BofA On Stock Market Valuations: Reasons For Investor Optimism

Table of Contents

BofA's Bullish Stance on Current Stock Market Valuations

BofA's overall assessment is cautiously optimistic, highlighting several factors that outweigh current market uncertainties. Their analysis suggests that despite ongoing economic challenges, the market may be undervalued, presenting attractive opportunities for investors. This positive stance is primarily supported by three key pillars: strong corporate earnings, the potential for interest rate cuts, and attractive valuation metrics.

Strong Corporate Earnings Despite Economic Headwinds

BofA's research indicates that corporate earnings have shown remarkable resilience in the face of economic headwinds. Many sectors have exceeded expectations, demonstrating the underlying strength of the corporate sector.

- Examples of sectors exceeding expectations: Technology, healthcare, and consumer staples have shown particular strength, defying predictions of a broader economic slowdown.

- Evidence of resilient profit margins: Despite rising costs, many companies have managed to maintain healthy profit margins, indicating effective cost management and pricing strategies.

- Specific BofA reports or analysts cited: BofA's Global Research team, led by Savita Subramanian, has been vocal in highlighting these trends in various publications and presentations, including their regularly released "US Equity Strategy" reports. These reports provide detailed analysis supporting their claims.

Potential for Interest Rate Cuts by the Federal Reserve

BofA anticipates that the Federal Reserve (Fed) may begin to cut interest rates sooner than some market participants expect. This perspective is based on their analysis of inflation trends and the potential impact on economic growth.

- Analysis of inflation trends and their influence on Fed decisions: BofA's analysts believe that inflation is peaking or has already peaked, allowing the Fed to ease its monetary policy. They monitor key inflation indicators like the CPI and PCE indices closely.

- BofA's predictions regarding future interest rate adjustments: While specific timelines vary in their predictions, BofA generally suggests a potential for rate cuts in the latter half of the year, depending on economic data.

- How lower interest rates could benefit stock prices: Lower interest rates typically boost stock prices by reducing borrowing costs for companies and making equities a more attractive investment compared to bonds.

Attractive Valuation Metrics Despite Recent Market Volatility

Despite recent market volatility, BofA's analysis suggests that many stocks are trading at attractive valuations. They compare current metrics to historical averages and future earnings projections to support this claim.

- Specific valuation metrics highlighted by BofA: BofA likely focuses on Price-to-Earnings (P/E) ratios, Price-to-Sales (P/S) ratios, and other key metrics to assess relative valuations.

- Comparison to historical market valuations: Their analysis compares current valuation multiples to historical averages to determine whether current prices represent a discount to long-term value.

- Explanation of why BofA considers current valuations attractive: BofA's reasoning likely centers on the belief that the current market undervalues the resilience of corporate earnings and the potential for future growth, supported by expected interest rate cuts.

Counterarguments and Potential Risks Addressed by BofA

While BofA maintains a relatively optimistic outlook, their analysis also acknowledges potential risks and counterarguments.

Persistent Inflationary Pressures

BofA acknowledges that persistent inflationary pressures could negatively impact corporate profits and consumer spending, potentially dampening economic growth and stock market performance. Their analysis carefully weighs the likelihood of inflation remaining elevated versus moderating.

Geopolitical Uncertainty and Its Influence on Markets

Geopolitical uncertainty, including ongoing conflicts and trade tensions, remains a significant risk factor. BofA's projections incorporate assessments of these uncertainties and their potential impact on market sentiment and economic stability.

Potential for Recessionary Scenarios

BofA's analysis considers various recessionary scenarios and their potential impact on stock valuations. They present probability estimates and assess the likely severity of any downturn. This involves examining leading economic indicators and historical precedent to build a comprehensive risk assessment.

Conclusion

BofA's analysis paints a cautiously optimistic picture of BofA Stock Market Valuations, emphasizing the resilience of corporate earnings, the potential for interest rate cuts, and attractive valuation metrics as key drivers for investor optimism. While acknowledging risks such as persistent inflation, geopolitical uncertainty, and the possibility of a recession, their overall view suggests that the market may present attractive investment opportunities. To understand the full scope of BofA's BofA Stock Market Valuations analysis and make informed investment decisions, explore their research reports and market insights available on their website. Stay updated on their latest perspectives on stock market valuations and other key economic indicators for a comprehensive understanding of the current investment landscape.

Featured Posts

-

Six Nations Takeaways Frances Victory And Lions Squad Selection

May 01, 2025

Six Nations Takeaways Frances Victory And Lions Squad Selection

May 01, 2025 -

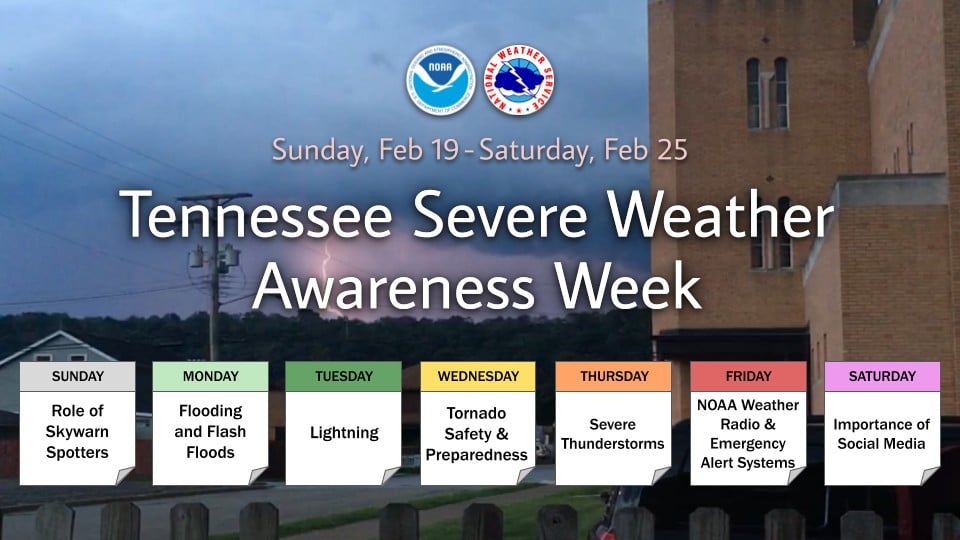

Kentucky Severe Weather Nwss Week Of Awareness And Action

May 01, 2025

Kentucky Severe Weather Nwss Week Of Awareness And Action

May 01, 2025 -

Farmers And Foragers Owner Selling Charlotte Old Lantern Barn

May 01, 2025

Farmers And Foragers Owner Selling Charlotte Old Lantern Barn

May 01, 2025 -

How To Watch Cavaliers Vs Heat Nba Playoffs Game 2 Live Stream Tv Schedule And Time

May 01, 2025

How To Watch Cavaliers Vs Heat Nba Playoffs Game 2 Live Stream Tv Schedule And Time

May 01, 2025 -

Passengers Stranded In Kogi Train Breakdown Causes Chaos

May 01, 2025

Passengers Stranded In Kogi Train Breakdown Causes Chaos

May 01, 2025