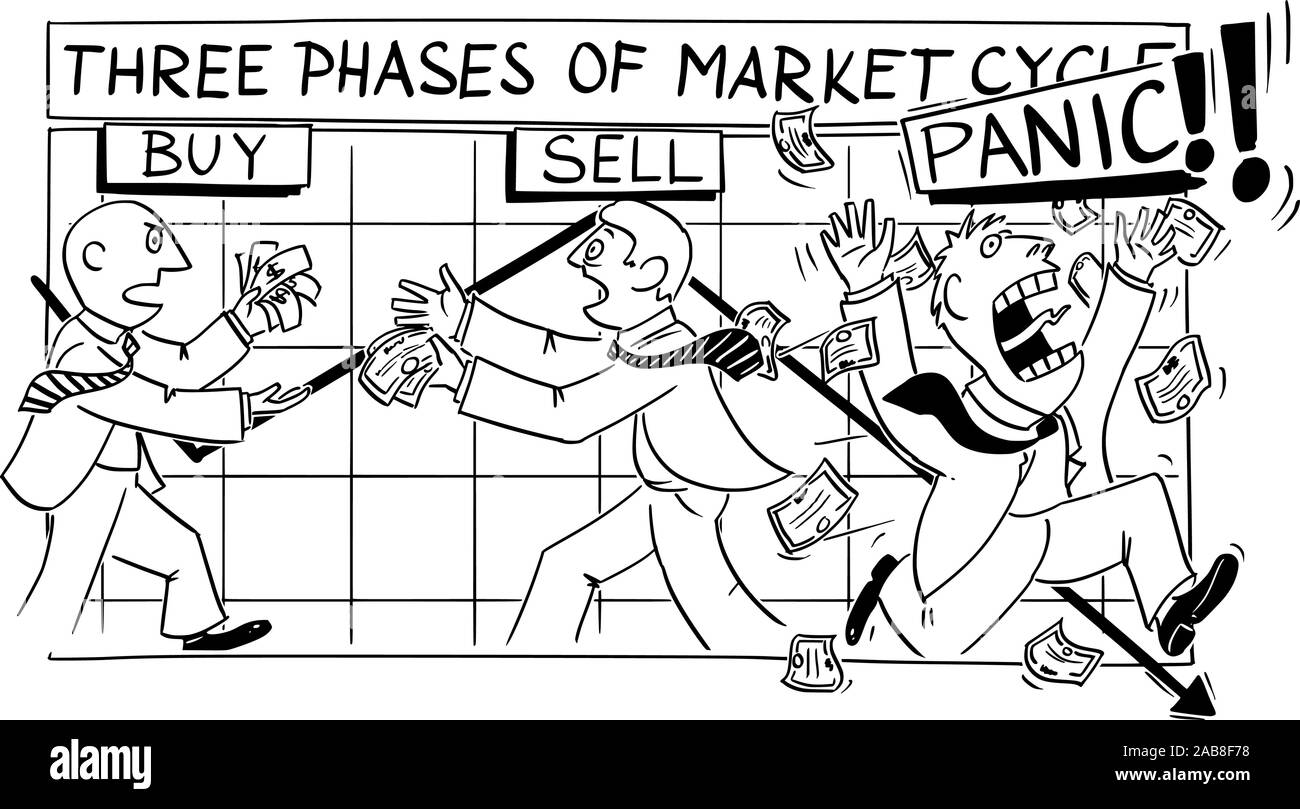

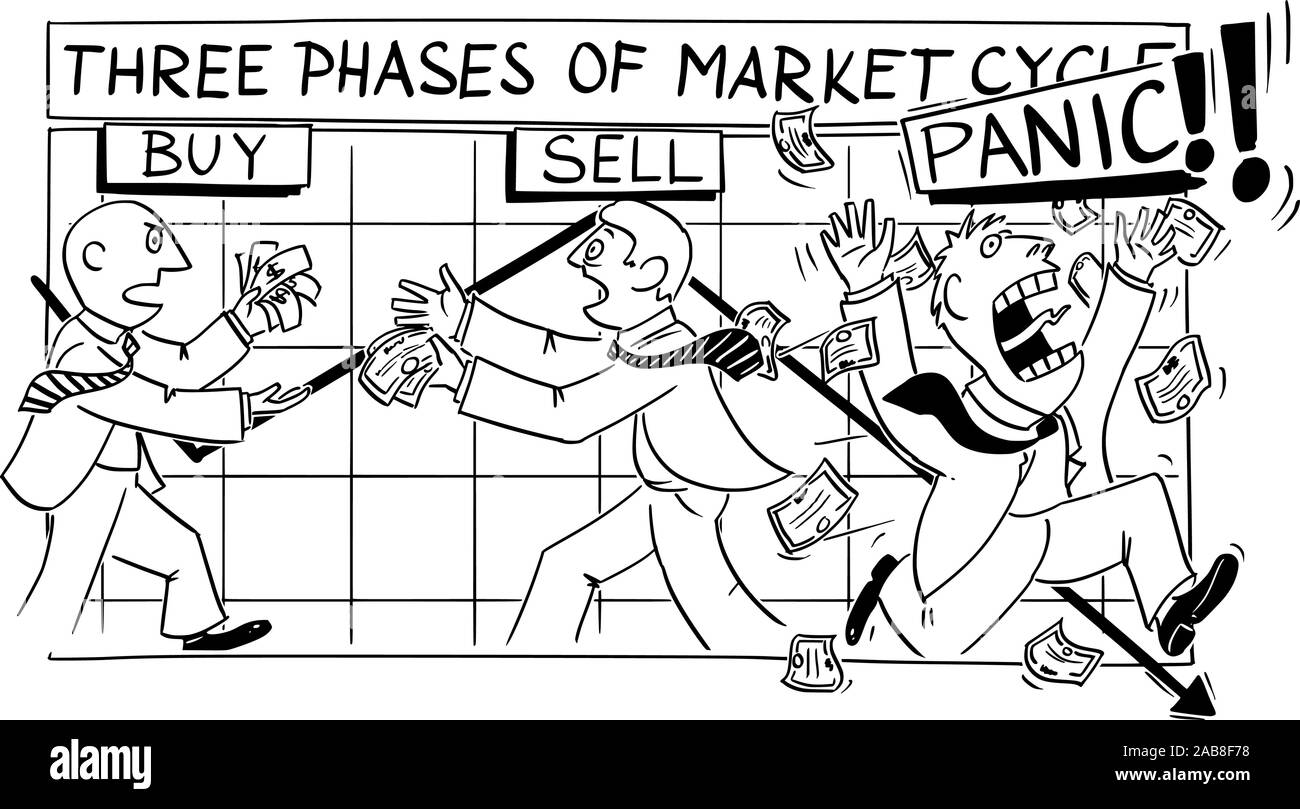

BofA On Stock Market Valuations: Why Investors Shouldn't Panic

Table of Contents

BofA's Key Findings on Current Stock Market Valuations

BofA's latest market analysis provides a measured assessment of current stock market valuations, arguing against widespread panic. While acknowledging the market's volatility, their findings suggest that valuations, while perhaps not historically cheap, aren't necessarily signaling an impending crash. Their analysis incorporates several key valuation metrics, including the Price-to-Earnings ratio (P/E) and the cyclically adjusted price-to-earnings ratio (Shiller PE).

-

Specific data points from BofA's report: (Note: This section requires specific data from a recent BofA report. Replace the bracketed information with actual data from a reputable source.) For example, BofA might indicate that the current S&P 500 P/E ratio is [insert number], slightly above the historical average of [insert number], but below the peak seen during [specific market event]. Similarly, the Shiller PE might be cited at [insert number].

-

Comparison to previous market cycles: BofA's analysis likely compares current valuations to those observed during previous market cycles, highlighting periods of similar uncertainty and volatility. This historical context helps to put current valuations in perspective, demonstrating that market fluctuations are normal and don't always predict catastrophic declines.

-

Specific sectors or asset classes BofA highlights: The report may identify specific sectors or asset classes that BofA views as relatively undervalued or overvalued, offering insights for targeted investment strategies. For instance, they might suggest that the technology sector is showing signs of correction while certain value stocks present promising opportunities.

Factors Supporting BofA's Optimistic Outlook

BofA's relatively optimistic outlook isn't based solely on valuation metrics. Several economic factors and market trends support their less bearish view.

-

Strong corporate earnings reports: Many companies have reported robust earnings, indicating resilience in the face of economic headwinds. These positive earnings reports contribute to a more optimistic outlook.

-

Positive economic indicators: While concerns about inflation and recession persist, certain economic indicators, such as [cite specific indicators, e.g., employment data, consumer spending], suggest a degree of economic strength that mitigates some of the immediate concerns.

-

Potential for future growth: BofA's analysis may incorporate projections for future economic growth, suggesting that current market valuations could be justified by expectations of future corporate earnings and overall economic expansion.

-

Geopolitical events and trends: The report should acknowledge and incorporate the impact of geopolitical events and trends, assessing their potential influence on the market. This transparent approach fosters trust and credibility.

Addressing Investor Concerns and Misconceptions

Many investors are understandably anxious due to widespread fears of inflation and a potential recession. BofA's analysis directly addresses these concerns:

-

Rebuttal of common market fears: BofA likely counters the fear of runaway inflation by pointing to [cite specific data, e.g., moderating inflation rates, central bank actions]. They may also address recession fears by highlighting the resilience of the economy and the potential for a "soft landing."

-

Explanation of why these fears may be overblown: BofA's analysis may explain why these fears might be disproportionate to the actual economic fundamentals, providing data to support their conclusions and reduce undue anxiety.

-

Alternative perspectives and potential scenarios: Presenting a range of possible scenarios, including less-dire outcomes, allows investors to contextualize their concerns and prepare for a variety of market conditions.

BofA's Recommendations for Investors

Based on their analysis, BofA likely offers specific recommendations for investors:

-

Specific investment recommendations: These could include suggesting sectors or asset classes that appear undervalued, or highlighting opportunities for strategic diversification.

-

Strategies to mitigate risk: BofA may emphasize the importance of diversification, risk management techniques, and a long-term investment horizon to weather market volatility.

-

Long-term vs. short-term investment approaches: The recommendations likely stress the importance of long-term investment strategies over short-term trading based on short-term market fluctuations. A buy-and-hold strategy may be advocated.

Conclusion: Navigating Stock Market Valuations – A Calm Approach

BofA's analysis of stock market valuations provides a valuable counterpoint to the prevailing market anxiety. Their findings suggest that while valuations may not be exceptionally cheap, they don't necessarily signal an imminent market crash. By considering various economic factors and addressing common investor concerns, BofA offers a more measured perspective. The key takeaway is that investors should avoid panic selling and instead focus on long-term investment strategies and sound risk management. Remember to consult with a financial advisor to develop a personalized investment plan aligned with your risk tolerance and long-term financial goals. For more information on BofA's investment strategies and resources, [insert link to relevant BofA resources]. Don't let market volatility dictate your investment decisions; instead, build a robust investment strategy based on careful analysis and sound financial planning.

Featured Posts

-

A Conservative Professors Prescription For Harvards Revitalization

Apr 26, 2025

A Conservative Professors Prescription For Harvards Revitalization

Apr 26, 2025 -

Dow Futures And Chinas Economy Todays Stock Market Update

Apr 26, 2025

Dow Futures And Chinas Economy Todays Stock Market Update

Apr 26, 2025 -

Trumps Nato Stance Ukraines Membership Prospects

Apr 26, 2025

Trumps Nato Stance Ukraines Membership Prospects

Apr 26, 2025 -

A Side Hustle Access To Elon Musks Private Companies

Apr 26, 2025

A Side Hustle Access To Elon Musks Private Companies

Apr 26, 2025 -

Lab Owner Pleads Guilty To Covid Test Result Fraud

Apr 26, 2025

Lab Owner Pleads Guilty To Covid Test Result Fraud

Apr 26, 2025