Buffett's Apple Investment: Impact Of Trump-Era Tariffs

Table of Contents

Warren Buffett's significant investment in Apple has been a phenomenal success story, cementing its place as one of the most lucrative bets in investment history. However, the economic landscape shifted dramatically during the Trump administration with the imposition of sweeping tariffs as part of its trade war. This article delves into the specific impact of these Trump-era tariffs on Buffett's Apple investment, analyzing the challenges and strategic responses employed during this period of heightened economic uncertainty.

The Tariff Landscape During the Trump Administration

The Trump administration's trade war significantly altered the global economic playing field. Its core strategy involved imposing tariffs, primarily on goods imported from China, aiming to protect American industries and renegotiate trade agreements. This directly impacted the technology sector, particularly electronics manufacturing, as many components for devices like iPhones are sourced from China.

- Key tariffs imposed: Significant tariffs were levied on a wide range of Chinese goods, including crucial components for iPhones such as processors, displays, and other integrated circuits. These tariffs increased the cost of manufacturing these products.

- Retaliatory tariffs: China responded with its own retaliatory tariffs on American goods, creating a tit-for-tat escalation that increased uncertainty and volatility in global markets. This added another layer of complexity for companies like Apple navigating international trade.

- Supply chain disruption: The imposition of tariffs created significant disruption and uncertainty within global supply chains. Companies had to reassess their sourcing strategies, leading to delays, increased costs, and complex logistical challenges.

- Impact on consumer prices: The increased costs associated with tariffs were eventually passed on to consumers, leading to higher prices for electronic goods, including iPhones. This impacted consumer demand and overall market dynamics.

Direct Impact on Apple's Supply Chain and Profitability

The Trump-era tariffs had a direct and tangible impact on Apple's supply chain and profitability. The company, heavily reliant on Chinese manufacturing, faced increased costs for many of its key components.

- Increased costs of components: Tariffs directly increased the cost of components sourced from China, squeezing Apple's profit margins. This required strategic adjustments to maintain competitiveness.

- Mitigation strategies: Apple responded by implementing several strategies to mitigate the impact of the tariffs. This included diversifying its supplier base, exploring alternative manufacturing locations, and, in some instances, absorbing some of the increased costs to maintain competitive pricing.

- Impact on profit margins: While Apple demonstrated resilience, its profit margins were undoubtedly affected by the increased costs associated with the tariffs. Financial reports from this period reflect the impact on overall profitability.

- Stock performance: Apple's stock performance during this period reflects the market's reaction to the trade war and the resulting uncertainty. Analyzing the stock price fluctuations in relation to tariff announcements provides insights into investor sentiment.

Buffett's Investment Strategy Amidst Tariff Uncertainty

Warren Buffett and Berkshire Hathaway's response to the tariff situation provides a fascinating case study in long-term investment strategies. Despite the challenges, Buffett maintained a long-term perspective on Apple's potential.

- Adjustments to Apple holdings: While precise details regarding adjustments to Apple holdings during this period may not be publicly available, it's crucial to remember Buffett's investment philosophy focuses on long-term value. Major shifts in holdings due solely to short-term tariff fluctuations were unlikely.

- Berkshire Hathaway's overall strategy: Berkshire Hathaway's overall investment strategy during the trade war emphasized diversification and a focus on fundamentally strong companies. This approach helped mitigate the risk associated with tariff uncertainty.

- Long-term view on Apple: Buffett's confidence in Apple's long-term prospects likely played a significant role in his continued investment despite the challenges posed by tariffs. He recognized Apple's brand strength and market dominance.

- Impact on Berkshire Hathaway's portfolio: While Apple’s exposure to tariffs did present challenges, its overall contribution to Berkshire Hathaway's portfolio performance likely remained positive due to Apple’s resilience and market share.

Long-Term Implications for Apple and Global Trade

The Trump-era tariffs had lasting implications for the technology industry and international trade, prompting significant shifts in global supply chains and manufacturing strategies.

- Restructuring of global supply chains: Companies like Apple accelerated efforts to diversify their supply chains, reducing reliance on single countries and regions. This trend continues to reshape global manufacturing.

- Changes in manufacturing locations: The tariffs incentivized some companies, including those within Apple's ecosystem, to shift manufacturing away from China and explore alternative locations.

- Long-term effects on consumer prices: The effects of tariffs on consumer prices were complex and varied, but the long-term impact remains a topic of ongoing discussion and economic analysis.

- Lessons learned: The trade war served as a crucial lesson for investors, emphasizing the importance of understanding and anticipating the impact of geopolitical factors and trade policies on investment decisions.

Conclusion

The Trump-era tariffs presented significant challenges to Apple's supply chain and profitability, impacting Buffett's substantial Apple investment. However, Apple's resilience, strategic adaptations, and Buffett's long-term investment approach allowed the company to navigate this turbulent period relatively well. Understanding the complexities of global trade and its influence on major investments like Buffett's Apple holdings is crucial for informed decision-making. To further your understanding of the intricate relationship between global economics and investment strategies, continue exploring the impact of trade policies on major corporations. Learn more about the effects of Trump-era tariffs on other investments and how investors navigate such economic uncertainties. Gaining a deeper understanding of the interplay between geopolitical events and investment strategies is key to navigating future market volatility and making sound investment choices in a globally interconnected world.

Featured Posts

-

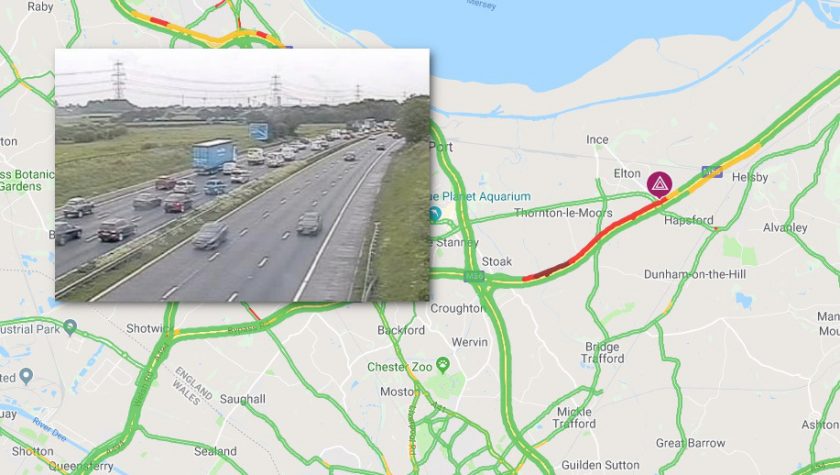

Cheshire Deeside M56 Delays Following Traffic Collision

May 24, 2025

Cheshire Deeside M56 Delays Following Traffic Collision

May 24, 2025 -

Al Roker Faces Backlash After Revealing Off The Record Conversation On Today Show

May 24, 2025

Al Roker Faces Backlash After Revealing Off The Record Conversation On Today Show

May 24, 2025 -

Jonathan Groff Discusses His Experiences With Asexuality

May 24, 2025

Jonathan Groff Discusses His Experiences With Asexuality

May 24, 2025 -

Joe Jonas The Unexpected Mediator In A Couples Argument

May 24, 2025

Joe Jonas The Unexpected Mediator In A Couples Argument

May 24, 2025 -

Paris Fashion Week Amira Al Zuhairs Zimmermann Debut

May 24, 2025

Paris Fashion Week Amira Al Zuhairs Zimmermann Debut

May 24, 2025