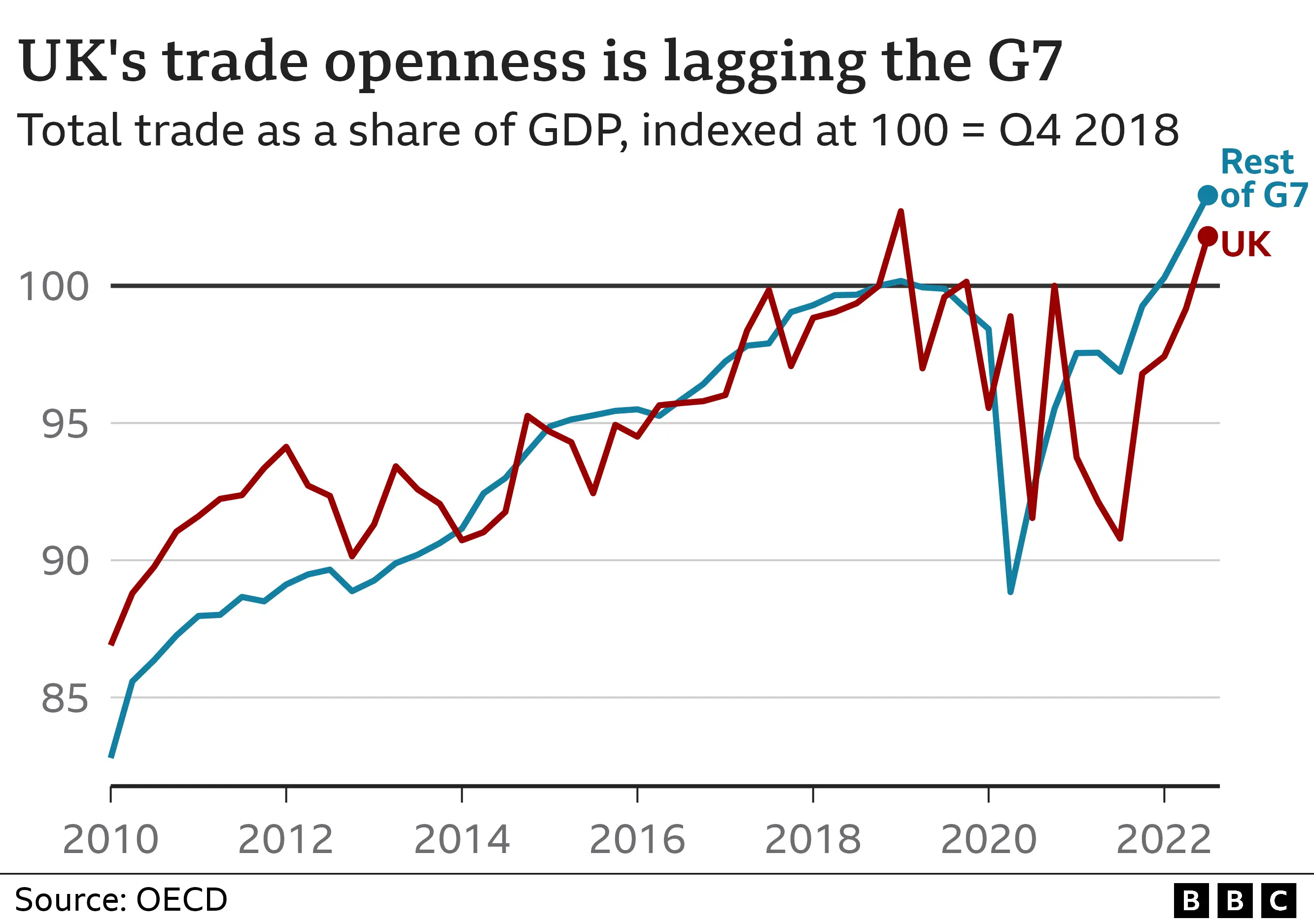

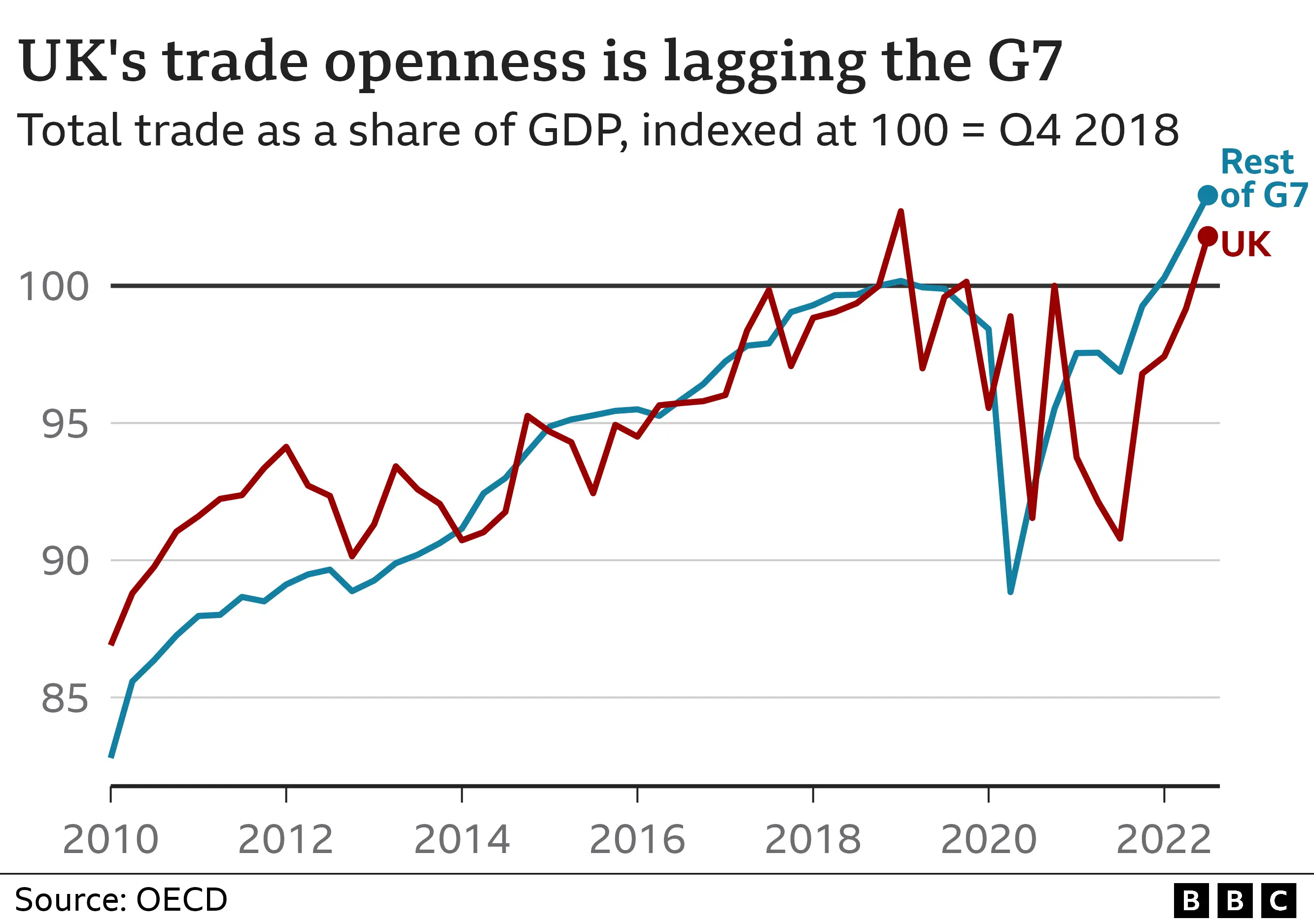

Brexit Impact: UK Luxury Exports To EU Suffer Growth Lag

Table of Contents

Increased Trade Barriers and Customs Delays

Brexit introduced new customs procedures and regulatory hurdles, creating substantial challenges for UK luxury exporters shipping to the EU. These non-tariff barriers manifest as increased paperwork, longer processing times, and significant delays at borders. This directly impacts the timely delivery of luxury goods – a crucial factor in maintaining brand prestige and customer satisfaction. The speed and efficiency of delivery are paramount for high-value items, and delays can lead to significant losses.

- Increased administrative burden for exporters: Navigating complex customs declarations and documentation requires specialized knowledge and resources, adding considerable costs and complexity for businesses.

- Significant delays in shipping times, impacting delivery schedules: Delays can cause missed deadlines for events like fashion shows or private client deliveries, leading to lost sales and reputational damage.

- Higher logistical costs associated with navigating new customs processes: Businesses must invest in new software, training, and potentially specialized customs brokers, adding to their operational expenses.

- Increased risk of goods being damaged or lost during transit: Longer transit times due to border delays increase the risk of damage or loss, leading to further financial losses and customer dissatisfaction.

For example, a shipment of bespoke, handcrafted furniture delayed by customs might miss a crucial delivery date for a high-profile client, resulting in not only lost revenue but also potential damage to the brand's reputation for reliability.

Tariffs and Increased Costs

While the UK and EU have a Trade and Cooperation Agreement, new tariffs on certain luxury goods can significantly increase the final cost for consumers, reducing demand and impacting UK export competitiveness. This price increase makes UK luxury goods less appealing compared to those from other countries who may have preferential access to the EU market. The resulting impact is a double blow: lower demand and reduced profitability.

- Higher prices making UK luxury goods less competitive in the EU market: Consumers are increasingly price-sensitive, and even a small tariff increase can make the difference between purchasing a UK luxury item or a competitor’s product.

- Reduced consumer demand due to increased costs: Higher prices directly translate to a decrease in sales volume, affecting the profitability of UK luxury exporters.

- Impact on profit margins for UK luxury exporters: Increased costs, including tariffs and logistical expenses, squeeze profit margins, making it harder for businesses to stay afloat.

- Potential loss of market share to competitors outside the UK: Businesses in countries with more favorable trade relationships with the EU are gaining a competitive edge, potentially pushing UK exporters out of the market.

Increased tariffs on high-end Scotch whisky, for example, could make it less appealing to EU consumers compared to similar products from other countries with more favorable trade terms, impacting both sales volume and the UK's global standing in the premium spirits market.

Supply Chain Disruptions

The complexities of post-Brexit trade have also significantly disrupted supply chains for UK luxury goods. Sourcing raw materials and components, often from within the EU, has become more challenging and costly. This ripple effect impacts production schedules and adds to the overall cost of goods.

- Difficulty sourcing specific materials from within the EU: Access to specialized materials or components used in luxury goods production can be restricted by new border controls and customs checks.

- Increased costs associated with transporting materials across borders: The added logistical complexities and delays increase the cost of shipping materials across the channel.

- Potential delays in production due to supply chain bottlenecks: Delays in sourcing materials can disrupt production schedules, leading to missed deadlines and potential loss of orders.

- Reduced production capacity and potential for missed orders: Supply chain disruptions can lead to reduced production capacity and an inability to fulfill orders, negatively impacting revenue and customer relationships.

The Impact on UK Luxury Brands

The challenges outlined above have a significant impact on UK luxury brands, affecting their profitability, market share, and ultimately, job security within the sector. The cumulative effect of increased costs, reduced demand, and supply chain disruptions puts substantial pressure on these businesses.

- Reduced sales and revenue for luxury businesses: Lower demand and higher prices directly translate into reduced sales and revenue.

- Potential job losses in the luxury goods industry: Financial difficulties can force businesses to reduce their workforce to cut costs.

- Damage to the reputation of UK luxury brands due to delays and complications: Delays and complications can damage the reputation of UK luxury brands, particularly when dealing with high-value, time-sensitive orders.

- Decreased investment in UK luxury goods manufacturing: The uncertain economic climate and reduced profitability may discourage investment in the sector, potentially hindering future growth.

Conclusion

Brexit has undeniably presented significant challenges for UK luxury exports to the EU. Increased trade barriers, customs delays, tariffs, and supply chain disruptions have all contributed to a growth lag in this vital sector. Addressing these issues requires a proactive approach from both the UK and EU governments, fostering smoother trade relations and minimizing the negative impact on UK luxury brands. Understanding the Brexit impact on UK luxury exports to the EU is crucial for businesses to adapt and for policymakers to implement strategies that support this important industry. It's vital to monitor the situation closely and actively explore solutions to alleviate the challenges faced by UK luxury exporters. Ignoring the impact could lead to further losses and damage the UK’s global standing in the luxury goods market. Proactive planning and adaptation are essential for the survival and continued success of UK luxury businesses in the post-Brexit landscape.

Featured Posts

-

Clisson Debat Sur Le Port De Symboles Religieux Au College

May 21, 2025

Clisson Debat Sur Le Port De Symboles Religieux Au College

May 21, 2025 -

The Truth Behind David Walliams Leaving Britains Got Talent

May 21, 2025

The Truth Behind David Walliams Leaving Britains Got Talent

May 21, 2025 -

Expected Return Juergen Klopp Back At Liverpool Before Season End

May 21, 2025

Expected Return Juergen Klopp Back At Liverpool Before Season End

May 21, 2025 -

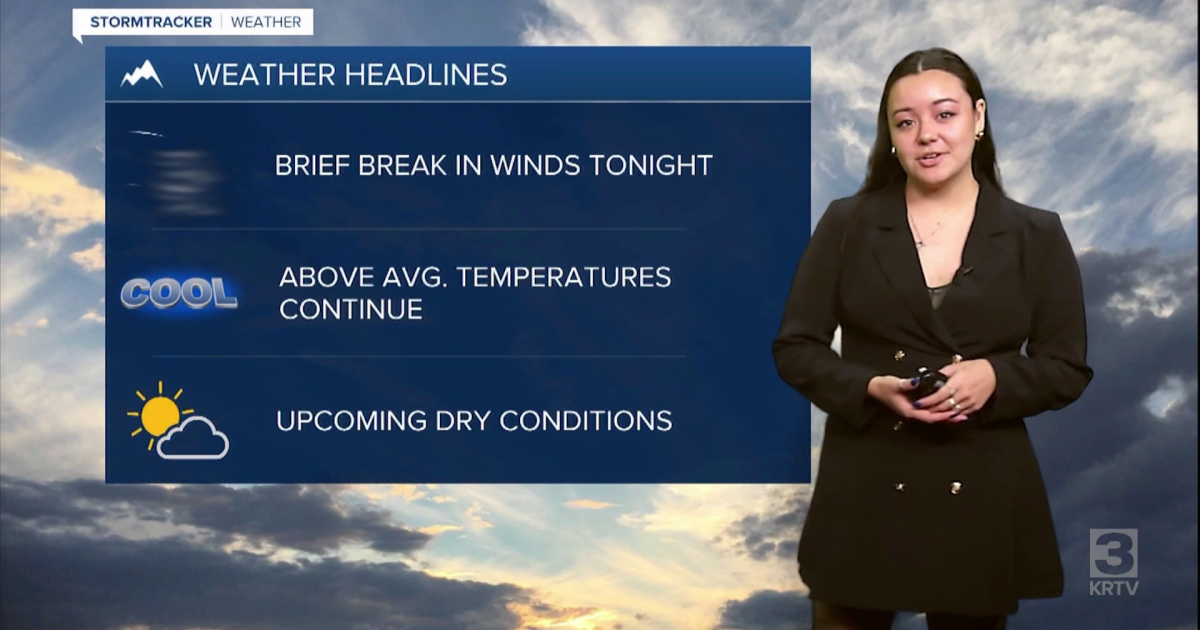

Mild Temperatures And Dry Weather Predicted

May 21, 2025

Mild Temperatures And Dry Weather Predicted

May 21, 2025 -

Mission Patrimoine 2025 Plouzane Et Clisson Symboles Du Patrimoine Breton Restaure

May 21, 2025

Mission Patrimoine 2025 Plouzane Et Clisson Symboles Du Patrimoine Breton Restaure

May 21, 2025