BofA's View: Understanding And Addressing Elevated Stock Market Valuations

Table of Contents

BofA's Assessment of Current Market Conditions

BofA's market outlook frequently incorporates a range of valuation metrics and economic indicators to gauge the overall health and potential risks within the stock market. Their analysis helps investors understand current market trends and make more informed decisions. Understanding BofA's stock market analysis is crucial for navigating the complexities of today's investment landscape.

Key indicators BofA uses to assess valuations include:

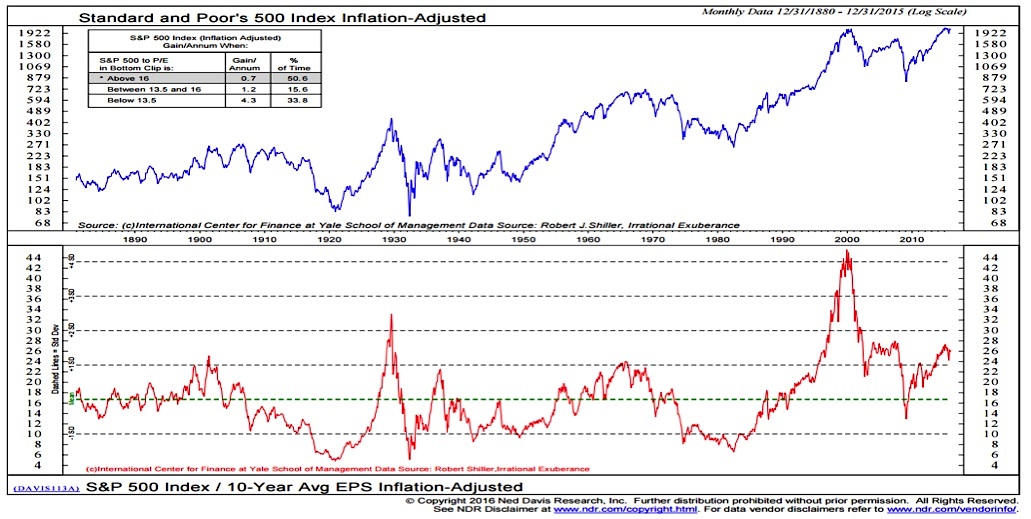

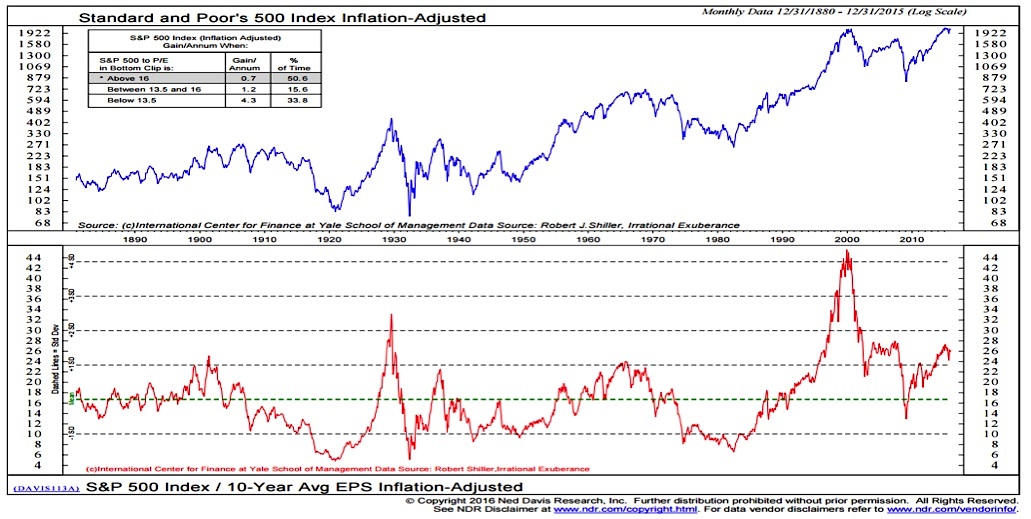

- Price-to-Earnings Ratio (P/E Ratio): This classic metric compares a company's stock price to its earnings per share, providing insights into how much investors are willing to pay for each dollar of earnings. BofA analyzes P/E ratios across different sectors and the market as a whole to identify potential overvaluations.

- Shiller P/E Ratio (Cyclically Adjusted Price-to-Earnings Ratio): This more sophisticated metric smooths out earnings fluctuations over time, providing a more stable picture of long-term valuations. BofA often uses this to gauge whether the market is historically overvalued.

- Other Key Metrics: BofA's analysis often extends beyond these core metrics, incorporating factors like dividend yields, growth rates, and interest rate environments to provide a comprehensive view of market valuations.

BofA's overall market sentiment, as reflected in their recent reports, often balances bullish and bearish considerations. While growth in certain sectors might support a bullish outlook, concerns about potential economic downturns and high inflation could lean the sentiment towards caution. The specific valuation metrics cited by BofA, along with their interpretations of these economic indicators, offer crucial context for informed investing. For example, elevated inflation and rising interest rates, as noted by BofA, can significantly impact stock valuations.

Identifying Potential Risks Associated with High Valuations

Investing in a market characterized by elevated stock prices presents inherent risks. The higher the valuation, the greater the potential for a significant price correction or even a bear market. Understanding these downside risks is paramount for successful risk management.

Risks associated with high valuations include:

- Significant Price Declines: Overvalued markets are more susceptible to sharp corrections, leading to substantial portfolio losses.

- Impact of Rising Interest Rates: Increased interest rates often lead to lower valuations as investors shift towards safer, higher-yielding assets. This is a key factor often highlighted in BofA's market commentary.

- Reduced Returns: Historically, periods of high valuations have often been followed by periods of lower returns, making it crucial to adjust investment strategies.

- The Importance of Risk Assessment and Management: In a high-valuation environment, thorough risk assessment and proactive risk management become even more critical for protecting your investment portfolio.

Strategies for Addressing Elevated Stock Market Valuations

Navigating elevated stock market valuations requires a proactive and adaptable investment strategy. BofA, while not explicitly providing prescriptive recommendations in every report, implicitly suggests adjusting portfolios to better handle this risk. Consider these strategies for mitigating risk in a high-valuation market:

- Diversification: Spreading investments across different asset classes, such as stocks, bonds, real estate, and alternative investments, reduces dependence on any single market segment and helps mitigate risk.

- Value Investing: Focusing on undervalued companies with strong fundamentals can offer better risk-adjusted returns compared to chasing high-growth, high-valuation stocks.

- Disciplined Approach to Buying and Selling: Avoid impulsive decisions based on short-term market fluctuations. Stick to your investment strategy and re-evaluate it periodically.

- Defensive Investing: Consider shifting towards more defensive investments, such as high-quality dividend-paying stocks or bonds, to preserve capital during market downturns.

- Regular Portfolio Rebalancing: Periodically rebalancing your portfolio to maintain your target asset allocation helps ensure you're not overly exposed to any single asset class.

BofA's Recommended Investment Approaches (if applicable)

While BofA doesn't typically offer specific stock picks, their reports often highlight sectors they view as relatively better positioned within the current market conditions. For instance, they might suggest a cautious approach to certain technology stocks while favoring companies with strong balance sheets and sustainable earnings in more defensive sectors. Consulting their latest reports provides the most up-to-date insights into their implied recommendations.

Conclusion

BofA's assessment of elevated stock market valuations highlights the importance of understanding the potential risks involved. The current market environment necessitates a cautious and proactive approach. By diversifying your portfolio, employing disciplined investment strategies, and adapting to changing market conditions, you can mitigate risk and improve the chances of long-term success. Stay informed on BofA's insights into stock market valuations and develop a robust investment strategy to navigate the current market conditions. Remember to conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Why Middle Management Matters A Key To Employee Retention And Business Growth

May 05, 2025

Why Middle Management Matters A Key To Employee Retention And Business Growth

May 05, 2025 -

2025 Playoffs Capitals New Initiatives Supported By Vanda Pharmaceuticals

May 05, 2025

2025 Playoffs Capitals New Initiatives Supported By Vanda Pharmaceuticals

May 05, 2025 -

Tournage De L Age D Or Premier Long Metrage De Berenger Thouin

May 05, 2025

Tournage De L Age D Or Premier Long Metrage De Berenger Thouin

May 05, 2025 -

Fan Reactions To Russell Westbrooks Play During The Nuggets Warriors Game

May 05, 2025

Fan Reactions To Russell Westbrooks Play During The Nuggets Warriors Game

May 05, 2025 -

Emma Stones Popcorn Dress Viral Sensation From Snls Golden Jubilee

May 05, 2025

Emma Stones Popcorn Dress Viral Sensation From Snls Golden Jubilee

May 05, 2025