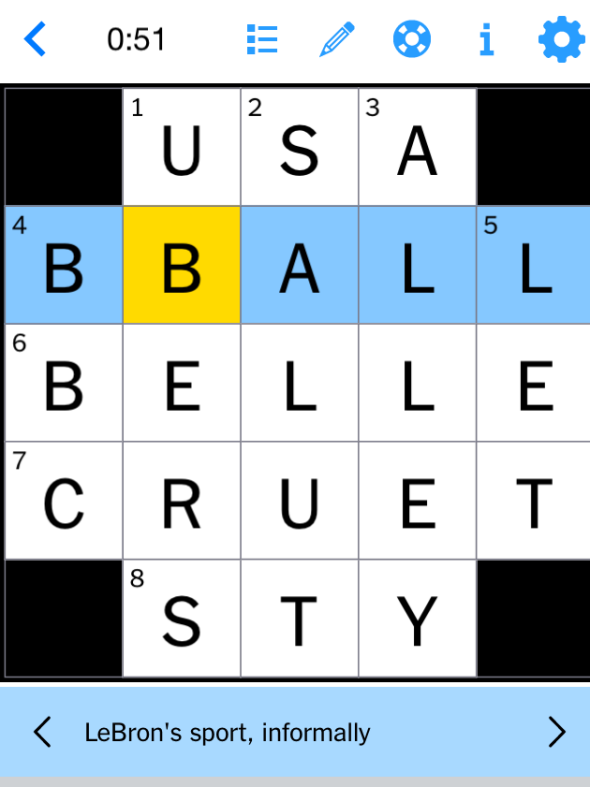

Nyt Mini Crossword Solution March 16 2025

May 20, 2025

Nyt Mini Crossword Solution March 16 2025

May 20, 2025 -

Matheus Cunha Transfer Target For Both Man United And Arsenal

May 20, 2025

Matheus Cunha Transfer Target For Both Man United And Arsenal

May 20, 2025 -

Complete Answers Nyt Mini Crossword March 31

May 20, 2025

Complete Answers Nyt Mini Crossword March 31

May 20, 2025 -

Novini Z Gollivudu Dzhennifer Lourens Vdruge Stala Matir Yu

May 20, 2025

Novini Z Gollivudu Dzhennifer Lourens Vdruge Stala Matir Yu

May 20, 2025 -

D Wave Quantum Inc Qbts Stock Surge Reasons Behind Todays Jump

May 20, 2025

D Wave Quantum Inc Qbts Stock Surge Reasons Behind Todays Jump

May 20, 2025