BofA's Reassuring View On Current Stock Market Valuations

Table of Contents

BofA's Methodology and Data Sources

BofA's assessment of current stock market valuations is based on a rigorous analytical framework. Their methodology incorporates a blend of quantitative and qualitative analysis, drawing upon extensive historical data and current economic indicators. This robust approach ensures a comprehensive understanding of the market's dynamics.

The data sources used by BofA include:

- Historical Data: Decades of market performance data, including price movements, earnings reports, and economic cycles, provide a context for current valuations.

- Economic Indicators: Key macroeconomic factors such as inflation rates, interest rates, GDP growth, and unemployment figures are carefully considered.

- Earnings Reports: Analysis of corporate earnings, revenue growth, and profit margins provides insight into the underlying strength of companies and sectors.

BofA employs a range of valuation models, including:

- Price-to-Earnings Ratio (P/E): A widely used metric comparing a company's stock price to its earnings per share.

- Price-to-Sales Ratio (P/S): Another common metric comparing a company's stock price to its revenue.

- Discounted Cash Flow (DCF) Analysis: A more complex model that projects future cash flows and discounts them back to their present value.

Furthermore, BofA likely utilizes proprietary models and research, adding a unique layer to their analysis, which is not publicly available in detail. Their assessment also considers data sets like the S&P 500 index and sector-specific indices, providing a holistic view of market valuations.

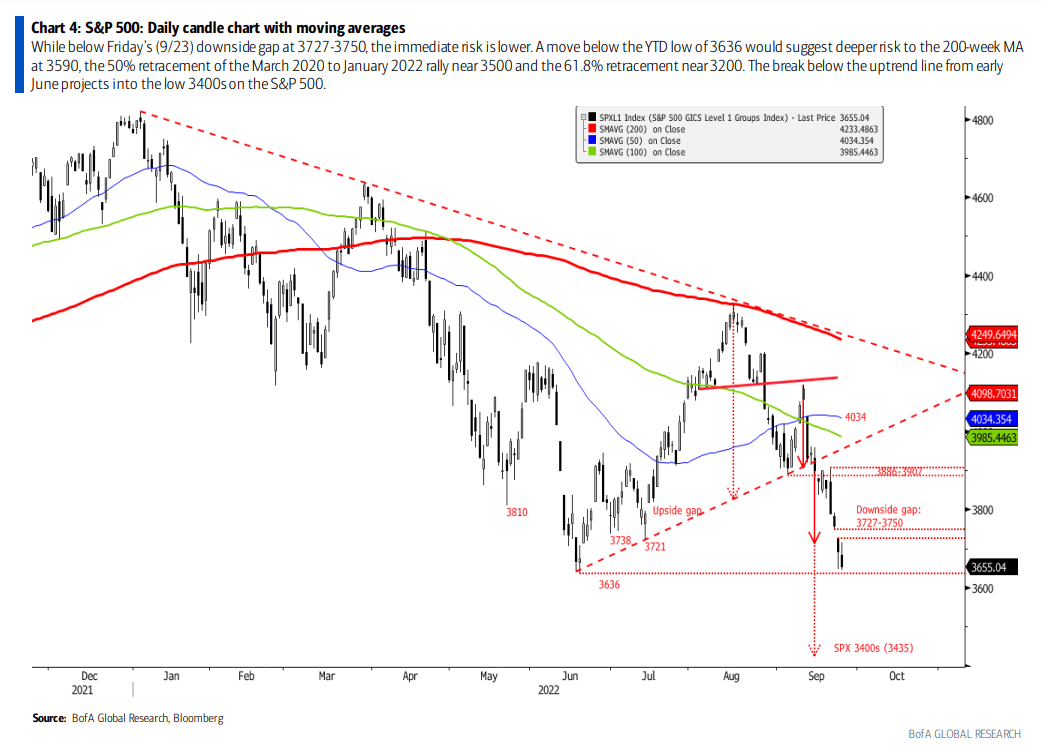

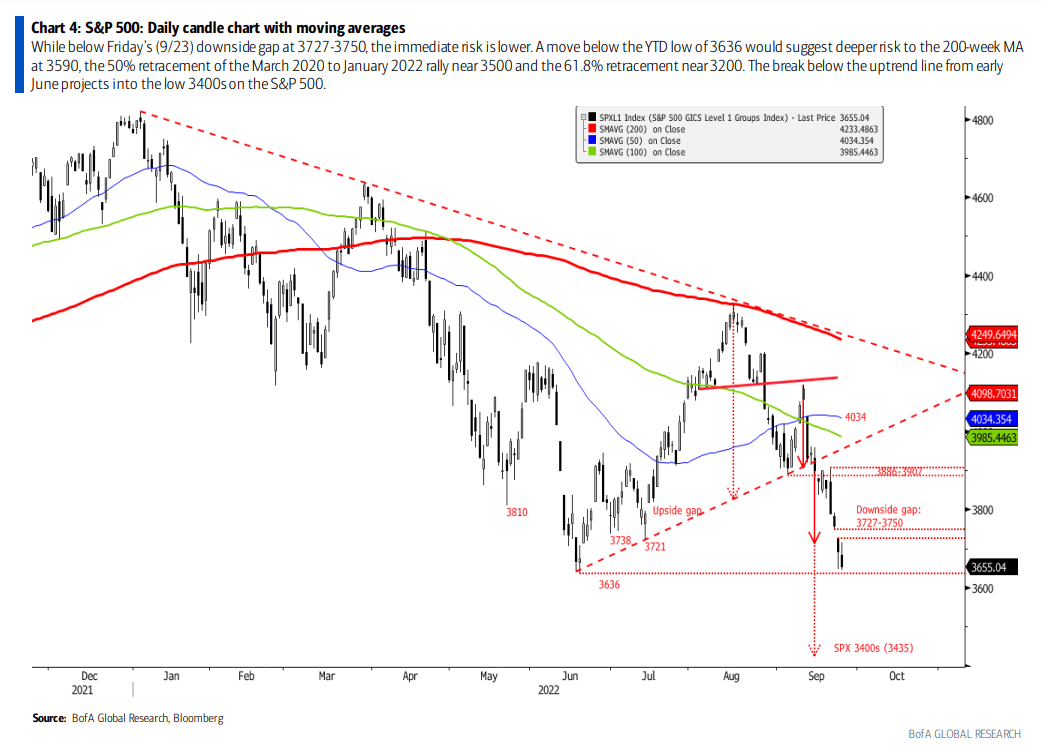

Key Findings on Current Valuations

BofA's analysis suggests that while certain sectors exhibit signs of overvaluation, the overall market is not drastically overvalued. They find that current valuations, while elevated compared to historical lows, are within a reasonable range considering current economic conditions and expected future growth. For example, while the current P/E ratio of the S&P 500 might be above its long-term average, it's not significantly higher than the average during periods of similar economic growth.

Specific findings include:

- Overvalued Sectors: BofA might identify specific sectors, perhaps technology or certain consumer discretionary segments, as exhibiting signs of overvaluation based on their analysis.

- Undervalued Sectors: Conversely, other sectors, possibly those in the energy or healthcare sectors, might be identified as potentially undervalued, presenting investment opportunities.

- Interest Rate Impact: The analysis undoubtedly incorporates the impact of recent interest rate hikes on valuation multiples, acknowledging that higher rates can depress valuations.

- Market Trends: Factors such as geopolitical events, supply chain disruptions, and technological advancements are considered in the overall valuation assessment.

BofA's Outlook and Investment Strategies

BofA's outlook for the near-term market performance is cautiously optimistic. While acknowledging the persistent challenges of inflation and geopolitical uncertainty, they anticipate moderate growth, potentially with periods of volatility. For the long-term, their outlook is more positive, reflecting expectations of sustained economic growth and corporate profitability.

Based on their valuation analysis, BofA's recommended investment strategies include:

- Asset Allocation: A diversified portfolio with a balanced mix of stocks and bonds is likely recommended, adjusting the allocation based on risk tolerance.

- Sector Selection: Investors may be advised to focus on sectors deemed undervalued by BofA's analysis, considering their growth potential and relative risk.

- Stock Selection: Specific stocks within those undervalued sectors, which meet BofA's criteria, might be recommended.

- Risk Mitigation: Strategies like dollar-cost averaging and diversification are likely emphasized to manage risk effectively.

Addressing Investor Concerns

Many investors are concerned about market volatility and inflation's impact on their investments. BofA addresses these concerns by highlighting the historical context of current valuations and emphasizing the long-term growth potential of the market. Data from their report likely underscores that while volatility is expected, periods of market correction are normal and often present buying opportunities for long-term investors. They likely offer reassuring data points comparing current market conditions to similar historical periods, emphasizing that the market has historically recovered from similar downturns.

Comparison with Other Analyst Views

It's essential to compare BofA's assessment with those of other prominent financial institutions. While specific details would require accessing individual reports, a general comparison might reveal areas of consensus and disagreement amongst analysts. Some might share BofA's relatively positive outlook, while others may express more caution or adopt a more bearish stance, offering a range of perspectives for investors to consider. This comparison provides a more holistic understanding of the market’s current state.

Conclusion

BofA's analysis presents a reassuring view on current stock market valuations. While acknowledging market volatility and economic uncertainties, their assessment suggests that the market is not drastically overvalued and offers long-term growth potential. Their detailed methodology, data-driven findings, and suggested investment strategies provide valuable insights for investors. Key takeaways include a balanced approach to investing, focusing on undervalued sectors, and a long-term perspective. Learn more about BofA's view on current stock market valuations to incorporate their insights into your investment strategy and navigate the current market conditions effectively. Understand the reassuring perspective on current market conditions from BofA and make informed decisions.

Featured Posts

-

Theater Het Kruispunt Beoordeling Van A Real Pain Met Kieran Culkin

May 23, 2025

Theater Het Kruispunt Beoordeling Van A Real Pain Met Kieran Culkin

May 23, 2025 -

Trinidad And Tobago Newsday Police Cite Safety Concerns For Kartels Restrictions

May 23, 2025

Trinidad And Tobago Newsday Police Cite Safety Concerns For Kartels Restrictions

May 23, 2025 -

Trucking News Big Rig Rock Report 3 12 On 98 5 The Fox

May 23, 2025

Trucking News Big Rig Rock Report 3 12 On 98 5 The Fox

May 23, 2025 -

Rybakina Kommentariy O Fizicheskoy Forme Posle Poslednego Turnira

May 23, 2025

Rybakina Kommentariy O Fizicheskoy Forme Posle Poslednego Turnira

May 23, 2025 -

The Nfls War On Butts Is Over The Survival Of The Tush Push

May 23, 2025

The Nfls War On Butts Is Over The Survival Of The Tush Push

May 23, 2025