BRB's Acquisition Of Banco Master: A Public-Private Banking Powerhouse Emerges In Brazil

Table of Contents

Synergies and Competitive Advantages Created by the BRB-Banco Master Merger

The BRB-Banco Master merger generates significant synergies, creating a powerful competitive advantage in the Brazilian banking sector. This strategic combination leverages the strengths of both institutions, leading to substantial improvements across multiple areas. Key benefits include:

-

Increased market share in the Brazilian banking sector: The combined entity will possess a significantly larger customer base and a broader geographic reach, instantly boosting its market share. This increased presence will allow for greater influence and a stronger voice in shaping the future of Brazilian finance.

-

Significant cost savings through operational efficiencies and economies of scale: By streamlining operations and eliminating redundancies, the merged entity can achieve substantial cost savings. These savings can be reinvested in areas such as technological upgrades, customer service improvements, and expansion into new market segments. Economies of scale will also play a crucial role in reducing operational costs per customer.

-

Diversification of product offerings catering to a wider customer base: BRB and Banco Master bring diverse product portfolios to the table. This merger allows for a broader range of financial services, attracting a wider customer base and strengthening its position within the competitive Brazilian market.

-

Enhanced technological capabilities and infrastructure through integration of systems: Combining technological resources allows for improved infrastructure and cutting-edge technology solutions. This modernization effort will enhance operational efficiency, improve customer experience, and support the expansion of digital banking services.

-

Improved access to capital and resources for expansion and growth: The enlarged entity will have enhanced access to capital markets and financial resources, facilitating future expansion and growth initiatives. This will position the new entity for strategic acquisitions and investments.

-

Stronger competitive positioning against larger private banks in Brazil: The combined strength and resources of BRB and Banco Master will allow the merged entity to better compete against larger, established private banks in Brazil.

The combined entity benefits from significant synergies. By merging their operations, BRB and Banco Master can streamline processes, eliminate redundancies, and negotiate better deals with suppliers. This leads to substantial cost savings that can be reinvested in innovation, customer service, and expansion into new markets. This strategic move positions the new entity for substantial growth within the dynamic Brazilian financial landscape.

Impact on the Brazilian Public and Private Banking Sectors

The BRB-Banco Master merger has wide-ranging implications for both the public and private banking sectors in Brazil. The effects ripple through the entire financial ecosystem:

-

Increased competition within the Brazilian banking sector, driving innovation and better services for consumers: The merger introduces a more formidable competitor, forcing other banks to innovate and improve their offerings to remain competitive. This ultimately benefits consumers through enhanced services and potentially lower prices.

-

Potential for improved financial inclusion with expanded reach into underserved communities: With its enlarged reach and resources, the merged entity can potentially expand financial services to underserved communities, promoting greater financial inclusion across Brazil.

-

Strengthening of the public banking sector in Brazil, demonstrating a successful model of public-private collaboration: The successful integration of a public and private bank showcases a viable model for public-private partnerships within the Brazilian banking system.

-

Potential impact on the regulatory environment, requiring close monitoring of competition and market dynamics: The merger's size and influence may necessitate adjustments to the regulatory environment to ensure fair competition and market stability.

-

Enhanced financial stability through diversification and consolidation within the banking sector: Consolidation within the banking sector can contribute to greater financial stability by reducing systemic risk.

The merger's effect extends beyond the merging entities. Increased competition will likely lead to improved services and more competitive pricing for consumers. The enhanced size and stability of the combined bank also contribute positively to the overall financial health of the Brazilian economy. This creates a stronger, more resilient banking sector, better equipped to support Brazil's economic growth.

Challenges and Potential Risks Associated with the BRB-Banco Master Integration

While the BRB-Banco Master merger presents significant opportunities, several challenges and potential risks need careful management:

-

Challenges related to integrating disparate IT systems and operational procedures: Merging different IT systems and operational procedures can be complex and time-consuming, requiring substantial investment in technology and skilled personnel. System integration is a critical factor for a successful outcome.

-

Potential cultural clashes between employees of the two organizations: Integrating two distinct organizational cultures requires careful planning and effective communication to mitigate potential conflicts and ensure a smooth transition for employees. Cultural sensitivity and employee engagement are paramount to success.

-

Navigating regulatory hurdles and complying with relevant financial regulations: The merger process requires navigating complex regulatory frameworks, ensuring full compliance with all relevant financial regulations in Brazil.

-

Managing potential risks associated with increased size and complexity: A larger, more complex entity faces increased operational and financial risks, requiring robust risk management strategies.

-

Ensuring seamless customer transition and maintaining customer satisfaction: Maintaining a positive customer experience throughout the integration process is crucial to retain customers and avoid disruption to banking services.

While the merger offers significant advantages, there are inherent integration challenges. Successfully merging two distinct organizational cultures and IT systems will require careful planning, effective communication, and proactive risk management. Addressing these challenges proactively is essential for a successful and beneficial merger.

Conclusion

The acquisition of Banco Master by BRB represents a pivotal moment for the Brazilian banking industry. This powerful public-private partnership has the potential to transform the financial landscape, fostering increased competition, enhanced financial inclusion, and improved services for Brazilian consumers. While integration challenges exist, the potential rewards of this merger are substantial. Successfully navigating these challenges will be key to realizing the full potential of this new banking powerhouse. Stay informed about the ongoing developments surrounding the BRB's acquisition of Banco Master and its impact on the Brazilian financial sector. Follow our updates on the evolution of this significant merger in the Brazilian banking market. Understanding the intricacies of this BRB and Banco Master merger is key to understanding the future of Brazilian banking.

Featured Posts

-

Thlyl Adae Daks Alalmany Tjawz Dhrwt Mars Wmadha Yeny Dhlk Llmstthmryn

May 24, 2025

Thlyl Adae Daks Alalmany Tjawz Dhrwt Mars Wmadha Yeny Dhlk Llmstthmryn

May 24, 2025 -

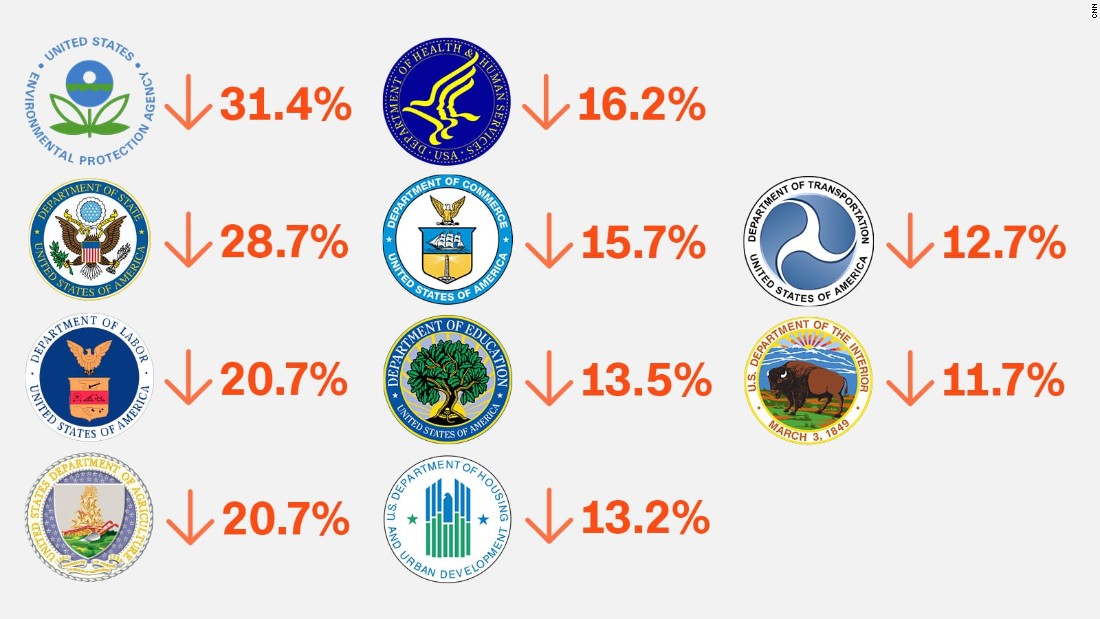

Saving Our Museums The Urgent Need For Funding After Trumps Budget Cuts

May 24, 2025

Saving Our Museums The Urgent Need For Funding After Trumps Budget Cuts

May 24, 2025 -

Understanding The Controversy Surrounding Thames Water Executive Bonuses

May 24, 2025

Understanding The Controversy Surrounding Thames Water Executive Bonuses

May 24, 2025 -

Your Checklist For A Successful Escape To The Country

May 24, 2025

Your Checklist For A Successful Escape To The Country

May 24, 2025 -

Essen San Hejmo Line Up Sorgt Fuer Begeisterungsstuerme

May 24, 2025

Essen San Hejmo Line Up Sorgt Fuer Begeisterungsstuerme

May 24, 2025