Brookfield Targets Distressed Assets Amidst Market Uncertainty: An Opportunistic Approach

Table of Contents

Brookfield's Expertise in Distressed Asset Acquisition

Brookfield's success in navigating challenging markets stems from its deep understanding of distressed asset acquisition and management. Their expertise lies not only in identifying undervalued opportunities but also in effectively managing the inherent risks associated with these investments.

Identifying and Evaluating Distressed Assets

Brookfield employs a rigorous due diligence process to identify promising distressed assets. This involves meticulous market research, analysis of underlying fundamentals, and detailed financial modeling. They leverage specialized teams with deep expertise in various asset classes, including real estate, infrastructure, and private equity. This allows them to assess opportunities across a diverse range of sectors.

- Detailed market research and analysis: Brookfield's analysts meticulously study market trends, economic forecasts, and industry-specific data to identify potential areas of distress.

- Experienced teams specializing in various asset classes: Dedicated teams possess in-depth knowledge of specific asset classes, enabling efficient due diligence and informed investment decisions.

- Advanced valuation techniques to identify undervalued opportunities: Brookfield utilizes sophisticated valuation models to identify assets trading below their intrinsic value, ensuring attractive entry points.

Strategic Advantages in a Volatile Market

Brookfield's financial strength and long-term investment horizon provide a significant competitive advantage in the distressed asset market. Unlike short-term investors, they can weather market downturns and patiently wait for asset values to recover. This patient capital approach is crucial in maximizing returns from distressed assets.

- Access to significant capital for acquisitions: Brookfield possesses substantial financial resources to acquire large portfolios of distressed assets and capitalize on opportune moments.

- Patient capital approach allowing for long-term value creation: Their long-term perspective enables them to hold assets through market cycles, maximizing value creation through operational improvements and market recovery.

- Proven track record of successful distressed asset investments: Brookfield's history demonstrates a consistent ability to identify and acquire undervalued assets, generating substantial returns for investors.

Risk Mitigation Strategies in Distressed Asset Investing

Investing in distressed assets inherently involves risk. However, Brookfield mitigates these risks through a comprehensive approach that includes thorough due diligence, experienced management, and portfolio diversification.

- Thorough risk assessment and due diligence: A rigorous process identifies and quantifies potential risks associated with each asset, allowing for informed decision-making.

- Experienced management teams to oversee troubled assets: Brookfield deploys expert management teams to implement turnaround strategies, improving operations and enhancing asset value.

- Diversified portfolio to mitigate overall risk: Investing across various asset classes and geographic locations reduces the impact of any single investment's underperformance.

Potential Returns and Future Outlook for Brookfield's Distressed Asset Strategy

Brookfield's distressed asset strategy offers the potential for substantial returns, particularly in a recovering market. The inherent discounts at which these assets are acquired create an attractive entry point for long-term value creation.

Expected Returns and Investment Potential

Investing in distressed assets can lead to significant capital appreciation as market conditions improve and asset values recover. Additionally, there's potential for income generation through rents or yields from operational improvements.

- Potential for significant capital appreciation: As markets recover, the value of distressed assets typically increases, leading to substantial returns for investors.

- Opportunities for income generation through yield and rent: Many distressed assets, such as real estate, generate income streams that can contribute to overall returns.

- Long-term value creation through asset improvements and repositioning: Brookfield actively manages its assets, implementing improvements to enhance value and create superior returns.

Market Trends and Future Opportunities

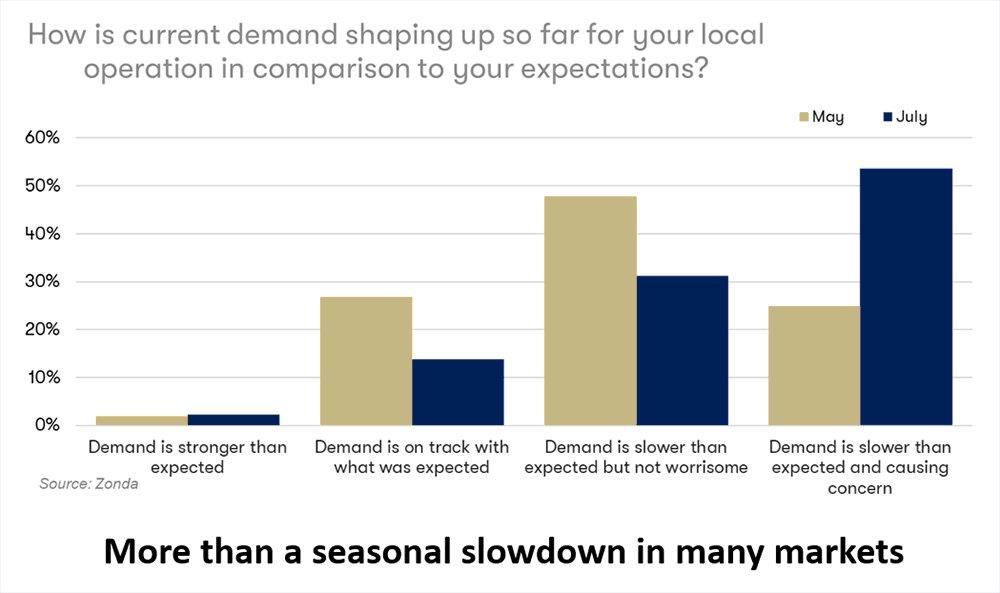

The current macroeconomic environment suggests a continued increase in distressed asset opportunities. Economic uncertainty and potential further market corrections could lead to more assets becoming available at attractive valuations.

- Increased economic uncertainty leading to more distressed assets: Global economic headwinds are likely to create further opportunities for Brookfield to acquire undervalued assets.

- Potential for government intervention influencing distressed markets: Government policies could influence the availability and pricing of distressed assets, creating both challenges and opportunities.

- Brookfield’s ability to adapt to changing market conditions: Brookfield's long history and flexible approach allow them to navigate evolving market dynamics and adapt their strategy as needed.

Conclusion: Brookfield's Distressed Asset Strategy: A Long-Term Perspective

Brookfield's approach to distressed assets is characterized by its expertise in identification, rigorous risk management, and a long-term investment horizon. Their opportunistic strategy is particularly well-suited to the current market climate, offering significant potential for high returns. By leveraging their financial strength and operational expertise, Brookfield is well-positioned to capitalize on distressed asset opportunities and deliver superior returns for investors. To learn more about Brookfield's investment strategy and the potential benefits of investing in distressed assets, further research into their investment portfolio and public statements is encouraged. Understanding Brookfield's distressed asset portfolio can provide valuable insights into this exciting area of investment.

Featured Posts

-

Toronto Housing Market Slowdown Sales Fall 23 Average Prices Down 4

May 08, 2025

Toronto Housing Market Slowdown Sales Fall 23 Average Prices Down 4

May 08, 2025 -

Lyon Psg Victoria Parisina En El Estadio De Lyon

May 08, 2025

Lyon Psg Victoria Parisina En El Estadio De Lyon

May 08, 2025 -

Barcelona Inter Milan Champions League Semi Final A High Scoring Draw

May 08, 2025

Barcelona Inter Milan Champions League Semi Final A High Scoring Draw

May 08, 2025 -

Ps Zh Proti Aston Villi Povniy Oglyad Yevrokubkovikh Zustrichey

May 08, 2025

Ps Zh Proti Aston Villi Povniy Oglyad Yevrokubkovikh Zustrichey

May 08, 2025 -

Psg Opens Doha Labs A Global Innovation Expansion Begins

May 08, 2025

Psg Opens Doha Labs A Global Innovation Expansion Begins

May 08, 2025

Latest Posts

-

Kripto Para Platformlari Icin Yeni Kurallar Sermaye Ve Guevenlik Odakli Duezenleme

May 08, 2025

Kripto Para Platformlari Icin Yeni Kurallar Sermaye Ve Guevenlik Odakli Duezenleme

May 08, 2025 -

Kripto Para Piyasasindaki Duesues Yatirimci Satislari Ve Nedenleri

May 08, 2025

Kripto Para Piyasasindaki Duesues Yatirimci Satislari Ve Nedenleri

May 08, 2025 -

Kripto Varlik Piyasasinda Yeni Bir Doenem Spk Nin Getirdigi Duezenlemeler

May 08, 2025

Kripto Varlik Piyasasinda Yeni Bir Doenem Spk Nin Getirdigi Duezenlemeler

May 08, 2025 -

Spk Dan Kripto Platformlarina Yeni Duezenleme Sermaye Ve Guevenlik Sartlari

May 08, 2025

Spk Dan Kripto Platformlarina Yeni Duezenleme Sermaye Ve Guevenlik Sartlari

May 08, 2025 -

Saturday Night Live And Counting Crows A Career Defining Moment

May 08, 2025

Saturday Night Live And Counting Crows A Career Defining Moment

May 08, 2025