BofA's Analysis: Why Current Stock Market Valuations Aren't Necessarily A Problem

Table of Contents

BofA's Methodology and Key Findings

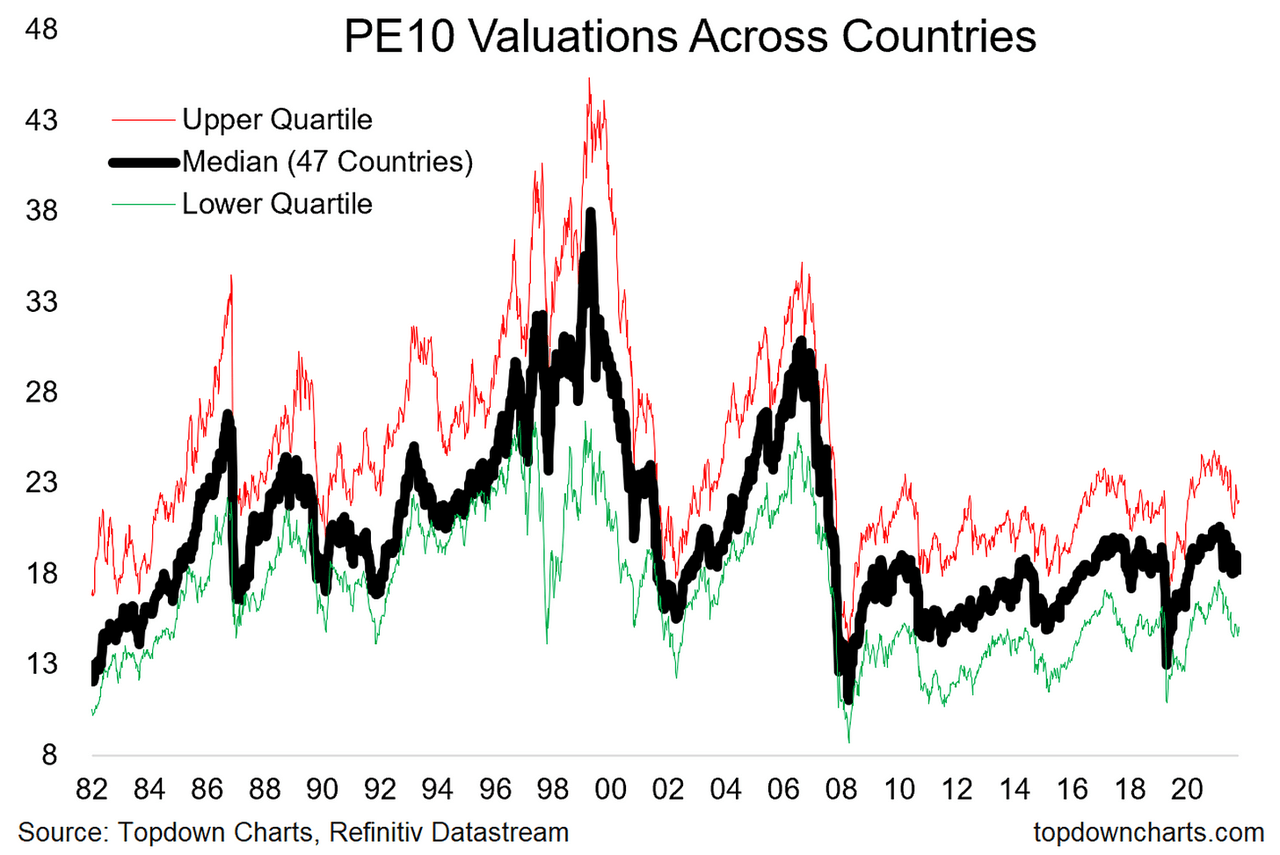

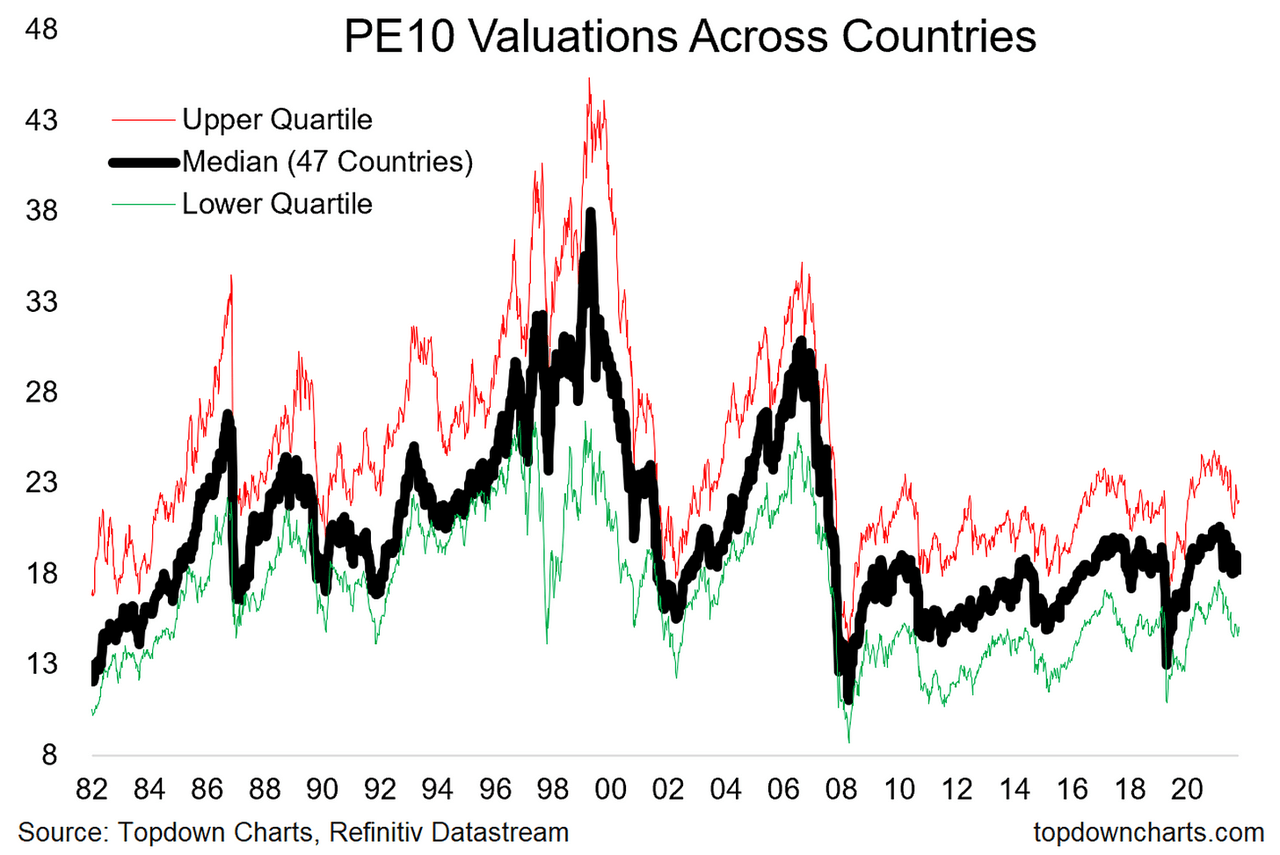

BofA's analysis employed a multifaceted approach, incorporating various valuation metrics to assess the current market landscape. They utilized traditional metrics like the Price-to-Earnings ratio (P/E), Price-to-Sales ratio (P/S), and the more sophisticated Cyclically Adjusted Price-to-Earnings ratio (CAPE), also known as the Shiller P/E ratio, to gain a comprehensive view. Their analysis primarily focused on the S&P 500, a leading indicator of US stock market performance, but also considered sector-specific valuations.

- Core Findings: BofA found that while some valuations appear elevated compared to historical averages, they aren't excessively so when considering the broader economic context.

- Sectoral Analysis: The analysis revealed varying valuations across different sectors, with some sectors appearing more richly valued than others. Technology stocks, for example, were a key area of focus due to their significant weight in the S&P 500.

- Comparison to Historical Averages: The report compared current valuation metrics to long-term historical averages, factoring in economic cycles and market shifts. This comparative analysis helped contextualize the current valuations within a longer-term perspective.

The Role of Interest Rates in Shaping Valuations

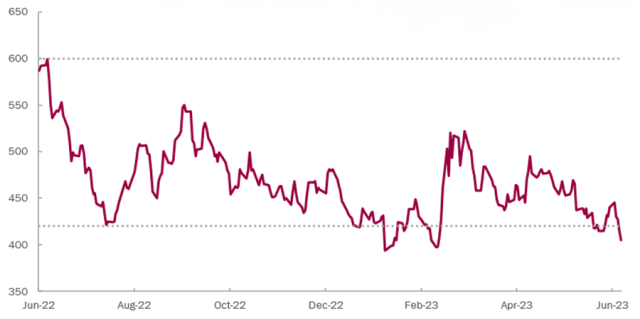

Interest rates play a crucial role in shaping stock valuations. Higher interest rates generally lead to lower valuations, as they increase the discount rate used in discounted cash flow models, making future earnings less valuable in present-day terms. Conversely, lower interest rates tend to support higher valuations.

BofA's analysis considered the current trajectory of interest rates and their potential future path. They acknowledged the recent interest rate hikes implemented by central banks to combat inflation but also incorporated projections for a potential future slowdown in rate increases or even rate cuts.

- BofA's Interest Rate Predictions: While specific predictions vary, BofA generally anticipates a moderation in the pace of interest rate increases, potentially leading to a stabilization or even a slight decrease in interest rates in the medium-term future. This could positively impact stock valuations.

- Impact on Valuation Models: BofA incorporated these interest rate projections into their valuation models, demonstrating how future interest rate paths can significantly influence the assessment of current market valuations.

Earnings Growth as a Counterbalance to High Valuations

Robust earnings growth can act as a counterbalance to seemingly high valuations. If companies are demonstrating significant earnings growth, higher price-to-earnings ratios might be justified, reflecting investor confidence in future profitability.

BofA's analysis included projections for corporate earnings growth. They considered various factors that could influence earnings growth in the coming quarters and years.

- BofA's Earnings Growth Projections: BofA anticipates moderate to strong earnings growth for several sectors, particularly those less susceptible to interest rate hikes.

- Key Factors Influencing Growth:

- Consumer spending: Continued robust consumer spending is a major contributor to earnings growth.

- Inflationary pressures: Managing inflationary pressures and supply chain disruptions are crucial for maintaining healthy earnings growth.

- Geopolitical risks: Geopolitical uncertainties pose a potential downside risk to earnings projections.

Inflation's Influence on Market Valuations and BofA's Take

Inflation significantly impacts stock valuations. High inflation erodes purchasing power and can increase uncertainty about future corporate profits, leading to lower valuations. Conversely, controlled inflation can be positive for growth.

BofA carefully analyzed the current inflationary environment and its potential impact on market valuations. They considered the Federal Reserve's actions to control inflation and their effectiveness.

- BofA's Inflation Outlook: BofA's analysis acknowledges the challenges posed by inflation but anticipates a gradual moderation in the rate of inflation over time.

- Impact on Investor Sentiment: Inflation's impact on investor sentiment and its influence on future earnings expectations were significant components of BofA's analysis.

Addressing Potential Risks and Caveats

While BofA's analysis suggests current valuations aren't overly problematic, they acknowledge several potential risks and caveats.

- Geopolitical Uncertainty: Ongoing geopolitical tensions could negatively impact market sentiment and corporate earnings.

- Recessionary Risks: The risk of a recession, even a mild one, could significantly impact valuations.

- Unforeseen Economic Shocks: Unexpected economic shocks could disrupt current market valuations.

Conclusion: Understanding BofA's Perspective on Stock Market Valuations

BofA's analysis concludes that current stock market valuations, while seemingly high in some instances, are not necessarily cause for immediate concern. Their assessment carefully weighs the interplay of various factors, including interest rates, earnings growth, and inflation. Understanding the nuances of these factors is crucial for a balanced perspective on current market conditions. BofA’s comprehensive report considers the long-term historical context, thereby offering a more nuanced interpretation of current valuations. To understand BofA's complete analysis on stock market valuations and learn more about the factors influencing current stock market valuations, we encourage you to delve deeper into their full report.

Featured Posts

-

Country Legend Willie Nelson Releases Oh What A Beautiful World

Apr 29, 2025

Country Legend Willie Nelson Releases Oh What A Beautiful World

Apr 29, 2025 -

Harvard Faces Trump Administration In Court Over Funding Cuts

Apr 29, 2025

Harvard Faces Trump Administration In Court Over Funding Cuts

Apr 29, 2025 -

High Valuations In The Stock Market Bof As Rationale For Investor Calm

Apr 29, 2025

High Valuations In The Stock Market Bof As Rationale For Investor Calm

Apr 29, 2025 -

Packers International Game Prospects Two 2025 Opportunities

Apr 29, 2025

Packers International Game Prospects Two 2025 Opportunities

Apr 29, 2025 -

The Ramiro Helmeyer Story Striving For Blaugrana Glory

Apr 29, 2025

The Ramiro Helmeyer Story Striving For Blaugrana Glory

Apr 29, 2025

Latest Posts

-

You Tube A Growing Platform For Older Viewers Seeking Familiar Entertainment

Apr 29, 2025

You Tube A Growing Platform For Older Viewers Seeking Familiar Entertainment

Apr 29, 2025 -

You Tubes Growing Popularity Among Older Viewers A Resurgence Of Classic Shows

Apr 29, 2025

You Tubes Growing Popularity Among Older Viewers A Resurgence Of Classic Shows

Apr 29, 2025 -

How Npr Explains You Tubes Expanding Older Adult User Base

Apr 29, 2025

How Npr Explains You Tubes Expanding Older Adult User Base

Apr 29, 2025 -

Is You Tube Becoming A Senior Destination Npr Explores The Shift

Apr 29, 2025

Is You Tube Becoming A Senior Destination Npr Explores The Shift

Apr 29, 2025 -

The Rise Of Older You Tube Users Data And Insights From Npr

Apr 29, 2025

The Rise Of Older You Tube Users Data And Insights From Npr

Apr 29, 2025