BP Chief Aims To Double Company Valuation: No US Listing Planned, FT Reports

Table of Contents

BP's Ambitious Valuation Target and its Implications

BP's current market capitalization sits at [insert current market cap - needs research and fact-checking]. The CEO's target represents a doubling of this figure, a monumental undertaking in the volatile energy sector. Achieving this ambitious goal will require a multi-pronged approach.

Potential implications of this ambitious valuation target include:

- Increased investment in renewable energy sources: A significant portion of the strategy likely involves accelerating BP's transition to renewable energy, encompassing solar, wind, and other sustainable energy sources. This shift is crucial for long-term growth and aligning with global climate goals.

- Strategic acquisitions or mergers to expand market share: To bolster its position and drive growth, BP might pursue strategic acquisitions of companies specializing in renewable energy technologies or possessing valuable assets in key markets. This aggressive expansion could rapidly increase the BP company valuation.

- Focus on operational efficiency and cost reduction: Streamlining operations and cutting costs across the board will be essential to free up capital for reinvestment and improve profitability. This includes optimizing existing oil and gas operations and improving the efficiency of renewable energy projects.

- Enhanced shareholder returns through dividends and share buybacks: Attracting and retaining investors is key. Boosting shareholder returns through dividends and share buybacks could significantly influence the BP stock price and overall investor sentiment.

- Potential impact on BP's stock price: The success or failure of this ambitious plan will directly impact the BP stock price. Positive progress toward the valuation target should increase investor confidence, leading to a higher share price.

However, challenges abound. Fluctuating oil prices, geopolitical instability, and the ongoing energy transition pose significant risks. The success of BP's renewable energy investments is crucial, as is effectively managing the transition from fossil fuels. Furthermore, competition in the renewable energy sector is fierce, requiring substantial investment and innovation to maintain a competitive edge. Effective management of the energy transition will be vital to the overall BP company valuation.

Reasons Behind the Decision to Exclude a US Listing

BP's decision to reportedly rule out a US listing is a strategic choice with several underlying factors.

Potential reasons include:

- Regulatory hurdles and compliance costs associated with a US listing: The US regulatory environment is notoriously complex and demanding, particularly for energy companies. Navigating these complexities and associated costs could outweigh the potential benefits of a US listing.

- Preference for maintaining its current London Stock Exchange listing: BP may prefer the familiarity and established relationships it has with the London Stock Exchange and its investor base.

- Focus on European and other international markets: BP's strategy may prioritize growth in European and other international markets, making a US listing less of a strategic priority.

- Potential concerns about US investor sentiment towards the energy sector: The US energy sector faces significant scrutiny regarding its environmental impact. BP might perceive less favorable investor sentiment in the US compared to other markets.

A UK listing on the London Stock Exchange provides access to a large pool of international investors, while a US listing would tap into a potentially larger but potentially more scrutinizing market. The decision reflects a strategic assessment of the advantages and disadvantages of each market, considering US regulatory environment and international investment opportunities.

Investor and Market Reaction to BP's Announcement

The initial market reaction to BP's announcement [insert details of market reaction – needs research and fact-checking; e.g., saw a [percentage]% increase/decrease in the BP share price]. This reaction reflects the market's assessment of the feasibility and potential success of BP's plan.

Financial analysts offer varied perspectives. [Insert quotes from financial analysts and news reports – needs research and fact-checking]. The overall market analysis and investor sentiment toward this bold strategy remains dynamic and requires further observation. The BP share price will continue to be a key indicator of investor confidence in this ambitious plan.

Long-Term Strategy and Sustainable Growth for BP

BP's long-term strategic plan is intricately linked to sustainable growth. The company is actively pursuing initiatives in renewable energy, aiming to reduce its carbon footprint and attract ESG investing. This commitment extends beyond simply meeting regulatory requirements; it's a fundamental shift towards sustainable energy and potentially achieving carbon neutrality. These initiatives, alongside cost-cutting measures and strategic acquisitions, are all integral parts of the strategy to propel the BP company valuation upward.

Conclusion

BP's ambitious goal to double its valuation, its decision against a US listing, and the resulting implications for investors and the energy sector are significant developments. This bold move underscores BP's commitment to a future shaped by sustainable energy, strategic acquisitions, and operational excellence. The success of this strategy will significantly impact the BP company valuation and its future position in the global energy market.

Call to Action: Stay informed about BP's progress toward its ambitious valuation target and the ongoing developments in the energy sector. Learn more about BP's investment strategies and their impact on the BP company valuation. Follow [link to relevant BP investor relations page or news source].

Featured Posts

-

Discussie Abn Amro En Geen Stijl Over Betaalbaarheid Van Huizen In Nederland

May 21, 2025

Discussie Abn Amro En Geen Stijl Over Betaalbaarheid Van Huizen In Nederland

May 21, 2025 -

Exploring The Themes In The Love Monster Book

May 21, 2025

Exploring The Themes In The Love Monster Book

May 21, 2025 -

Self Guided Hiking In Provence A Mountain To Mediterranean Itinerary

May 21, 2025

Self Guided Hiking In Provence A Mountain To Mediterranean Itinerary

May 21, 2025 -

Seger I Malta Jacob Friis Foersta Match Som Traenare

May 21, 2025

Seger I Malta Jacob Friis Foersta Match Som Traenare

May 21, 2025 -

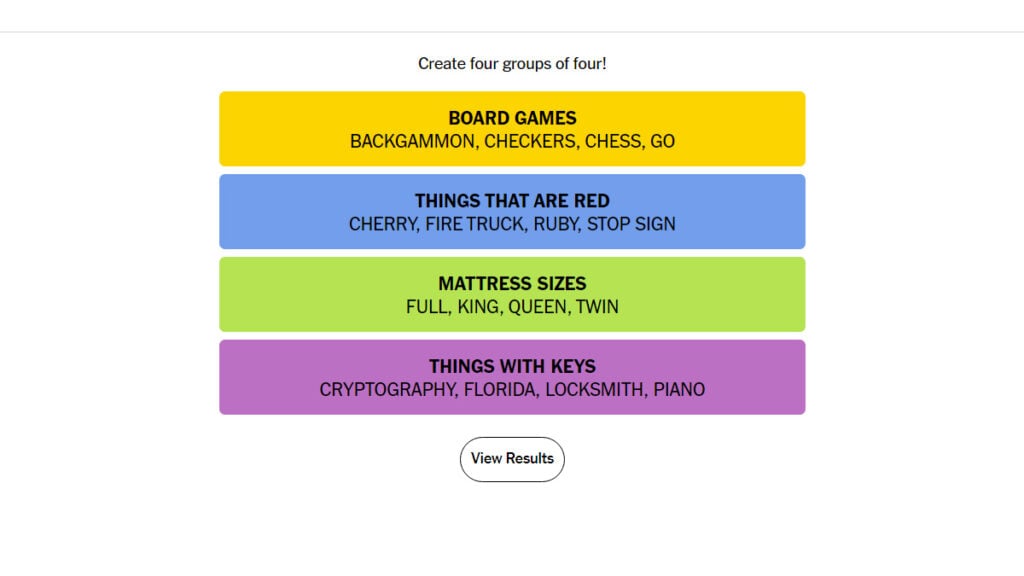

Solve The Nyt Mini Crossword April 20 2025 Answers And Hints

May 21, 2025

Solve The Nyt Mini Crossword April 20 2025 Answers And Hints

May 21, 2025