Bond Market Volatility: The Ripple Effect Of Tariff Hikes

Table of Contents

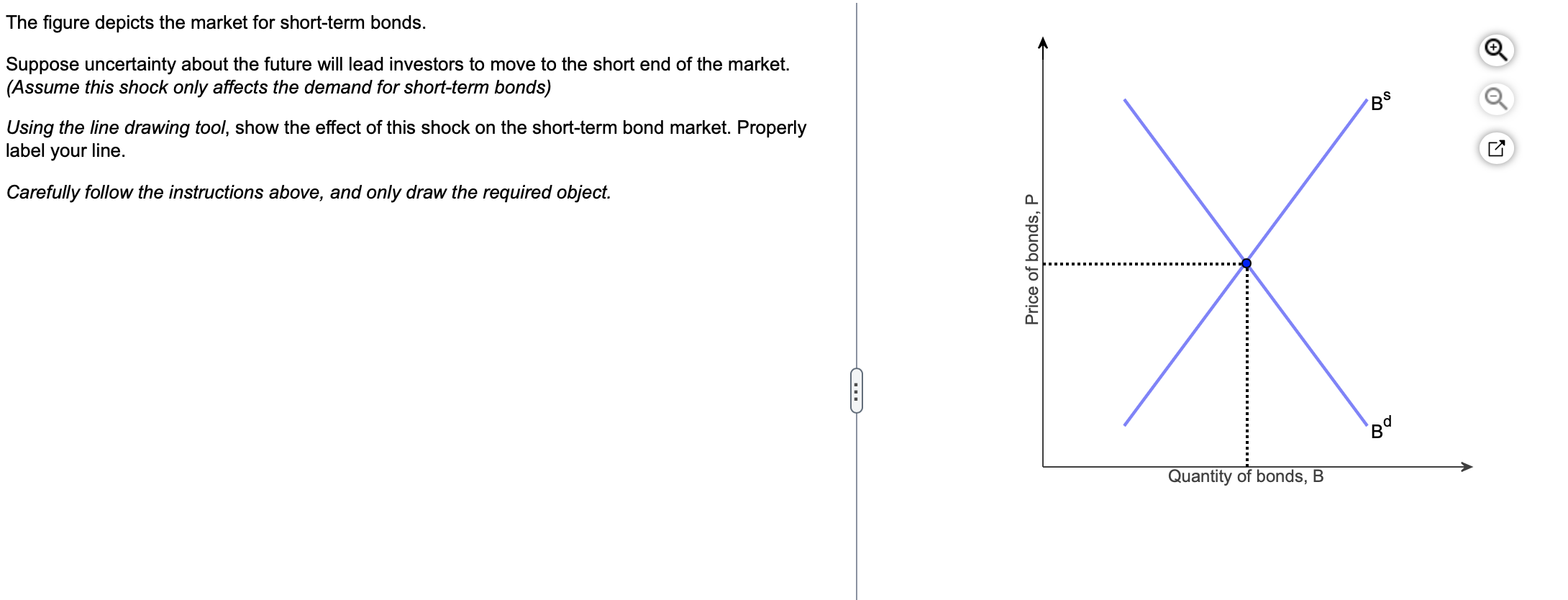

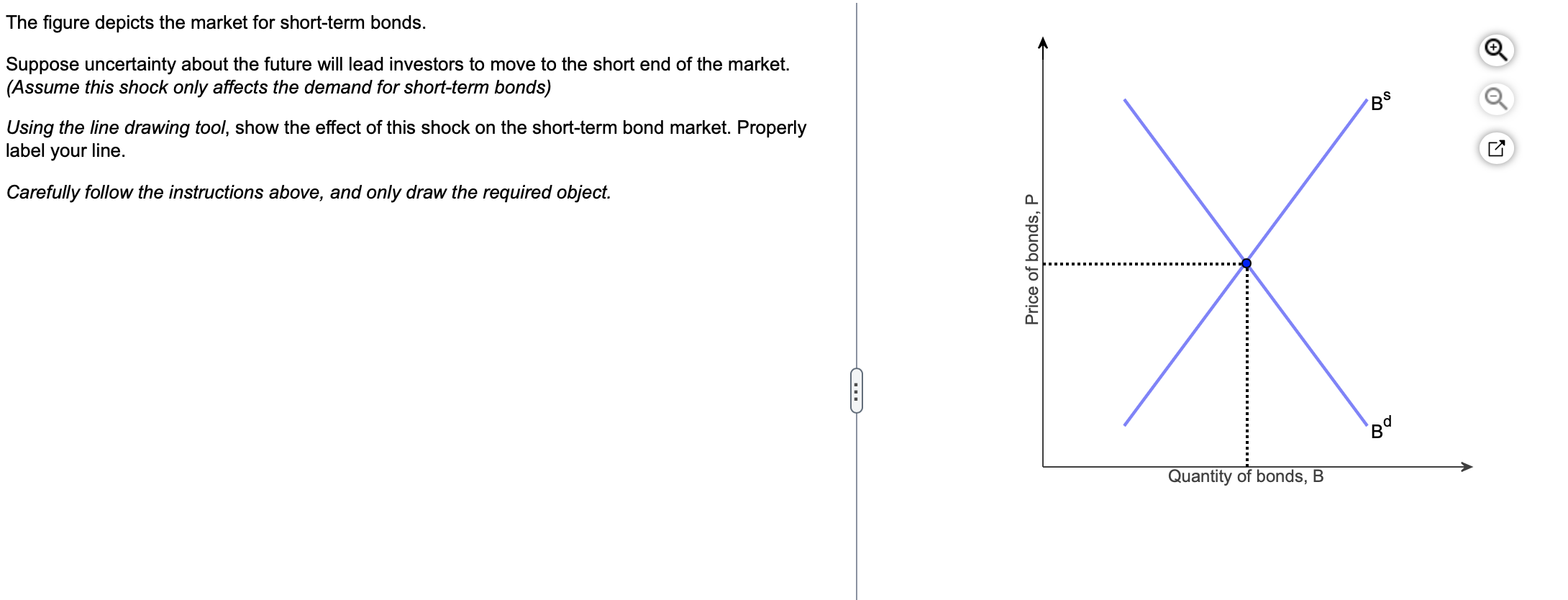

Understanding the Link Between Tariffs and Bond Market Volatility

The bond market operates on an inverse relationship between interest rates and bond prices. When interest rates rise, bond prices fall, and vice versa. Increased uncertainty, a direct consequence of tariff hikes, significantly impacts investor confidence. This uncertainty forces investors to re-evaluate their risk tolerance and portfolio allocations. In times of heightened uncertainty, investors often seek safe haven assets, such as government bonds, perceived as less risky.

- Tariffs increase inflationary pressures: By increasing the cost of imported goods, tariffs contribute to higher consumer prices.

- Inflation erodes bond yields: Higher inflation reduces the real return on fixed-income investments like bonds, impacting their attractiveness.

- Uncertainty leads to increased demand for safe-haven assets: Investors flee riskier assets, driving up demand for government bonds.

- Increased demand can drive bond prices up, initially: This initial surge reflects the flight-to-safety phenomenon.

- However, sustained uncertainty and economic slowdown can cause bond prices to fall: Prolonged uncertainty can negatively impact economic growth, leading to lower demand for bonds and subsequently lower prices. This creates significant bond market volatility.

The Impact of Tariff Hikes on Inflation and Interest Rates

Tariffs directly contribute to inflation by raising the prices of imported goods. This inflationary pressure forces central banks to consider countermeasures. Central banks often respond to rising inflation by increasing interest rates. This monetary policy aims to cool down the economy and curb inflation. However, rising interest rates have a knock-on effect on the bond market.

- Tariffs lead to higher consumer prices: Increased costs are passed on to consumers, fueling inflation.

- Central banks may raise interest rates to combat inflation: This is a standard response to inflationary pressures.

- Higher interest rates make existing bonds less attractive: Newly issued bonds offer higher yields, making older bonds less desirable.

- This can lead to a decline in bond prices: Investors sell existing bonds to buy higher-yielding ones, increasing supply and lowering prices.

- This creates volatility in the bond market: Fluctuations in bond prices due to interest rate changes amplify bond market volatility.

Investor Sentiment and Flight to Safety

Tariff hikes generate uncertainty and negatively impact investor sentiment. This uncertainty leads to a "flight to safety," where investors move capital from riskier assets into safer havens like government bonds. While this initially boosts bond prices, persistent uncertainty can reverse this trend.

- Uncertainty causes investors to reduce risk: Investors shift from equities and other riskier assets.

- Increased demand for government bonds drives up prices: The increased demand pushes bond prices higher.

- However, if the uncertainty persists, it can lead to a decline in prices: Prolonged uncertainty may negatively impact economic growth, decreasing demand and prices.

- This creates volatility in the bond market: The shifts in demand cause significant fluctuations in bond prices.

- Global investors react to tariff implications: The impact of tariffs is felt globally, affecting investor behavior worldwide.

Geopolitical Risks and Bond Market Reactions

Tariff disputes can escalate into broader geopolitical conflicts, further increasing uncertainty and amplifying bond market volatility. The interconnected nature of the global economy means that trade tensions often spill over into other areas, creating a complex web of interconnected risks.

- Trade wars can escalate into broader geopolitical tensions: Trade disputes can easily escalate into diplomatic conflicts.

- This increases market uncertainty: Geopolitical instability creates a more unpredictable investment environment.

- Investors seek safe havens in government bonds: This flight to safety further increases demand for government bonds.

- This can create significant bond market volatility: The increased uncertainty leads to greater price fluctuations.

- This also affects global markets (e.g., stock market): The ripple effect extends beyond the bond market.

Conclusion

Tariff hikes significantly impact bond market volatility through their influence on inflation, interest rates, and investor sentiment. The uncertainty generated by these policies causes unpredictable shifts in bond prices, creating substantial risk for investors. Understanding this complex relationship is vital for navigating the complexities of the global financial market. Stay informed about global trade policies and their potential impact on bond market volatility. Monitor economic indicators and investor sentiment to make informed investment decisions regarding your bond portfolio. Understanding the interplay between tariffs and bond market volatility is crucial for effective risk management.

Featured Posts

-

Scenes De Menages Gerard Hernandez Devoile Sa Relation Avec Chantal Ladesou

May 12, 2025

Scenes De Menages Gerard Hernandez Devoile Sa Relation Avec Chantal Ladesou

May 12, 2025 -

De Vernedering Van Kompany Reacties En Gevolgen

May 12, 2025

De Vernedering Van Kompany Reacties En Gevolgen

May 12, 2025 -

Milwaukee Apartment Fire 4 Dead Hundreds Displaced

May 12, 2025

Milwaukee Apartment Fire 4 Dead Hundreds Displaced

May 12, 2025 -

Posible Sucesores Del Papa Francisco Una Vision De Los Candidatos

May 12, 2025

Posible Sucesores Del Papa Francisco Una Vision De Los Candidatos

May 12, 2025 -

Chicago O Hares Airline Power Struggle United And Americans Battle For Market Share

May 12, 2025

Chicago O Hares Airline Power Struggle United And Americans Battle For Market Share

May 12, 2025