Bulldog Banker Takes On Canada's Resource Sector Challenges

Table of Contents

Navigating Volatile Commodity Prices

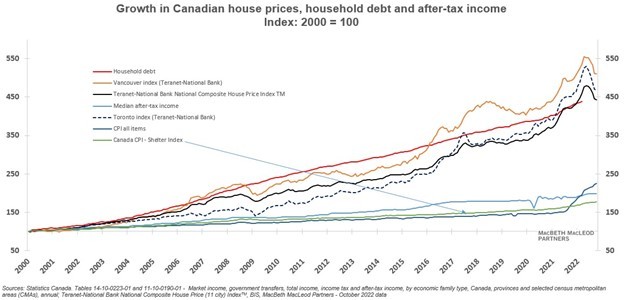

The inherent volatility of commodity prices—crucial to the Canadian economy, including oil, gas, and various minerals—creates significant financial risk for resource companies. This price instability directly impacts profitability, investment decisions, and the overall health of the sector.

Price Fluctuations and Risk Mitigation

The unpredictable nature of commodity markets necessitates proactive risk management strategies. Resource companies must employ sophisticated tools and techniques to mitigate the impact of price swings.

- Implementing hedging strategies: Hedging involves using financial instruments to offset potential losses from price fluctuations. This might involve using futures contracts or options to lock in prices for future sales.

- Diversifying investment portfolios: Spreading investments across various commodities and geographical locations helps reduce overall risk. If one commodity's price falls, others might be performing well, minimizing the overall impact.

- Utilizing financial instruments: Futures and options contracts, swaps, and other derivatives are powerful tools for managing price risk, but require specialized expertise.

- Detail: For example, Canadian oil and gas producers have successfully used hedging strategies to protect against sharp price drops, allowing them to maintain profitability during periods of market downturn. A well-structured hedging program considers both price volatility and potential production levels.

Impact on Investment and Project Financing

Price uncertainty significantly impacts the ability to secure project financing and attract investment. Investors are naturally hesitant to commit capital to projects with unpredictable returns.

- Robust financial modelling and forecasting: Accurate forecasting, considering various price scenarios, is crucial for securing financing. This demonstrates to investors a thorough understanding of the risks and potential returns.

- Securing long-term contracts: Negotiating long-term contracts with buyers provides price stability and reduces uncertainty, making projects more attractive to investors.

- Exploring alternative financing options: Private equity, infrastructure funds, and government incentives can provide alternative funding sources when traditional financing is challenging.

- Detail: Fluctuating nickel prices, for instance, can directly impact investment decisions in Canadian nickel mining projects. Companies must demonstrate a clear understanding of price volatility and present mitigation strategies to secure funding.

Environmental Regulations and Sustainability

Canada’s resource sector operates under increasingly stringent environmental regulations, designed to protect the environment and minimize the impact of resource extraction. Compliance represents a significant cost but is also increasingly essential for attracting investment.

Meeting Stringent Environmental Standards

Meeting these standards requires significant investment in technology and best practices. Failure to comply can result in hefty fines and reputational damage.

- Cost of compliance: Environmental regulations increase operational costs, requiring companies to invest in monitoring, remediation, and mitigation measures.

- Investing in environmentally friendly technologies: Adopting cleaner technologies and processes, such as carbon capture and storage, reduces environmental impact and enhances the company's sustainability profile.

- ESG (Environmental, Social, and Governance) investing: ESG investing is gaining momentum, with investors increasingly prioritizing companies with strong environmental and social performance.

- Detail: Companies like Teck Resources have invested heavily in reducing their carbon footprint and improving their environmental performance, attracting ESG-focused investors.

Securing Social Licenses to Operate

Public acceptance and support are crucial for the long-term success of resource projects. Negative public perception can lead to delays, protests, and ultimately, project cancellation.

- Engaging with local communities: Open and transparent communication with local communities is paramount. Addressing concerns and actively seeking input builds trust and support.

- Transparent communication strategies: Regular communication, including public forums and community consultations, fosters understanding and reduces misinformation.

- Implementing community benefit agreements: Agreements that provide direct benefits to local communities can mitigate concerns and garner support for projects.

- Detail: Successful projects often involve collaborative partnerships with First Nations communities, ensuring their involvement and benefit sharing throughout the project lifecycle.

Geopolitical Risks and Global Competition

The Canadian resource sector operates within a global context, facing competition from international players and navigating geopolitical uncertainties.

Global Market Dynamics and Competition

Canadian companies must adapt to changing global market conditions and compete effectively with international players.

- Analyzing global market trends: Understanding global demand, supply, and pricing trends allows companies to make informed strategic decisions.

- Developing competitive advantages: Investing in innovation, operational efficiency, and technological advancements helps maintain a competitive edge.

- Exploring new markets and trade opportunities: Diversifying export markets reduces dependence on any single market and minimizes risk.

- Detail: The impact of global trade agreements and tariffs on Canadian resource exports highlights the importance of adapting to changing geopolitical landscapes.

Navigating Political and Regulatory Uncertainty

Political instability and changes in government policies can significantly impact investment decisions and project viability.

- Risk assessment and mitigation strategies: Proactive risk assessment identifies potential political and regulatory risks, enabling the development of mitigation strategies.

- Building strong relationships: Strong relationships with government agencies and regulatory bodies help ensure smooth project approvals and efficient regulatory processes.

- Lobbying for supportive policies: Advocating for policies that support the resource sector creates a more favorable operating environment.

- Detail: Changes in environmental regulations or mining permits can significantly impact the timeline and cost of Canadian resource projects, highlighting the need for effective engagement with policymakers.

Conclusion

Canada's resource sector faces a complex interplay of challenges, requiring sophisticated financial strategies and resilient leadership. By proactively addressing volatile commodity prices, stringent environmental regulations, and global competition, the "Bulldog Banker"—representing strong financial management—plays a pivotal role in the sector’s continued success. Understanding and mitigating these Canada's resource sector challenges is key for ensuring the long-term prosperity of this vital industry. To stay informed on the latest developments and strategies for navigating Canada's resource sector challenges, continue exploring resources dedicated to Canadian financial markets and resource management.

Featured Posts

-

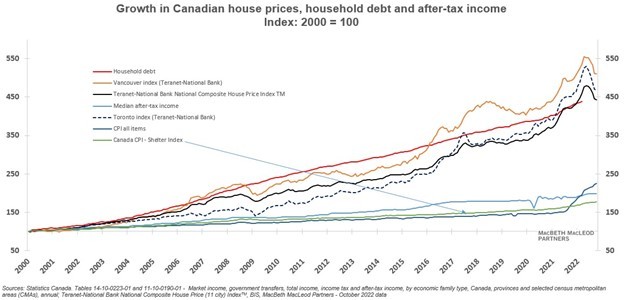

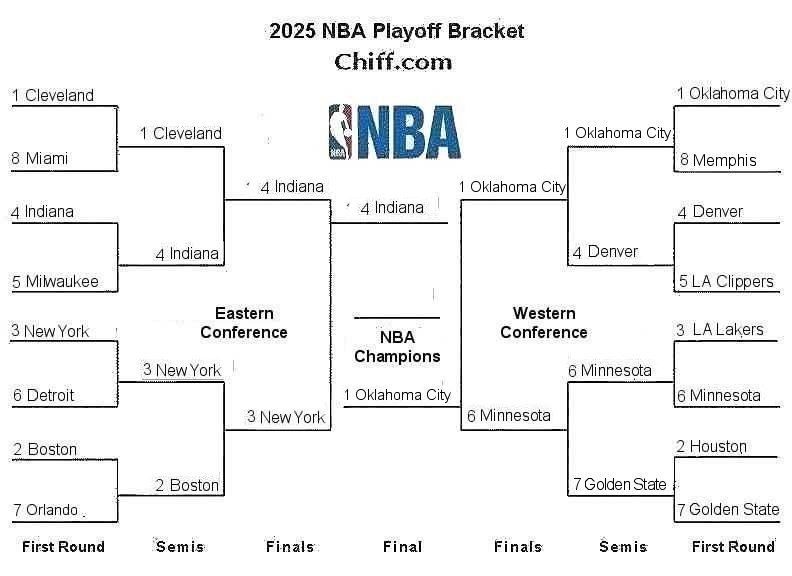

Nba Playoffs 2025 Tatums Clean X Rays After Hard Fall During Game

May 16, 2025

Nba Playoffs 2025 Tatums Clean X Rays After Hard Fall During Game

May 16, 2025 -

Nhl News Ovechkin Ties Gretzkys All Time Goal Record

May 16, 2025

Nhl News Ovechkin Ties Gretzkys All Time Goal Record

May 16, 2025 -

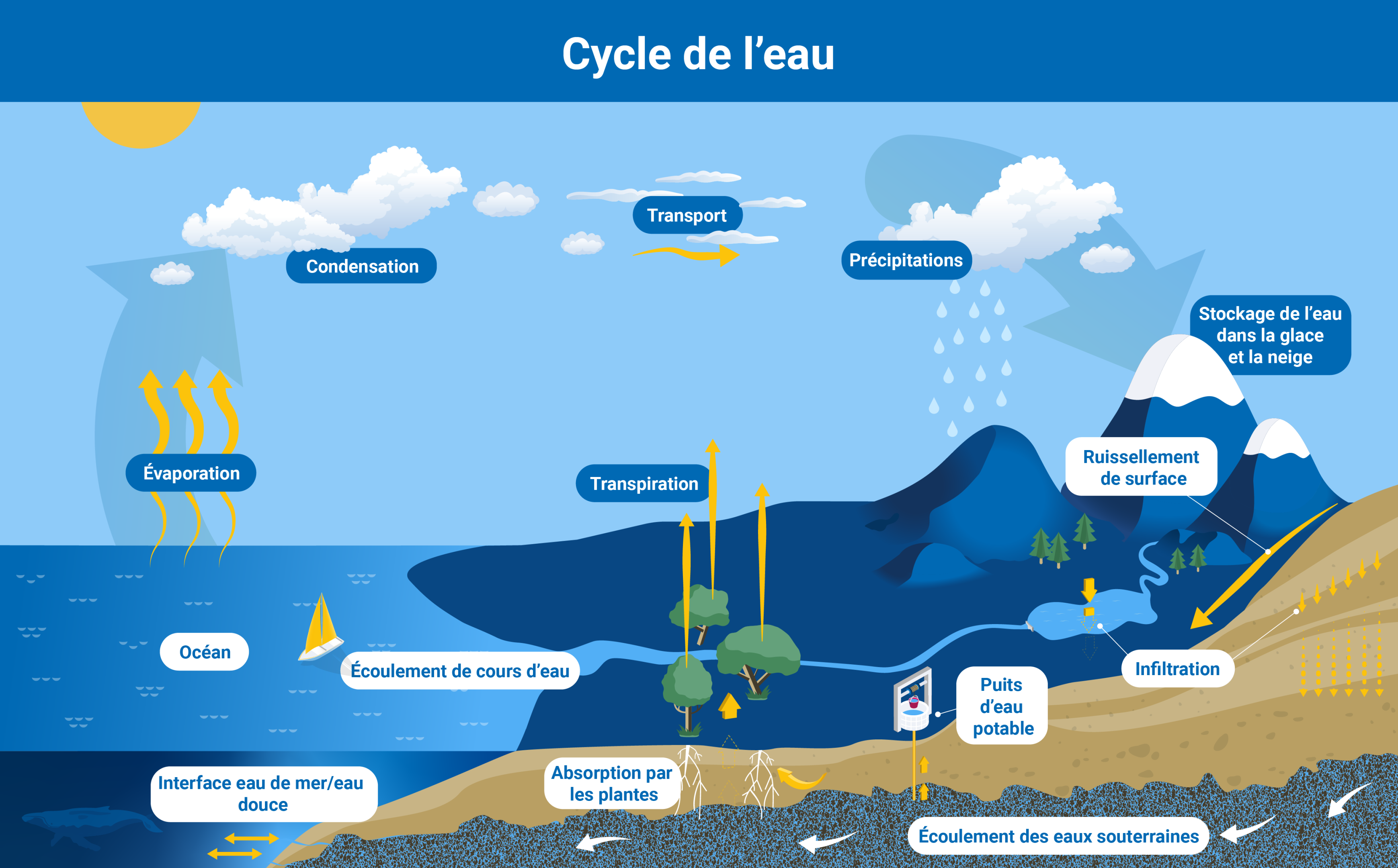

Filtration De L Eau Du Robinet Comment Eliminer Les Polluants Et Ameliorer La Qualite De L Eau

May 16, 2025

Filtration De L Eau Du Robinet Comment Eliminer Les Polluants Et Ameliorer La Qualite De L Eau

May 16, 2025 -

Can Paddy Pimblett Win A Ufc Title A Legends Changed Opinion

May 16, 2025

Can Paddy Pimblett Win A Ufc Title A Legends Changed Opinion

May 16, 2025 -

Real Salt Lake To Face San Jose Earthquakes In Mls Season Opener

May 16, 2025

Real Salt Lake To Face San Jose Earthquakes In Mls Season Opener

May 16, 2025