BofA's View: Addressing Concerns About Elevated Stock Market Valuations

Table of Contents

BofA's Assessment of Current Market Conditions

BofA's overall assessment of the current market environment often leans towards a nuanced perspective, acknowledging both positive and negative factors. While they may not explicitly label the market as purely bullish or bearish, their analysis reflects a cautious optimism tempered by the awareness of elevated valuations. Their assessment considers a complex interplay of economic indicators and market sentiment.

- Key Economic Indicators: BofA closely monitors key economic indicators such as inflation rates, interest rate adjustments by the Federal Reserve, and GDP growth figures. These factors significantly influence their evaluation of stock valuations and overall market health. For instance, persistent inflation might lead to higher interest rates, which can negatively impact stock prices. Conversely, strong GDP growth might support higher valuations, although this is contingent on other factors.

- Sectoral Analysis: BofA's reports often highlight specific sectors they view as overvalued or undervalued. For example, they might identify the technology sector as potentially overvalued due to high growth expectations already priced into the market, while sectors like energy or healthcare may appear more attractively valued depending on their analyses of future prospects.

- BofA Reports and Analyses: To gain a deeper understanding, it's crucial to consult BofA's official research publications and investor reports. These documents provide detailed breakdowns of their economic forecasts, valuation models, and investment recommendations. They often include detailed charts, graphs, and insightful commentary which help to support their arguments.

Analyzing Price-to-Earnings Ratios (P/E) and other Valuation Metrics

BofA employs a multi-faceted approach to valuation, going beyond simple Price-to-Earnings (P/E) ratios. They utilize a range of valuation metrics and methodologies to arrive at a comprehensive assessment.

- Valuation Methods: BofA uses various methods, including discounted cash flow (DCF) analysis, to determine intrinsic value. DCF analysis projects future cash flows and discounts them back to their present value, providing a more nuanced view than simple P/E ratios.

- Historical Comparisons: BofA compares current market valuations to historical averages and standard deviations, recognizing that market cycles occur and that current valuations may be high compared to past norms, but potentially justified by future growth expectations.

- Market Condition Adjustments: Their valuation models factor in adjustments for specific market conditions. For example, periods of low interest rates might justify higher P/E ratios as the cost of capital is lower.

Identifying Potential Risks and Opportunities

While acknowledging potential for long-term growth, BofA identifies several risks associated with elevated valuations.

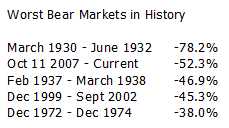

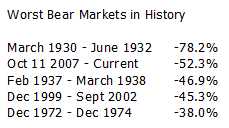

- Market Correction: The elevated valuations increase the risk of a significant market correction or downturn. A sudden shift in investor sentiment or unexpected economic events could trigger a sharp decline in stock prices.

- Rising Interest Rates: The impact of rising interest rates on stock valuations is a key concern highlighted by BofA. Higher interest rates increase the cost of borrowing, reducing corporate profitability and potentially leading to lower stock prices.

- Geopolitical Risks: Global events and geopolitical instability can significantly impact market sentiment and valuation. Uncertainties arising from international conflicts or policy changes can influence investor confidence and market performance.

BofA's Recommendations for Investors

Given the elevated valuations and inherent risks, BofA often recommends a cautious approach to investing.

- Diversification: A well-diversified portfolio across different asset classes and sectors is crucial to mitigate risk. Spreading investments across multiple sectors and asset types is a core tenet of risk management.

- Sector-Specific Recommendations: BofA might suggest focusing on specific sectors they deem less overvalued or possessing stronger long-term growth prospects.

- Risk Management: Implementing effective risk management strategies, such as hedging techniques, can help to limit potential losses during market downturns.

Considering Long-Term Growth Prospects

BofA balances concerns about high valuations by considering the potential for long-term growth.

- Growth Drivers: Factors like technological innovation, demographic shifts, and global economic expansion contribute to long-term growth potential. These positive factors can justify higher valuations if sustained growth is expected.

- Future Market Projections: BofA’s market projections incorporate the interplay of these factors to estimate future market performance. Their long-term outlook helps contextualize current valuations within the broader perspective of future growth.

- Growth's Influence on Valuation: The potential for robust long-term growth can influence BofA’s valuation assessments, potentially justifying higher current valuations if future returns are expected to justify the current price.

Conclusion

BofA's analysis of elevated stock market valuations underscores a cautious yet optimistic view. While acknowledging the risks associated with high valuations, including potential market corrections and the impact of rising interest rates, they also recognize the long-term growth potential driven by factors like technological innovation. Their recommendations emphasize the importance of diversification, sector-specific analysis, and prudent risk management strategies for investors. Understanding BofA's view on elevated stock market valuations is crucial for making informed investment decisions. Stay informed about BofA's ongoing insights into elevated stock market valuations and refine your investment strategy accordingly. Learn more by visiting [link to BofA resources].

Featured Posts

-

Escape To Tranquility Planning Your Rehoboth Beach Vacation

May 26, 2025

Escape To Tranquility Planning Your Rehoboth Beach Vacation

May 26, 2025 -

Is Naomi Campbell Banned From The 2025 Met Gala A Look At The Anna Wintour Conflict

May 26, 2025

Is Naomi Campbell Banned From The 2025 Met Gala A Look At The Anna Wintour Conflict

May 26, 2025 -

Sled Investigating Fatal Myrtle Beach Officer Involved Shooting 11 Injured

May 26, 2025

Sled Investigating Fatal Myrtle Beach Officer Involved Shooting 11 Injured

May 26, 2025 -

4 Gol Birden Soerloth La Liga Da Firtina Gibi Esti

May 26, 2025

4 Gol Birden Soerloth La Liga Da Firtina Gibi Esti

May 26, 2025 -

Link Streaming Moto Gp Inggris 2025 Saksikan Aksi Sengit Sprint Race Jam 20 00 Wib

May 26, 2025

Link Streaming Moto Gp Inggris 2025 Saksikan Aksi Sengit Sprint Race Jam 20 00 Wib

May 26, 2025