BofA Reassures Investors: Why High Stock Market Valuations Are Not A Threat

Table of Contents

BofA's Rationale Behind the Reassurance

BofA's reassurance isn't based on blind optimism; it's rooted in a comprehensive analysis of various economic factors. Their market outlook considers several key elements that contribute to their confidence. The bank's experts aren't dismissing the high valuations entirely, but rather contextualizing them within a broader economic picture.

-

BofA's assessment of current economic growth: BofA's analysts point to continued, albeit moderated, economic growth as a key supporting factor. While the pace of expansion might be slowing from recent highs, it remains positive, supporting corporate earnings and justifying, to some extent, higher valuations. Their reports often cite specific economic indicators to support this claim.

-

Their perspective on inflation and its impact on valuations: While inflation remains a concern, BofA’s analysis suggests that current levels are manageable and that the Federal Reserve's actions are effectively addressing the issue. They acknowledge the impact of inflation on valuations but believe that the current trajectory isn’t unsustainable and won’t necessarily lead to a significant market downturn.

-

Analysis of interest rate hikes and their effect on the market: BofA acknowledges the impact of interest rate hikes on market valuations. However, their analysis suggests that the market has largely priced in these increases, and further hikes are anticipated to be more measured. This implies that the current valuations already reflect the anticipated impact of monetary policy.

-

Specific sectors BofA sees as particularly strong despite high valuations: BofA's research often highlights specific sectors – like technology or healthcare – that continue to demonstrate strong growth prospects despite high valuations, suggesting resilience within the market. Their sector-specific analysis provides a nuanced understanding of where opportunities might still exist.

Understanding the Factors Driving High Stock Market Valuations

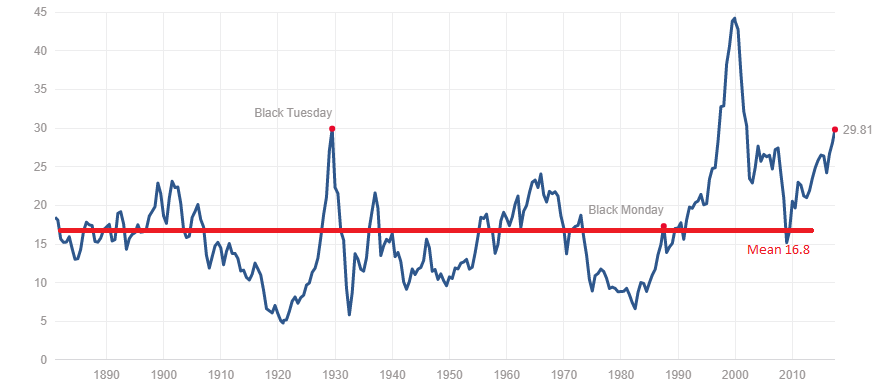

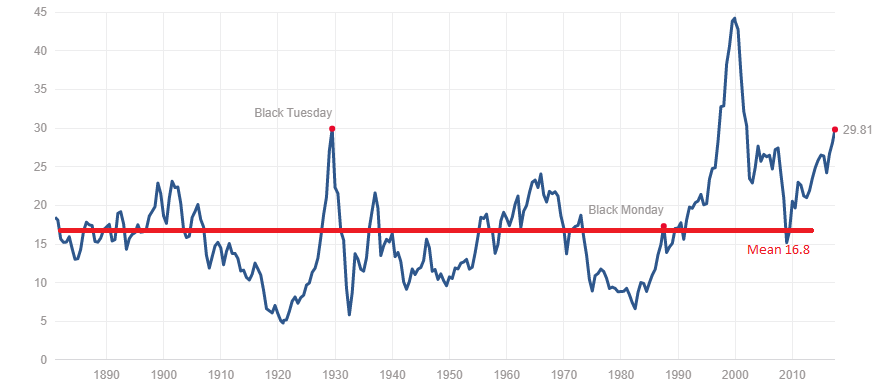

High stock market valuations, often measured using metrics like the Price-to-Earnings (P/E) ratio and Price-to-Sales ratio, can appear alarming at first glance. However, several factors contribute to these seemingly elevated numbers, and understanding them is crucial to avoid knee-jerk reactions.

-

Explanation of key valuation metrics (e.g., P/E ratio, Price-to-Sales ratio): It's important to understand that these ratios are relative and should be interpreted within a broader context. A high P/E ratio might reflect strong future earnings growth potential rather than simply overvaluation.

-

Discussion of strong corporate earnings growth: Many companies have demonstrated robust earnings growth, supporting higher valuations. This strong performance indicates that the market isn't necessarily overvalued but rather reflects the financial health and potential of many businesses.

-

The role of low interest rates in supporting higher valuations: Historically low interest rates have made investing in stocks more attractive compared to bonds and other fixed-income securities, contributing to higher stock prices and valuations. This dynamic is changing as interest rates rise, but it played a significant role in reaching current levels.

-

Analysis of positive investor sentiment and its influence on pricing: Positive investor sentiment, fueled by various factors including economic growth prospects and technological innovation, can significantly impact market valuations. Confidence in future growth contributes to higher price-to-earnings ratios.

Historical Context: High Valuations and Past Market Performance

Looking at historical market data provides valuable perspective. There have been many periods throughout history where stock market valuations appeared high, yet the market continued to grow or experienced only temporary corrections.

-

Examples of past periods with high valuations and their eventual outcomes: Analyzing past market cycles reveals that high valuations alone aren't reliable predictors of imminent crashes. Many instances show periods of high valuations followed by extended periods of continued growth.

-

Emphasis on the importance of long-term investing: A long-term investment horizon is crucial for navigating market cycles and potential short-term corrections. Focusing on long-term growth rather than short-term fluctuations is a key strategy for mitigating risk.

-

Discussion of the cyclical nature of the stock market: The stock market is inherently cyclical; periods of high growth are often followed by periods of consolidation or correction. This is a normal part of the market's natural rhythm, and it's important not to overreact to temporary fluctuations.

-

Importance of diversifying investments and managing risk: Diversifying investments across different asset classes and sectors is key to managing risk. A well-diversified portfolio can help mitigate the impact of any single market segment experiencing a downturn.

Addressing Potential Risks and Mitigation Strategies

While BofA's analysis is reassuring, it's crucial to acknowledge potential downsides. High valuations do increase the risk of a market correction.

-

Potential risks associated with high valuations (e.g., market correction): A sharp correction is always a possibility, and investors should be prepared for potential volatility.

-

Strategies for mitigating those risks (e.g., diversification, hedging): Diversifying your portfolio, employing hedging strategies, and having a clear investment plan are essential risk management tools.

-

The importance of having a well-defined investment strategy: A well-defined investment strategy tailored to your risk tolerance and financial goals is crucial for navigating market uncertainties.

Conclusion

BofA's reassurance regarding high stock market valuations stems from a comprehensive analysis of economic factors, corporate earnings, and historical market trends. While high valuations are a noteworthy observation, they don't automatically signal an impending market crash. The bank's analysis highlights the importance of considering the broader economic picture and long-term investment strategies. Don't let concerns about high stock market valuations deter you from making sound investment choices. Conduct your own research, consult with a financial advisor, and develop a robust investment strategy today. Learn more about BofA's market analysis and make informed decisions based on your risk tolerance and investment goals.

Featured Posts

-

16 April 2025 Daily Lotto Results Announced

May 02, 2025

16 April 2025 Daily Lotto Results Announced

May 02, 2025 -

Boj Slashes Growth Outlook Trade Disputes Take Their Toll On Japans Economy

May 02, 2025

Boj Slashes Growth Outlook Trade Disputes Take Their Toll On Japans Economy

May 02, 2025 -

Escape To Italys Little Tahiti Pristine Beaches And Crystal Clear Waters

May 02, 2025

Escape To Italys Little Tahiti Pristine Beaches And Crystal Clear Waters

May 02, 2025 -

Fortnite Understanding The Recent Game Mode Discontinuations

May 02, 2025

Fortnite Understanding The Recent Game Mode Discontinuations

May 02, 2025 -

Ted Kotcheff Director Of Rambo First Blood Dies At 94

May 02, 2025

Ted Kotcheff Director Of Rambo First Blood Dies At 94

May 02, 2025