BofA On Stock Market Valuations: A Reason For Optimism

Table of Contents

BofA's Current Valuation Assessment

BofA employs a sophisticated multi-faceted approach to assess stock market valuations, drawing on a range of established financial models. Their analysis isn't simply a gut feeling; it's data-driven, incorporating rigorous quantitative methods. Key methodologies include:

- Price-to-Earnings (P/E) ratios: Analyzing the relationship between a company's stock price and its earnings per share to gauge relative valuation.

- Discounted Cash Flow (DCF) models: Projecting future cash flows and discounting them back to their present value to estimate intrinsic value.

- Comparable Company Analysis: Benchmarking against similar companies in the same industry to determine relative valuation.

BofA's recent reports suggest a nuanced view of current valuations. While certain sectors might be deemed overvalued, others appear to present attractive opportunities. Their findings, while not explicitly stating "undervalued," lean towards a more positive outlook than many other analysts. For instance, BofA might highlight that while the overall market P/E ratio is elevated compared to its historical average, it's not necessarily at bubble levels considering projected earnings growth.

- Specific valuation metrics used: P/E ratios, Price-to-Sales (P/S) ratios, and Enterprise Value to EBITDA (EV/EBITDA).

- Key sectors highlighted: BofA's analysis may point towards technology, healthcare, or specific sub-sectors within these broader areas as potentially undervalued or showing strong growth prospects. Conversely, they may flag overvalued sectors like certain consumer discretionary areas.

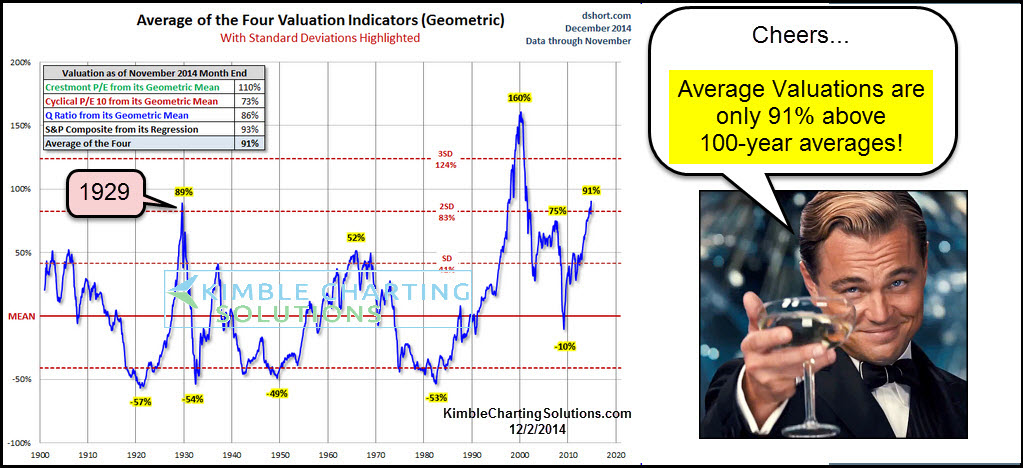

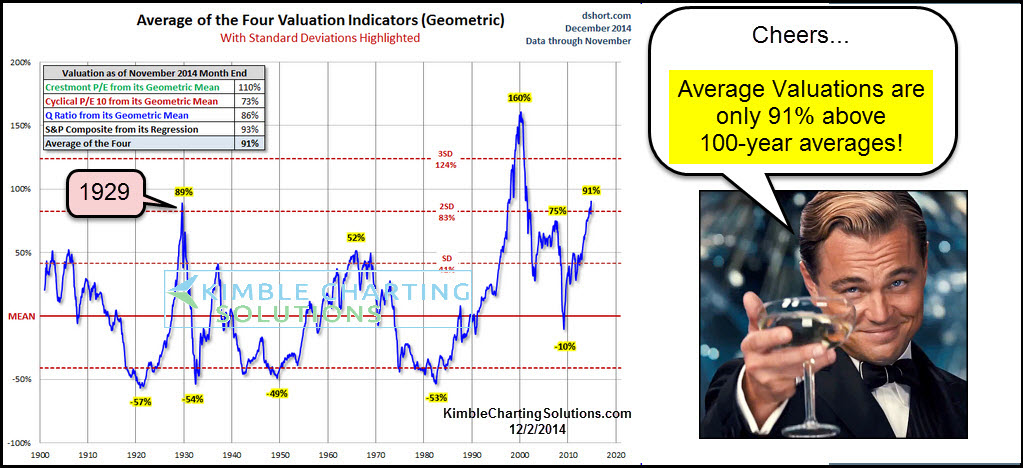

- Comparison to historical levels: BofA's reports likely contextualize current valuations against historical averages, highlighting periods of similar valuation levels and subsequent market performance.

Factors Contributing to BofA's Optimism

BofA's optimistic outlook isn't based solely on valuation metrics; it considers several broader macroeconomic and geopolitical factors.

- Potential for earnings growth: BofA’s analysts likely project robust earnings growth for the S&P 500, driven by factors like ongoing technological advancements, increased consumer spending (depending on economic conditions), and corporate efficiency improvements.

- Interest rate expectations: While higher interest rates can impact valuations, BofA's analysis might incorporate expectations for interest rate hikes to eventually plateau, potentially leading to improved market sentiment. They may argue that higher rates are a necessary evil to combat inflation.

- Inflation trends: BofA likely considers the potential for inflation to moderate over time, reducing its negative impact on corporate profits and stock prices. Their analysis might include scenarios of inflation cooling, allowing for stronger earnings growth in the future.

Geopolitically, while uncertainties exist, BofA's analysis may incorporate probabilities of various outcomes. For example, a de-escalation of geopolitical tensions could positively impact investor confidence and boost market valuations.

Potential Risks and Caveats

Despite BofA's optimism, it's crucial to acknowledge potential risks. No analysis is foolproof, and even the most sophisticated models have limitations.

- Recessionary risks: BofA likely acknowledges the possibility of a recession, which would significantly impact corporate earnings and stock prices. This is a major risk to their optimistic outlook.

- Geopolitical instability: Unexpected geopolitical events can trigger market volatility and negatively impact valuations, regardless of underlying fundamentals.

- Unexpected inflation spikes: A resurgence of high inflation could derail the anticipated moderation and negatively affect corporate profits.

BofA's analysis likely accounts for these risks through scenario planning and sensitivity analysis. However, investors must understand that unforeseen events could invalidate the optimistic predictions.

- Specific downside risks: BofA may detail specific scenarios, such as a prolonged period of high inflation or a deeper-than-expected recession, and their potential impact on market valuations.

- Scenarios invalidating positive assessment: The analysis probably includes scenarios that would lead to a less favorable market outcome, highlighting the limitations of the optimistic forecast.

- Risk mitigation strategies: Investors can mitigate risks through diversification (across different asset classes and sectors), hedging strategies, and careful position sizing.

Investment Strategies Based on BofA's Analysis

BofA's analysis can inform investment strategies, but it shouldn't be the sole determinant. Investors should use it as one input among many.

- Favored sectors/asset classes: BofA may recommend overweighting specific sectors identified as relatively undervalued or with strong growth potential, according to their assessment.

- Investment strategies: Depending on their findings, BofA may suggest value investing (focus on undervalued companies) or growth investing (focus on companies with high growth potential) or a balanced approach.

- Portfolio diversification: A diversified portfolio, spread across different asset classes and sectors, remains a crucial risk mitigation strategy, regardless of any specific analyst's outlook.

Conclusion: BofA's Positive Stock Market Valuation Outlook: A Call to Action

BofA's analysis suggests potential reasons for optimism regarding current stock market valuations, highlighting several factors supportive of a positive outlook. However, it's crucial to remember that inherent risks and uncertainties remain. BofA's insights should be one piece of the puzzle in your investment decision-making process. Conduct thorough research, carefully consider your risk tolerance and financial goals, and consult with a financial advisor before making any investment decisions. Remember to explore BofA's reports on stock market valuations for a more comprehensive understanding. Don't just rely on summaries; delve into the details to make truly informed investment choices based on your own risk profile and investment objectives. Understanding BofA's perspective on stock market valuations is a valuable step in navigating the complexities of today's markets.

Featured Posts

-

Despite Apple Price Target Cut Wedbushs Bullish Outlook Should You Buy

May 24, 2025

Despite Apple Price Target Cut Wedbushs Bullish Outlook Should You Buy

May 24, 2025 -

Die Beliebteste Eissorte In Nrw Ein Ueberraschendes Ergebnis

May 24, 2025

Die Beliebteste Eissorte In Nrw Ein Ueberraschendes Ergebnis

May 24, 2025 -

Is Sean Penns Defense Of Woody Allen A Me Too Failure

May 24, 2025

Is Sean Penns Defense Of Woody Allen A Me Too Failure

May 24, 2025 -

Komplettes Line Up Fuer San Hejmo Konzert In Essen Veroeffentlicht

May 24, 2025

Komplettes Line Up Fuer San Hejmo Konzert In Essen Veroeffentlicht

May 24, 2025 -

Camunda Con Amsterdam 2025 Orchestrating Ai And Automation For Business Success

May 24, 2025

Camunda Con Amsterdam 2025 Orchestrating Ai And Automation For Business Success

May 24, 2025