Boston Celtics' New Ownership: Analyzing The $6.1 Billion Private Equity Deal

Table of Contents

The Players Involved: Who Bought the Boston Celtics?

The $6.1 billion acquisition of the Boston Celtics wasn't a simple transaction; it involved several key players with significant roles in shaping the franchise's future.

Bain Capital's Role: A Giant Enters the Court

Bain Capital, a prominent global private equity firm, spearheaded the acquisition. Their involvement signifies a significant shift in the ownership structure, bringing substantial financial resources and extensive business expertise to the Celtics.

- Wyc Grousbeck's Continued Involvement: While the ownership structure has changed, current governor Wyc Grousbeck remains a key figure, offering continuity and invaluable institutional knowledge. His continued presence ensures a smooth transition and a focus on maintaining the Celtics' winning tradition.

- Bain Capital's Track Record: Bain Capital boasts a history of successful investments across diverse sectors. Their experience in managing large-scale enterprises and navigating complex financial landscapes provides a strong foundation for the Celtics' future growth.

- Strategic Investment Approach: Bain Capital's approach is known for its long-term perspective and strategic focus on maximizing value. This suggests a commitment to building the Celtics into an even more successful franchise, both on and off the court.

The Seller's Perspective: Why the Sale?

The decision by the previous ownership group to sell at this juncture reflects a confluence of factors.

- Maximizing Return on Investment: The $6.1 billion price tag represents a significant return on the initial investment, reflecting the escalating value of NBA franchises. This is a strategic move to capitalize on the current market conditions and secure substantial profits.

- Succession Planning: A key factor in the sale might have been succession planning within the previous ownership structure. Selling to a large, established firm like Bain Capital ensures the franchise’s future stability and minimizes disruption.

- Legacy and Long-Term Vision: The previous owners may have sought a buyer who would not only maintain the Celtics' legacy but also further enhance its position within the NBA and the broader sports world.

Other Key Stakeholders: A Team Effort

This monumental deal didn't happen in a vacuum. Several other stakeholders played crucial roles.

- Financial Advisors and Legal Teams: Expert financial advisors and legal teams meticulously structured the transaction, ensuring a smooth and legally sound process. Their expertise was crucial in navigating the complexities of such a high-value deal.

- League Approval: The NBA's approval process was another critical step, guaranteeing the deal's adherence to league regulations and ensuring a seamless transition of ownership.

Financial Implications of the $6.1 Billion Deal

The sheer scale of the $6.1 billion transaction demands a close examination of its financial implications.

Valuation and Market Trends: A Record-Breaking Deal

The $6.1 billion valuation places the Boston Celtics among the most valuable sports franchises globally. This price tag reflects several factors:

- NBA Market Growth: The NBA's increasing popularity worldwide, coupled with lucrative media rights deals, has driven up the value of its teams significantly.

- Celtics' Brand Recognition: The Celtics' storied history, passionate fanbase, and consistent on-court competitiveness contribute to their high market value.

- Comparison to Other Sales: The deal highlights the soaring valuations of NBA franchises, surpassing even previous record-breaking sales. This trend underscores the increasing investment attractiveness of professional sports.

Funding Sources and Debt: Financing the Acquisition

The acquisition's financing strategy remains largely undisclosed, but it likely involved a combination of equity and debt.

- Equity Investment: Bain Capital's significant equity contribution demonstrates their commitment to the long-term success of the Celtics.

- Potential Debt Financing: Leveraging debt to finance a portion of the purchase could impact the Celtics' financial operations. Careful management of this debt will be crucial for maintaining financial stability.

- Financial Risk Assessment: The high leverage involved carries inherent risks. The ability of the Celtics to generate sufficient revenue to service the debt will be a key factor in the long-term success of this investment.

Return on Investment (ROI) Expectations: A Long-Term Play

Bain Capital's investment aims for a substantial long-term return. The Celtics' revenue streams offer diverse avenues for growth:

- Merchandising and Licensing: The Celtics' strong brand recognition provides ample opportunities to expand merchandise sales and licensing agreements.

- Broadcasting Rights: The increasing value of NBA broadcasting rights contributes significantly to team revenue.

- Ticket Sales and Premium Seating: Maintaining a winning team and enhancing the fan experience will drive strong ticket sales and premium seating revenue.

Impact on the Boston Celtics and the NBA

The new ownership's impact will resonate across multiple facets of the Celtics and the broader NBA landscape.

On-Court Performance: A Winning Formula?

The new ownership group’s impact on on-court performance is yet to be fully realized, but potential changes include:

- Strategic Decisions: Bain Capital's business acumen may influence strategic decisions regarding player acquisition, coaching strategies, and overall team management.

- Investment in Talent: Increased financial resources could translate into greater investment in acquiring top-tier talent through trades or free agency.

- Enhanced Player Development: Investing in better player development programs could yield long-term benefits.

Franchise Management and Operations: A Modern Approach

The new ownership may introduce modernized management practices and operational improvements:

- Improved Infrastructure: Investments in facilities, training equipment, and technology could enhance the overall player and fan experience.

- Enhanced Marketing and Fan Engagement: A renewed marketing strategy could boost fan engagement through innovative digital platforms and community outreach programs.

- Business Development and Revenue Generation: Bain Capital's expertise could lead to exploring new revenue streams and optimizing existing ones, such as sponsorships and partnerships.

The Broader NBA Landscape: Setting a Precedent

The $6.1 billion deal sets a significant precedent for the NBA and professional sports:

- Rising Team Valuations: The transaction reinforces the escalating value of NBA franchises and influences future team valuations.

- Attracting Private Equity: This deal encourages further investment from private equity firms in the NBA, potentially leading to greater financial stability and increased competitiveness within the league.

- League Revenue Sharing Implications: The implications for league-wide revenue sharing policies remain to be seen but could influence future agreements.

Conclusion

The $6.1 billion sale of the Boston Celtics marks a transformative moment for the franchise and the NBA. This private equity deal highlights the ever-increasing value of professional sports franchises and signals a new era for the Celtics. Bain Capital's acquisition brings substantial financial resources and business acumen, promising significant improvements across various aspects of the franchise. This deal provides a compelling case study in the evolution of sports investment and underscores the growing importance of strategic financial partnerships in achieving sustained success. For further insights into this significant acquisition and its lasting impact, continue your research on Boston Celtics new ownership and the $6.1 billion private equity deal.

Featured Posts

-

Auction Of Kid Cudis Personal Items Yields Unexpectedly High Prices

May 15, 2025

Auction Of Kid Cudis Personal Items Yields Unexpectedly High Prices

May 15, 2025 -

Gaza Airstrike Israel Targets Hamas Leader Mohammed Sinwar

May 15, 2025

Gaza Airstrike Israel Targets Hamas Leader Mohammed Sinwar

May 15, 2025 -

A Hypothetical Conversation Between Two Max Muncys

May 15, 2025

A Hypothetical Conversation Between Two Max Muncys

May 15, 2025 -

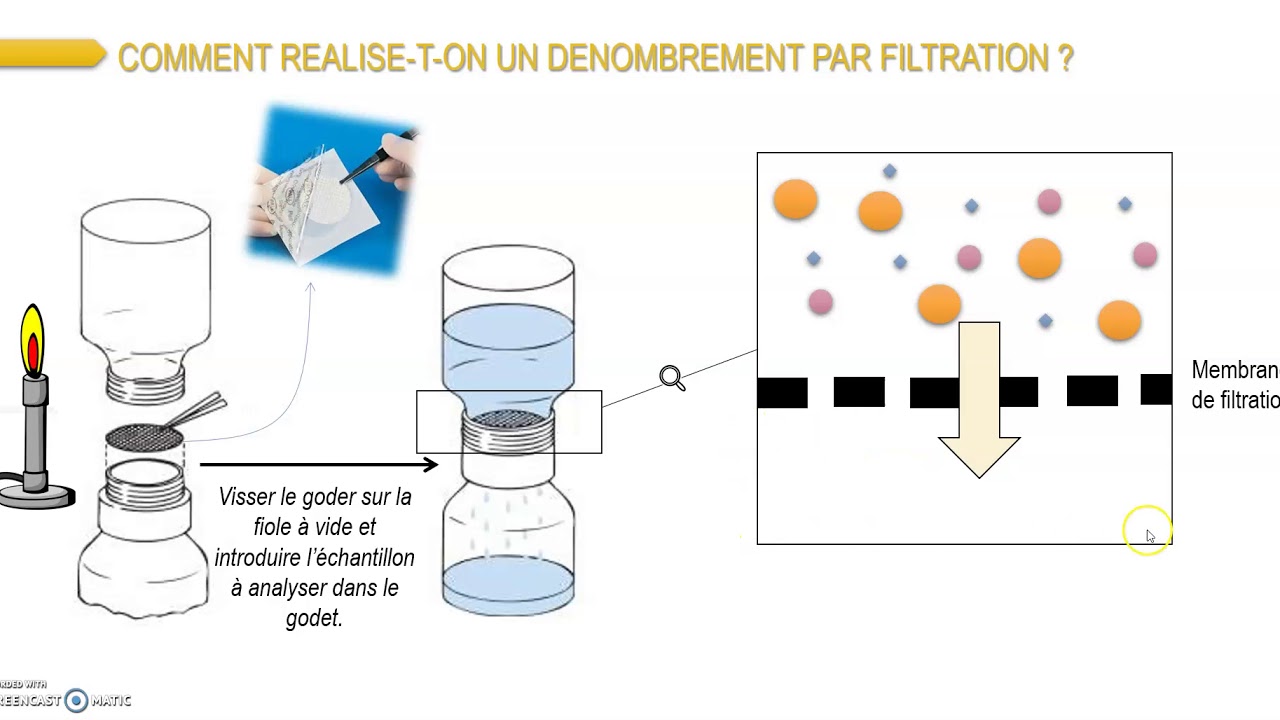

Pollution De L Eau Guide Complet De Filtration Pour L Eau Du Robinet

May 15, 2025

Pollution De L Eau Guide Complet De Filtration Pour L Eau Du Robinet

May 15, 2025 -

Block Mirror A Technical Analysis Of Its Functionality In Bypassing Restrictions

May 15, 2025

Block Mirror A Technical Analysis Of Its Functionality In Bypassing Restrictions

May 15, 2025