Broadcom's VMware Acquisition: AT&T Reports A Potential 1,050% Cost Increase

Table of Contents

AT&T's 1,050% Cost Increase: A Case Study

The reported 1,050% price jump by AT&T serves as a stark warning to other companies relying heavily on VMware's infrastructure. This dramatic increase underscores the potential financial ramifications of Broadcom's takeover.

The Specific VMware Products Affected

While the exact details of AT&T's contracts remain confidential, reports suggest that the substantial price increase affects several key VMware products. Precise product names haven't been publicly disclosed by AT&T, but it's likely that enterprise-level solutions like vSphere, vSAN, and NSX are involved. These products are critical components of many large-scale data centers.

- Previous Pricing (Hypothetical): Let's assume, for illustrative purposes, a hypothetical annual licensing cost of $100,000 for a specific combination of VMware products.

- New Pricing (Hypothetical): Based on the reported 1050% increase, the annual cost could potentially reach $1,150,000.

| Product Category | Hypothetical Previous Annual Cost | Hypothetical New Annual Cost | Percentage Increase |

|---|---|---|---|

| VMware vSphere | $50,000 | $525,000 | 1050% |

| VMware vSAN | $30,000 | $315,000 | 1050% |

| VMware NSX | $20,000 | $210,000 | 1050% |

| Total Hypothetical Cost | $100,000 | $1,050,000 | 1050% |

This hypothetical example highlights the massive potential cost burden on businesses. The specifics of AT&T's contracts, including licensing agreements and volume discounts, will determine the exact figures.

AT&T's Response and Potential Alternatives

AT&T's official response to this significant price increase has not been publicly detailed. However, given the scale of the potential cost increase, they are likely exploring several options:

- Renegotiating Contracts: AT&T will likely attempt to renegotiate its contracts with VMware, leveraging its significant purchasing power.

- Exploring Alternative Solutions: The company may consider migrating some or all of its workloads to alternative virtualization platforms.

- Internal Cost Optimization: They might also explore ways to optimize their VMware usage and reduce their reliance on certain products.

Potential alternatives AT&T could consider include:

- Open-source solutions: Such as Proxmox VE or oVirt.

- Competitor products: Like Citrix XenServer or Microsoft Hyper-V.

The impact on AT&T's services and infrastructure will depend on the extent of the migration to alternative solutions, the time required for the transition, and potential disruptions during the process.

The Broader Implications of the Broadcom VMware Acquisition

The AT&T situation is not an isolated incident. The Broadcom VMware acquisition has raised serious concerns across the industry about potential price increases and reduced competition.

Concerns Regarding Increased VMware Pricing

Many businesses fear that the Broadcom acquisition will lead to higher prices for VMware products and reduced innovation. This is particularly concerning for:

- Smaller Businesses and Startups: These companies may lack the resources to absorb significant price increases, potentially forcing them to switch to less-suitable alternatives or face financial hardship.

- Competition: The reduced competition in the virtualization market could stifle innovation and limit customer choice.

Antitrust Concerns and Regulatory Scrutiny

The acquisition has faced significant antitrust scrutiny from various regulatory bodies worldwide, including the FTC in the US and the EU Commission. Concerns focus on:

- Reduced Competition: Broadcom's dominance in the networking market, combined with VMware's leading position in virtualization, raises concerns about reduced competition and potential monopolistic practices.

- Increased Prices: The potential for significantly higher prices for VMware products following the acquisition is a major antitrust concern.

The ongoing investigations could lead to several outcomes, including:

- Approval with Conditions: The acquisition might be approved, but with conditions aimed at protecting competition, such as divestments of certain assets.

- Rejection: The acquisition could be blocked entirely by regulatory authorities.

Strategies for Businesses Facing VMware Price Increases

Businesses facing unexpected VMware price increases need a proactive approach:

Negotiating with VMware

Businesses should actively negotiate with VMware to secure better pricing. This includes:

- Leveraging Purchasing Power: Companies with large deployments should leverage their scale to negotiate favorable contracts.

- Exploring Alternative Licensing Models: Investigate different licensing options, such as subscription-based models or enterprise agreements.

- Strong Contract Language: Ensure contracts clearly define pricing, terms, and conditions to protect against future price hikes.

Exploring VMware Alternatives

If negotiation fails, exploring alternatives is crucial:

- Open-source solutions: Proxmox VE, oVirt, and others offer compelling alternatives with lower costs and increased flexibility.

- Competitor products: Citrix XenServer, Microsoft Hyper-V, and others provide comparable functionality, although migration can be complex.

Migrating from VMware can be time-consuming and challenging, requiring careful planning and execution. However, it might be a necessary strategy to mitigate the financial impact of significant price increases.

Conclusion

The Broadcom VMware acquisition, as exemplified by AT&T's reported 1,050% cost increase, highlights significant potential challenges for businesses reliant on VMware technology. Understanding the implications of this merger, exploring alternative solutions, and employing effective negotiation strategies are crucial for navigating this evolving landscape. Staying informed about the ongoing regulatory scrutiny and potential price increases is essential for proactive planning. To stay updated on the latest developments regarding the Broadcom VMware acquisition and its impact on your business, continue to monitor industry news and expert analysis. Don't be caught unaware; proactively address the potential consequences of this monumental merger.

Featured Posts

-

Google Faces Doj Scrutiny Potential Negative Effects On User Confidence

May 08, 2025

Google Faces Doj Scrutiny Potential Negative Effects On User Confidence

May 08, 2025 -

Mike Trout Out With Knee Soreness Angels Drop Fifth Consecutive Game

May 08, 2025

Mike Trout Out With Knee Soreness Angels Drop Fifth Consecutive Game

May 08, 2025 -

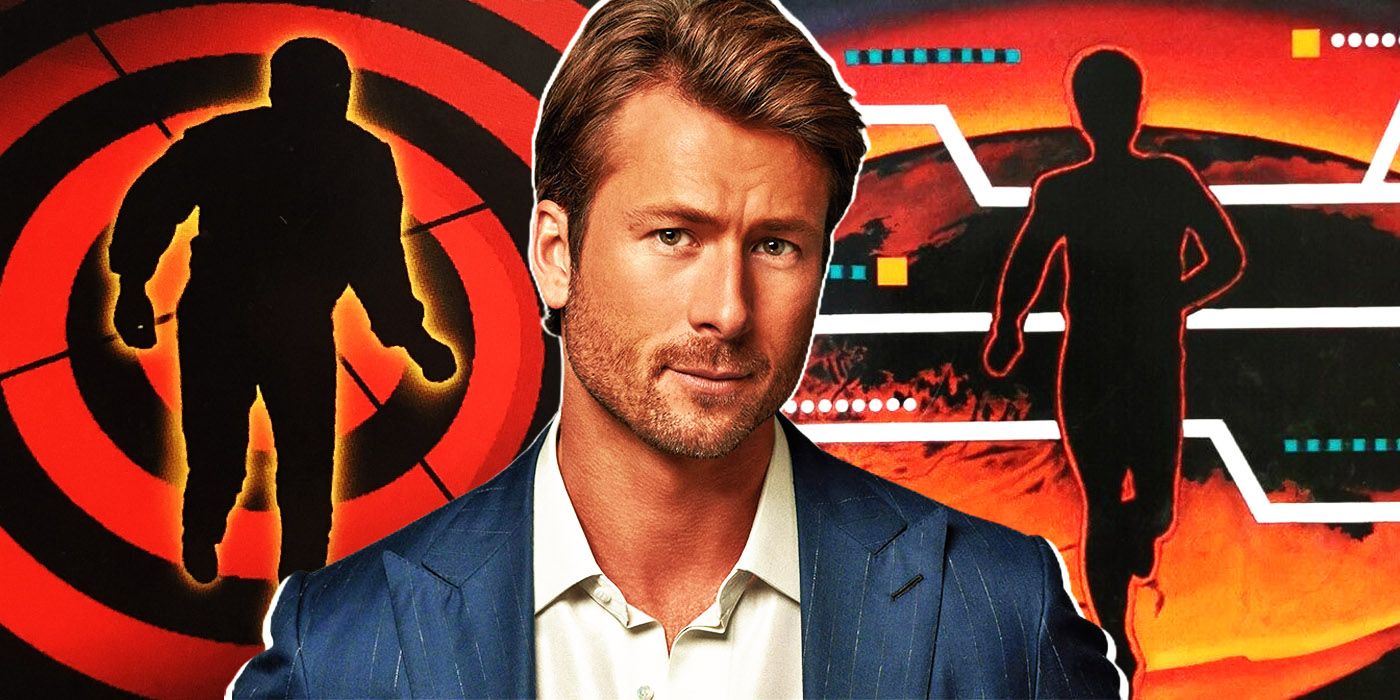

Glen Powells Fitness Regime And Character Development In The Running Man

May 08, 2025

Glen Powells Fitness Regime And Character Development In The Running Man

May 08, 2025 -

Thunder Grizzlies Showdown Previewing A Key Western Conference Battle

May 08, 2025

Thunder Grizzlies Showdown Previewing A Key Western Conference Battle

May 08, 2025 -

A Rogue One Stars Unfiltered Thoughts On A Fan Favorite

May 08, 2025

A Rogue One Stars Unfiltered Thoughts On A Fan Favorite

May 08, 2025

Latest Posts

-

Cleveland Browns Land De Andre Carter To Enhance Wide Receiver Depth

May 08, 2025

Cleveland Browns Land De Andre Carter To Enhance Wide Receiver Depth

May 08, 2025 -

Cyndi Lauper And Counting Crows Jones Beach Concert Dates Announced

May 08, 2025

Cyndi Lauper And Counting Crows Jones Beach Concert Dates Announced

May 08, 2025 -

De Andre Carter Chicago Bears Free Agent Joins Cleveland Browns

May 08, 2025

De Andre Carter Chicago Bears Free Agent Joins Cleveland Browns

May 08, 2025 -

See Counting Crows Live This Summer Indianapolis Concert Details

May 08, 2025

See Counting Crows Live This Summer Indianapolis Concert Details

May 08, 2025 -

Charlotte Hornets Veteran Options To Fill Gibsons Role

May 08, 2025

Charlotte Hornets Veteran Options To Fill Gibsons Role

May 08, 2025