Bond Crisis: Its Impact And How To Protect Your Investments

Table of Contents

Understanding the Potential Impacts of a Bond Crisis

A bond crisis can stem from several interconnected factors, significantly impacting investors' portfolios. Understanding these risks is the first step towards effective protection.

Rising Interest Rates and Their Effect on Bond Values

Interest rates and bond prices share an inverse relationship. When interest rates rise, newly issued bonds offer higher yields, making existing bonds with lower coupon rates less attractive. This leads to a decrease in the market value of those existing bonds.

- Increased borrowing costs: Higher interest rates make it more expensive for businesses and governments to borrow money, potentially hindering economic growth.

- Reduced bond valuations: Existing bond prices fall as investors seek higher yields from newer issues. This results in potential capital losses for bondholders.

- Potential capital losses: Depending on the magnitude and speed of the interest rate increase, investors could face substantial losses on their bond holdings.

Keywords: Interest rate risk, bond price volatility, yield curve, rising interest rates, bond valuation

Inflation's Role in a Bond Crisis

High inflation erodes the purchasing power of fixed-income investments like bonds. Even if a bond pays a certain interest rate, the real return (after accounting for inflation) could be significantly lower or even negative.

- Reduced real returns: Inflation eats away at the gains from bond interest payments, resulting in a lower real return for investors.

- Decreased investor confidence: High inflation can lead to uncertainty and decreased investor confidence, potentially triggering a sell-off in the bond market.

- Potential for defaults: High inflation can strain borrowers' ability to repay their debts, increasing the risk of defaults on bonds.

Keywords: Inflation risk, real yield, purchasing power, inflation, bond defaults

Systemic Risk and Contagion

A bond crisis isn't always contained to a single sector. A crisis in one segment of the bond market, such as corporate bonds, can quickly spread to other segments, creating a systemic risk.

- Credit rating downgrades: A decline in the creditworthiness of a significant issuer can trigger downgrades, leading to further market instability.

- Liquidity issues: During a crisis, it can become difficult to sell bonds quickly without significant price concessions due to reduced liquidity.

- Market freezes: In severe cases, the bond market can completely freeze, preventing investors from buying or selling bonds.

Keywords: Systemic risk, contagion effect, credit default swaps, market liquidity, bond market freeze

Strategies to Protect Your Investments During a Bond Crisis

While a bond crisis can be unsettling, several strategies can help protect your investments.

Diversification

Diversification is crucial to mitigate risk. Don't put all your eggs in one basket. Spread your investments across different asset classes.

- Reduce overall portfolio risk: By diversifying into stocks, real estate, commodities, or alternative investments, you reduce your dependence on the bond market's performance.

- Mitigate losses in one asset class: If one asset class underperforms, the others can potentially offset those losses.

Keywords: Asset allocation, portfolio diversification, risk management, diversification strategy

Shortening Your Bond Duration

Shorter-term bonds are less susceptible to interest rate changes than longer-term bonds. Consider adjusting your bond portfolio's maturity dates.

- Reduced interest rate risk: Shorter-term bonds have less time for interest rate fluctuations to impact their value.

- Greater liquidity: Shorter-term bonds are generally easier to buy and sell than longer-term bonds.

Keywords: Bond duration, maturity date, interest rate sensitivity, short-term bonds

High-Quality Bond Selection

Focus on bonds issued by entities with high credit ratings, reducing the risk of default.

- Lower default risk: High-quality bonds issued by governments or highly rated corporations carry a lower risk of default.

- Greater stability: These bonds tend to exhibit greater price stability during periods of market uncertainty.

Keywords: Credit rating, bond yield, default risk, high-quality bonds

Alternative Investment Options to Consider

Diversification also includes exploring alternative investment vehicles.

Treasury Inflation-Protected Securities (TIPS)

TIPS adjust their principal value based on inflation, offering protection against rising prices.

- Inflation protection: TIPS provide a hedge against inflation, preserving the purchasing power of your investment.

- Principal adjustment: The principal amount of a TIPS increases with inflation, maintaining its real value.

Keywords: TIPS, inflation-indexed bonds, real return, inflation protection

Preferred Stocks

Preferred stocks offer a blend of characteristics from bonds and common stocks, providing a relatively stable income stream.

- Higher dividend yield than common stocks: Preferred stocks often pay higher dividends than common stocks.

- Less volatile than common stocks: Preferred stocks tend to be less volatile than common stocks, offering a degree of stability.

Keywords: Preferred stock, dividend yield, equity investment, preferred shares

Real Estate Investment Trusts (REITs)

REITs provide exposure to the real estate market without requiring direct property ownership.

- Dividend income: Many REITs distribute a significant portion of their income as dividends.

- Diversification: REITs offer diversification benefits beyond traditional bond and stock investments.

- Exposure to real estate market: REITs provide a way to participate in the real estate market's potential growth.

Keywords: REITs, real estate investment, dividend income, real estate investment trusts

Conclusion

A bond crisis can significantly impact your investment portfolio. By understanding the potential impacts of rising interest rates, inflation, and systemic risk, you can implement effective strategies to protect your investments. Diversifying your portfolio, shortening bond duration, selecting high-quality bonds, and exploring alternative investment options like TIPS, preferred stocks, and REITs are crucial steps in navigating this challenging environment. Don't wait until a crisis hits – proactively manage your bond holdings and build a resilient investment strategy to mitigate risk and safeguard your financial future. Take control of your financial well-being and learn more about protecting your investments from a potential future bond crisis.

Featured Posts

-

El Idolo De Fede Valverde Toni Kroos

May 29, 2025

El Idolo De Fede Valverde Toni Kroos

May 29, 2025 -

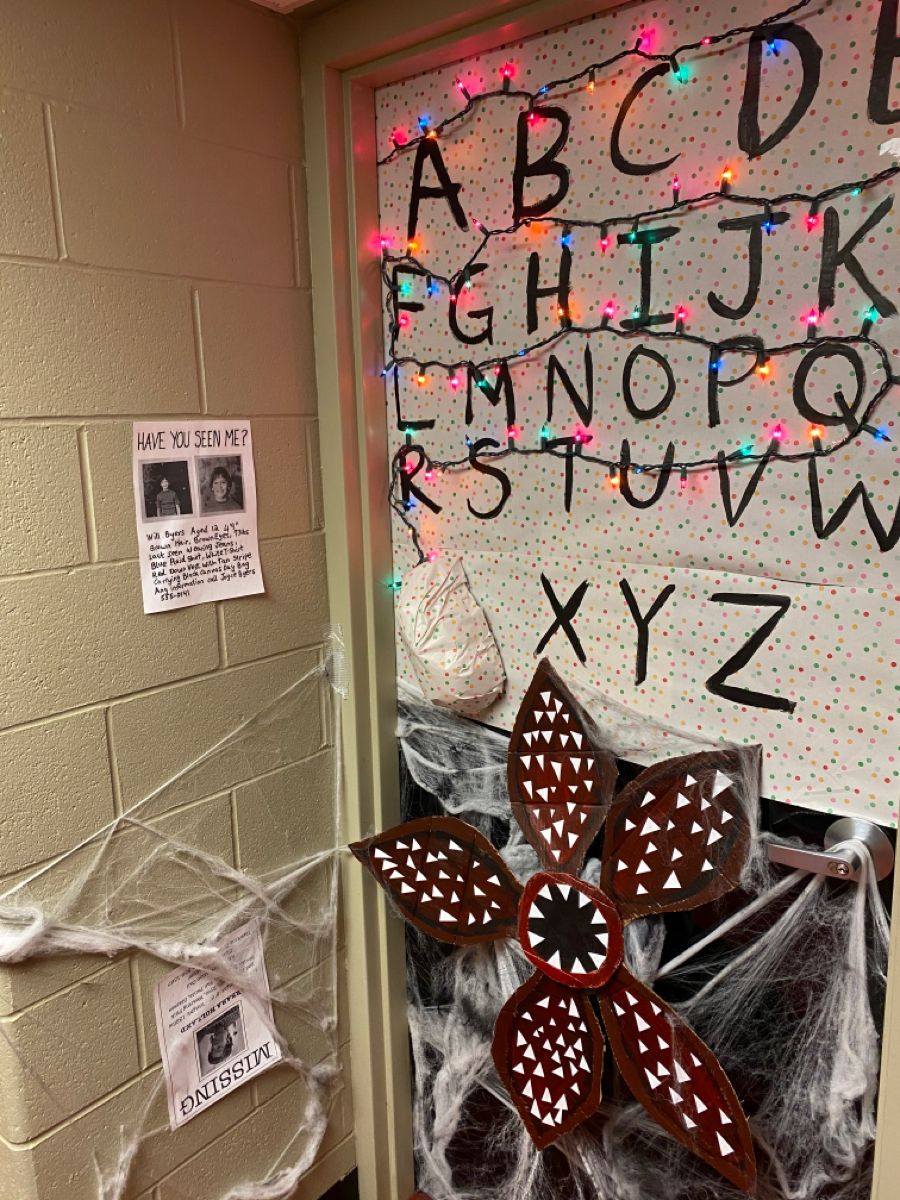

New Tv Show Stranger Things Star Seen Filming In Cardiff

May 29, 2025

New Tv Show Stranger Things Star Seen Filming In Cardiff

May 29, 2025 -

Pokemon Tcg Game Stops New Purchase Restriction Policy Explained

May 29, 2025

Pokemon Tcg Game Stops New Purchase Restriction Policy Explained

May 29, 2025 -

A24s Bring Her Back Rotten Tomatoes Score And Critical Acclaim

May 29, 2025

A24s Bring Her Back Rotten Tomatoes Score And Critical Acclaim

May 29, 2025 -

Oslo Nyhetsvarsel For Alvorlig Brann I Havnen

May 29, 2025

Oslo Nyhetsvarsel For Alvorlig Brann I Havnen

May 29, 2025