BofA's Take: Why Current Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Positive Economic Outlook Fuels Market Confidence

BofA's positive outlook on the economy is a cornerstone of their belief that current stock market valuations are justifiable. This optimism stems from several key factors:

Robust Corporate Earnings Growth

BofA projects strong corporate earnings growth in the coming quarters. This projection is fueled by several factors: sustained consumer spending, despite inflation concerns, and continued innovation across various sectors.

- Technology: The tech sector is expected to continue its strong performance, driven by advancements in artificial intelligence and cloud computing.

- Healthcare: Biotechnology and pharmaceutical companies are poised for growth, driven by ongoing research and development.

- Consumer Staples: Despite inflationary pressures, essential goods companies are demonstrating resilience.

BofA's analysts predict an average earnings growth rate of X% for the S&P 500 in the next year, significantly higher than previous forecasts. These projections are supported by strong revenue growth and improved profit margins across many sectors.

Resilient Economic Fundamentals

BofA's analysis of key economic indicators paints a picture of continued, albeit moderated, growth. Several factors contribute to this positive assessment:

- Low Unemployment: The unemployment rate remains historically low, indicating a strong labor market and sustained consumer spending power.

- Positive GDP Growth Forecasts: BofA's economists predict positive GDP growth for the remainder of the year, though at a slower pace than previous years.

- Manageable Inflation: While inflation remains a concern, BofA's analysis suggests it's becoming more manageable, with predictions of a gradual decline in the coming months. These predictions are detailed in their latest economic outlook report (link to report).

These indicators suggest a healthy economic foundation that supports continued growth and justifies current market valuations.

Interest Rate Hikes Near Their Peak

BofA believes the Federal Reserve's interest rate hikes are nearing their peak. This assessment is crucial for understanding the impact on stock market valuations:

- Current Interest Rate Environment: The current interest rate environment, while higher than in previous years, is considered manageable by BofA analysts.

- Future Rate Adjustments: The expectation is for fewer and smaller rate hikes in the near future, contributing to increased market stability.

- Positive Impact on Market: Interest rate stability is expected to reduce uncertainty and encourage further investment, positively impacting stock market valuations.

Understanding Current Stock Market Valuations in Context

While current valuation multiples may appear high at first glance, a closer examination within a historical context reveals a different story.

Historical Comparisons and Contextualization

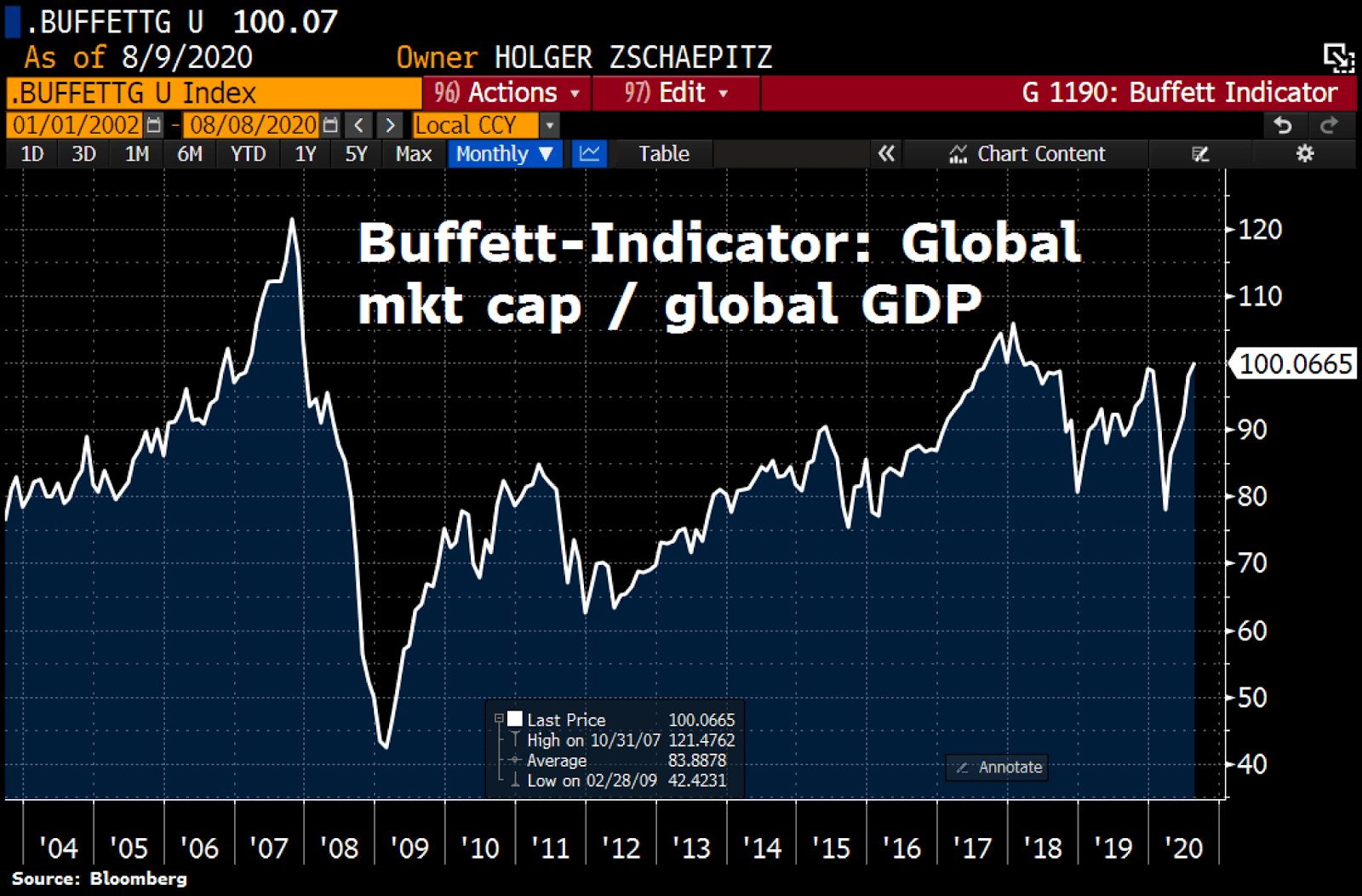

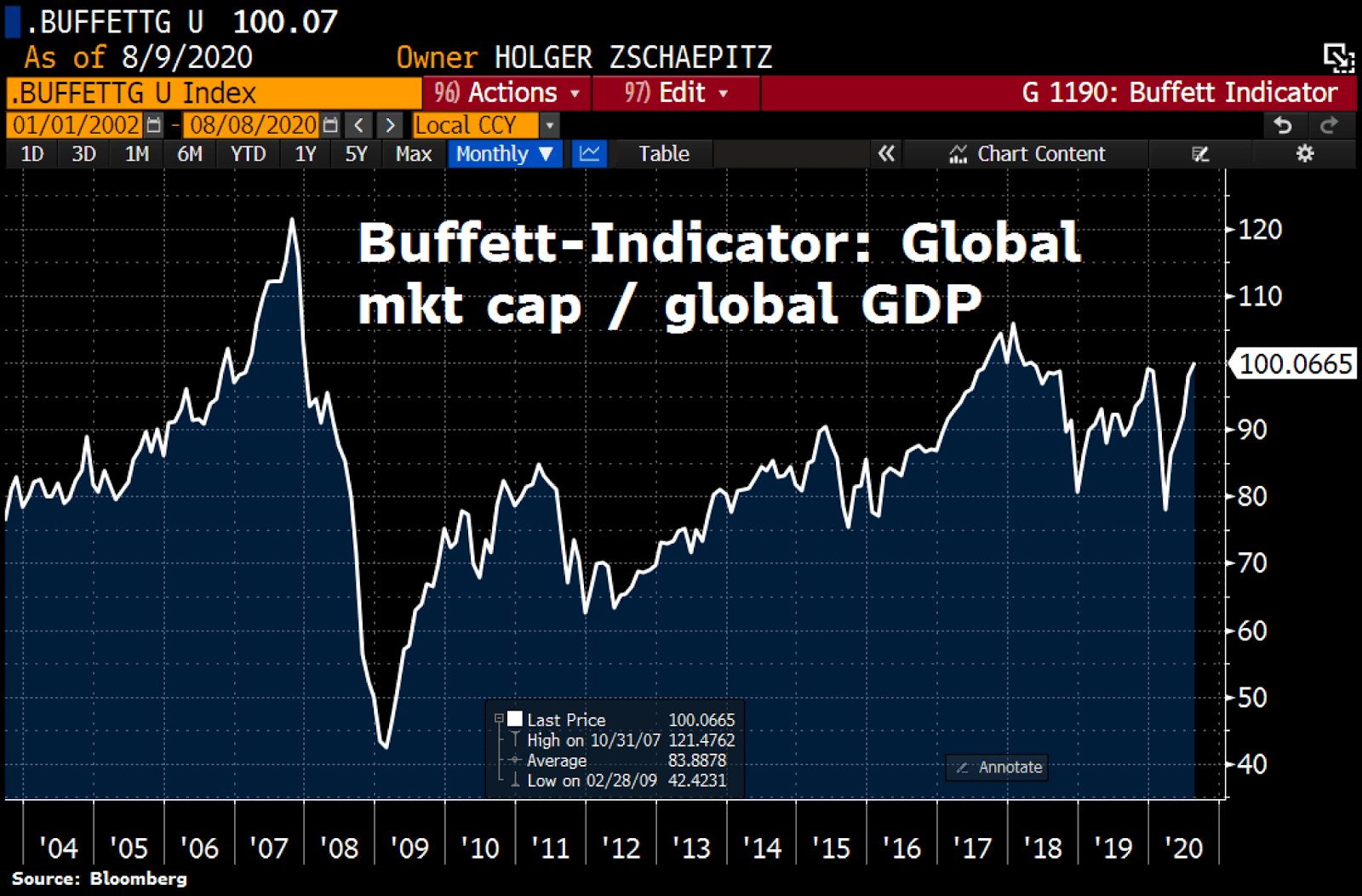

Current valuations, while elevated, aren't unprecedented. Comparing current Price-to-Earnings (P/E) ratios to historical averages reveals periods with even higher valuations. (Insert chart comparing current P/E ratios to historical averages here).

- P/E Ratios: While current P/E ratios are above historical averages, they are not drastically higher. The PEG ratio (Price/Earnings to Growth ratio) offers a more nuanced view by incorporating earnings growth.

- Market Cycles: Understanding market cycles is crucial. High valuations are often associated with periods of strong economic growth and expansion.

- Technological Innovation: The current market benefits from the ongoing disruption and growth fueled by technology, influencing valuations.

The Role of Low Interest Rates in Valuation

Lower interest rates significantly impact stock market valuations by making equities a more attractive investment compared to bonds.

- Inverse Relationship: There is an inverse relationship between interest rates and stock valuations. Lower interest rates make borrowing cheaper for companies, encouraging investment and growth.

- Attractiveness of Equities: When interest rates are low, the return on bonds is reduced, making equities a more compelling alternative for investors seeking higher returns.

- Bond Yields vs. Equity Returns: The current bond yields are significantly lower than projected equity returns, further justifying higher stock valuations.

Sector-Specific Valuations

Valuations differ significantly across sectors. While some sectors might appear overvalued, others offer compelling investment opportunities.

- Undervalued Sectors: Certain sectors, such as [mention specific examples], might be considered undervalued based on their growth potential and current valuations.

- Overvalued Sectors: Conversely, other sectors, like [mention specific examples], might have valuations that reflect a higher level of risk.

- Investment Opportunities: A thorough sector-specific analysis is essential for identifying attractive investment opportunities.

Strategies for Navigating the Current Market Environment

Navigating the current market requires a thoughtful approach. Here are some key strategies:

Diversification as a Risk Management Tool

Diversification is crucial for managing risk and mitigating potential losses.

- Asset Class Diversification: Spread investments across various asset classes (stocks, bonds, real estate, etc.).

- Sector Diversification: Don't concentrate investments in a single sector.

- Geographic Diversification: Consider diversifying across different geographic markets.

Long-Term Investment Perspective

A long-term investment perspective is crucial for weathering short-term market volatility.

- Patience is Key: Avoid making impulsive decisions based on short-term market fluctuations.

- Fundamental Analysis: Focus on fundamental analysis—evaluating a company's financial health and growth potential—rather than reacting to daily market noise.

- Buy-and-Hold Strategy: A buy-and-hold strategy can be highly effective in the long run.

Working with a Financial Advisor

Seeking professional guidance is always beneficial.

- Personalized Financial Planning: A financial advisor can help create a personalized investment strategy tailored to your specific goals and risk tolerance.

- Navigating Market Complexities: Professional advice can simplify the process of navigating the complexities of the stock market.

Conclusion

BofA's analysis suggests that while current stock market valuations might seem high, they shouldn't discourage investors with a long-term perspective. Strong economic fundamentals, robust corporate earnings, and a considered historical context all support this view. Don't let concerns about stock market valuations deter you from long-term investment success. Explore BofA's insights today to make informed investment decisions. Review their research and reports for a more in-depth analysis and consider incorporating a long-term investment strategy into your portfolio.

Featured Posts

-

Move Over Quinoa The New Superfood Revolution

Apr 29, 2025

Move Over Quinoa The New Superfood Revolution

Apr 29, 2025 -

Ohio Doctors Murder Conviction Sons Emotional Journey Before Parole Decision

Apr 29, 2025

Ohio Doctors Murder Conviction Sons Emotional Journey Before Parole Decision

Apr 29, 2025 -

Anthony Edwards Injury Status Latest News On Timberwolves Guard

Apr 29, 2025

Anthony Edwards Injury Status Latest News On Timberwolves Guard

Apr 29, 2025 -

Anthony Edwards Loses Paternity Case Ayesha Howard Granted Custody

Apr 29, 2025

Anthony Edwards Loses Paternity Case Ayesha Howard Granted Custody

Apr 29, 2025 -

Wrexham Football Club Promoted Ryan Reynolds Response

Apr 29, 2025

Wrexham Football Club Promoted Ryan Reynolds Response

Apr 29, 2025

Latest Posts

-

Ohio Doctors Murder Conviction Sons Emotional Journey Before Parole Decision

Apr 29, 2025

Ohio Doctors Murder Conviction Sons Emotional Journey Before Parole Decision

Apr 29, 2025 -

Parole Hearing Looms For Ohio Doctor Convicted Of Killing Wife 36 Years Ago

Apr 29, 2025

Parole Hearing Looms For Ohio Doctor Convicted Of Killing Wife 36 Years Ago

Apr 29, 2025 -

36 Years Later Ohio Doctors Son Confronts Fathers Past Ahead Of Parole Hearing

Apr 29, 2025

36 Years Later Ohio Doctors Son Confronts Fathers Past Ahead Of Parole Hearing

Apr 29, 2025 -

Son Grapples With Emotion As Ohio Doctor Convicted Of Wifes Murder Faces Parole

Apr 29, 2025

Son Grapples With Emotion As Ohio Doctor Convicted Of Wifes Murder Faces Parole

Apr 29, 2025 -

Ohio Doctors Parole Hearing Sons Struggle 36 Years After Mothers Murder

Apr 29, 2025

Ohio Doctors Parole Hearing Sons Struggle 36 Years After Mothers Murder

Apr 29, 2025