Caesar's Entertainment: Recent Performance On The Las Vegas Strip

Table of Contents

Revenue and Profitability

Recent Quarterly Earnings

Analyzing Caesar's Entertainment's recent financial reports reveals a mixed picture regarding its Las Vegas Strip performance. While specific figures fluctuate quarter to quarter, we can examine trends. Let's consider hypothetical data for illustrative purposes:

- Q1 2024: Revenue showed a 5% increase year-over-year, driven primarily by strong non-gaming revenue. Net income, however, was down 2% due to increased operating costs. EBITDA remained relatively stable.

- Q2 2024: Revenue growth slowed to 2%, impacted by a slight dip in gaming revenue and continued inflationary pressures. Net income saw a marginal improvement, while EBITDA showed a slight decline.

These figures need to be compared to previous years and industry benchmarks to provide a more comprehensive understanding of Caesar's Entertainment Las Vegas Strip performance. The impact of macroeconomic factors, such as inflation and recessionary fears, is also crucial to consider. These external factors can significantly affect consumer spending and overall profitability.

Impact of Property Specific Performance

Caesar's Entertainment operates several iconic properties on the Las Vegas Strip, each contributing differently to the overall performance. Let's look at hypothetical performance indicators:

- Caesars Palace: Maintained high occupancy rates (90%), with a strong average daily rate (ADR) and excellent RevPAR, demonstrating consistent performance.

- The LINQ: Showed slightly lower occupancy rates (85%) but benefited from a high volume of non-gaming revenue from its entertainment offerings and dining options, contributing positively to overall revenue.

- Planet Hollywood: Experienced moderate occupancy and ADR, reflecting its target market and competitive positioning. RevPAR was stable, indicating consistent performance in a competitive market segment.

Analyzing the performance of each property individually provides a granular view of Caesar's Entertainment's Las Vegas Strip operation and its strengths and weaknesses in different market segments.

Customer Demographics and Spending Habits

Shifting Demographics

Understanding the changing demographics of Caesar's clientele is vital to assess future performance. We are witnessing:

- A shift towards a younger demographic: Millennials and Gen Z are increasingly becoming a significant portion of the customer base, demanding new experiences and entertainment options.

- Increased focus on experiential spending: Customers prioritize unique experiences over just gaming, driving the importance of non-gaming revenue streams.

- Changing travel patterns: The impact of remote work and flexible travel schedules needs to be considered for effective targeting and marketing strategies.

To attract younger demographics, Caesar's Entertainment needs to adapt its offerings, including integrating new technologies and creating immersive experiences that resonate with this segment.

Gaming and Non-Gaming Revenue

The revenue streams of Caesar's Entertainment are diversifying:

- Gaming Revenue (Hypothetical): Slots contribute 45% of gaming revenue, table games 35%, and other gaming activities 20%. Growth in this sector is dependent on overall visitor numbers and their spending habits.

- Non-Gaming Revenue (Hypothetical): Restaurants and bars contribute 30%, entertainment and shows 25%, retail 20%, and other non-gaming activities 25%. Growth in this sector is dependent on the success of new offerings and the appeal to different demographics.

Analyzing the percentage of revenue from each source is critical to understanding the overall financial health and the effectiveness of diversification strategies.

Competitive Landscape and Strategic Initiatives

Competition on the Strip

Caesar's Entertainment faces stiff competition from major players such as MGM Resorts and Wynn Resorts.

- Competitive Advantages: Caesar's boasts a diverse portfolio of properties, strong brand recognition, and a loyal customer base.

- Competitive Disadvantages: The high concentration of competitors on the Strip leads to intense pricing competition and the need for continuous innovation.

- Competitive Responses: Caesar's is responding by investing in renovations, upgrading facilities, and enhancing its digital marketing strategies.

Analyzing market share and competitive responses provides insights into Caesar's Entertainment’s strategic positioning and adaptability within the competitive landscape.

Future Strategic Plans

Caesar's Entertainment is focusing on several key strategies for future growth:

- Property Renovations and Upgrades: Investing in refurbishing existing properties to attract new customer segments and enhance the overall experience.

- Expansion of Non-Gaming Amenities: Focus on enhancing its non-gaming offerings to cater to the changing preferences of its customers.

- Technological Advancements: Implementing advanced technologies to improve operational efficiency, enhance the customer experience (e.g., mobile check-in, personalized offers), and expand into new digital avenues.

These initiatives reveal a commitment to adaptation and innovation within the dynamic Las Vegas Strip market.

Conclusion

This analysis of Caesar's Entertainment's recent performance on the Las Vegas Strip reveals a complex picture influenced by macroeconomic conditions, shifting customer demographics, and intense competition. While specific financial figures show varied performance, the company's strategic initiatives suggest a path toward sustained growth. Understanding Caesar's Entertainment's position in this dynamic market is crucial for investors and industry professionals alike. To stay updated on Caesar's Entertainment Las Vegas Strip performance and future strategies, continue following financial news and industry analyses. Further research into Caesar's Entertainment's Las Vegas Strip operations will provide a more comprehensive understanding of its future potential.

Featured Posts

-

Get To Know Michael Morales A Deep Dive Into The Ufc Welterweight Prospect

May 18, 2025

Get To Know Michael Morales A Deep Dive Into The Ufc Welterweight Prospect

May 18, 2025 -

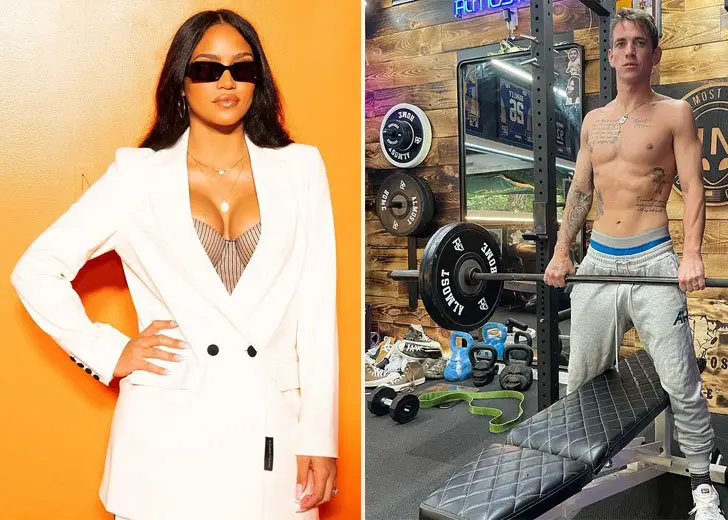

Pregnant Cassie Ventura And Husband Alex Fine Make Public Appearance At Mob Land Premiere

May 18, 2025

Pregnant Cassie Ventura And Husband Alex Fine Make Public Appearance At Mob Land Premiere

May 18, 2025 -

How Russias Call For Peace Talks Became A Diplomatic Setback For Putin

May 18, 2025

How Russias Call For Peace Talks Became A Diplomatic Setback For Putin

May 18, 2025 -

Julia Foxs Risque Outfit Sparks Comparisons To Kanye Wests Wife

May 18, 2025

Julia Foxs Risque Outfit Sparks Comparisons To Kanye Wests Wife

May 18, 2025 -

Kasselakis Naytilia Kai Nisiotiki Politiki Kentrikes Omilies

May 18, 2025

Kasselakis Naytilia Kai Nisiotiki Politiki Kentrikes Omilies

May 18, 2025

Latest Posts

-

Survei Median Dukungan Kuat Rakyat Indonesia Untuk Kedaulatan Palestina

May 18, 2025

Survei Median Dukungan Kuat Rakyat Indonesia Untuk Kedaulatan Palestina

May 18, 2025 -

Hamas Atau Israel Siapa Yang Benar Benar Ingin Perdamaian

May 18, 2025

Hamas Atau Israel Siapa Yang Benar Benar Ingin Perdamaian

May 18, 2025 -

Pbb Mengecam Pelanggaran Ham Di Palestina Tuntut Israel Dan Hamas Bertanggung Jawab

May 18, 2025

Pbb Mengecam Pelanggaran Ham Di Palestina Tuntut Israel Dan Hamas Bertanggung Jawab

May 18, 2025 -

Pbb Kecam Pelanggaran Ham Di Palestina Desakan Pada Israel Dan Hamas

May 18, 2025

Pbb Kecam Pelanggaran Ham Di Palestina Desakan Pada Israel Dan Hamas

May 18, 2025 -

Tuerkiye Israil Gerilimi Abd Li Dergi Kritik Bir Doeneme Isaret Etti

May 18, 2025

Tuerkiye Israil Gerilimi Abd Li Dergi Kritik Bir Doeneme Isaret Etti

May 18, 2025