Breaking Free: How To Overcome Lack Of Funds And Achieve Your Goals

Table of Contents

Identifying Your Goals and Priorities

Before diving into the nitty-gritty of finances, we need clarity. Defining Your "Why" is crucial. Why are these goals important to you? What will achieving them mean for your life? A strong "why" fuels motivation and helps you persevere through challenges.

- Use the SMART goal method: Make your goals Specific, Measurable, Achievable, Relevant, and Time-bound. Instead of "get rich," aim for "save $5,000 for a down payment on a house within 18 months."

- Prioritize ruthlessly: Not all goals are created equal. Prioritize based on importance and urgency. What will have the biggest positive impact on your life? Focus your energy there.

- Break down large goals: Overwhelmed by a massive goal? Break it into smaller, manageable steps. This makes the journey less daunting and provides a sense of accomplishment along the way. This approach is especially helpful when dealing with financial limitations. Small, consistent progress is key to overcoming a lack of funds gradually.

Creating a Realistic Budget and Tracking Expenses

Facing lack of funds head-on requires understanding your current financial situation. Assessing Your Current Financial Situation involves honestly analyzing your income and expenses. Use budgeting apps (Mint, YNAB), spreadsheets, or even a simple notebook to track everything.

- Identify areas for reduction: Where is your money going? Are there subscriptions you can cancel? Can you find cheaper alternatives for groceries, entertainment, or transportation? Identifying areas where you can cut expenses is crucial in effectively managing finances.

- Explore budgeting methods: The 50/30/20 rule (50% needs, 30% wants, 20% savings/debt repayment), zero-based budgeting (assigning every dollar a purpose), and envelope budgeting are all effective budgeting tips. Find the method that best suits your personality and lifestyle.

- Track diligently: Regularly review your spending habits to stay on track. This consistent monitoring is vital for effective expense tracking and achieving your financial planning goals.

Exploring Income Generation Opportunities

A lack of funds can often be addressed by increasing income streams. Side Hustles and Freelancing offer incredible flexibility and potential. Consider your skills and interests – what can you offer others?

- Utilize freelance platforms: Upwork, Fiverr, and Guru offer opportunities to find freelance work in various fields. Explore your options based on your skills and experience.

- Brainstorm side hustle ideas: Depending on your skills and interests, you might offer tutoring, virtual assistant services, dog walking, crafts, or even rent out a spare room. Many side hustle ideas are readily available online.

- Set realistic expectations: Don't expect to become a millionaire overnight. Start small, build your experience, and gradually increase your extra income streams.

Seeking Financial Support and Resources

Sometimes, overcoming a lack of funds requires seeking external assistance. Utilizing Available Resources can significantly help bridge the gap.

- Explore government programs: Many countries offer grants, loans, and unemployment benefits. Research programs relevant to your situation and needs.

- Seek non-profit assistance: Local charities and non-profit organizations often provide financial assistance to individuals facing hardship. Look for relevant organizations in your community.

- Responsible borrowing and debt management: If you need to borrow money, be sure to understand the terms and conditions. Avoid high-interest debt, and explore options like debt consolidation to manage your finances effectively.

Conclusion

Overcoming a lack of funds and achieving your goals requires a multifaceted approach. By clearly defining your goals, creating a realistic budget, exploring income generation opportunities, and utilizing available resources, you can significantly improve your financial situation. Remember that consistent effort and planning are paramount. Start overcoming your lack of funds today! Begin budgeting to achieve your goals, and explore income generation options to break free from financial constraints. With persistence and a well-defined plan, you can break free from the limitations of financial hardship and build a brighter future. You have the power to achieve your dreams; don't let a temporary lack of funds define your potential.

Featured Posts

-

Blog Home Office Vs Kancelaria 79 Manazerov Preferuje Osobne Stretnutia

May 21, 2025

Blog Home Office Vs Kancelaria 79 Manazerov Preferuje Osobne Stretnutia

May 21, 2025 -

Investigating The Reasons Behind D Wave Quantum Qbts Stocks Thursday Decline

May 21, 2025

Investigating The Reasons Behind D Wave Quantum Qbts Stocks Thursday Decline

May 21, 2025 -

Southern French Alps Late Snowfall And Stormy Weather

May 21, 2025

Southern French Alps Late Snowfall And Stormy Weather

May 21, 2025 -

Joint Statement Switzerland And China Seek Dialogue On Tariffs

May 21, 2025

Joint Statement Switzerland And China Seek Dialogue On Tariffs

May 21, 2025 -

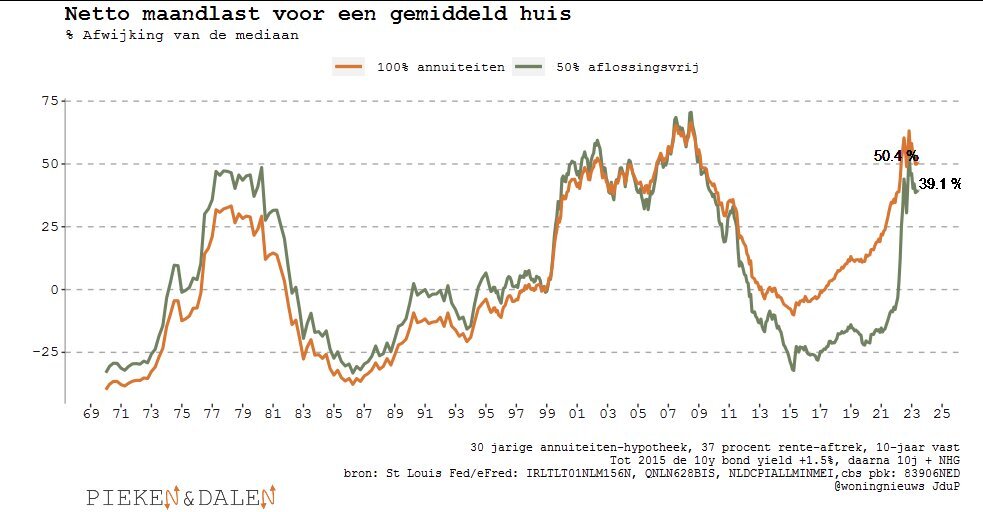

Betaalbaarheid Woningen Nederland Analyse Van De Standpunten Abn Amro En Geen Stijl

May 21, 2025

Betaalbaarheid Woningen Nederland Analyse Van De Standpunten Abn Amro En Geen Stijl

May 21, 2025