Broadcom's VMware Acquisition: AT&T Highlights Extreme Cost Increase

Table of Contents

AT&T's Public Statement and the Scale of the Increase

AT&T, a major telecommunications player, has publicly acknowledged a significant increase in costs following Broadcom's acquisition of VMware. While exact figures remain undisclosed due to confidential agreements, AT&T's statements suggest a substantial percentage increase in their VMware licensing and support fees. The scale of this increase is worrying, prompting concerns about the financial implications for the company and the broader telecommunications sector.

- Affected AT&T Services: The cost increases likely affect various AT&T services and departments relying on VMware's virtualization and cloud technologies, impacting network operations, data centers, and customer support infrastructure.

- Long-Term Financial Implications: The potential long-term financial burden on AT&T is significant. Sustained higher costs could affect profitability, investment strategies, and the company's ability to compete effectively.

- Comparison with Other Telecom Giants: While precise figures from other telecom giants are unavailable, industry analysts suggest that similar cost pressures are being felt across the board, indicating a widespread impact of the Broadcom VMware acquisition cost increase. This suggests a broader industry challenge rather than a problem isolated to AT&T.

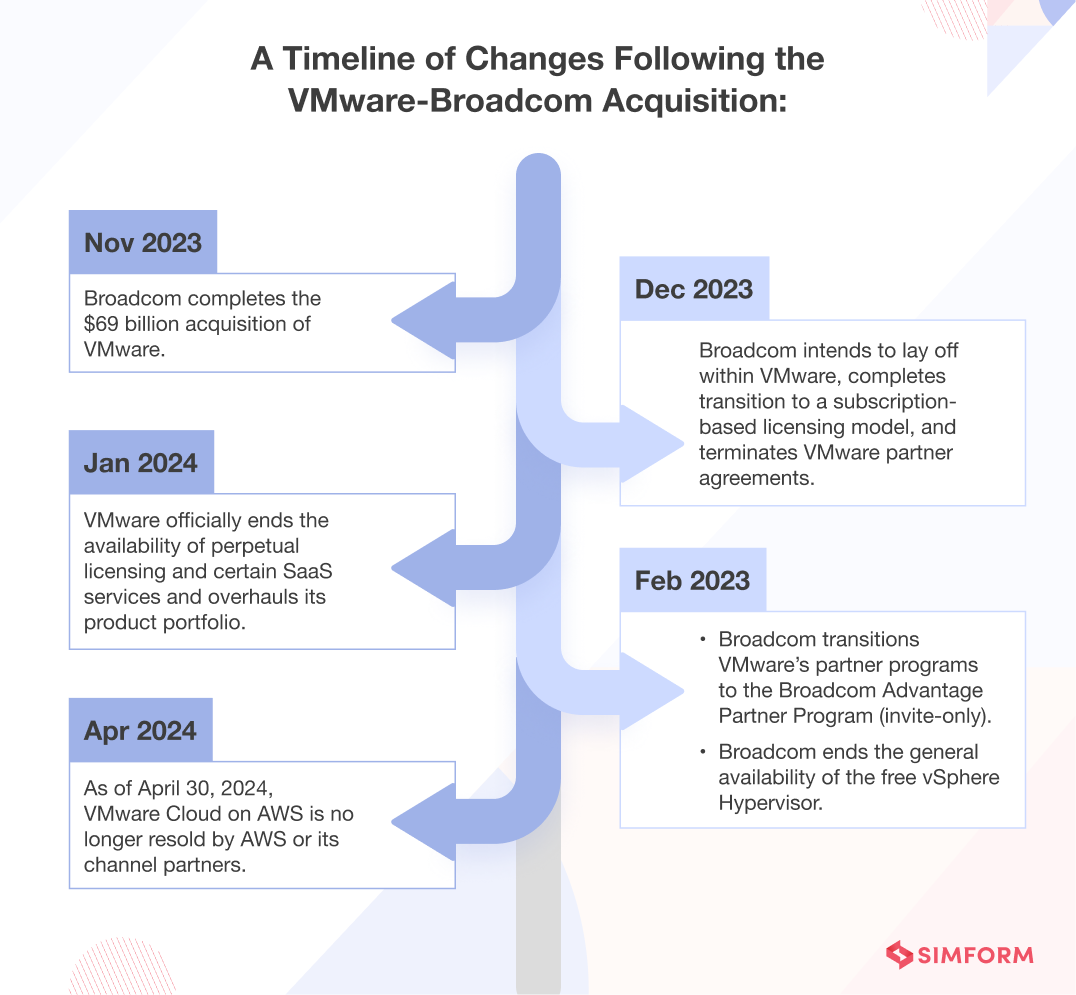

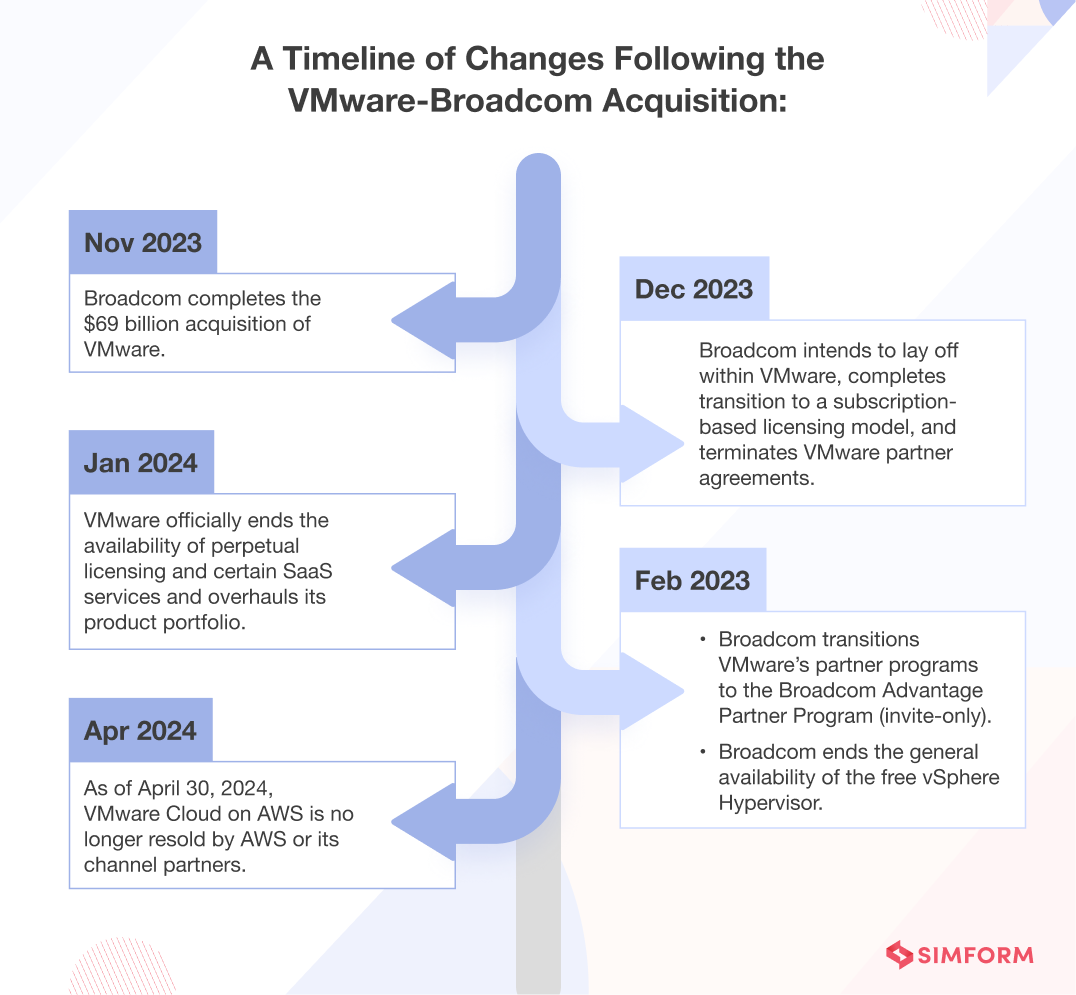

The Underlying Reasons for Increased Costs

The surge in costs for companies like AT&T stems from several factors directly related to Broadcom's acquisition of VMware.

-

Increased Licensing Fees: Post-acquisition, Broadcom has implemented increased licensing fees for VMware products, reflecting a revised pricing strategy geared towards maximizing profitability.

-

Changes in Contract Terms: Existing contracts with VMware are likely being renegotiated under Broadcom’s terms, potentially leading to less favorable conditions for large clients. This includes changes to support agreements and service level agreements (SLAs).

-

Reduced Competition: Broadcom's acquisition has reduced competition in the virtualization market, lessening the negotiating power of large clients like AT&T who previously had more vendor options.

-

Broadcom's Pricing Strategies: Broadcom's strategy appears to be focused on consolidating market share and leveraging its newfound dominance to increase profitability through higher prices. This is a significant concern for businesses dependent on VMware's technology.

-

Market Dominance and Future Price Increases: Broadcom’s now dominant market position raises concerns about the potential for further price increases in the future. The lack of strong competition may incentivize continued price hikes, squeezing margins for businesses.

Broadcom's Strategy and Market Consolidation

Broadcom's acquisition of VMware is a key component of their larger strategy to consolidate market share in the enterprise software and networking sectors.

- Broadcom's Market Position: This acquisition significantly strengthens Broadcom's position as a major player in the industry, giving them control over a crucial segment of the enterprise software market.

- Antitrust Concerns: The acquisition has prompted antitrust scrutiny, with regulators examining the potential for reduced competition and anti-competitive practices.

- Long-Term Consequences for Innovation: Market consolidation can stifle innovation, as the lack of competition reduces the pressure to develop new and improved technologies.

Alternatives and Mitigation Strategies for Businesses

Businesses facing escalating costs due to the Broadcom VMware acquisition need to adopt proactive mitigation strategies.

- Negotiating with Broadcom: Businesses should carefully negotiate contract terms with Broadcom, aiming to secure more favorable pricing and support agreements. Consolidating purchasing power through industry alliances could prove beneficial.

- Exploring Open-Source Alternatives: Consider migrating to open-source virtualization platforms as a potential cost-effective alternative to VMware products. This requires careful planning and assessment of compatibility and functionality.

- Optimizing VMware Deployments: Examine existing VMware deployments to identify areas for optimization, potentially reducing the number of licenses needed or improving resource utilization. This can involve infrastructure consolidation and efficient resource allocation.

Conclusion

The Broadcom VMware acquisition represents a significant shift in the enterprise software landscape, with AT&T's experience serving as a stark example of the potential for substantial Broadcom VMware acquisition cost increase. This merger raises concerns about market consolidation, pricing strategies, and the future availability of competitive solutions. Understanding the implications of the Broadcom VMware acquisition cost increase is crucial for businesses relying on VMware technologies. Proactive planning and exploration of alternative strategies, including robust negotiation, open-source alternatives, and deployment optimization, are essential to mitigate potential financial burdens and maintain operational efficiency. Stay informed about developments in this evolving market to safeguard your organization's budget and operational efficiency.

Featured Posts

-

Binnenhof Renovations Reveal 13th Century Remains

May 28, 2025

Binnenhof Renovations Reveal 13th Century Remains

May 28, 2025 -

Fenerbahce Yi Heyecanlandiran Ronaldo Goeruentueleri Portekiz Kampi Suerprizi

May 28, 2025

Fenerbahce Yi Heyecanlandiran Ronaldo Goeruentueleri Portekiz Kampi Suerprizi

May 28, 2025 -

Tyrese Haliburtons Pacers Knicks Game A Look At The Nbas Reaction

May 28, 2025

Tyrese Haliburtons Pacers Knicks Game A Look At The Nbas Reaction

May 28, 2025 -

50m Man Utd Player Exit Imminent House Sale Fuels Transfer Speculation

May 28, 2025

50m Man Utd Player Exit Imminent House Sale Fuels Transfer Speculation

May 28, 2025 -

Bianca Censoris Bold Fashion Choices Minimalist Style

May 28, 2025

Bianca Censoris Bold Fashion Choices Minimalist Style

May 28, 2025