Can Palantir Reach A Trillion-Dollar Valuation By 2030?

Table of Contents

Palantir's Current Strengths and Growth Potential

Palantir's current success and future potential are built on several key pillars.

Dominating the Government and Defense Sectors

Palantir enjoys a strong foothold in government contracts, particularly within the defense and national security sectors. Palantir Gotham, its platform specifically designed for government agencies, provides critical data integration and analysis capabilities. This dominance stems from:

- Exclusive Partnerships: Palantir has cultivated strong relationships with various government agencies, providing them with vital tools for national security.

- Data Security Expertise: The company's commitment to data security and privacy is paramount in this sensitive sector, giving it a significant competitive advantage.

- Global Geopolitical Landscape: Increasing global instability and defense spending contribute to continued demand for Palantir's services. Future conflicts and the need for enhanced national security measures could significantly boost Palantir's growth in this sector.

This sector, however, isn't without its challenges. Fluctuations in government budgets and shifts in political priorities always present a risk.

Expanding into the Commercial Sector

While initially focused on government clients, Palantir is aggressively pursuing growth in the commercial sector. Palantir Foundry, its commercial platform, offers data integration and analytics capabilities to a wide range of industries. Success in this area depends on:

- Attracting High-Profile Clients: Securing contracts with major corporations across diverse sectors will be crucial for demonstrating Palantir's platform scalability and broad applicability.

- Overcoming Price Sensitivity: The cost of Palantir's services can be substantial. Demonstrating a strong ROI to potential clients is key.

- Effective Marketing and Sales: Aggressive marketing and sales efforts are crucial to increase brand awareness and attract new clients within a highly competitive market.

The commercial sector presents substantial opportunities, but success requires overcoming challenges related to competition, pricing, and market penetration.

Technological Innovation and Future Product Development

Palantir's continuous investment in R&D is another crucial factor. The company is actively exploring and integrating:

- Artificial Intelligence (AI) and Machine Learning (ML): Integrating cutting-edge AI and ML algorithms enhances the capabilities of their platforms, providing clients with more powerful predictive analytics.

- Advanced Data Mining Techniques: Constantly improving data mining techniques allows for more efficient and insightful data analysis.

- Enhanced Software Development: Continuous improvement of their software infrastructure ensures scalability, reliability, and user-friendliness.

This commitment to innovation could pave the way for groundbreaking technological advancements, solidifying Palantir's position in the data analytics market.

Challenges and Risks Hindering Palantir's Trillion-Dollar Goal

Despite its strengths, Palantir faces several significant challenges that could hinder its trillion-dollar ambition.

Intense Competition in the Data Analytics Market

The data analytics market is fiercely competitive. Palantir faces competition from established tech giants such as:

- Amazon Web Services (AWS): AWS offers a comprehensive suite of cloud-based data analytics tools.

- Microsoft Azure: Azure provides similar cloud-based solutions with strong integration with other Microsoft products.

- Google Cloud Platform (GCP): GCP provides competitive data analytics offerings within a broader cloud infrastructure.

Palantir needs to maintain its competitive edge through continuous innovation, strategic partnerships, and a relentless focus on customer needs.

Dependence on Large Government Contracts

A significant portion of Palantir's revenue stems from government contracts. This presents risks, including:

- Budget Cuts: Government budget constraints or shifts in spending priorities could negatively impact Palantir's revenue.

- Political Risk: Changes in government administrations or policy shifts could affect the company's future contracts.

- Competition for Government Contracts: The competition for government contracts is intense, necessitating a continuous effort to maintain and expand its market share.

Diversifying revenue streams beyond government contracts is vital to mitigate these risks.

Valuation Concerns and Market Volatility

Reaching a trillion-dollar valuation depends heavily on maintaining consistent and substantial revenue growth, coupled with favorable investor sentiment. Factors affecting Palantir stock include:

- Market Downturns: General economic downturns can significantly impact investor sentiment and stock valuations.

- Investor Confidence: Maintaining investor confidence requires delivering consistent financial performance and demonstrating a clear path to future growth.

- Competition and Technological Disruption: The emergence of disruptive technologies or new competitors could negatively impact Palantir's valuation.

Achieving a trillion-dollar market capitalization in such a short timeframe requires not only sustained revenue growth but also a consistently positive outlook from investors.

Conclusion: Can Palantir Achieve a Trillion-Dollar Valuation? A Final Verdict

Palantir's journey toward a trillion-dollar valuation by 2030 presents a compelling but challenging prospect. While the company boasts significant strengths, including dominance in the government sector and promising growth in the commercial sphere, coupled with a commitment to technological innovation, it also faces formidable challenges. Intense competition, dependence on government contracts, and market volatility all pose significant risks. While a trillion-dollar valuation by 2030 appears ambitious, Palantir's potential for future growth remains significant. Continued expansion into the commercial sector, successful navigation of geopolitical uncertainties, and consistent technological innovation will be critical. Stay informed about Palantir's valuation and future developments; further research into Palantir's growth trajectory is crucial to understanding its potential. Follow Palantir's progress toward its trillion-dollar ambition. Careful consideration of Palantir investment opportunities is warranted given the inherent risks and rewards.

Featured Posts

-

Overtaym Drama Vegas Golden Nayts Pobezhdaet Minnesotu V Pley Off

May 09, 2025

Overtaym Drama Vegas Golden Nayts Pobezhdaet Minnesotu V Pley Off

May 09, 2025 -

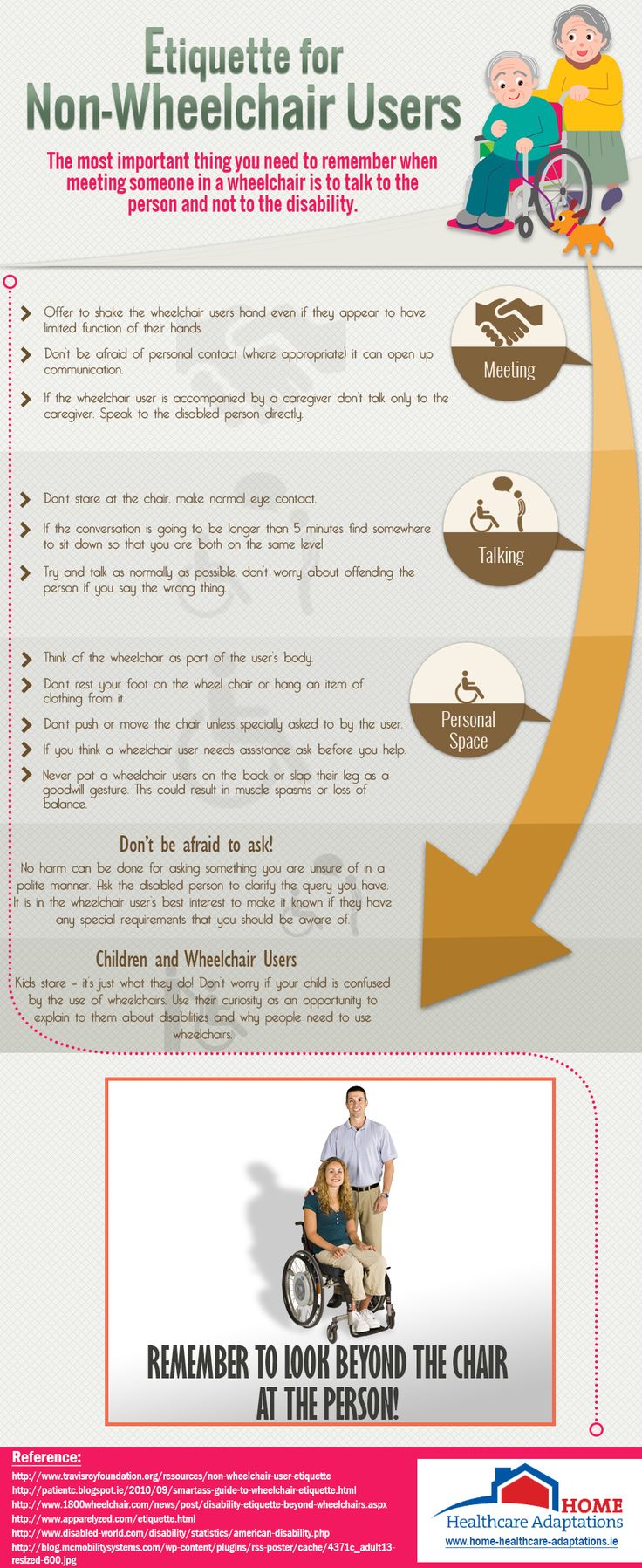

Elizabeth Line Accessibility Navigating Gaps For Wheelchair Users

May 09, 2025

Elizabeth Line Accessibility Navigating Gaps For Wheelchair Users

May 09, 2025 -

New Song Snippet Young Thug Vows To End Cheating

May 09, 2025

New Song Snippet Young Thug Vows To End Cheating

May 09, 2025 -

Draisaitls 100 Point Milestone Leads Oilers To Overtime Victory Against Islanders

May 09, 2025

Draisaitls 100 Point Milestone Leads Oilers To Overtime Victory Against Islanders

May 09, 2025 -

Preview And Prediction Bayern Munichs Clash Against Eintracht Frankfurt

May 09, 2025

Preview And Prediction Bayern Munichs Clash Against Eintracht Frankfurt

May 09, 2025

Latest Posts

-

Skill Development Program For Transgender People In Punjab

May 10, 2025

Skill Development Program For Transgender People In Punjab

May 10, 2025 -

Tragic Fate Of Americas First Nonbinary Person

May 10, 2025

Tragic Fate Of Americas First Nonbinary Person

May 10, 2025 -

Lynk Lee Nhan Sac Rang Ro Tinh Yeu Hanh Phuc Sau Chuyen Gioi

May 10, 2025

Lynk Lee Nhan Sac Rang Ro Tinh Yeu Hanh Phuc Sau Chuyen Gioi

May 10, 2025 -

Technical Training Program Empowers Transgender Community In Punjab

May 10, 2025

Technical Training Program Empowers Transgender Community In Punjab

May 10, 2025 -

Su Lot Xac Ngoan Muc Cua Lynk Lee Sau Chuyen Gioi

May 10, 2025

Su Lot Xac Ngoan Muc Cua Lynk Lee Sau Chuyen Gioi

May 10, 2025