BofA's View: Are High Stock Market Valuations Cause For Concern?

Table of Contents

Keywords: High stock market valuations, BofA, Bank of America, stock market valuation, market outlook, investment strategy, risk assessment, stock market analysis, portfolio management, equity valuations

The current stock market exhibits high valuations, a fact acknowledged by many financial analysts. But what does Bank of America (BofA), a major player in the financial world, think? Are these high stock market valuations a cause for concern, or do they present hidden opportunities? Let's delve into BofA's perspective and analyze the implications for your investment strategy.

BofA's Current Assessment of Stock Market Valuations

BofA regularly publishes research reports offering insights into the market. Their recent analyses often focus on key valuation metrics to gauge the overall health of the market. While specific statements evolve, a common thread often weaves through their analyses: a cautious approach to the current high stock market valuations.

- Valuation Metrics: BofA employs several metrics, including the Price-to-Earnings ratio (P/E), and the cyclically adjusted price-to-earnings ratio (Shiller PE), to assess market valuations. These provide a broader perspective than simply looking at current earnings.

- Overvalued Sectors: BofA frequently highlights specific sectors, such as technology or certain growth stocks, as potentially overvalued relative to historical averages and projected earnings. This analysis varies with market shifts, so staying updated on their reports is crucial.

- Overall Sentiment: BofA's overall sentiment often leans towards cautious optimism, acknowledging the strong performance of the market but also emphasizing the risks associated with elevated valuations. They don't usually offer outright bullish or bearish predictions, preferring a more nuanced approach.

[Link to relevant BofA research report 1] [Link to relevant BofA research report 2]

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors contribute to the current high stock market valuations:

- Low Interest Rates: Historically low interest rates have made borrowing cheaper for companies and spurred investment, driving up asset prices across the board. This makes bonds less attractive, leading to more money flowing into stocks.

- Quantitative Easing (QE): Central bank policies like QE inject liquidity into the market, increasing the money supply and further inflating asset prices. This artificial boost can lead to inflated stock valuations.

- Strong Corporate Earnings (or Lack Thereof): While strong corporate earnings can justify higher valuations, in some cases, high valuations might be driven by expectations of future earnings rather than current performance. It's crucial to distinguish between these scenarios.

- Investor Sentiment and Market Psychology: Positive investor sentiment and a "fear of missing out" (FOMO) can drive up prices beyond what fundamental analysis would suggest. This exuberance can inflate market bubbles.

- Geopolitical Events: Global events, such as trade wars or political instability, can significantly impact investor confidence and market valuations, sometimes leading to heightened uncertainty and either a surge or decline in stock prices.

Potential Risks Associated with High Valuations

Investing in a market with high valuations presents several risks:

- Market Correction or Crash: High valuations increase the probability of a market correction or even a crash. A significant drop in prices could lead to substantial losses for investors.

- Reduced Potential for Future Returns: High valuations typically imply lower potential for future returns. The higher the starting point, the less room for growth.

- Impact on Investment Strategies: High valuations disproportionately impact different investment strategies. Value investors, for example, may find fewer attractive opportunities, while growth investors may be more exposed to potential losses.

- Sector-Specific Risks: Overvaluation isn't uniform across all sectors. Some sectors may be more vulnerable to corrections than others.

[Insert chart showing historical examples of market corrections following periods of high valuations]

Opportunities Despite High Valuations

Despite the elevated valuations, opportunities still exist:

- Undervalued Companies: Even within overvalued sectors, some companies may be undervalued relative to their fundamentals. Thorough research is essential to identify these gems.

- Diversification Strategies: Diversifying across asset classes and sectors can help mitigate the risk associated with high valuations. A well-diversified portfolio may buffer some of the impacts.

- Strong Fundamentals: Focus on companies with strong fundamentals, sustainable competitive advantages, and long-term growth potential. These companies may be less susceptible to market fluctuations.

- Alternative Asset Classes: Consider exploring alternative asset classes, such as real estate or commodities, to diversify your portfolio beyond equities.

Adjusting Your Investment Strategy Based on BofA's View

BofA's cautious outlook suggests investors should consider these adjustments:

- Rebalancing: Rebalance your portfolio to align with your risk tolerance and investment goals. This may involve shifting some assets from high-valuation sectors to more defensive ones.

- Conservative Approach: Consider adopting a more conservative approach, perhaps reducing your overall equity exposure and increasing your allocation to fixed-income assets.

- Defensive Investments: Increase your allocation to defensive investments, such as consumer staples or utilities, which tend to be less volatile during market corrections.

- Professional Advice: Seek guidance from a qualified financial advisor to create a personalized investment strategy based on your circumstances and risk tolerance.

Disclaimer: This information is for educational purposes only and does not constitute financial advice. Consult with a financial advisor before making any investment decisions.

Conclusion

BofA's analysis indicates that while the market currently exhibits high stock market valuations, this doesn't necessarily signal an immediate crash. However, investors should proceed with caution, acknowledging the increased risk of market corrections and reduced potential for future returns. By carefully considering the factors contributing to high valuations, identifying potential risks, and exploring opportunities, investors can adapt their strategies to navigate this market environment. Stay informed about market trends and BofA's ongoing analysis to make informed decisions about your investment strategy. Regularly review your portfolio and consider adjusting it based on changes in high stock market valuations.

Featured Posts

-

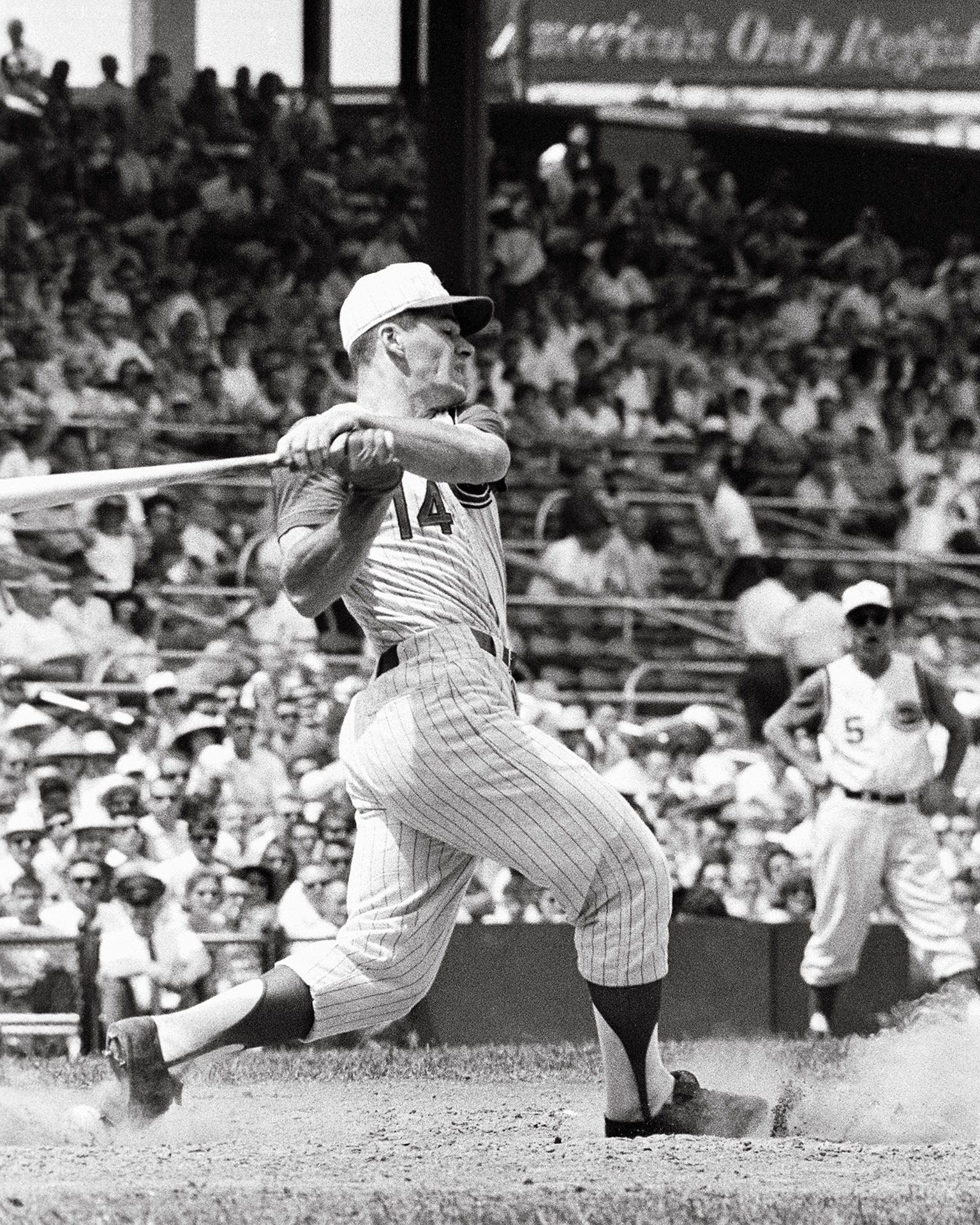

Trump On Pete Rose Mlb Decision Draws Presidential Ire

Apr 29, 2025

Trump On Pete Rose Mlb Decision Draws Presidential Ire

Apr 29, 2025 -

Ftc Probes Open Ai Implications For Ai Development And Regulation

Apr 29, 2025

Ftc Probes Open Ai Implications For Ai Development And Regulation

Apr 29, 2025 -

Analysis Trumps Potential Pardon Of Pete Rose For Baseball Betting

Apr 29, 2025

Analysis Trumps Potential Pardon Of Pete Rose For Baseball Betting

Apr 29, 2025 -

Will Anthony Edwards Play Key Injury Update For Timberwolves Lakers Matchup

Apr 29, 2025

Will Anthony Edwards Play Key Injury Update For Timberwolves Lakers Matchup

Apr 29, 2025 -

Significant Improvement Expected For Louisville Mail Delivery

Apr 29, 2025

Significant Improvement Expected For Louisville Mail Delivery

Apr 29, 2025

Latest Posts

-

Cardinal Beccius Unfair Trial Claim Bolstered By New Evidence

Apr 29, 2025

Cardinal Beccius Unfair Trial Claim Bolstered By New Evidence

Apr 29, 2025 -

Reviving Nostalgia Older Viewers And Their You Tube Habits

Apr 29, 2025

Reviving Nostalgia Older Viewers And Their You Tube Habits

Apr 29, 2025 -

How You Tube Is Attracting A Growing Audience Of Older Viewers

Apr 29, 2025

How You Tube Is Attracting A Growing Audience Of Older Viewers

Apr 29, 2025 -

London Real Estate Fraud British Court Upholds Vaticans Claim

Apr 29, 2025

London Real Estate Fraud British Court Upholds Vaticans Claim

Apr 29, 2025 -

Vatican Defrauded London Real Estate Deal Ruled Fraudulent By British Court

Apr 29, 2025

Vatican Defrauded London Real Estate Deal Ruled Fraudulent By British Court

Apr 29, 2025