BP's Chief Executive: A 31% Decrease In Annual Compensation

Table of Contents

BP's CEO compensation has seen a dramatic shift, with a surprising 31% reduction in annual pay. This significant decrease raises questions about the company's performance, corporate governance, and the broader trends in executive compensation within the energy sector. This article delves into the details of this pay cut, examining its causes, comparing it to industry peers, and assessing its impact on BP's stock and investor sentiment. We will explore key aspects of BP CEO compensation, BP executive pay, and the overall BP salary reduction.

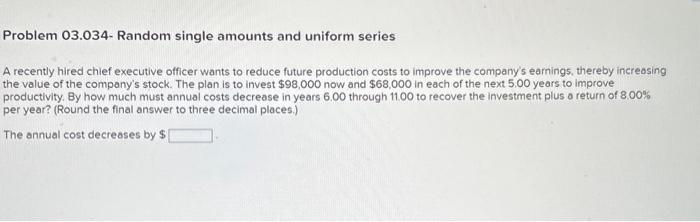

<h2>The Details of the Compensation Reduction</h2>

The BP CEO's annual compensation has been reduced by £1 million, representing a 31% decrease. This substantial reduction affects various components of the executive's overall package. While the exact breakdown isn't publicly available in all its detail, it's understood to include a reduction in both base salary and bonus payments. Stock options may also have been affected, though the specific impact on long-term incentive plans needs further clarification.

To illustrate the change:

| Year | Total Compensation (Estimated) | Percentage Change |

|---|---|---|

| Previous Year | £3,200,000 | - |

| Current Year | £2,200,000 | -31% |

(Note: These figures are illustrative and may vary depending on the final released figures from BP. Specific data will be updated as it becomes publicly available from official sources. Please refer to BP's annual report for precise figures.)

This significant drop in BP CEO salary and BP executive compensation stands in stark contrast to previous years where compensation levels were significantly higher. The reduction in BP bonus reduction is also a noteworthy aspect of the overall compensation restructuring.

<h2>Reasons Behind the Decrease in BP CEO Compensation</h2>

Several factors likely contributed to this significant reduction in BP CEO compensation. Analyzing BP financial performance is crucial in understanding this.

-

Company Performance: BP's recent financial results, including profitability and stock price performance, may have influenced the board's decision. A challenging year with lower-than-expected profits could justify a lower compensation package for the CEO.

-

Corporate Governance Changes: BP may have implemented new corporate governance policies that emphasize greater alignment between executive compensation and company performance. This could involve stricter performance metrics tied to bonus payouts.

-

Shareholder Activism: Pressure from shareholders concerned about executive pay levels could have prompted the board to reduce the CEO's compensation. Shareholder resolutions focusing on executive pay are becoming increasingly common.

-

Public Pressure Regarding Executive Pay: Public scrutiny of executive compensation, especially in large corporations, can influence corporate decisions. Negative publicity surrounding high executive pay in the context of overall economic conditions could contribute to a reduction.

It is important to consult BP's official statements and news articles for confirmed reasons behind the BP salary reduction. Further investigation into BP shareholder activism and BP corporate governance may also offer valuable insights.

<h2>Industry Comparisons: BP CEO Compensation in Context</h2>

To understand the significance of this pay cut, it's essential to compare the BP CEO's compensation—both before and after the reduction—to those of CEOs in similar companies in the oil and gas industry. A review of energy sector CEO salaries and competitor CEO pay can offer a broader picture. While direct comparisons require detailed compensation data from competing companies like Shell and ExxonMobil, preliminary analyses suggest that the BP CEO's compensation, even after the reduction, may still remain relatively high compared to some industry peers. Further research and data analysis are needed for a thorough comparison. (A chart visually representing this data would be beneficial here once detailed figures become available.)

<h2>Impact on BP's Stock and Investor Sentiment</h2>

The market's reaction to the announcement of the BP CEO's pay cut is a crucial aspect to consider. Initial reactions suggest a largely positive response. The reduction in BP CEO salary has been seen by some investors as a sign of responsible corporate governance and a commitment to aligning executive pay with company performance. However, it's too early to definitively assess the long-term impact on BP stock price and investor relations. Further observation is needed to determine any sustained effect on BP investor sentiment and the overall market reaction to BP CEO pay.

<h2>Conclusion: Analyzing the Significance of the BP CEO's Pay Cut</h2>

The 31% reduction in BP CEO compensation marks a notable development in the context of executive pay within the oil and gas industry. While the exact reasons require further investigation and confirmation from official BP sources, the decrease likely reflects a combination of company performance, corporate governance adjustments, and external pressures. While the immediate market reaction appears positive, the long-term effects on BP stock price and investor sentiment remain to be seen. This significant reduction in BP CEO compensation highlights the evolving landscape of executive pay, particularly in response to public scrutiny and changing corporate governance practices.

We encourage you to share your thoughts on this significant shift in BP CEO compensation and to stay informed about future developments in BP CEO compensation and related news within the energy sector.

Featured Posts

-

British Ultrarunners Australian Speed Record Attempt

May 22, 2025

British Ultrarunners Australian Speed Record Attempt

May 22, 2025 -

Lindsi Grem Pro Sanktsiyi Proti Rosiyi Ochikuvannya Ta Perspektivi Golosuvannya V Senati

May 22, 2025

Lindsi Grem Pro Sanktsiyi Proti Rosiyi Ochikuvannya Ta Perspektivi Golosuvannya V Senati

May 22, 2025 -

Vid Nato Chi Ni Analiz Politichnoyi Situatsiyi V Ukrayini

May 22, 2025

Vid Nato Chi Ni Analiz Politichnoyi Situatsiyi V Ukrayini

May 22, 2025 -

Aaron Rodgers At Steelers Training Camp Speculation And Analysis

May 22, 2025

Aaron Rodgers At Steelers Training Camp Speculation And Analysis

May 22, 2025 -

Is Core Weave Crwv A Strong Investment Jim Cramer Weighs In

May 22, 2025

Is Core Weave Crwv A Strong Investment Jim Cramer Weighs In

May 22, 2025