BofA's Take: Why Stretched Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Rationale: Understanding the Current Market Context

BofA's optimistic outlook isn't blind optimism; it's rooted in a careful analysis of several key economic factors influencing current market valuations.

Low Interest Rates and Their Impact

Historically low interest rates significantly impact stock market valuations. This isn't necessarily a negative, however.

- The Bond-Stock Relationship: Low bond yields, a direct result of low interest rates, make stocks relatively more attractive. When bonds offer meager returns, investors seek higher yields elsewhere, pushing up demand—and prices—for stocks.

- Discounted Cash Flow (DCF) Models: Low discount rates, used in DCF models to value companies, lead to higher valuations. A lower discount rate inflates the present value of future cash flows, making companies appear more valuable.

- Increased Investor Appetite for Risk: Low interest rates often encourage investors to take on more risk, further driving up stock prices.

Strong Corporate Earnings and Growth Prospects

Robust corporate earnings and positive future growth projections are major contributors to higher stock valuations.

- Strong Performing Sectors: Several sectors, including technology, healthcare, and consumer staples, have reported exceptionally strong earnings, fueling market optimism. These companies' financial strength supports the higher stock prices.

- Innovation and Technological Advancements: Continuous innovation and technological advancements are driving growth in many sectors, generating future earnings potential that justifies current high valuations.

- Future Earnings Growth: Analysts predict continued earnings growth in several key sectors, further supporting the argument that current valuations aren't necessarily overblown when considering future prospects.

Inflationary Pressures and Their Influence

Inflation is another factor affecting market valuations. However, BofA argues its impact is either already factored into current prices or manageable.

- Federal Reserve's Role: The Federal Reserve's actions to manage inflation play a critical role. Their policies, including interest rate adjustments, influence inflation expectations and subsequently affect stock valuations.

- Inflation Expectations in Market Pricing: Market participants already factor inflation expectations into their investment decisions. Current stock prices likely reflect the anticipated inflationary environment.

- Mitigating Factors: Factors like increased productivity and supply chain improvements can potentially mitigate inflationary pressures, reducing the negative impact on valuations.

Long-Term Investing Perspective: Why Time Horizon Matters

Navigating seemingly "stretched stock market valuations" requires a long-term perspective. Short-term market fluctuations shouldn't dictate long-term investment strategies.

The Importance of Long-Term Investment Strategies

A long-term investment strategy is crucial for weathering short-term market volatility.

- Market Corrections are Normal: Market corrections are a natural part of the investment cycle. Focusing on the long term allows investors to ride out these periods of downturn.

- The Power of Compounding: Over the long term, the power of compounding significantly outweighs short-term market fluctuations.

- Ignoring Short-Term Market Noise: Focusing on fundamentals and long-term goals helps investors avoid emotional decision-making driven by short-term market noise.

Historical Context and Market Cycles

History demonstrates that periods of high valuations have often been followed by substantial market growth.

- Historical Examples: Numerous historical examples showcase periods of seemingly high valuations followed by significant market expansion, illustrating the cyclical nature of the market.

- Market Timing Difficulties: Trying to time the market is notoriously difficult and often unsuccessful. A long-term approach avoids the pitfalls of market timing.

Diversification as a Risk Management Tool

Diversification is key to mitigating risk associated with potentially overvalued sectors.

- Asset Class Diversification: Diversifying across asset classes (stocks, bonds, real estate, etc.) reduces overall portfolio risk.

- Geographic Diversification: Investing in different geographic regions further mitigates risk. A downturn in one region doesn't necessarily impact all investments.

- Well-Diversified Portfolio: A well-diversified portfolio reduces exposure to any single sector or market, thereby mitigating risks associated with potentially overvalued sectors.

BofA's Recommendations for Investors

BofA offers practical advice for navigating the current market environment.

Maintain a Balanced Portfolio

A well-balanced portfolio is crucial for managing risk and capitalizing on opportunities.

- Asset Allocation: BofA recommends maintaining a balanced portfolio tailored to individual risk tolerance and investment goals.

- Risk Tolerance Adjustment: Allocations should be adjusted to reflect individual circumstances and risk profiles.

Focus on Quality Companies with Strong Fundamentals

Selecting high-quality companies with robust business models is paramount.

- Strong Management Teams: Look for companies with strong leadership and proven track records.

- Competitive Advantages: Choose companies with sustainable competitive advantages (e.g., strong brands, patents).

- Innovation and Growth: Invest in companies exhibiting consistent innovation and growth potential.

Stay Disciplined and Avoid Emotional Decision-Making

Sticking to a long-term investment plan is crucial.

- Avoid Panic Selling: Resist the urge to panic sell during market downturns.

- Disciplined Approach: Maintain a disciplined approach to investing, avoiding impulsive decisions based on short-term market volatility.

Conclusion

While current stock market valuations might seem stretched, BofA's analysis highlights the importance of a long-term perspective. Low interest rates, strong corporate earnings, and manageable inflationary pressures all contribute to a more optimistic outlook. By focusing on quality companies, maintaining a diversified portfolio, and avoiding emotional decision-making, investors can navigate these seemingly "stretched stock market valuations" effectively. Consider BofA's insights as you evaluate your investment strategy and consult with a financial advisor to tailor an approach best suited to your individual circumstances and risk tolerance. Remember, a well-informed approach is key to successfully navigating even seemingly high stock market valuations.

Featured Posts

-

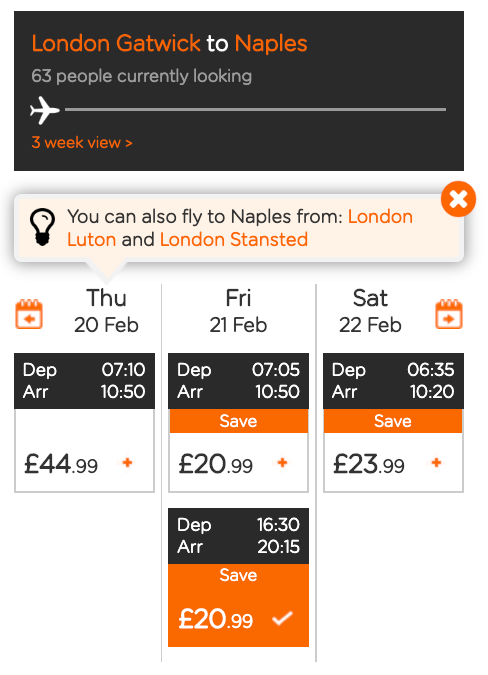

Find Your Fun Booking Flights Made Easy

May 12, 2025

Find Your Fun Booking Flights Made Easy

May 12, 2025 -

Lily Collins Stars In Sexy Calvin Klein Campaign See Photo 5133599

May 12, 2025

Lily Collins Stars In Sexy Calvin Klein Campaign See Photo 5133599

May 12, 2025 -

From Cabin Crew To Cockpit One Ex Sia Flight Attendants Inspiring Pilot Story

May 12, 2025

From Cabin Crew To Cockpit One Ex Sia Flight Attendants Inspiring Pilot Story

May 12, 2025 -

Sylvester Stallone Regrette T Il Cobra Un Thriller Culte Des Annees 80

May 12, 2025

Sylvester Stallone Regrette T Il Cobra Un Thriller Culte Des Annees 80

May 12, 2025 -

Ill House U Andrea Loves Collaboration With Neal Mc Clelland

May 12, 2025

Ill House U Andrea Loves Collaboration With Neal Mc Clelland

May 12, 2025