Bullion's Rise: Examining The Link Between Trade Wars And Gold Prices

Table of Contents

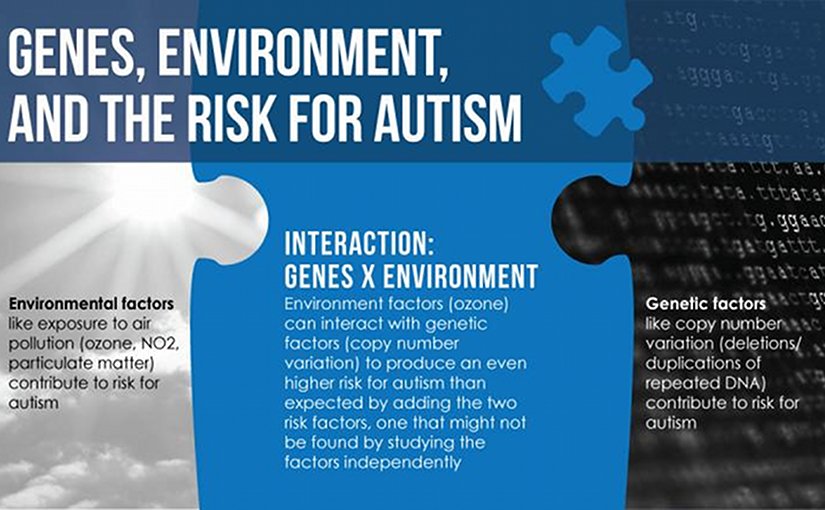

Understanding the Safe-Haven Appeal of Gold (Bullion)

Gold has long been considered a safe-haven asset, a store of value sought during times of economic and political uncertainty. This safe-haven appeal is significantly amplified during periods of heightened trade tensions.

Gold as a Hedge Against Uncertainty

Investors often turn to gold as a hedge against uncertainty because of its:

- Diversification benefits: Gold provides diversification within a portfolio, reducing overall risk. Unlike stocks or bonds, gold's price tends to move independently of traditional asset classes.

- Inflation hedging capabilities: Gold is often seen as a hedge against inflation. During inflationary periods, the purchasing power of fiat currencies declines, while gold tends to retain its value.

- Portfolio protection during geopolitical risk: In times of geopolitical instability, such as trade wars, investors seek the perceived security of tangible assets like gold. This flight to safety drives up demand and, consequently, prices.

Historical data supports this. During previous periods of trade conflict, such as the Smoot-Hawley Tariff Act of 1930, gold prices generally exhibited a positive correlation with escalating trade tensions.

The Psychology of Investment in Times of Trade War

The surge in gold demand during trade wars is also driven by investor psychology. Fear, uncertainty, and doubt (FUD) significantly influence market behavior.

- FUD and market behavior: The uncertainty surrounding the outcome of trade disputes fuels anxiety among investors. This fear often leads to a sell-off in riskier assets and a rush towards safe-haven investments like gold.

- Flight-to-safety phenomena: The flight-to-safety phenomenon describes the mass movement of capital from riskier assets to safer alternatives, particularly during times of crisis. Gold consistently benefits from this phenomenon.

For example, during the 2018-2019 US-China trade war, many investors shifted their portfolios towards gold as a response to the increased market volatility.

How Trade Wars Directly Impact Gold Prices

Trade wars have both direct and indirect effects on bullion prices.

Currency Devaluation and Gold's Price

Trade wars often lead to currency fluctuations. A weakening US dollar, for instance, can boost gold prices.

- Currency depreciation and gold value: Since gold is priced in US dollars, a weaker dollar makes gold more affordable for buyers using other currencies, increasing demand.

- Historical currency movements and gold prices: Examining historical data reveals a correlation between currency depreciation during trade wars and subsequent increases in gold prices. A weakening currency often reflects decreased confidence in a nation's economy, driving investors towards gold.

Increased Market Volatility and Gold Investment

The increased uncertainty associated with trade wars contributes to greater market volatility. This volatility drives investors towards less volatile assets.

- Investor reaction to volatile markets: Investors often seek to mitigate risk by investing in assets perceived as stable during times of market instability.

- Trade war events and gold price impact: Specific trade war events, like the imposition of tariffs or retaliatory measures, often trigger immediate reactions in gold prices, reflecting the uncertainty surrounding future economic conditions.

Alternative Factors Influencing Bullion Prices

While trade wars play a significant role, other factors also impact bullion prices.

Interest Rates and Gold

There is an inverse relationship between interest rates and gold prices.

- Interest rate changes and opportunity cost: Higher interest rates increase the opportunity cost of holding non-interest-bearing assets like gold, potentially decreasing demand. Lower rates make gold more attractive.

Global Economic Growth and Gold Demand

Global economic growth or slowdown also affects gold demand.

- Economic growth and investor confidence: Strong economic growth often boosts investor confidence, leading them to invest in riskier assets, reducing demand for safe-haven assets like gold.

- Economic slowdown and gold's safe-haven appeal: Conversely, economic slowdowns or recessions tend to increase gold's appeal as investors seek safety.

Supply and Demand Dynamics in the Gold Market

Supply and demand dynamics within the gold market itself influence prices.

- Gold mining production: Changes in gold mining production affect the overall supply available in the market.

- Central bank holdings: Central bank purchases or sales of gold can impact prices.

- Jewelry demand: Fluctuations in jewelry demand, particularly from major consuming countries like India and China, also influence gold prices. These factors interact with the effects of trade wars to shape the overall price.

Conclusion

In summary, the rise in bullion prices is often closely linked to escalating trade wars. Gold's safe-haven appeal, amplified by the uncertainty and volatility created by trade disputes, drives investor demand. Currency devaluation resulting from trade wars further contributes to price increases. While other factors such as interest rates, global economic growth, and supply-demand dynamics also influence bullion prices, the impact of trade wars is undeniable. Understanding the correlation between bullion's rise and trade wars is crucial for informed investment decisions. Learn more about protecting your portfolio during times of economic uncertainty and consider consulting a financial advisor to explore the role of bullion in a diversified investment strategy.

Featured Posts

-

Should You Return To A Company That Laid You Off A Practical Guide

Apr 26, 2025

Should You Return To A Company That Laid You Off A Practical Guide

Apr 26, 2025 -

The Impact Of Trump Tariffs Ceo Warnings And Economic Outlook

Apr 26, 2025

The Impact Of Trump Tariffs Ceo Warnings And Economic Outlook

Apr 26, 2025 -

California Now Worlds Fourth Largest Economy An Economic Analysis

Apr 26, 2025

California Now Worlds Fourth Largest Economy An Economic Analysis

Apr 26, 2025 -

Confronting Power The American Battleground And The Worlds Richest

Apr 26, 2025

Confronting Power The American Battleground And The Worlds Richest

Apr 26, 2025 -

Access To Birth Control The Impact Of Over The Counter Availability Post Roe

Apr 26, 2025

Access To Birth Control The Impact Of Over The Counter Availability Post Roe

Apr 26, 2025