Can Wall Street's Recovery Undermine The DAX's Recent Success?

Table of Contents

The DAX, Germany's leading stock market index, has recently enjoyed a period of strong performance. However, the ongoing recovery of Wall Street, the powerhouse of the US stock market, casts a shadow over this success. The interconnectedness of global markets raises a crucial question: Can the resurgence of Wall Street negatively impact the DAX's recent gains? This article will explore the key factors influencing this dynamic relationship, including global economic factors, investor sentiment, the correlation between the US and German economies, and the potential for capital flight.

<h2>The DAX's Recent Performance and Underlying Factors</h2>

The DAX's recent positive trajectory is fueled by several interconnected factors. Strong corporate earnings, driven by robust global demand for German goods, particularly in the automotive, technology, and industrial goods sectors, are key contributors. Supportive government policies and a generally positive economic climate in Germany have also played a significant role.

- Strong Performers: Companies like Volkswagen, Siemens, and Allianz have reported impressive earnings, bolstering the DAX's overall performance.

- Growth Compared to Other Indices: The DAX has outperformed several other major global indices in recent months, showcasing its resilience and strength. (Specific data points comparing DAX performance to, for example, the S&P 500 or FTSE 100, would be inserted here.)

- Contributing Events: Factors such as the easing of supply chain bottlenecks and increased consumer spending in key export markets have positively impacted German businesses and, consequently, the DAX.

<h2>Wall Street's Recovery and its Global Implications</h2>

Wall Street's recovery is primarily driven by the Federal Reserve's monetary policies, robust corporate earnings, and a surge in investor confidence. However, this recovery has global implications, particularly for the DAX. A strengthening US dollar, a common byproduct of a healthy US economy, can negatively impact German exports, as it makes German goods more expensive for international buyers.

- Key Indicators: The S&P 500 and Dow Jones Industrial Average have shown significant gains, indicating a healthy US economy. (Specific data points showcasing the performance of these indices would be included here.)

- US Economic Data: Positive US economic data, such as strong job growth and declining inflation, contribute to investor confidence and fuel capital inflows into the US market.

- Capital Flow Shifts: A strong US market could attract capital from other regions, including Europe, potentially leading to a decrease in investment in the DAX.

<h2>Correlation Between Wall Street and the DAX: A Historical Perspective</h2>

The DAX and US stock markets exhibit a complex and often intertwined relationship. Historically, periods of strong correlation have been observed, particularly during global crises or periods of significant economic uncertainty where investors seek safe havens. Conversely, periods of divergence have also occurred, driven by factors specific to either the German or US economy.

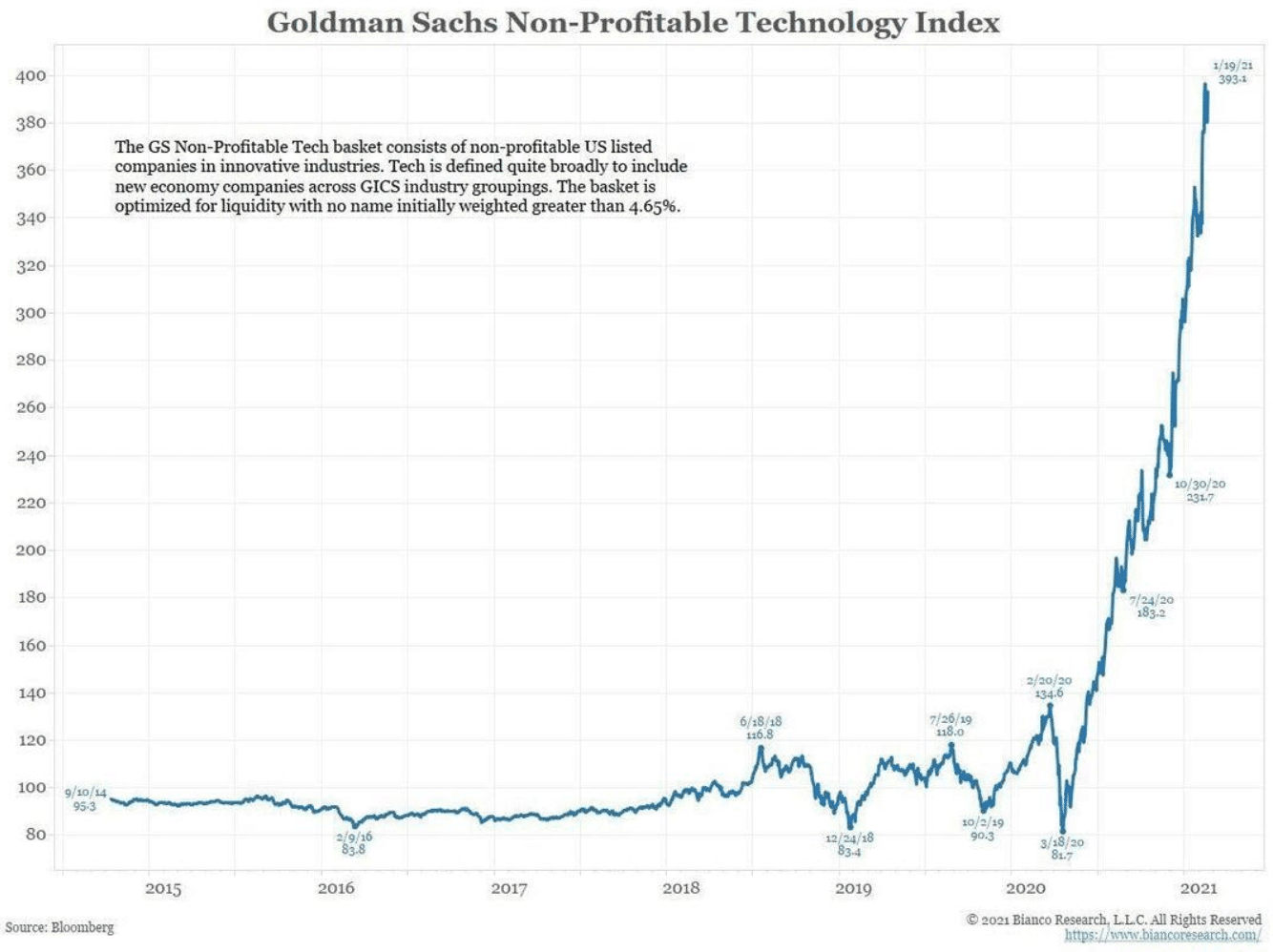

- Historical Correlations: (Charts and graphs illustrating the historical correlation between the DAX and relevant US indices would be inserted here. Analysis should include periods of high and low correlation, with explanations for the divergences.)

- Influencing Factors: Global crises, such as the 2008 financial crisis, tend to increase the correlation between the two markets. Economic cycles, however, can lead to periods of divergence.

- Leading Economic Indicators: Analysis of leading economic indicators, such as manufacturing PMI and consumer confidence, can help predict the future correlation between the two markets.

<h2>Potential Risks and Opportunities for Investors</h2>

The Wall Street recovery presents both risks and opportunities for DAX investors. A potential outflow of capital to the US market could negatively impact DAX performance. However, the strong fundamentals of the German economy and the resilience of certain DAX companies could mitigate these risks.

- Risk Mitigation: Diversification is key. Investors can diversify their portfolios by investing in other asset classes or geographic regions. Hedging strategies can also minimize potential losses.

- Investment Opportunities: Despite the potential risks, the DAX offers attractive investment opportunities for long-term investors. Sectors such as renewable energy and technology present promising avenues for growth.

- Recommendations: Investors should carefully assess their risk tolerance and investment goals before making decisions. A balanced approach, considering both the US and German markets, might be optimal.

<h2>Conclusion: Can Wall Street's Recovery Truly Undermine the DAX's Success?</h2>

The interdependence between Wall Street and the DAX is undeniable. While Wall Street's recovery could pose challenges to the DAX's recent success through factors like currency exchange rates and capital flows, it doesn't automatically guarantee a downturn. The strength of the German economy, coupled with the performance of individual DAX companies, remains a significant factor. To make informed investment decisions, it’s crucial to monitor Wall Street's performance and its impact on the DAX. Carefully assess your DAX investments and stay updated on the correlation between Wall Street and the DAX to navigate this evolving global economic landscape effectively.

Featured Posts

-

Thames Water Executive Compensation A Case Study In Public Outrage

May 24, 2025

Thames Water Executive Compensation A Case Study In Public Outrage

May 24, 2025 -

Billie Jean King Cup Rybakinas Victory Secures Kazakhstans Finals Spot

May 24, 2025

Billie Jean King Cup Rybakinas Victory Secures Kazakhstans Finals Spot

May 24, 2025 -

Pameran Seni Dan Otomotif Porsche Indonesia Classic Art Week 2025

May 24, 2025

Pameran Seni Dan Otomotif Porsche Indonesia Classic Art Week 2025

May 24, 2025 -

Is News Corp An Undervalued Asset A Deeper Look At Its Business Units

May 24, 2025

Is News Corp An Undervalued Asset A Deeper Look At Its Business Units

May 24, 2025 -

Imcd N V Agm All Resolutions Passed By Shareholders

May 24, 2025

Imcd N V Agm All Resolutions Passed By Shareholders

May 24, 2025