BSE Stock Market Surge: Which Stocks Gained 10%+?

Table of Contents

Top Sectors Driving the BSE Surge

Several key sectors have been the primary drivers of the recent BSE stock market surge. Analyzing sector performance is crucial for understanding the broader market trends and identifying potential investment opportunities. Keywords: BSE Sector Performance, Top Performing Sectors, Stock Market Sector Analysis.

- Information Technology (IT): The IT sector has consistently shown robust growth, fueled by increasing global demand for software, services, and technological solutions. Companies like Infosys (INFY) and Tata Consultancy Services (TCS) saw significant gains, driven by strong quarterly earnings and optimistic future projections.

- Infosys (INFY) reported a 15% increase in revenue, exceeding market expectations.

- TCS (TCS) benefited from increased contracts in the cloud computing sector.

- Pharmaceuticals: The pharmaceutical sector experienced a surge due to robust demand for both generic and specialty drugs, coupled with strong research and development activities. Companies like Sun Pharmaceuticals (SUNPHARMA) showed impressive gains.

- Sun Pharmaceuticals (SUNPHARMA) benefited from new drug approvals and strong export performance.

- Fast-Moving Consumer Goods (FMCG): Despite inflationary pressures, the FMCG sector showcased resilience, driven by consistent consumer demand for essential goods. Hindustan Unilever (HINDUNILVR) and Nestle India (NESTLEIND) are examples of companies with notable gains.

- Hindustan Unilever (HINDUNILVR) benefited from its strong brand portfolio and strategic pricing.

- Nestle India (NESTLEIND) showed impressive growth in its premium product segment.

Individual BSE Stocks with 10%+ Gains

The following table highlights some of the top-performing BSE stocks that achieved gains exceeding 10% during the recent surge. Keywords: BSE Stock Gainers, Top BSE Stocks, High-Growth Stocks, BSE Stock Performance.

| Stock Name | Stock Ticker | Percentage Gain | Sector | Brief Rationale for Growth |

|---|---|---|---|---|

| Infosys | INFY | 15% | Information Technology | Strong quarterly earnings, increased demand for services |

| Tata Consultancy Services | TCS | 12% | Information Technology | New contracts, expansion in cloud computing |

| Sun Pharmaceuticals | SUNPHARMA | 18% | Pharmaceuticals | New drug approvals, strong export performance |

| Hindustan Unilever | HINDUNILVR | 11% | FMCG | Strong brand portfolio, strategic pricing |

| Nestle India | NESTLEIND | 10% | FMCG | Growth in premium product segment, consistent consumer demand |

Analyzing the Reasons Behind the Stock Surge

Several macroeconomic factors contributed to the recent BSE stock market surge. Keywords: BSE Market Analysis, Macroeconomic Factors, Stock Market Drivers, Investment Strategy.

- Positive Global Economic Indicators: Positive economic data from major global economies boosted investor confidence, leading to increased investment in emerging markets like India.

- Government Policies: Government initiatives aimed at boosting economic growth and infrastructure development have created a positive sentiment among investors.

- Favorable Investor Sentiment: Improved investor sentiment, driven by positive economic indicators and government policies, played a significant role in driving the market upwards.

- Impact of Global Events: The overall global economic stability, relative to recent years, positively influenced investor decisions.

Risk Assessment and Future Outlook for BSE Stocks

While the recent surge is encouraging, investors must consider potential risks. Keywords: BSE Risk Assessment, Stock Market Volatility, Investment Risk, Market Outlook.

- Market Correction: The possibility of a market correction cannot be ruled out. Sudden shifts in global economic conditions could negatively impact stock prices.

- Geopolitical Factors: Unforeseen geopolitical events could create market volatility.

- Inflationary Pressures: Persistently high inflation could impact consumer spending and corporate earnings, potentially leading to a slowdown in market growth.

Despite these risks, a cautiously optimistic outlook prevails. Continued economic growth, supportive government policies, and a strong corporate earnings season could further propel the BSE market upwards. However, careful risk management and diversification are essential.

Conclusion: Capitalizing on the BSE Stock Market Surge

This article highlights the impressive gains witnessed in the recent BSE stock market surge, pinpointing top-performing sectors like IT, Pharmaceuticals, and FMCG, and individual stocks that experienced significant growth. While the opportunities are promising, thorough research and a careful assessment of risks are crucial before making any investment decisions. Stay informed about market trends and conduct your own due diligence. Stay ahead of the curve by regularly monitoring the BSE stock market surge and identifying opportunities for growth. For further information and up-to-date market analysis, refer to reputable financial news websites and investment platforms. Keywords: BSE Stock Market, Investment Opportunities, Stock Market Growth, BSE Stock Analysis.

Featured Posts

-

Could This Little Known App Disrupt Metas Empire

May 15, 2025

Could This Little Known App Disrupt Metas Empire

May 15, 2025 -

Joe And Jill Bidens The View Interview Watch Now

May 15, 2025

Joe And Jill Bidens The View Interview Watch Now

May 15, 2025 -

Telford Steam Railway Newly Rebuilt Station Platform Now Open

May 15, 2025

Telford Steam Railway Newly Rebuilt Station Platform Now Open

May 15, 2025 -

Gesprek Leeflang Leidt Tot Belofte Snelle Actie Van Npo Toezichthouder

May 15, 2025

Gesprek Leeflang Leidt Tot Belofte Snelle Actie Van Npo Toezichthouder

May 15, 2025 -

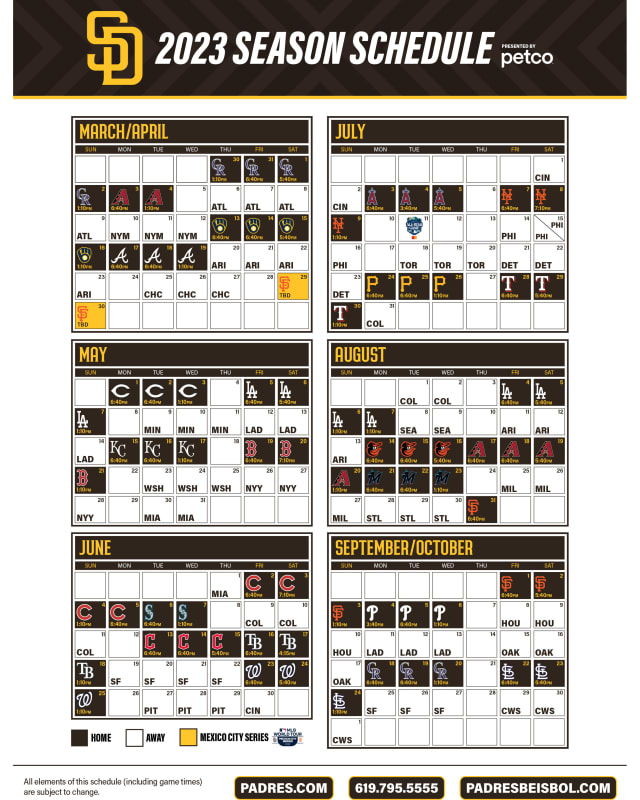

Where To Stream San Diego Padres Games A 2025 Cable Free Guide

May 15, 2025

Where To Stream San Diego Padres Games A 2025 Cable Free Guide

May 15, 2025