Broadcom's VMware Acquisition: A 1,050% Price Increase Concerns AT&T

Table of Contents

The VMware Price Surge: A Deep Dive into the 1,050% Increase

The acquisition of VMware by Broadcom has resulted in a dramatic price hike for VMware's virtualization software. Before the acquisition, VMware held a dominant market share with a pricing structure competitive within the enterprise virtualization market. However, post-acquisition, prices have skyrocketed, leading to widespread concern among users.

Several factors contribute to this dramatic increase:

- Monopoly Power: Broadcom's acquisition eliminated a significant competitor, potentially creating a near-monopoly in certain virtualization segments, allowing them to dictate pricing.

- Increased Profitability Goals: Broadcom is likely aiming for a higher return on investment following the significant acquisition cost, leading to increased pricing across the VMware product line.

- Market Consolidation: This merger is part of a broader trend of consolidation in the tech industry, where larger companies acquire smaller ones, often leading to price increases for consumers.

The following chart illustrates the shocking price differences:

[Insert chart/graph visually depicting the pre- and post-acquisition pricing of key VMware products. Data points should be clearly labelled.]

- Pre-acquisition VMware pricing and market share: Dominant player with competitive pricing, high market penetration.

- Post-acquisition pricing changes and market analysis: Significant price increases across the board, potential impact on market share depending on competitor response.

- Impact on smaller businesses and enterprises: Smaller businesses face disproportionate challenges due to the increased costs, potentially forcing them to seek alternative, less mature solutions.

- Comparison to competitor pricing: A comparison to the pricing strategies of competitors like Microsoft Azure, Amazon Web Services, and other virtualization solutions is needed to understand the competitive landscape.

AT&T's Dependence on VMware and Potential Financial Strain

AT&T, a major telecommunications company, heavily relies on VMware's virtualization technologies for its network infrastructure. This significant dependence makes them particularly vulnerable to the price surge.

- AT&T's current VMware infrastructure: A detailed explanation of AT&T's extensive use of VMware products in their data centers and network operations is needed here.

- Projected cost increase for AT&T: Quantify the projected financial impact of the price increase on AT&T's operational budget. Include estimations of potential annual costs.

- Alternative virtualization solutions for AT&T: Explore potential alternative virtualization solutions that AT&T could consider to mitigate the price increase. This could include open-source solutions, cloud-based alternatives, or solutions from competitors.

- Potential impact on AT&T's profitability: Analyze how this cost increase could affect AT&T's overall profitability and its ability to invest in other areas of its business.

Regulatory Scrutiny and Antitrust Concerns surrounding Broadcom's VMware Acquisition

The sheer size and potential impact of Broadcom's VMware acquisition have understandably attracted significant regulatory scrutiny from bodies like the Federal Trade Commission (FTC) in the US and the European Commission (EC) in Europe. Concerns center around potential antitrust violations, reduced competition, and the stifling of innovation.

- Arguments for and against the acquisition: Present a balanced view, including arguments for increased efficiency and economies of scale versus concerns about monopolies and reduced consumer choice.

- Potential implications of regulatory intervention: Discuss the potential outcomes of the regulatory review, including the possibility of blocking the deal, imposing conditions, or requiring divestitures.

- Similar past acquisitions and their regulatory outcomes: Compare this acquisition to similar large tech mergers in the past, highlighting regulatory responses and their long-term effects on the market.

- Impact on competition within the virtualization market: Analyze how the acquisition impacts competition within the virtualization market, potentially creating barriers to entry for new players and hindering innovation.

Long-Term Implications of Broadcom's VMware Acquisition for the Tech Industry

The ramifications of Broadcom's VMware acquisition extend far beyond AT&T. This deal sets a precedent for future acquisitions and mergers in the tech industry, impacting innovation, competition, and pricing strategies.

- Potential changes in the virtualization market: Discuss the potential for increased market concentration and the potential for reduced innovation due to lack of competition.

- Impact on cloud computing and data center infrastructure: Analyze how this acquisition will affect the cloud computing market and the broader data center infrastructure.

- Long-term effects on software pricing strategies: Assess the potential for other software companies to follow suit, increasing their prices due to reduced competition.

- Predictions for future industry consolidation: Consider the implications of this acquisition for future mergers and acquisitions within the tech industry.

Conclusion: Understanding the Ramifications of Broadcom's VMware Acquisition

Broadcom's VMware acquisition presents significant challenges, particularly the dramatic price increase affecting major companies like AT&T. The 1,050% surge underscores concerns about reduced competition and the potential for monopolistic practices. Regulatory scrutiny is crucial to ensuring a fair and competitive market. The long-term implications for the tech industry are far-reaching, impacting innovation, pricing, and the overall competitive landscape. Stay informed about developments in Broadcom's VMware acquisition and its ripple effects. Further research and discussion are critical to understanding the full impact of this landmark tech deal and its potential ramifications for the future.

Featured Posts

-

May 3rd Al Haymon Announces Details On Canelo Vs Crawford Fight

May 05, 2025

May 3rd Al Haymon Announces Details On Canelo Vs Crawford Fight

May 05, 2025 -

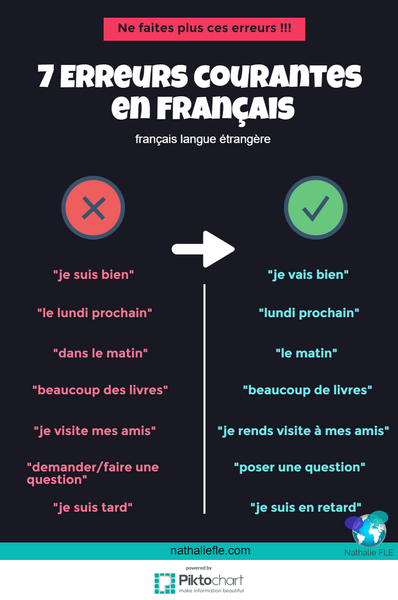

Comment Eviter Les Erreurs Couteuses

May 05, 2025

Comment Eviter Les Erreurs Couteuses

May 05, 2025 -

The Benavidez Factor Is Canelo Avoiding A High Risk Fight Against A Fellow Mexican

May 05, 2025

The Benavidez Factor Is Canelo Avoiding A High Risk Fight Against A Fellow Mexican

May 05, 2025 -

Kentucky Derby And Ford A Multi Year Partnership Extension Announced

May 05, 2025

Kentucky Derby And Ford A Multi Year Partnership Extension Announced

May 05, 2025 -

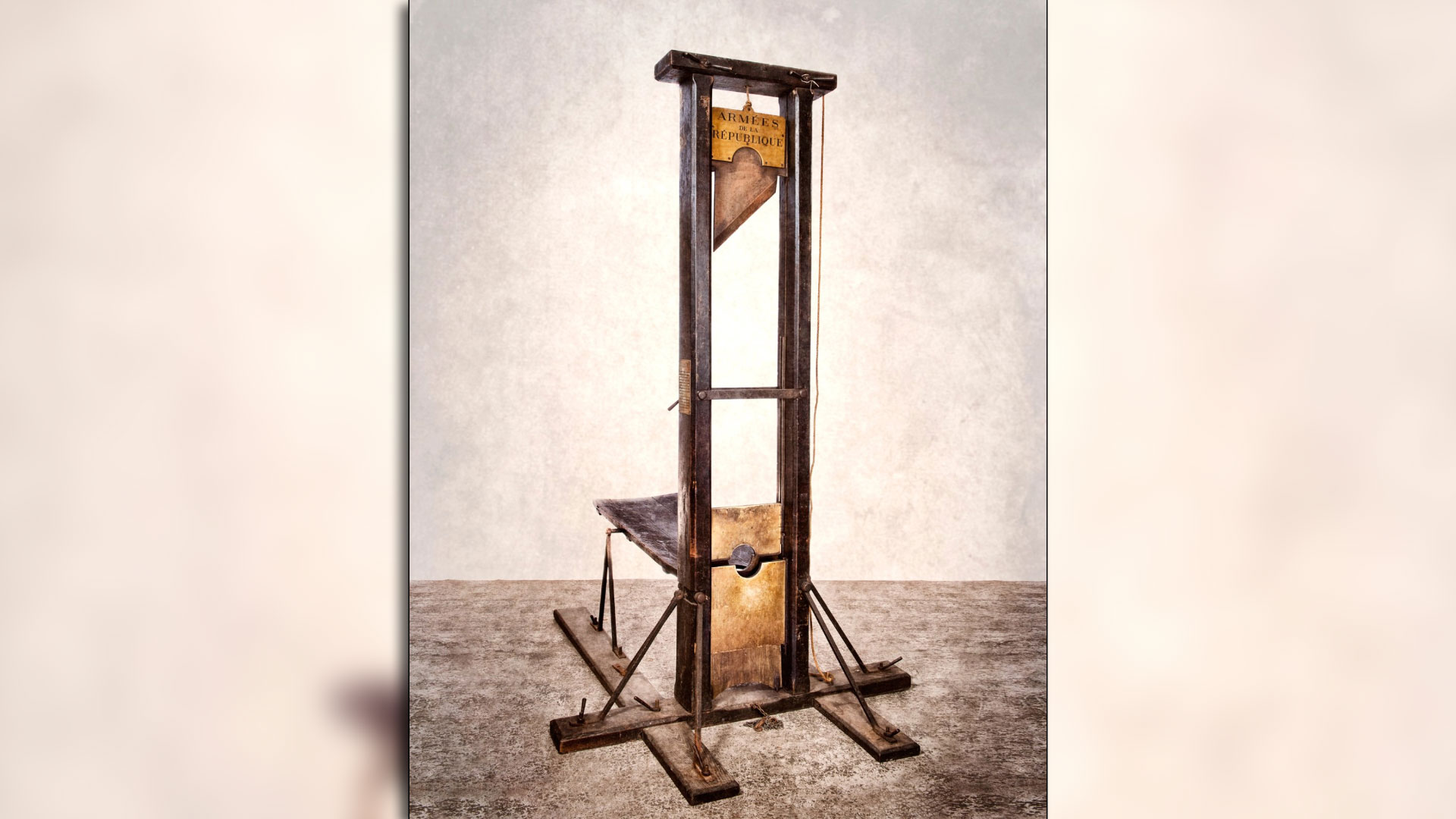

La Guillotina Afilada Una Herramienta Para Evitar Acciones Tontas

May 05, 2025

La Guillotina Afilada Una Herramienta Para Evitar Acciones Tontas

May 05, 2025

Latest Posts

-

Mastering Office Lunch Etiquette 6 Essential Rules

May 31, 2025

Mastering Office Lunch Etiquette 6 Essential Rules

May 31, 2025 -

The Six Golden Rules Of Office Lunch Etiquette

May 31, 2025

The Six Golden Rules Of Office Lunch Etiquette

May 31, 2025 -

The Last Of Us Stars Prior Role A Must See Crime Drama

May 31, 2025

The Last Of Us Stars Prior Role A Must See Crime Drama

May 31, 2025 -

Before The Last Of Us Fame Kaitlyn Devers Underrated Crime Drama Performance

May 31, 2025

Before The Last Of Us Fame Kaitlyn Devers Underrated Crime Drama Performance

May 31, 2025 -

The Accuracy Of Veterinary Watchdog Reports A Critical Analysis

May 31, 2025

The Accuracy Of Veterinary Watchdog Reports A Critical Analysis

May 31, 2025