BofA On Stock Market Valuations: Addressing Investor Concerns

Table of Contents

BofA's Current Valuation Assessment

BofA's current assessment of stock market valuations is nuanced, avoiding blanket statements of "overvalued" or "undervalued." Their analysis employs a multifaceted approach, considering a variety of economic indicators and market trends. Instead of a single definitive conclusion, BofA's reports suggest a more sector-specific approach, identifying pockets of opportunity and risk.

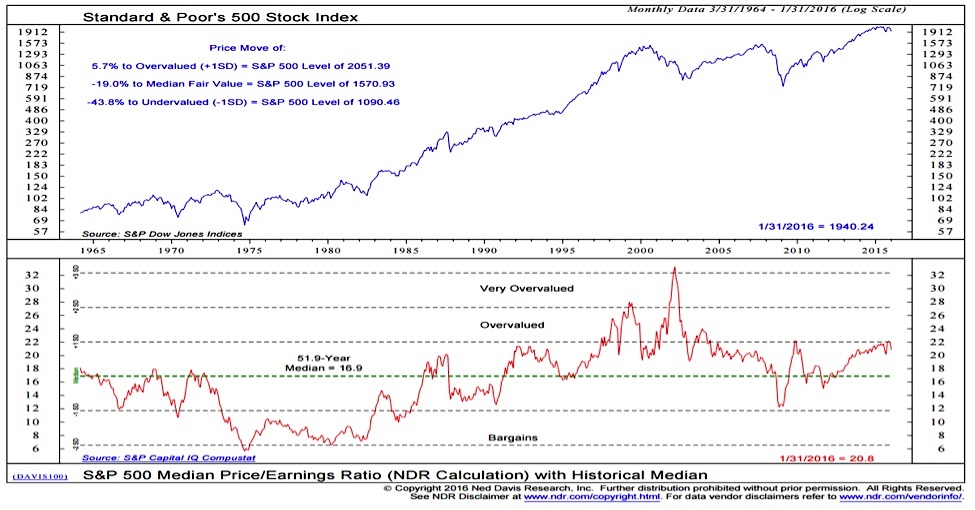

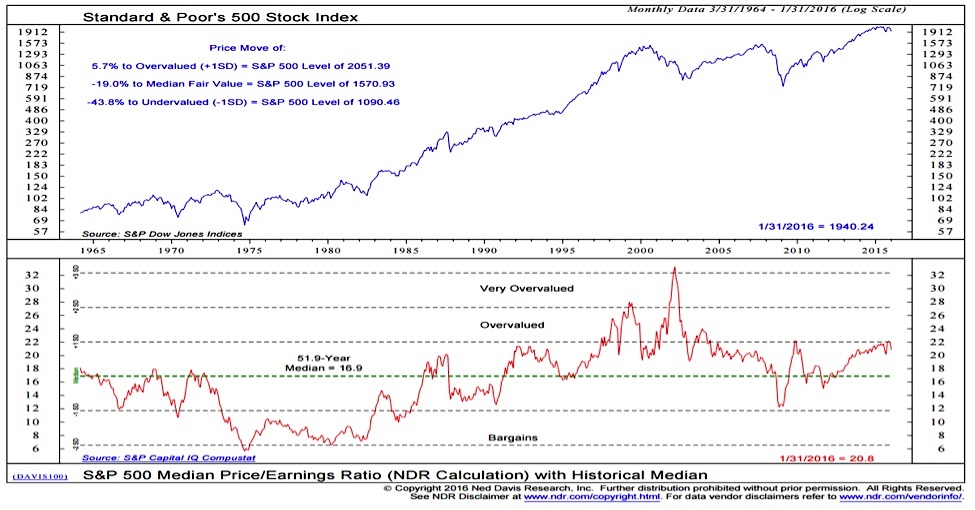

- Key valuation ratios and their current levels according to BofA: BofA frequently utilizes metrics like Price-to-Earnings (P/E) ratios, Price-to-Sales (P/S) ratios, and dividend yields to gauge market valuations. Their recent reports may highlight specific sectors where these ratios deviate significantly from historical averages. For example, they may identify a sector with inflated P/E ratios suggesting potential overvaluation.

- Comparison to historical averages and benchmarks: BofA's analyses typically compare current market valuations to long-term historical averages and benchmarks, providing context for current levels. This historical perspective allows for a more informed assessment of whether current valuations represent a significant deviation from the norm. They might note that certain sectors are trading at premiums compared to their historical averages.

- Specific sectors or industries BofA highlights as particularly overvalued or undervalued: BofA's research frequently pinpoints specific sectors showing signs of either overvaluation or undervaluation. For instance, they may highlight the technology sector as potentially overvalued due to high growth expectations, while pointing to undervalued opportunities within the energy sector. These sector-specific assessments provide valuable granular insight for investors.

Addressing Key Investor Concerns

Investor anxiety is currently fueled by several factors: inflation, interest rate hikes, recession risks, and geopolitical instability. BofA directly addresses these concerns in its regular market commentaries and reports.

- Inflation concerns and BofA's outlook on its impact on valuations: BofA's economists closely monitor inflation data and its potential impact on corporate earnings and stock valuations. Their analysis often explores how rising inflation might affect company profit margins and investor sentiment.

- Interest rate hike impact on stock prices according to BofA’s predictions: The Federal Reserve's interest rate hikes have a direct bearing on stock prices. BofA models the potential impact of these hikes on corporate borrowing costs and investor risk appetite, offering insights into how rate changes affect valuations.

- BofA’s assessment of recession probabilities and its influence on market valuations: Recessionary risks significantly impact stock market valuations. BofA incorporates macroeconomic indicators and economic forecasts into their models to assess recession probabilities and their likely influence on market performance. They may discuss the impact of a potential recession on different sectors.

- Geopolitical risks and BofA's analysis of their effect on stock market performance: Global geopolitical events, such as the ongoing conflict in Ukraine, significantly impact market sentiment and valuations. BofA analyzes the potential consequences of such events, assessing their impact on various sectors and the overall market.

BofA's Recommendations and Investment Strategies

Based on their valuation assessment and analysis of market risks, BofA offers investment strategies tailored to various risk profiles.

- Specific investment recommendations from BofA: BofA's recommendations often involve a balanced approach, incorporating a mix of asset classes and sectors. They may suggest exposure to value stocks in specific sectors or emphasize the importance of diversifying across asset classes like stocks and bonds.

- Risk tolerance considerations: BofA's recommendations always consider investor risk tolerance. They would likely advocate for a more conservative approach for risk-averse investors while suggesting higher-risk investments for those with a higher tolerance.

- Diversification strategies: BofA emphasizes the importance of diversification to mitigate risk. Their investment strategies usually promote diversification across different sectors, asset classes, and geographies.

- Long-term vs. short-term investment horizons: BofA’s advice considers both short-term and long-term investment goals. They would likely advise long-term investors to remain focused on their investment goals despite short-term market fluctuations.

Alternative Perspectives and Cautions

While BofA's analysis is highly regarded, it's crucial to acknowledge alternative perspectives and potential limitations.

- Mention other prominent financial institutions’ analyses and their differing views (if any): It is important to note that other financial institutions may have slightly different views on market valuations. Comparing BofA's assessment with other reputable analyses can provide a more comprehensive picture.

- Discuss potential risks and uncertainties not fully captured in BofA's analysis: No analysis is perfect. Unforeseen events or shifts in market sentiment could impact the accuracy of BofA's predictions. It is crucial to acknowledge these inherent uncertainties.

- Emphasize the importance of independent research and due diligence: Investors should always conduct their own thorough research and due diligence before making any investment decisions, relying on multiple sources and considering their own financial circumstances.

Conclusion: Making Informed Decisions Based on BofA Stock Market Valuations

BofA's insights into stock market valuations provide a valuable framework for investors navigating current market uncertainties. Their analysis highlights the importance of considering sector-specific valuations, addressing inflation, interest rate hikes, recessionary risks, and geopolitical factors. While BofA's recommendations offer valuable guidance, remember that independent research and a clear understanding of your own risk tolerance are crucial for making informed investment choices. Stay informed about BofA's ongoing analysis of stock market valuations to make well-informed investment choices. [Link to BofA's investment research resources].

Featured Posts

-

Danse Avec Les Stars La Polemique Autour De L Elimination D Ines Reg

May 12, 2025

Danse Avec Les Stars La Polemique Autour De L Elimination D Ines Reg

May 12, 2025 -

Pokhudenie Dzhessiki Simpson Podrobnosti Diety I Trenirovok

May 12, 2025

Pokhudenie Dzhessiki Simpson Podrobnosti Diety I Trenirovok

May 12, 2025 -

Mueller Et Le Bayern Victoire Face A L Inter En Quarts De Ligue Des Champions

May 12, 2025

Mueller Et Le Bayern Victoire Face A L Inter En Quarts De Ligue Des Champions

May 12, 2025 -

Celtics Guard Payton Pritchard Wins Prestigious Nba Sixth Man Award

May 12, 2025

Celtics Guard Payton Pritchard Wins Prestigious Nba Sixth Man Award

May 12, 2025 -

Win Tickets Sold Out Tales From The Track Presented By Relay

May 12, 2025

Win Tickets Sold Out Tales From The Track Presented By Relay

May 12, 2025