Broadcom's VMware Acquisition: AT&T Exposes A 1,050% Cost Increase

Table of Contents

The 1050% Cost Increase: A Deep Dive into AT&T's Experience

AT&T's public disclosure of a 1,050% increase in their VMware licensing costs has highlighted a major concern for businesses heavily invested in VMware's infrastructure. This unprecedented price hike underscores the potential risks associated with the Broadcom acquisition.

Specifics of the Price Hike

While precise figures remain partially undisclosed due to the complexities of enterprise licensing agreements, reports indicate that the cost increase affects a range of VMware products crucial to AT&T's operations. The impact isn't uniformly distributed across all services; some products experienced proportionally larger increases than others.

- Specific VMware products impacted: vSphere, vSAN, NSX (and potentially others, depending on the specifics of AT&T's contracts).

- Previous pricing: While exact previous pricing isn't publicly available, industry experts suggest significant previous investments by AT&T in VMware's infrastructure.

- New pricing: The 1050% increase represents a dramatic shift, translating to millions of dollars in added expense for AT&T.

- Percentage increase per product: The percentage increase varied depending on the specific product and contract terms, with some experiencing increases exceeding 1050%.

AT&T has not yet issued a comprehensive public statement detailing the exact breakdown of the cost increase or its specific impact on different services. However, the sheer magnitude of the increase highlights the vulnerability of large enterprise customers in the wake of this acquisition.

AT&T's Response and Strategic Implications

AT&T's reaction to this drastic cost surge is crucial to understanding the broader impact. The company is likely evaluating various options, including:

- AT&T's public statements: Limited official statements suggest AT&T is assessing its options and potentially seeking negotiations with Broadcom.

- Potential cost-cutting measures: This situation will likely force AT&T to re-evaluate its IT spending and explore cost-cutting measures across its operations.

- Alternatives to VMware: The exorbitant price increase compels AT&T to explore alternative virtualization and cloud solutions, potentially impacting its long-term technology strategy.

- Strategic re-evaluation of IT infrastructure: This event will undoubtedly prompt a thorough review of AT&T's IT infrastructure, potentially leading to significant changes in its technology roadmap.

Broadcom's Acquisition Strategy and Pricing Practices

Broadcom's acquisition of VMware raises concerns about its pricing strategies and potential impact on the broader technology landscape. The 1050% cost increase to AT&T raises serious questions about the future of VMware's pricing model.

Broadcom's Business Model and Profitability Goals

Broadcom is known for its aggressive approach to acquisitions and integration. Understanding their historical practices offers insights into their post-VMware strategy.

- Examples of past acquisitions and resulting pricing changes: Analyzing Broadcom's past acquisitions reveals a pattern of cost optimization and potential price increases for acquired products/services.

- Broadcom's financial projections post-acquisition: Broadcom's financial projections after the VMware acquisition likely incorporate significant revenue increases driven, in part, by potential price increases.

- Potential synergies sought through the VMware merger: Broadcom is likely aiming to leverage synergies and streamline operations, possibly leading to cost reductions on some levels while raising prices in others.

Potential Antitrust Concerns and Regulatory Scrutiny

The significant impact of the Broadcom-VMware merger necessitates regulatory scrutiny and raises potential antitrust concerns.

- Ongoing or potential investigations: Regulatory bodies are likely to investigate the potential for anti-competitive practices and the impact on the market.

- Statements from regulatory bodies: Official statements from regulatory agencies will provide crucial insight into the ongoing investigations and potential actions.

- Concerns regarding market dominance and potential monopolistic practices: The combined market power of Broadcom and VMware raises concerns about market dominance and the potential for monopolistic practices, impacting pricing and innovation.

Impact on the Broader Telecom and Enterprise Landscape

The implications of the Broadcom-VMware acquisition extend far beyond AT&T, influencing the broader telecom and enterprise IT sectors.

The Ripple Effect on Other VMware Customers

The 1050% price increase for AT&T isn't an isolated incident, and other large enterprises using VMware products should anticipate potential price hikes.

- Potential for widespread price hikes: Other VMware customers, particularly large organizations, could face similar significant cost increases, impacting their budgets and IT strategies.

- Reaction from other major VMware clients: Major clients are likely reevaluating their reliance on VMware and exploring alternative solutions.

- Implications for budget planning and IT strategy: Businesses must adjust their budget planning and IT strategies to account for the potential for substantial price increases in VMware products.

Shifting Market Dynamics and Emerging Alternatives

The substantial price increases are likely to accelerate the adoption of alternative virtualization and cloud solutions.

- Key competitors to VMware: Competitors like Microsoft Azure, Amazon Web Services (AWS), and Google Cloud Platform are likely to benefit from the increased demand for alternative solutions.

- Advantages and disadvantages of alternative solutions: Businesses will need to carefully assess the advantages and disadvantages of each alternative solution, considering factors such as cost, compatibility, and performance.

- Market share predictions post-acquisition: The acquisition could significantly reshape the market share dynamics of the virtualization and cloud computing sectors.

Conclusion

The Broadcom-VMware acquisition has introduced unprecedented uncertainty into the enterprise software market. The 1050% cost increase experienced by AT&T serves as a stark warning to other businesses relying on VMware solutions. Broadcom's acquisition strategy, potential antitrust concerns, and the resulting shifts in the market landscape necessitate a proactive and strategic response from all stakeholders. The future of VMware pricing remains uncertain, but it's clear that companies must carefully evaluate their licensing agreements, explore alternative virtualization and cloud solutions, and proactively plan for potential significant price increases. Understanding the implications of this acquisition is paramount for navigating the changing landscape of enterprise software and virtualization. Learn more about alternative virtualization strategies and mitigating the risks of the Broadcom VMware acquisition.

Featured Posts

-

Crowd Intervenes In Ice Arrest Sparking Chaos Cnn

May 12, 2025

Crowd Intervenes In Ice Arrest Sparking Chaos Cnn

May 12, 2025 -

Six Shots Back Mc Ilroy And Lowrys Zurich Classic Title Defense

May 12, 2025

Six Shots Back Mc Ilroy And Lowrys Zurich Classic Title Defense

May 12, 2025 -

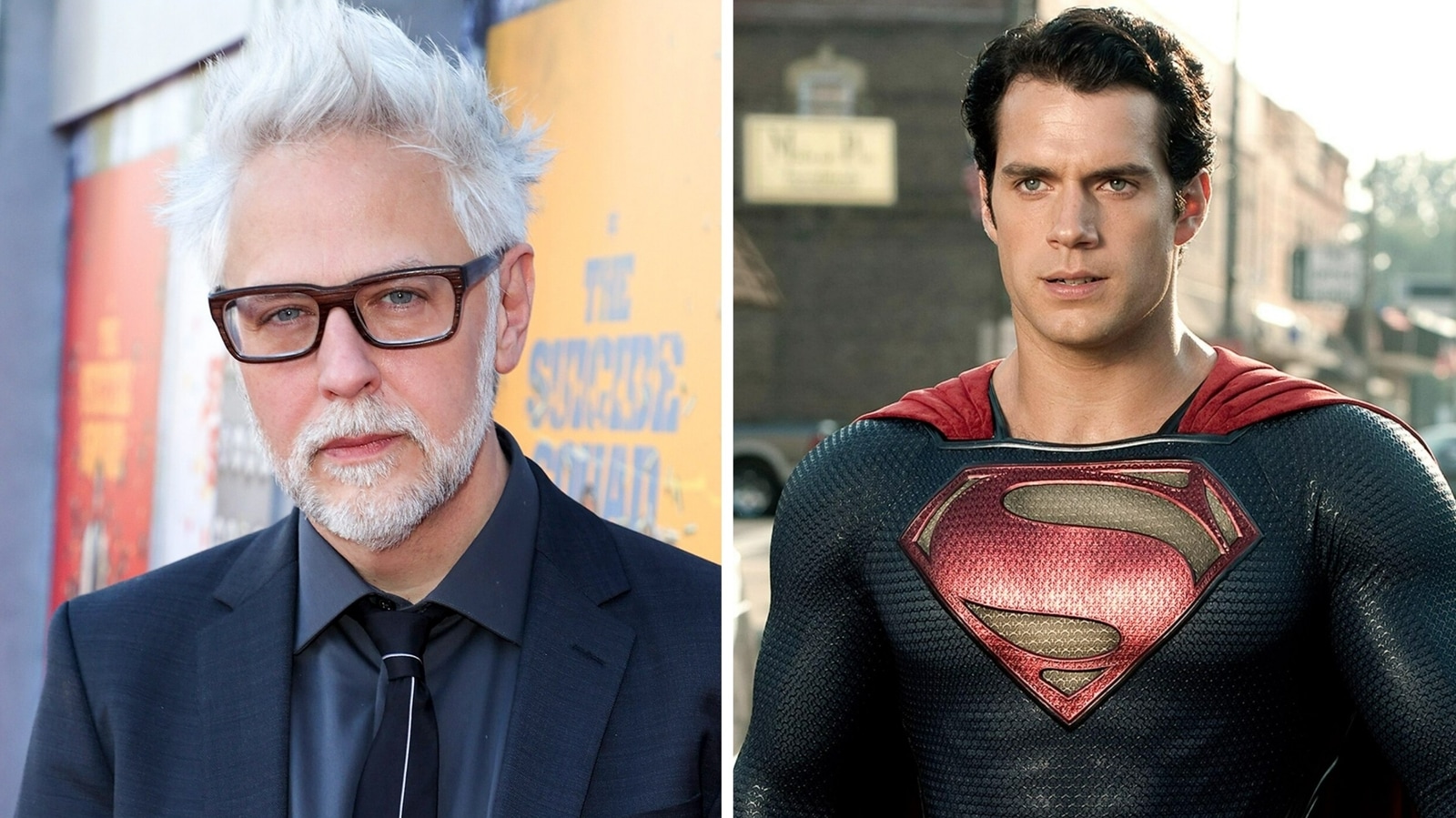

James Gunn On Henry Cavills Dc Departure Was He Wronged

May 12, 2025

James Gunn On Henry Cavills Dc Departure Was He Wronged

May 12, 2025 -

Princess Beatrice Opens Up About Her Parents Divorce From Prince Andrew And Sarah Ferguson

May 12, 2025

Princess Beatrice Opens Up About Her Parents Divorce From Prince Andrew And Sarah Ferguson

May 12, 2025 -

Blowout Win Propels Celtics To Division Championship

May 12, 2025

Blowout Win Propels Celtics To Division Championship

May 12, 2025