Brookfield Capitalizes On Market Dislocation With Opportunistic Investments

Table of Contents

Identifying and Exploiting Market Dislocations

Brookfield's success in opportunistic investing stems from its ability to identify undervalued assets during periods of market turmoil. This requires a sophisticated approach to market analysis and a robust due diligence process. Their team meticulously analyzes market trends, scrutinizing economic indicators, geopolitical events, and sector-specific dynamics to pinpoint distressed assets with significant upside potential.

This process involves:

- Analyzing market trends and identifying distressed assets: Brookfield's analysts constantly monitor global markets, identifying sectors and specific assets experiencing temporary distress due to market-wide events or company-specific issues.

- Utilizing proprietary data and analytics: They leverage advanced data analytics and proprietary models to assess the intrinsic value of assets, going beyond publicly available information to uncover hidden opportunities.

- Employing a team of specialized experts across various sectors: Brookfield boasts a global network of experts with deep sector knowledge in real estate, infrastructure, renewable power, and private equity, allowing for thorough due diligence and informed decision-making.

- Focusing on long-term value creation, rather than short-term gains: Brookfield adopts a long-term investment horizon, focusing on improving the underlying assets and maximizing their value over time, rather than pursuing quick profits. This patient approach allows them to weather short-term market fluctuations.

Keywords: Market analysis, due diligence, risk management, distressed assets, long-term investment

Brookfield's Portfolio of Opportunistic Investments

Brookfield's portfolio showcases its successful track record of opportunistic investments across diverse asset classes. Their strategy involves acquiring assets at discounted prices during market downturns and then actively managing them to enhance their value.

Here are some examples:

- Real estate acquisitions in specific markets experiencing downturns: Brookfield has capitalized on downturns in specific real estate markets by acquiring properties at significantly reduced prices, subsequently renovating and repositioning them to generate strong returns.

- Infrastructure projects benefiting from government stimulus packages: They have strategically invested in infrastructure projects, leveraging government stimulus initiatives to secure favorable terms and participate in large-scale developments.

- Renewable energy investments driven by the global shift towards sustainable energy: Brookfield has recognized the long-term growth potential of renewable energy and has made significant investments in wind, solar, and hydro projects, benefitting from the global transition to cleaner energy sources.

- Private equity investments in undervalued companies: Brookfield’s private equity arm actively seeks out undervalued companies with strong underlying fundamentals, providing capital and operational expertise to drive growth and profitability.

Keywords: Real estate portfolio, infrastructure projects, renewable energy portfolio, private equity investments, successful investments

The Advantages of Brookfield's Approach

Brookfield's long-term investment horizon and value-add strategies provide several key advantages:

- Superior risk-adjusted returns compared to traditional investments: Their focus on long-term value creation and disciplined risk management enables them to achieve superior risk-adjusted returns compared to traditional investment strategies.

- Ability to secure assets at discounted prices during market downturns: Their opportunistic approach allows them to acquire high-quality assets at significantly discounted prices during periods of market stress.

- Expertise in asset management and operational improvements: Brookfield possesses extensive expertise in asset management and operational improvements, allowing them to enhance the performance of their acquired assets.

- Strong financial position and access to diverse funding sources: Their strong financial position and access to a diverse range of funding sources provide them with the flexibility and resources to capitalize on emerging investment opportunities.

Keywords: Risk-adjusted returns, discounted assets, asset management expertise, financial strength, capital markets access

Future Outlook and Investment Strategy

Brookfield remains optimistic about the long-term prospects for opportunistic investments. They anticipate continued market volatility, creating further opportunities to acquire undervalued assets. Their future investment strategy will focus on:

- Continued focus on opportunistic investments in undervalued assets: Brookfield will remain actively engaged in identifying and acquiring undervalued assets across various sectors.

- Expansion into new sectors and geographies: They plan to expand their investment activities into new sectors and geographies, seeking out promising investment opportunities.

- Leveraging technology and data analytics for enhanced investment decision-making: Brookfield will continue to leverage advanced technology and data analytics to improve their investment decision-making process.

- Commitment to sustainable and responsible investing: They are committed to incorporating Environmental, Social, and Governance (ESG) factors into their investment decisions, aligning their portfolio with long-term sustainability goals.

Keywords: Future investment trends, market outlook, sustainable investing, responsible investing, technology investments

Conclusion: Brookfield's Success with Opportunistic Investments

Brookfield's success in capitalizing on market dislocations highlights the power of a long-term, value-oriented investment strategy. By combining deep market expertise, rigorous due diligence, and a strong financial foundation, they consistently identify and acquire undervalued assets, generating superior risk-adjusted returns for their investors. Their commitment to sustainable and responsible investing further strengthens their approach. Learn more about how Brookfield capitalizes on market dislocations for opportunistic investment opportunities by visiting [Insert Link Here].

Featured Posts

-

2 1

May 08, 2025

2 1

May 08, 2025 -

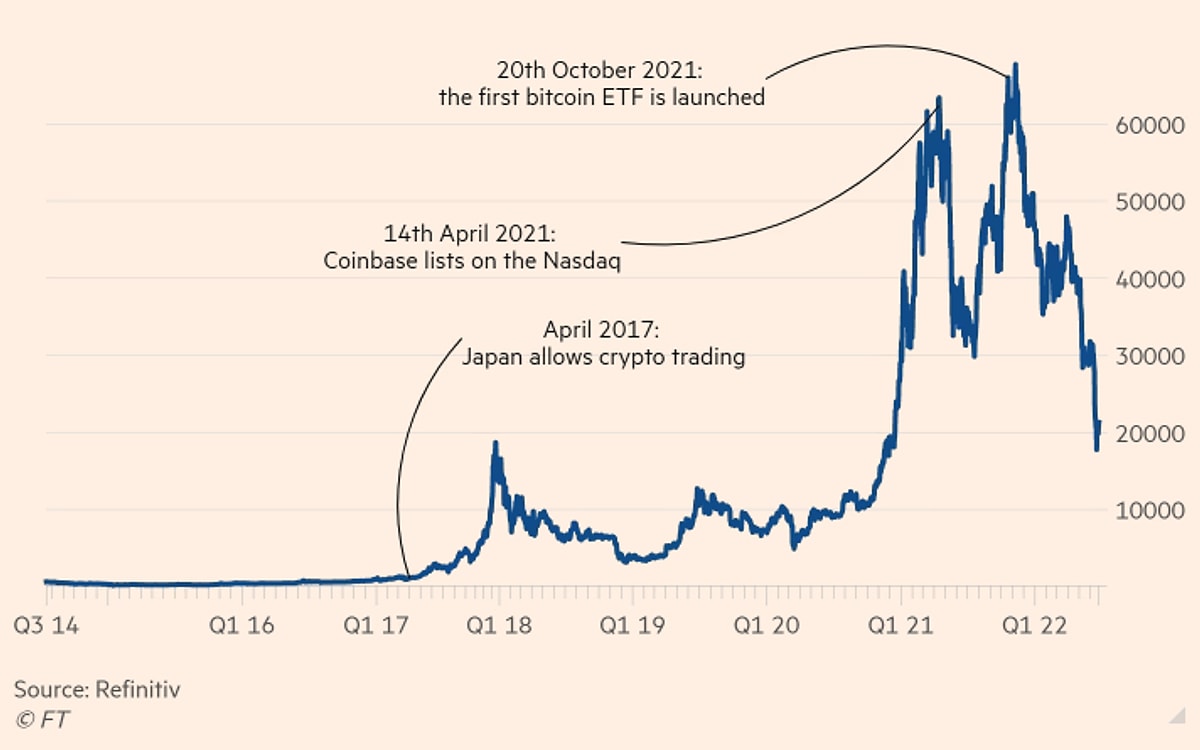

Bitcoin Price Golden Cross What It Means For Investors

May 08, 2025

Bitcoin Price Golden Cross What It Means For Investors

May 08, 2025 -

Is A Half Point Interest Rate Cut The Right Move For The Bank Of England

May 08, 2025

Is A Half Point Interest Rate Cut The Right Move For The Bank Of England

May 08, 2025 -

Hot Toys Japan Exclusive 1 6 Scale Rogue One Galen Erso Figure Unveiled

May 08, 2025

Hot Toys Japan Exclusive 1 6 Scale Rogue One Galen Erso Figure Unveiled

May 08, 2025 -

Thunder Game 1 Alex Caruso Enters Nba Playoff History Books

May 08, 2025

Thunder Game 1 Alex Caruso Enters Nba Playoff History Books

May 08, 2025

Latest Posts

-

Bitcoin Fiyati Son Dakika Guencellemeleri Ve Analizler

May 08, 2025

Bitcoin Fiyati Son Dakika Guencellemeleri Ve Analizler

May 08, 2025 -

Understanding The Dogecoin Shiba Inu And Sui Price Increase

May 08, 2025

Understanding The Dogecoin Shiba Inu And Sui Price Increase

May 08, 2025 -

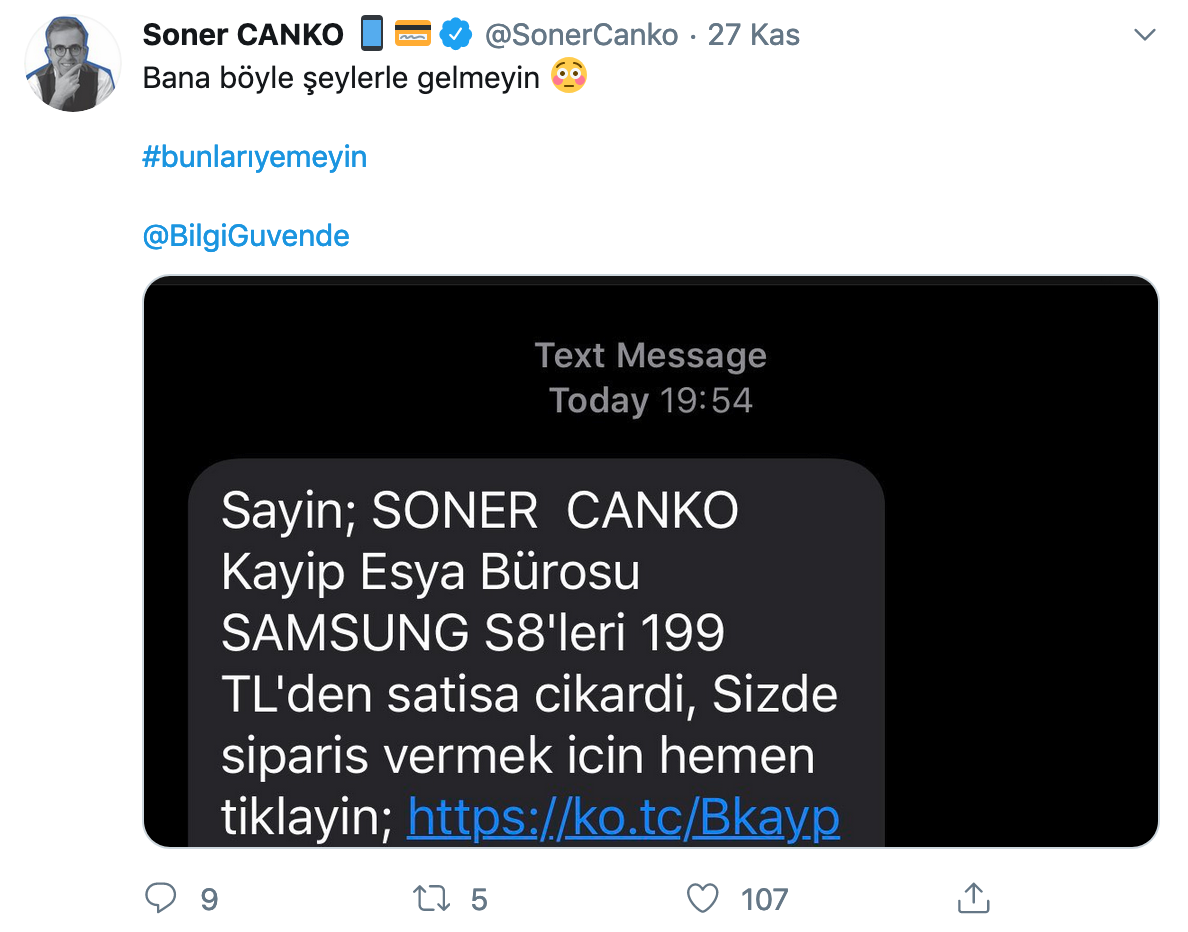

Sms Dolandiriciligi Kurbani Oldunuz Mu Sikayetinizi Nasil Bildirebilirsiniz

May 08, 2025

Sms Dolandiriciligi Kurbani Oldunuz Mu Sikayetinizi Nasil Bildirebilirsiniz

May 08, 2025 -

Bitcoin In Buguenkue Durumu Fiyat Hareketleri Ve Gelecek Tahminleri

May 08, 2025

Bitcoin In Buguenkue Durumu Fiyat Hareketleri Ve Gelecek Tahminleri

May 08, 2025 -

Recent Gains In Dogecoin Shiba Inu And Sui Causes And Potential Impacts

May 08, 2025

Recent Gains In Dogecoin Shiba Inu And Sui Causes And Potential Impacts

May 08, 2025