BofA's Analysis: Why Investors Shouldn't Worry About Elevated Stock Market Valuations

Table of Contents

BofA's Justification for Current Market Valuations

BofA's report provides several compelling reasons to temper concerns about high stock market valuations. Their analysis points to a confluence of factors supporting current prices, suggesting that a simple "high valuation = imminent correction" equation is an oversimplification.

Strong Corporate Earnings and Profitability

BofA's assessment highlights robust corporate earnings growth as a key justification for current Price-to-Earnings (P/E) ratios. Many sectors are experiencing significant profitability, supporting the elevated market capitalization we're seeing.

- Examples of strong performing sectors: Technology, healthcare, and consumer staples have shown particularly strong earnings growth.

- Projections for future earnings growth: BofA projects continued, albeit potentially moderated, earnings growth in the coming quarters.

- Comparisons to historical P/E ratios: While current P/E ratios are higher than historical averages, they're not unprecedented, especially considering the current low-interest-rate environment. The historical context is crucial in evaluating the significance of these ratios. Comparing current P/E ratios to those during similar periods of economic expansion provides valuable perspective.

Low Interest Rates and Monetary Policy

The influence of low interest rates on maintaining elevated valuations is another crucial element of BofA's analysis. The prolonged period of low interest rates, fueled by quantitative easing policies, has made equities a more attractive investment compared to bonds, driving up demand and valuations.

- Impact of quantitative easing: The Federal Reserve's (Fed) quantitative easing programs significantly increased the money supply, contributing to higher asset prices, including stocks.

- Potential future interest rate hikes and their predicted effects: While future interest rate hikes are anticipated, BofA's analysis suggests that the impact on stock valuations is likely to be gradual, allowing for an orderly adjustment. The timing and magnitude of these hikes will be closely monitored.

- Comparison to previous periods of low interest rates: By examining previous periods with low interest rates, BofA's report provides a historical context for understanding the current situation and potential future market movements.

Robust Economic Growth and Future Outlook

BofA's positive economic outlook significantly supports its view on market valuations. Strong economic growth translates to increased corporate profits, bolstering stock prices.

- GDP growth projections: BofA's projections indicate continued, though potentially slowing, GDP growth, supporting the expectation of continued, albeit more moderate, corporate earnings growth.

- Unemployment rates: Low unemployment rates signal a healthy economy, further justifying the current market valuation.

- Consumer confidence indicators: Strong consumer confidence reflects a healthy economy with strong spending, benefiting corporate profits.

- Sector-specific growth predictions: BofA provides sector-specific forecasts, offering investors a more granular understanding of where growth is expected to be strongest.

Addressing Investor Concerns About Market Volatility

While BofA's analysis suggests that current valuations are not inherently unsustainable, market volatility is always a concern. The report offers strategies to manage risk in this environment.

Managing Risk in a High-Valuation Environment

BofA emphasizes the importance of sound risk management strategies to navigate the current market.

- Diversification strategies: Diversifying across different asset classes, sectors, and geographies is key to mitigating risk.

- Asset allocation: Adjusting asset allocation based on risk tolerance and investment goals is crucial for managing portfolio volatility.

- Risk tolerance assessment: Understanding one's own risk tolerance is paramount in making informed investment decisions.

- Importance of long-term investing: Maintaining a long-term investment horizon allows investors to ride out short-term market fluctuations and benefit from long-term growth.

Identifying Undervalued Opportunities

Even in a market with elevated valuations, BofA suggests opportunities exist for investors to identify undervalued stocks.

- Fundamental analysis: Thorough fundamental analysis of individual companies is crucial in identifying stocks trading below their intrinsic value.

- Value investing strategies: Employing value investing strategies can help investors find companies with strong fundamentals that are temporarily undervalued by the market.

- Sector-specific opportunities: Certain sectors might offer more attractive valuations than others, presenting specific opportunities for investors.

BofA's Long-Term Market Predictions and Their Implications

BofA's long-term market outlook informs their assessment of current valuations. While the firm anticipates continued growth, potential headwinds need to be considered.

Projected Market Growth and Potential Challenges

BofA's long-term projections indicate continued market growth, though at a potentially slower pace than recently observed. However, challenges remain.

- Long-term growth projections: BofA offers long-term growth projections, providing investors with a roadmap for planning their investments.

- Potential risks (e.g., inflation, geopolitical uncertainty): The report acknowledges potential risks such as inflation and geopolitical uncertainty.

- Mitigating strategies: BofA discusses strategies to mitigate these potential risks, including diversification and strategic asset allocation.

Conclusion: Why Investors Shouldn't Fear Elevated Stock Market Valuations (Based on BofA's Analysis)

BofA's analysis reveals that strong corporate earnings, a low-interest-rate environment, and a positive economic outlook contribute to justifying current, seemingly high, stock market valuations. While market volatility is a possibility, a long-term perspective and sound risk management strategies are key. Don't let elevated stock market valuations deter you. Understand BofA's analysis, manage your risk effectively, and make informed investment decisions based on a long-term strategy. Review BofA's full report for a comprehensive understanding and to refine your approach to investing in this dynamic market environment.

Featured Posts

-

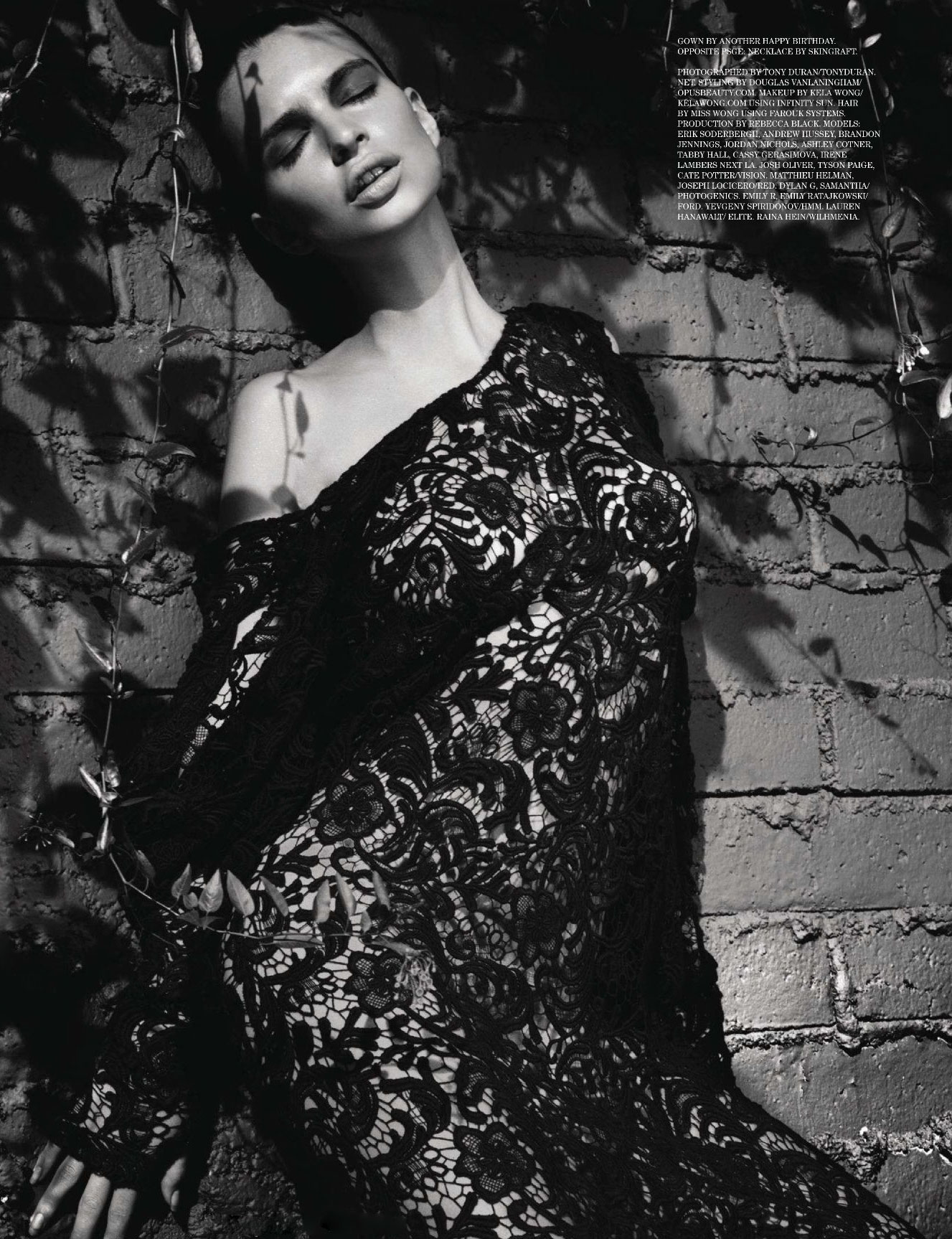

Rianna Vidverta Fotosesiya U Rozhevomu Merezhivi

May 06, 2025

Rianna Vidverta Fotosesiya U Rozhevomu Merezhivi

May 06, 2025 -

Getting To Know Tracee Ellis Rosss Celebrated Family Members

May 06, 2025

Getting To Know Tracee Ellis Rosss Celebrated Family Members

May 06, 2025 -

Actor Chris Pratt Addresses Patrick Schwarzeneggers White Lotus Nudity

May 06, 2025

Actor Chris Pratt Addresses Patrick Schwarzeneggers White Lotus Nudity

May 06, 2025 -

Rytsarstvo Stivena Fraya Podrobnosti Tseremonii

May 06, 2025

Rytsarstvo Stivena Fraya Podrobnosti Tseremonii

May 06, 2025 -

The Future Of Fitness Nike And Skims Join Forces

May 06, 2025

The Future Of Fitness Nike And Skims Join Forces

May 06, 2025