BP Executive Compensation: A 31% Reduction In CEO Pay

Table of Contents

The 31% Reduction: Details and Context

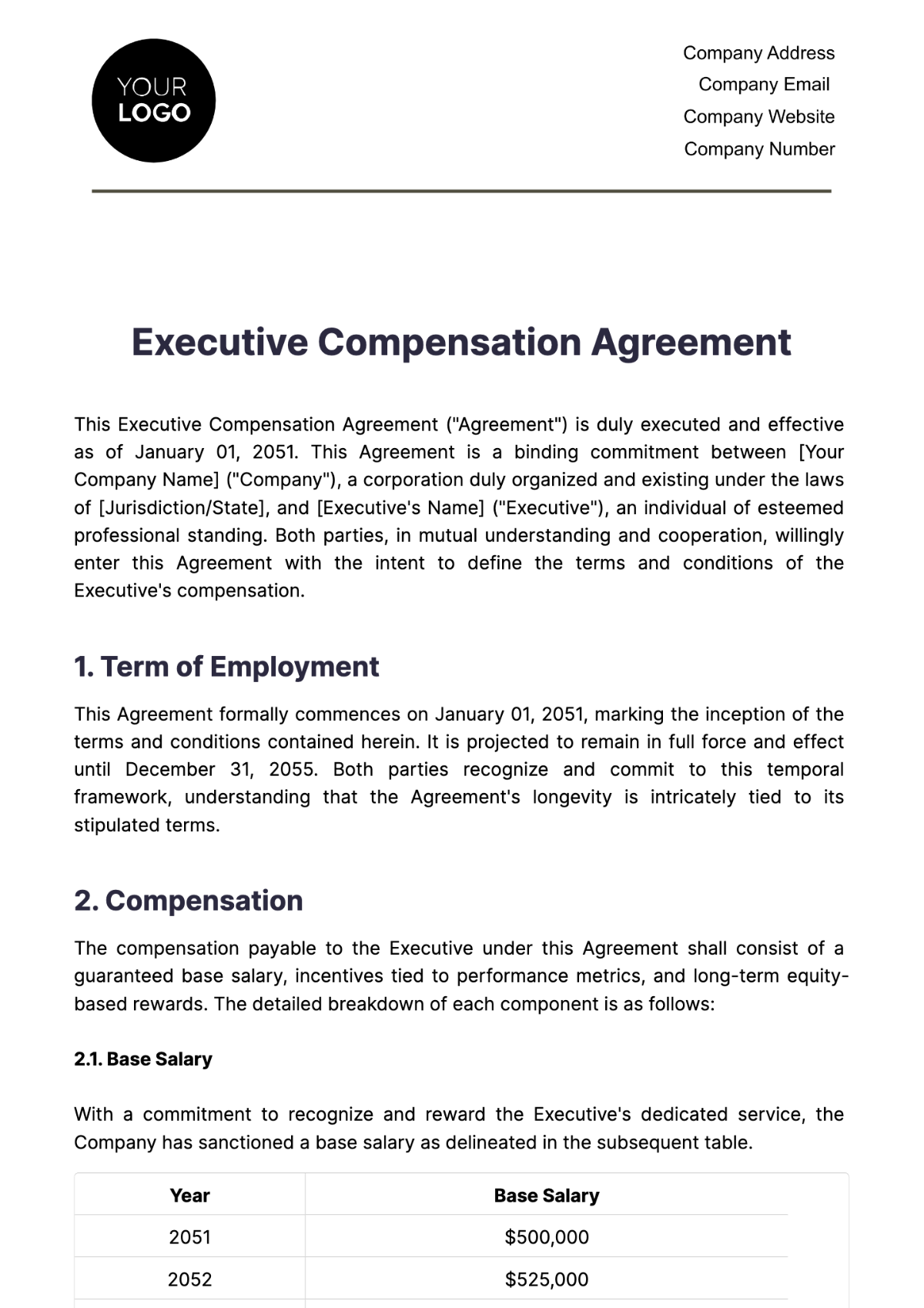

The 31% reduction in BP's CEO pay represents a considerable decrease in total compensation. While the exact figures may vary depending on the reporting period and specific components of the compensation package, let's assume, for illustrative purposes, a hypothetical scenario. Let's say the CEO's total compensation package in the previous year totaled $15 million, encompassing base salary, bonuses, stock options, and other benefits. The 31% reduction would translate to a decrease of approximately $4.65 million, resulting in a total compensation of roughly $10.35 million for the current year. This reduction, applicable to the 2023 fiscal year (for example), is not an isolated incident. Other executive compensation packages within BP also experienced adjustments, reflecting a broader strategy of recalibrating executive pay structures. Keywords: BP CEO salary, executive bonus, stock options, total compensation, pay reduction. Further details can be found in BP's official financial reports.

- Total Compensation (Previous Year): (Illustrative example: $15 million)

- Pay Reduction: 31% (Illustrative example: $4.65 million)

- Total Compensation (Current Year): (Illustrative example: $10.35 million)

Reasons Behind the CEO Pay Cut

Several factors likely contributed to BP's decision to significantly reduce its CEO's pay. These factors intertwine to paint a picture of a company adapting to evolving financial realities and increasing pressure for responsible corporate governance.

Company Performance

BP's recent financial performance has undoubtedly played a significant role. While the company has enjoyed periods of profitability, fluctuations in oil prices, increased regulatory scrutiny, and investments in renewable energy sources have presented challenges. Profit margins have been under pressure, and stock prices have experienced volatility. This, coupled with shareholder activism and demands for greater accountability, likely influenced the decision to reduce executive compensation. Keywords: BP financial performance, profit margin, stock price, shareholder activism, corporate performance.

- Fluctuating Oil Prices: A key factor impacting BP's profitability and shareholder returns.

- Investment in Renewables: Significant capital expenditure in transitioning towards a greener energy portfolio.

- Shareholder Pressure: Increased scrutiny on executive pay packages in relation to company performance.

Corporate Governance and Sustainability Initiatives

BP has increasingly emphasized its commitment to Environmental, Social, and Governance (ESG) factors. The CEO pay cut could be viewed as a symbolic gesture aligning with this broader strategy. This move demonstrates a willingness to prioritize long-term sustainability over short-term gains, reflecting the growing importance of responsible business practices in the eyes of investors and the public. The company might have implemented new policies promoting executive pay transparency and linking compensation more directly to demonstrable achievements in sustainability. Keywords: ESG factors, corporate governance, sustainable business practices, responsible investment, executive pay transparency.

- Alignment with ESG Goals: Showing a tangible commitment to responsible business practices.

- Enhanced Transparency: Increased disclosure regarding executive compensation structures.

- Performance Metrics: Linking executive pay to measurable ESG targets.

External Pressures

External pressures, including government regulations, evolving public opinion, and increased investor activism concerning executive pay, cannot be ignored. The energy sector is under intense scrutiny regarding its environmental impact and corporate responsibility. Government regulations are becoming stricter, and public pressure for greater corporate accountability is mounting. Furthermore, the trend toward more responsible and transparent executive compensation is gaining momentum globally. Keywords: Government regulation, public opinion, investor relations, industry trends, executive pay benchmarking.

- Increased Regulatory Scrutiny: The energy sector faces heightened environmental regulations and reporting requirements.

- Public Perception: Public opinion increasingly influences corporate decision-making and executive compensation.

- Investor Activism: Investors are demanding greater accountability and transparency in executive pay.

Implications of the Reduced BP Executive Compensation

The reduction in BP's CEO pay holds several implications, both for the company itself and the wider energy sector.

Impact on Shareholder Value

The impact on shareholder value is multifaceted. While some investors may view the pay cut positively as a sign of responsible management and alignment with ESG principles, others may worry about its potential to impact the company's ability to attract and retain top talent. The long-term effect on investor sentiment and return on investment remains to be seen. Keywords: Shareholder value, return on investment, investor sentiment, talent acquisition, employee retention.

- Positive Investor Sentiment: May signal a commitment to responsible corporate governance and long-term value creation.

- Talent Retention Concerns: Could potentially impact the ability to attract and retain highly skilled executives.

- Long-Term Impact: The ultimate effect on shareholder returns will depend on several factors, including company performance and overall market conditions.

Wider Implications for the Energy Sector

BP's decision could set a precedent for other companies in the energy sector, potentially influencing executive compensation practices across the industry. This move signifies a shift towards more responsible and transparent executive pay structures, driven by ESG considerations and external pressures. The trend towards linking executive pay more closely to sustainability goals is likely to continue. Keywords: Industry trends, energy sector compensation, corporate leadership, executive pay reform.

- Industry Benchmarking: The decision may influence executive compensation practices among BP's competitors.

- ESG Integration: Further emphasizes the growing importance of integrating ESG factors into executive compensation structures.

- Future of Executive Pay: Points towards a potential paradigm shift in how executive pay is determined and structured within the energy sector.

Conclusion: Analyzing BP Executive Compensation and its Future

The 31% reduction in BP's CEO pay is a significant development, reflecting a complex interplay of company performance, evolving corporate governance standards, and external pressures. While the long-term implications remain to be seen, this decision signals a growing trend towards more responsible and transparent executive compensation within the energy sector. This shift is driven by increasing shareholder activism, a heightened focus on ESG factors, and stricter regulatory environments. To stay informed about BP executive compensation and other crucial corporate governance developments in the energy sector, continue following reputable financial news sources and industry publications. Understanding these trends is critical for investors, policymakers, and anyone interested in the future of responsible business practices.

Featured Posts

-

Vstup Ukrayini Do Nato Analiz Golovnikh Rizikiv Ta Zagroz

May 22, 2025

Vstup Ukrayini Do Nato Analiz Golovnikh Rizikiv Ta Zagroz

May 22, 2025 -

Southern France Weather Alert Heavy Snow In The Alps

May 22, 2025

Southern France Weather Alert Heavy Snow In The Alps

May 22, 2025 -

Steelers Face Qb Dilemma After Latest Matthew Stafford Update

May 22, 2025

Steelers Face Qb Dilemma After Latest Matthew Stafford Update

May 22, 2025 -

Ntt Multi Interconnect At Be X Ascii Jp

May 22, 2025

Ntt Multi Interconnect At Be X Ascii Jp

May 22, 2025 -

Pripinennya Dopomogi Ukrayini Grem Zasudzhuye Rishennya Ta Vimagaye Yogo Pereglyadu

May 22, 2025

Pripinennya Dopomogi Ukrayini Grem Zasudzhuye Rishennya Ta Vimagaye Yogo Pereglyadu

May 22, 2025