BofA Reassures Investors: Why Current Stock Market Valuations Aren't A Threat

Table of Contents

BofA's Key Arguments for a Healthy Market

BofA's positive outlook isn't based on blind optimism; it's grounded in a thorough analysis of several key factors.

Strong Corporate Earnings

BofA highlights robust corporate earnings as a major pillar supporting current market valuations. Despite inflationary pressures and economic uncertainty, many companies have demonstrated impressive resilience.

- Resilient profit margins despite inflationary pressures: Companies have shown remarkable ability to manage rising costs, either through price increases or efficiency improvements, preserving profitability.

- Strong revenue growth across various sectors: Revenue growth remains positive across multiple sectors, indicating healthy underlying demand and economic activity. This is particularly notable in technology, healthcare, and consumer staples.

- Positive earnings revisions pointing towards future growth: Analysts are increasingly revising their earnings estimates upwards, suggesting continued confidence in future corporate performance. This positive sentiment contributes to higher stock valuations.

Favorable Interest Rate Environment (with caveats)

While acknowledging the challenges posed by interest rate hikes, BofA suggests that the current environment, although tighter, is still manageable for many established companies.

- Analysis of the impact of interest rate increases on different sectors: The impact of rising interest rates varies across sectors. While some sectors (like highly leveraged companies) are more vulnerable, others (like those with strong cash flows) can weather the storm.

- Discussion of the Federal Reserve's future monetary policy and its potential effects: BofA's analysis incorporates projections of the Federal Reserve's future actions, offering insights into the likely trajectory of interest rates and their implications for the market.

- Mention of BofA's predictions regarding future interest rate adjustments: BofA likely provides its own forecast for future interest rate adjustments, allowing investors to anticipate potential market shifts and adapt their strategies accordingly.

Long-Term Growth Potential

Beyond short-term concerns, BofA emphasizes the significant long-term growth prospects of the US and global economies, counterbalancing anxieties about immediate valuations.

- Focus on technological advancements and their impact on future growth: Technological innovation continues to drive economic growth, creating new opportunities and fueling expansion across various sectors.

- Highlighting emerging markets and their contribution to global growth: Emerging markets are increasingly contributing to global economic growth, providing additional diversification and opportunities for investment.

- Discussion of the potential for sustainable and renewable energy sectors: The transition to sustainable energy represents a significant long-term growth opportunity, attracting significant investment and driving innovation.

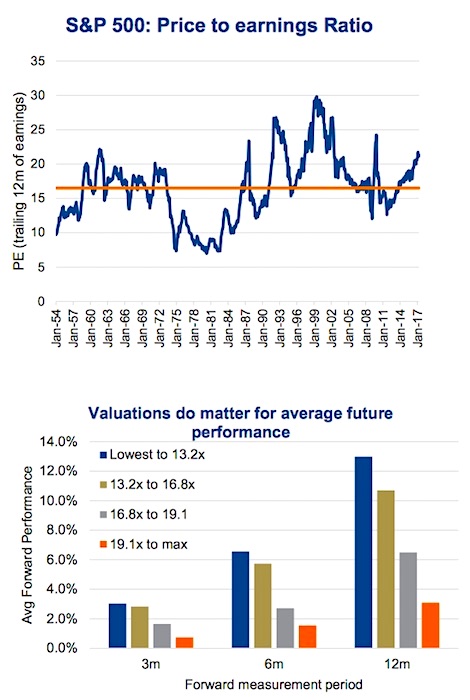

Addressing Investor Concerns Regarding Valuation Metrics

High price-to-earnings (P/E) ratios and other valuation metrics often spark investor concern. BofA addresses these anxieties by offering a balanced and contextualized view.

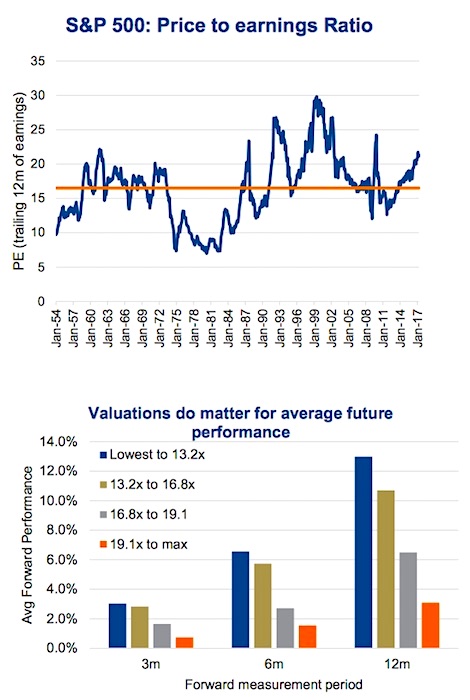

Price-to-Earnings (P/E) Ratios

While some P/E ratios may appear high at first glance, BofA likely provides valuable context:

- Comparison of current P/E ratios to historical data: BofA's analysis might show that current P/E ratios, while elevated, aren't unprecedented when considered within their historical context.

- Explanation of how inflation impacts P/E ratio interpretation: Inflation significantly affects earnings and therefore the interpretation of P/E ratios. BofA likely adjusts for inflation to provide a more accurate picture.

- Addressing any discrepancies between sector P/E ratios: P/E ratios vary significantly across different sectors. BofA’s analysis likely highlights these differences and explains the rationale behind them.

Other Valuation Metrics

BofA likely analyzes a range of valuation metrics, offering a comprehensive assessment:

- Discussion of the significance of different valuation metrics: BofA emphasizes that relying solely on one metric is insufficient; a holistic view incorporating various metrics is crucial.

- Comparative analysis of multiple valuation metrics to provide a holistic view: This includes metrics like Price-to-Sales (P/S) ratios, dividend yield, and others, providing a more comprehensive valuation picture.

- Highlighting the limitations of relying solely on any single valuation metric: Each metric has its limitations; combining them gives a more nuanced perspective.

BofA's Investment Strategies and Recommendations

Based on their analysis, BofA likely provides actionable investment strategies and recommendations.

Sector-Specific Opportunities

BofA's analysts likely identify specific sectors poised for growth despite current market valuations:

- Recommendation of specific investment opportunities: BofA may recommend specific companies or sectors that are well-positioned for future growth.

- Justification for sector-specific recommendations: They'll support their recommendations with detailed analysis and justification.

- Risk assessment for each suggested investment opportunity: BofA will undoubtedly emphasize the importance of risk assessment and diversification.

Diversification and Risk Management

Regardless of the market outlook, diversification and risk management are paramount:

- Discussion of the benefits of a diversified portfolio: A diversified portfolio reduces the overall risk associated with individual investments.

- Guidance on managing risk in the current market environment: BofA will offer strategies to manage risk considering the current market conditions.

- Tips on building a resilient investment strategy: They'll provide practical advice on constructing an investment strategy that can withstand market fluctuations.

Conclusion

BofA's reassurances regarding current stock market valuations offer investors a more balanced perspective. By carefully considering strong corporate earnings, a manageable interest rate environment, and robust long-term growth potential, investors can approach the market with increased confidence. While risks always exist, a well-diversified strategy, informed by comprehensive analyses like BofA's, can help mitigate those risks. Don't let market volatility cloud your judgment; understand the underlying factors influencing stock market valuation and develop your own informed investment strategy today.

Featured Posts

-

Pga Tours Zurich Classic Mc Ilroy And Lowry Commit To Title Defense

May 11, 2025

Pga Tours Zurich Classic Mc Ilroy And Lowry Commit To Title Defense

May 11, 2025 -

Celtics Blowout Win Division Title Secured

May 11, 2025

Celtics Blowout Win Division Title Secured

May 11, 2025 -

Lowry Makes A Push At The Valspar Championship

May 11, 2025

Lowry Makes A Push At The Valspar Championship

May 11, 2025 -

Jessica Simpson Credits Eric Johnson For Encouraging Her Music Comeback

May 11, 2025

Jessica Simpson Credits Eric Johnson For Encouraging Her Music Comeback

May 11, 2025 -

City Name Mi A College Town Experience Unlike Any Other

May 11, 2025

City Name Mi A College Town Experience Unlike Any Other

May 11, 2025