BofA's View: Why Current Stock Market Valuations Are Not A Red Flag

Table of Contents

BofA's Bullish Stance: Understanding Their Rationale

BofA's bullish stance on the stock market isn't based on blind optimism. Their analysis considers several key factors, leading them to believe that current valuations are justifiable and potentially represent attractive investment opportunities.

The Role of Interest Rates and Inflation

BofA's perspective acknowledges the impact of rising interest rates and persistent inflation on stock market valuations. However, their analysis suggests that these factors are already largely priced into the market.

- Expected Future Interest Rate Trajectories: BofA's economists predict a potential slowdown in interest rate hikes, anticipating a peak rate followed by a period of stabilization or even potential rate cuts depending on future economic data. This expectation is crucial, as it affects the cost of borrowing for companies and influences their future profitability.

- Inflation's Influence on Corporate Earnings: While inflation impacts corporate earnings, BofA's analysis indicates that many companies have successfully managed to pass increased costs onto consumers, mitigating the negative impact on profit margins. This ability to manage price increases contributes to their positive outlook.

- BofA Reports and Analyst Opinions: Numerous BofA reports and analyst statements consistently highlight the resilience of corporate earnings despite inflationary pressures. These reports provide detailed breakdowns of sector-specific performance and forecasts, bolstering their overall positive market sentiment. (Note: Specific data and chart examples from BofA reports would be inserted here in a real-world article).

Strong Corporate Earnings & Future Growth Projections

BofA's analysis focuses on the strength of corporate earnings and their projection for future growth as a key reason why current valuations are not a red flag.

- Strong Sectors: BofA identifies several sectors demonstrating robust earnings growth, including technology, healthcare, and select consumer staples. These sectors are expected to continue to drive overall market performance.

- Specific Companies in BofA's Analysis: BofA's research highlights specific companies within these sectors showcasing strong earnings and growth potential, further substantiating their positive outlook. (Note: Specific company examples and data points would be included in a complete article).

- Earnings Growth and Valuation Metrics: BofA's analysts demonstrate a clear correlation between projected earnings growth and current valuation metrics, suggesting that the current valuations are largely justified by anticipated future performance. (Note: Charts illustrating this correlation would be included here).

Global Economic Outlook and its Influence

BofA's positive view on valuations also considers the global economic outlook.

- Key Economic Indicators: BofA monitors various key economic indicators, including GDP growth, employment figures, and consumer confidence, indicating a continued, albeit moderated, global economic expansion.

- Geopolitical Factors: While acknowledging the impact of geopolitical uncertainty, BofA's analysis incorporates these risks into its forecasts, concluding that the overall global economic outlook remains favorable.

- Emerging Markets Impact: BofA's analysis includes an assessment of emerging market growth, acknowledging their contribution to overall global economic expansion and their impact on corporate earnings. (Note: Charts and graphs showing global growth projections would be added here).

Addressing Common Valuation Concerns: Why Current Metrics Aren't Necessarily Ominous

Many investors focus solely on traditional valuation metrics, leading to concerns about high valuations. BofA argues that this narrow focus is misleading.

Beyond Price-to-Earnings Ratios (P/E): A Multi-Factor Approach

Relying solely on Price-to-Earnings (P/E) ratios can provide a skewed view of a company's true valuation.

- Other Key Valuation Metrics: BofA utilizes a comprehensive approach, incorporating other valuation metrics such as the Price-to-Sales (P/S) ratio, the Price/Earnings to Growth (PEG) ratio, and discounted cash flow (DCF) analysis to gain a more holistic view.

- Holistic Valuation Approach: This multi-faceted approach allows for a more nuanced understanding of a company's value, accounting for factors beyond simple earnings.

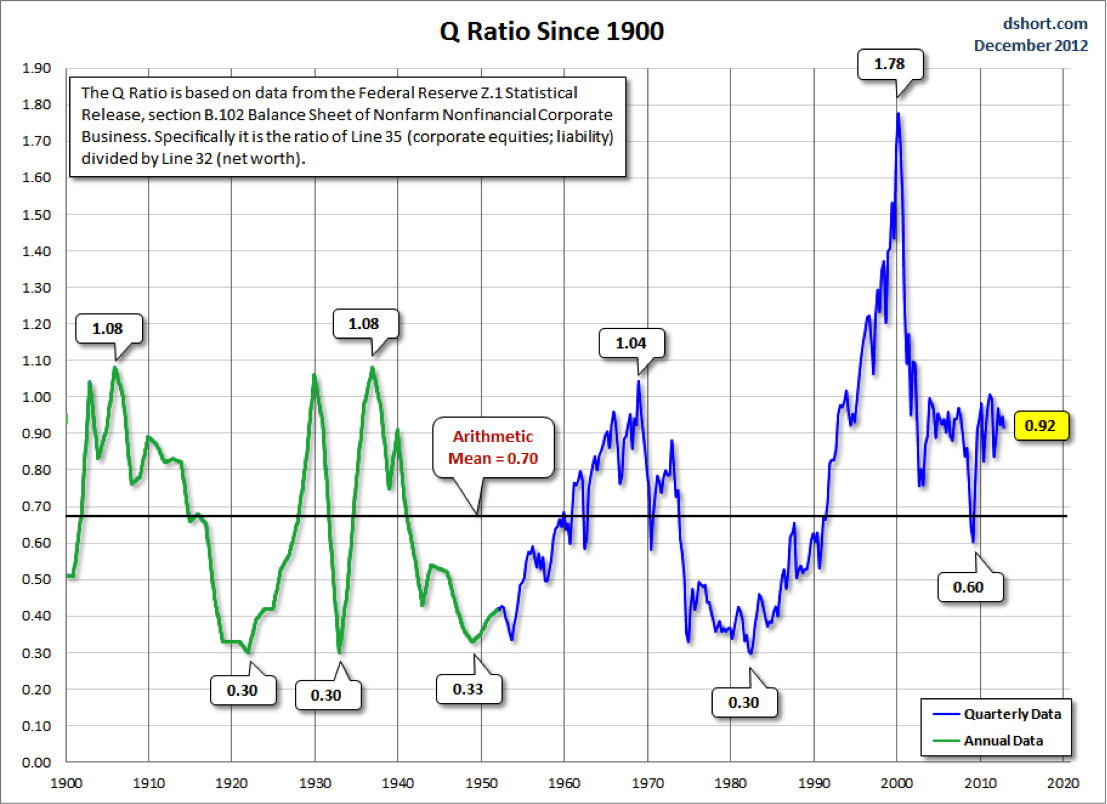

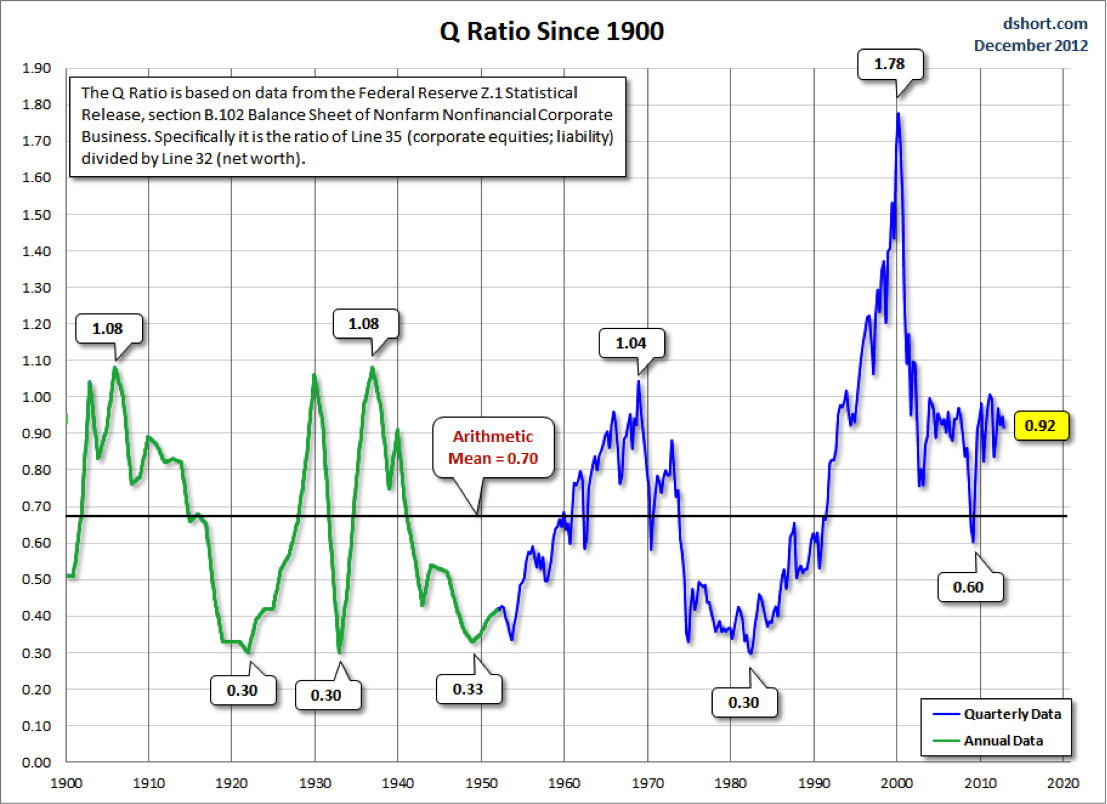

- Comparison to Historical Averages and Industry Benchmarks: BofA compares current valuation metrics to historical averages and industry benchmarks, illustrating that current valuations, while high, are not unprecedented and are often justified by strong growth prospects.

The Importance of Considering Long-Term Growth Potential

BofA emphasizes the crucial role of long-term growth potential in mitigating concerns about high valuations.

- Technological Advancements and Industry Disruptions: BofA’s analysis highlights the significant impact of technological advancements and industry disruptions on long-term growth potential, emphasizing that companies well-positioned to benefit from these trends often justify higher valuations.

- Sectors with Significant Growth Potential: Specific sectors, such as renewable energy and artificial intelligence, are identified as having substantial long-term growth potential.

- Long-Term Growth in Valuation Models: BofA's valuation models explicitly incorporate long-term growth projections, demonstrating that higher current valuations are often justifiable given the expectation of substantial future earnings growth.

Investing Strategies Based on BofA's Analysis

BofA's analysis informs specific investment strategies, acknowledging both opportunities and potential risks.

Opportunities and Risks in the Current Market

BofA suggests several potential investment strategies based on their positive outlook.

- Potential Investment Sectors: The analysis identifies several sectors with strong growth potential for investment, highlighting opportunities for selective allocation.

- Diversification as a Key Risk Management Strategy: BofA underscores the importance of diversification to mitigate potential risks and protect investments.

- Favorable Asset Classes: BofA points to specific asset classes, such as equities in strong-growth sectors, as being potentially favorable under the current market conditions.

Cautions and Considerations for Investors

Despite the positive outlook, BofA acknowledges potential risks and uncertainties.

- Potential Macroeconomic Headwinds: BofA recognizes the potential for unexpected macroeconomic events that could impact market performance.

- Importance of Individual Risk Tolerance: BofA emphasizes the critical role of individual risk tolerance in investment decision-making.

- Consultation with Financial Advisors: BofA consistently advises investors to consult with financial advisors to tailor their investment strategies to their individual financial situations and risk profiles.

Conclusion

BofA's analysis suggests that current stock market valuations, while high, are not necessarily a red flag. Their rationale is built upon strong corporate earnings, positive long-term growth projections, and a sophisticated, multi-faceted approach to valuation that goes beyond simple P/E ratios. While acknowledging potential risks and uncertainties, BofA's research indicates a positive outlook for the market, largely driven by anticipated future growth. It is crucial, however, to conduct thorough research and consider your own risk tolerance before making any investment decisions. Explore BofA's research and other reputable sources for a deeper understanding of the current market landscape and consider consulting a financial advisor. Remember, according to BofA's analysis, current stock market valuations are not necessarily a red flag.

Featured Posts

-

El Tenis Espanol De Luto Fallece Joan Aguilera Ganador De Un Masters 1000

May 19, 2025

El Tenis Espanol De Luto Fallece Joan Aguilera Ganador De Un Masters 1000

May 19, 2025 -

Joan Aguilera Recordando Al Primer Espanol En Conquistar Un Masters 1000

May 19, 2025

Joan Aguilera Recordando Al Primer Espanol En Conquistar Un Masters 1000

May 19, 2025 -

Libraries Under Threat Staff Cuts And Service Reductions

May 19, 2025

Libraries Under Threat Staff Cuts And Service Reductions

May 19, 2025 -

Renowned Singers Last Performance A Heartfelt Goodbye Due To Memory Problems

May 19, 2025

Renowned Singers Last Performance A Heartfelt Goodbye Due To Memory Problems

May 19, 2025 -

London Parks Under Siege Mark Rylances Condemnation Of Music Festival Impact

May 19, 2025

London Parks Under Siege Mark Rylances Condemnation Of Music Festival Impact

May 19, 2025