Bond Traders' Rate Cut Optimism: Powell's Speech Changes The Outlook

Table of Contents

Powell's Speech: A Pivot in Monetary Policy Communication?

Chairman Powell's recent address marked a potential pivot in the Federal Reserve's communication strategy. His remarks, deviating from the previously hawkish tone, injected a fresh wave of bond traders' rate cut optimism into the market. Key excerpts suggesting a potential shift in monetary policy included:

- Softening on Inflation: Powell acknowledged a slowdown in inflation, suggesting that the pace of interest rate hikes might ease.

- Emphasis on Economic Data: He emphasized the importance of upcoming economic data in guiding future interest rate decisions, hinting at a data-dependent approach.

- Less Aggressive Stance: A noticeable shift from the previously aggressive stance on inflation control was perceived, fueling speculation about impending rate cuts.

The shift in tone, compared to previous speeches where a more resolute commitment to fighting inflation was evident, was immediately noticeable to market analysts. Experts like [mention a relevant financial analyst and their viewpoint] interpreted Powell's words as signaling a potential pause or even a reversal in the interest rate hiking cycle. This interpretation significantly contributed to the surge in bond traders' rate cut optimism.

Impact on Bond Yields and Trading Activity

The inverse relationship between interest rates and bond prices is well-established. As expectations for rate cuts strengthened following Powell's speech, bond prices rose, resulting in a decline in bond yields.

- Immediate Market Reaction: Treasury yields, a benchmark for other fixed-income securities, experienced a notable drop immediately following the speech. For example, the 10-year Treasury yield fell by [insert percentage] within [timeframe].

- Increased Trading Volume: The bond market witnessed a significant surge in trading activity, indicating increased investor engagement driven by the altered expectations surrounding interest rates.

- Yield Curve Changes: The yield curve, which plots yields of bonds with different maturities, also showed adjustments reflecting the shift in rate cut expectations. Shorter-term yields fell more sharply than longer-term yields, flattening the curve. (Include a relevant chart or graph here illustrating the changes in bond yields across different maturities.)

Specifically, we observed the following yield changes:

- 10-year Treasury yield: [Insert percentage change]

- 2-year Treasury yield: [Insert percentage change]

- Corporate bond yields (Investment Grade): [Insert percentage change]

Shifting Expectations for Future Rate Cuts

The market's expectation for the timing and magnitude of future rate cuts has significantly shifted since Powell's speech. Previously, many analysts predicted continued rate hikes throughout [mention timeframe]. However, the new consensus, fueled by bond traders' rate cut optimism, anticipates rate cuts to begin as early as [mention timeframe] with [mention number] rate cuts expected by [mention timeframe].

The Role of Inflation Data in Shaping Rate Cut Outlook

Upcoming inflation reports will play a pivotal role in confirming or contradicting the current optimism surrounding rate cuts. If inflation data shows a continued decline, it will reinforce the expectation of rate cuts. Conversely, if inflation proves more persistent than anticipated, it could dampen bond traders' rate cut optimism and potentially lead to increased market volatility.

Different inflation scenarios would dramatically impact bond trader behavior:

- Sustained Inflation Decline: Continued decline in inflation would solidify rate cut expectations, leading to further increases in bond prices and lower yields.

- Inflation Remains Stubbornly High: This scenario could trigger a sell-off in the bond market, as rate cut expectations diminish and investors seek higher yields elsewhere.

The potential for further market volatility is high, depending on these upcoming inflation figures.

Bond Traders' Rate Cut Optimism: A Summary and Call to Action

In summary, Chairman Powell's recent speech significantly shifted market sentiment, igniting a surge in bond traders' rate cut optimism. This optimism has already impacted bond yields and trading activity, with bond prices rising and yields falling. However, the outlook remains highly dependent on upcoming economic data, particularly inflation figures. While the current optimism is palpable, significant uncertainties remain.

Stay tuned for further updates on bond traders' rate cut optimism and its implications as we navigate this evolving economic landscape. Understanding these shifts is crucial for making informed investment decisions in the bond market. [Link to relevant resources or future articles].

Featured Posts

-

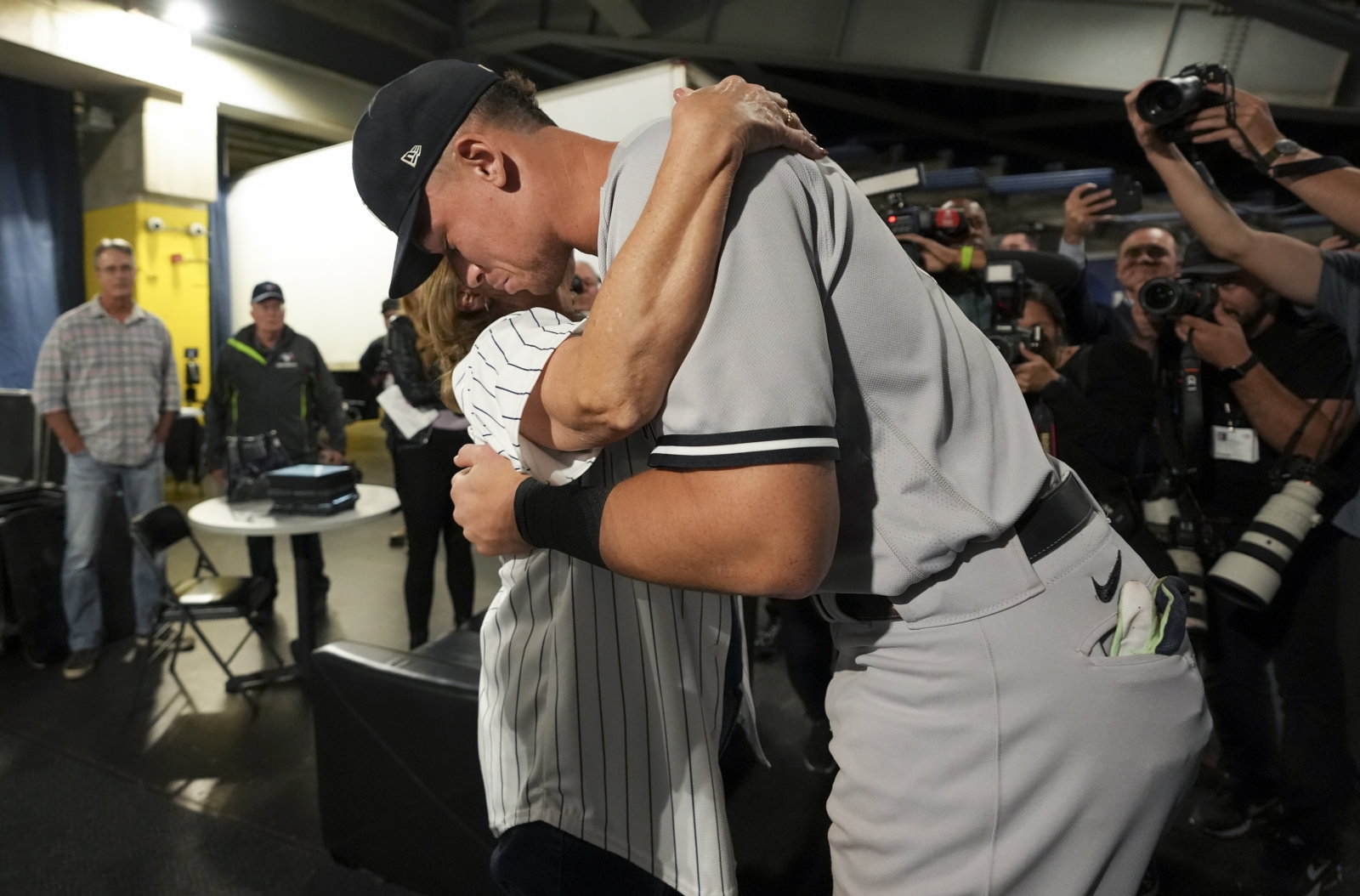

Analyzing Aaron Judges Hall Of Fame Chances At The 1 000 Game Milestone

May 12, 2025

Analyzing Aaron Judges Hall Of Fame Chances At The 1 000 Game Milestone

May 12, 2025 -

Concerns Over Uk Trade Deal White House Response To North American Auto Industry

May 12, 2025

Concerns Over Uk Trade Deal White House Response To North American Auto Industry

May 12, 2025 -

Impact Of Reduced Attendance Cineplex Reports Q1 Financial Losses

May 12, 2025

Impact Of Reduced Attendance Cineplex Reports Q1 Financial Losses

May 12, 2025 -

2 Mph Karlyn Pickens Sets New Standard In Ncaa Softball

May 12, 2025

2 Mph Karlyn Pickens Sets New Standard In Ncaa Softball

May 12, 2025 -

The Impact Of Johnsons Leadership On The Diamond League Duplantis Perspective

May 12, 2025

The Impact Of Johnsons Leadership On The Diamond League Duplantis Perspective

May 12, 2025