BofA's Take: Are High Stock Market Valuations A Cause For Concern?

Table of Contents

Recent reports indicate that the current stock market is experiencing historically high valuations. A recent BofA Global Research report highlighted this, sparking concerns among investors about potential market corrections and future returns. This article delves into BofA's analysis of these high stock market valuations, examining their valuation metrics, the influence of economic factors, and the associated risks. We'll explore BofA's recommendations to help investors navigate this challenging environment.

H2: BofA's Valuation Metrics and Analysis

BofA employs several key valuation metrics to assess the stock market's health. These include the widely used Price-to-Earnings ratio (P/E), which compares a company's stock price to its earnings per share, and the Shiller PE ratio (also known as the CAPE ratio), which considers inflation-adjusted earnings over a longer period (typically 10 years). BofA also looks at other metrics like the Price-to-Sales ratio and Price-to-Book ratio to get a comprehensive view.

BofA's current assessment suggests that many of these metrics are currently elevated compared to historical averages. While specific numbers fluctuate based on the report's release date, the general trend points towards high valuations across the board.

- Specific data points from recent BofA reports: (Note: Specific data requires access to current BofA reports. This section should be updated with current data at the time of publication. Example: "As of October 26, 2023, BofA's analysis indicated a Shiller PE ratio of X, exceeding the long-term average of Y.")

- Comparison to historical valuations: BofA often compares current valuations to those observed during previous market booms and busts, providing valuable context for investors. This historical perspective helps assess whether current valuations are truly excessive or simply reflect strong economic fundamentals.

- Mention any specific sectors BofA highlights as overvalued: BofA's reports frequently pinpoint specific sectors showing signs of overvaluation. This could include technology, consumer discretionary, or other sectors experiencing rapid growth.

H2: Economic Factors Influencing Stock Market Valuations

Several macroeconomic factors significantly influence stock market valuations. BofA's economists carefully consider these variables in their analysis. These include:

- Interest rates: Rising interest rates generally increase borrowing costs for businesses, potentially slowing economic growth and impacting corporate earnings, thus affecting stock valuations.

- Inflation: High inflation erodes purchasing power and can lead to central bank interventions (like interest rate hikes), affecting stock market performance.

- Economic growth: Robust economic growth typically supports higher stock valuations, while slower growth can lead to downward pressure.

- Geopolitical risks: Global uncertainties, such as wars or trade disputes, introduce volatility and can negatively impact market sentiment and valuations.

BofA's predictions for key economic indicators are crucial to their valuation outlook. Their economists continuously monitor these factors and adjust their forecasts accordingly.

- BofA's predictions for key economic indicators: (Again, this section needs to be updated with the latest predictions from BofA reports.) For instance, their forecasts for GDP growth, inflation rates, and unemployment rates directly impact their view on stock market valuations.

- How these predictions affect their valuation outlook: Positive predictions generally support higher valuations, while negative predictions suggest a potential for market corrections or even a bear market.

- Discussion of potential market corrections or bubbles: BofA's analysis considers the possibility of market corrections or even the formation of speculative bubbles, which are characterized by unsustainable price increases driven by excessive speculation.

H2: Potential Risks Associated with High Stock Market Valuations

High stock market valuations present several potential risks for investors:

- Increased market volatility: Highly valued markets are often more susceptible to sharp price swings, leading to greater uncertainty and potential losses.

- Potential for a correction: A market correction is a significant price decline, typically exceeding 10%, which can occur when valuations become unsustainable.

- Reduced future returns: High valuations suggest that future returns might be lower than those experienced during periods of lower valuations.

BofA's risk assessment incorporates these potential downsides.

- Potential scenarios for market downturns: BofA models various scenarios, exploring potential triggers for market downturns and their likely impact on different asset classes.

- BofA's suggested portfolio adjustments or risk management strategies: They might suggest diversification, hedging strategies, or shifting towards less volatile assets to mitigate the risks associated with high valuations.

- Discussion of defensive investment options: This may include focusing on value stocks, dividend-paying stocks, or other investments that are considered less vulnerable to market corrections.

H2: BofA's Recommendations for Investors

BofA's overall stance on investing in the current market environment typically emphasizes cautious optimism. Their recommendations often involve a balance between capitalizing on potential growth opportunities and mitigating risks.

- Specific asset allocation advice: BofA might recommend adjusting asset allocation, potentially reducing exposure to equities and increasing exposure to fixed income or other less volatile asset classes.

- Sector-specific recommendations (if any): They might advise investors to favor sectors they believe are less overvalued or have stronger long-term growth prospects.

- Advice on managing risk in a high-valuation market: This often includes employing diversification strategies, utilizing stop-loss orders, and regularly reviewing and adjusting investment portfolios.

3. Conclusion: Navigating High Stock Market Valuations

BofA's analysis indicates that high stock market valuations present both opportunities and risks. While the market might continue to grow, the potential for corrections remains. Careful analysis and robust risk management are crucial for navigating this environment. Understanding BofA's valuation metrics and their assessment of macroeconomic factors is essential for informed investment decisions. Consult BofA's research reports or seek professional financial advice to develop a well-diversified investment strategy that considers the current landscape of high stock market valuations. Remember, a well-informed approach is key to successfully managing your investments in this market climate.

Featured Posts

-

The Truth Behind Michael Sheens Million Pound Giveaway

May 01, 2025

The Truth Behind Michael Sheens Million Pound Giveaway

May 01, 2025 -

The Sec And Xrp Navigating Uncertainty In The Crypto Market

May 01, 2025

The Sec And Xrp Navigating Uncertainty In The Crypto Market

May 01, 2025 -

Ovechkin I Rekord Grettski Noviy Prognoz N Kh L

May 01, 2025

Ovechkin I Rekord Grettski Noviy Prognoz N Kh L

May 01, 2025 -

Inside Michael Sheens World Relationships Wealth And Career Choices

May 01, 2025

Inside Michael Sheens World Relationships Wealth And Career Choices

May 01, 2025 -

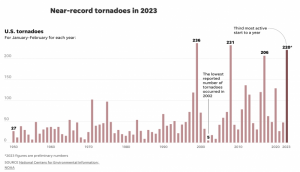

Severe Weather Pummels Louisville Snow Tornadoes And Historic Flooding In 2025

May 01, 2025

Severe Weather Pummels Louisville Snow Tornadoes And Historic Flooding In 2025

May 01, 2025