Broadcom's VMware Acquisition: AT&T Highlights A Staggering 1,050% Cost Increase

Table of Contents

AT&T's Public Statement and the 1050% Cost Increase

AT&T's public statements regarding the VMware cost increase haven't been explicitly detailed in press releases, but industry analysts and reports have highlighted the significant jump. While precise figures and specific contract details remain confidential, the reported 1050% increase points to a massive shift in pricing. This scale of price jump raises serious concerns about the potential impact on AT&T's operational budget and its ability to deliver services cost-effectively. The magnitude of this increase is unprecedented and serves as a cautionary tale.

- Specific VMware products/services impacted: While the exact products aren't publicly known, it's likely that core virtualization, cloud management, and networking solutions were affected.

- Original pricing vs. new pricing: Unfortunately, precise figures are unavailable due to confidentiality agreements. However, the 1050% figure indicates a transformation from potentially manageable costs to a significant budget burden.

- Impact on AT&T's overall IT budget: This unforeseen expense likely necessitates significant budget reallocations, potentially impacting other IT initiatives and projects.

Potential Reasons Behind the Dramatic Price Hike

Several factors could contribute to such a substantial price increase following Broadcom's VMware acquisition:

- Loss of competitive pricing: With Broadcom's acquisition, the competitive landscape for VMware solutions has fundamentally changed. The absence of a significant competitor may have allowed for less competitive pricing.

- Changes in VMware's licensing models post-acquisition: Broadcom might have implemented new licensing models, potentially shifting from perpetual licenses to subscription-based models with increased costs.

- Integration costs passed on to clients: The integration of VMware into Broadcom's portfolio could involve significant costs, some of which might be passed on to existing clients.

- Strategic pricing adjustments by Broadcom: Broadcom may have strategically adjusted pricing to maximize profitability, particularly after a significant acquisition cost.

Implications for Other VMware Customers

AT&T's experience is a stark warning for other VMware customers across various sectors. Companies relying heavily on VMware technologies for their core operations face a potential for similar price increases.

- Industries most affected: Telecommunications, finance, healthcare, and other industries with extensive IT infrastructure relying on VMware are particularly vulnerable.

- Potential for legal challenges and antitrust investigations: The magnitude of the price increase raises concerns about potential monopolistic practices, leading to potential legal challenges and antitrust investigations.

- Recommendations for companies negotiating VMware contracts: Businesses should proactively review their VMware contracts, understand all clauses, and prepare for potential renegotiations. Negotiating favorable terms, exploring alternative technologies, and diversifying vendors are crucial strategies.

Strategies for Mitigating Cost Increases After Mergers and Acquisitions

Proactive measures are essential to mitigate the risk of significant price increases following technology mergers and acquisitions:

- Importance of thorough contract analysis before signing: Careful scrutiny of contract terms and conditions, including pricing structures, renewal clauses, and exit strategies, is crucial.

- Strategies for negotiating favorable terms: Businesses should actively negotiate with vendors, exploring options like volume discounts, multi-year contracts with price guarantees, and clear escalation clauses.

- Exploring alternative technologies and vendors: Diversifying technology solutions and exploring alternative vendors provides crucial leverage and reduces reliance on a single provider.

Conclusion: Navigating the Post-Acquisition Landscape of Broadcom's VMware Deal

AT&T's dramatic cost increase following Broadcom's VMware acquisition underscores the significant risks associated with technology mergers and acquisitions. The potential for substantial price hikes, driven by reduced competition, licensing model changes, or strategic pricing adjustments, is a reality that businesses must acknowledge. The implications of Broadcom's impact on VMware pricing are far-reaching, affecting various sectors and requiring proactive strategies. To navigate this post-acquisition landscape effectively, carefully review your VMware contracts, explore alternative solutions like cloud migration or open-source alternatives, and prepare for potential price adjustments. Understanding the VMware cost implications and developing robust post-acquisition VMware pricing strategies is vital for safeguarding your business's financial stability.

Featured Posts

-

Nhl Referees The Rise Of The Apple Watch On Ice

May 15, 2025

Nhl Referees The Rise Of The Apple Watch On Ice

May 15, 2025 -

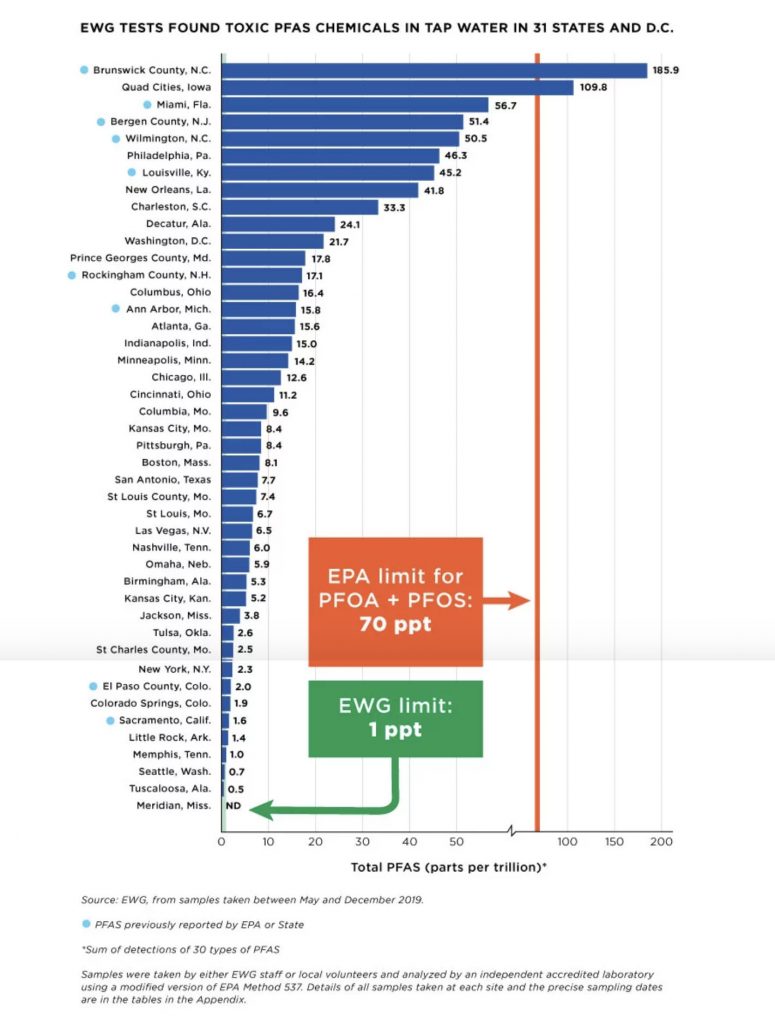

Millions Exposed New Report Details Widespread Drinking Water Contamination In America

May 15, 2025

Millions Exposed New Report Details Widespread Drinking Water Contamination In America

May 15, 2025 -

Kid Cudi Memorabilia Fetches Record Prices At Auction

May 15, 2025

Kid Cudi Memorabilia Fetches Record Prices At Auction

May 15, 2025 -

Le Metier De Gardien Salaires Perspectives Et Formations

May 15, 2025

Le Metier De Gardien Salaires Perspectives Et Formations

May 15, 2025 -

Stefanos Stefanu Ve Kibris Sorunu Coezuem Icin Yeni Bir Yaklasim

May 15, 2025

Stefanos Stefanu Ve Kibris Sorunu Coezuem Icin Yeni Bir Yaklasim

May 15, 2025