BofA's Reassurance: Why Stretched Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Positive Outlook and its Rationale

BofA's analysts recently published a report suggesting that despite high valuations, the current stock market presents a favorable investment climate. Their argument rests on several key pillars, supported by robust data analysis.

-

Specific Data Points: BofA's analysis points to continued strong corporate earnings growth, despite inflationary pressures. They forecast moderate interest rate increases, suggesting a controlled economic environment that supports continued growth rather than triggering a sharp market downturn. Their projections also incorporate sustained consumer spending and a gradual easing of supply chain disruptions.

-

Bullish Sectors: BofA's report highlights specific sectors poised for growth, including technology (especially AI and cloud computing), healthcare, and select areas within the consumer discretionary sector. These sectors are expected to benefit from ongoing technological advancements and evolving consumer preferences.

-

Underlying Reasons for Optimism: The bank's optimism stems from a combination of factors. Strong corporate earnings, despite inflationary pressures, demonstrate resilience and adaptation. Ongoing technological innovation provides a powerful engine for future growth, creating new opportunities and disrupting traditional industries. Furthermore, government support measures and policies are expected to continue providing a tailwind for the economy.

Understanding "Stretched" Valuations

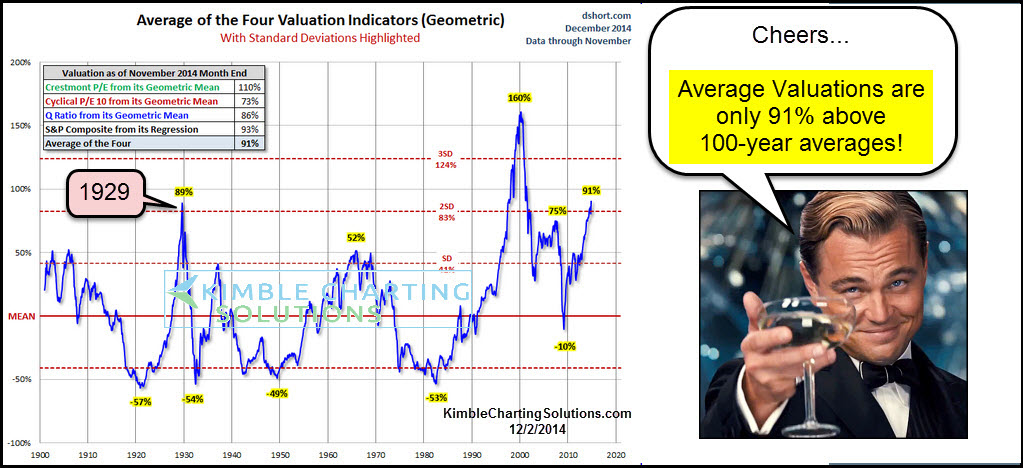

"Stretched valuations" refers to a situation where the price of a stock or the overall market seems high relative to its underlying fundamentals, such as earnings or revenue. This is often measured using various metrics.

-

Valuation Metrics: Common valuation metrics include the Price-to-Earnings ratio (P/E ratio), which compares a company's stock price to its earnings per share; and the Price-to-Sales ratio (P/S ratio), which compares a company's stock price to its revenue per share. A high P/E or P/S ratio might suggest that a stock is overvalued.

-

Current Market Context: While some valuations appear high compared to historical averages, it's crucial to consider the context. Current interest rates, while rising, remain relatively low compared to previous economic cycles. Furthermore, the potential for future growth in specific sectors, driven by technological innovation, may justify higher valuations.

-

Common Misconceptions: Many investors mistakenly believe that high valuations automatically signal an impending market crash. However, high valuations can persist for extended periods, particularly when earnings growth is robust and future prospects are promising. It's not the absolute level of valuation, but the relationship between valuation and future growth that truly matters.

Why Long-Term Investors Shouldn't Panic

Market volatility is a natural part of the investment cycle. Short-term fluctuations should not dictate long-term investment strategies. A well-defined, long-term approach can help mitigate the impact of short-term market downturns.

-

Risk Mitigation Strategies: Dollar-cost averaging, a strategy that involves investing a fixed amount of money at regular intervals regardless of market price, can help reduce the impact of market volatility. Diversification across different asset classes and sectors can further mitigate risk.

-

Historical Context: History demonstrates that market corrections are normal occurrences. While painful in the short term, these corrections are often followed by significant rebounds. Focusing on long-term growth rather than short-term price movements is key to navigating these fluctuations.

-

Fundamental Analysis: Instead of solely focusing on valuation metrics, long-term investors should prioritize fundamental analysis. This involves assessing a company's financial health, competitive position, and growth prospects. Strong fundamentals can often outweigh concerns about high valuations in the long run.

The Role of Innovation and Technological Advancements

Technological advancements are a significant driver of growth and can justify higher valuations, especially in certain sectors.

-

Impact of Emerging Technologies: AI, cloud computing, and other technologies are transforming industries, creating new markets and boosting productivity. Companies leading these advancements often command higher valuations due to their significant growth potential.

-

Examples of High-Growth Companies: Many companies in the technology sector, despite high valuations, demonstrate impressive growth trajectories driven by their innovative products and services. These companies represent the potential for future value creation.

Conclusion

BofA's positive outlook, grounded in robust data analysis and an understanding of ongoing technological advancements, suggests that current stretched stock market valuations shouldn't trigger widespread panic among investors. The key takeaways are the importance of a long-term investment strategy, the utilization of risk mitigation techniques, and the focus on fundamental analysis rather than solely reacting to short-term market fluctuations. Don't let concerns about stretched stock market valuations deter you from sound long-term investment strategies. Conduct thorough research, consult with a financial advisor, and consider BofA's analysis to inform your investment decisions. Learn more about BofA's investment strategies and gain a deeper understanding of navigating market volatility.

Featured Posts

-

Elizabeth City Apartment Complex Car Break Ins Dozens Of Vehicles Targeted

May 10, 2025

Elizabeth City Apartment Complex Car Break Ins Dozens Of Vehicles Targeted

May 10, 2025 -

Palantir Stock Should You Invest Before May 5th Earnings

May 10, 2025

Palantir Stock Should You Invest Before May 5th Earnings

May 10, 2025 -

Analysis Trumps Selection Of Casey Means For Surgeon General

May 10, 2025

Analysis Trumps Selection Of Casey Means For Surgeon General

May 10, 2025 -

Su Ung Ho Cua Ban Trai Giup Lynk Lee Toa Sang Sau Chuyen Gioi

May 10, 2025

Su Ung Ho Cua Ban Trai Giup Lynk Lee Toa Sang Sau Chuyen Gioi

May 10, 2025 -

A Footballers Resilience Rejected By Wolves Now A European Champion

May 10, 2025

A Footballers Resilience Rejected By Wolves Now A European Champion

May 10, 2025