Canada And The Global Tariff Ruling: A Posthaste Analysis

Table of Contents

Economic Implications of the Global Tariff Ruling for Canada

The Global Tariff Ruling's economic implications for Canada are multifaceted and potentially severe. The immediate impact is likely to be felt through reduced GDP growth. Preliminary estimates suggest a potential downturn of [insert estimated percentage or range, citing source], primarily due to increased costs associated with imported goods and decreased export demand. Specific industries are particularly vulnerable. For example, the Canadian lumber industry, already facing challenges, will likely experience further strain from potential retaliatory tariffs or decreased demand from affected markets. Similarly, the automotive sector, heavily reliant on international supply chains, could face significant disruptions and increased production costs, potentially impacting job security.

- Increased costs for imported goods: Higher tariff rates directly translate to increased prices for consumers, reducing purchasing power and potentially slowing economic growth.

- Potential job losses in tariff-sensitive sectors: Industries heavily reliant on imports or exports, like manufacturing and agriculture, are particularly vulnerable to job losses due to decreased competitiveness and production cuts.

- Reduced consumer purchasing power: Increased prices for imported goods erode consumer spending, leading to a dampening effect on overall economic activity.

- Impact on inflation and interest rates: The combination of increased import prices and reduced consumer demand could contribute to inflationary pressures, potentially leading to adjustments in interest rates by the Bank of Canada.

We need more detailed data and analysis to accurately gauge the full extent of these impacts. However, the potential consequences highlight the urgency of a comprehensive response.

Canada's Response to the Global Tariff Ruling

The Canadian government has reacted swiftly to the Global Tariff Ruling, issuing statements emphasizing its commitment to defending Canadian businesses and workers. Initial responses have included [insert details of government actions, citing official sources – e.g., press releases, policy announcements]. Furthermore, Canada is exploring potential countermeasures, including retaliatory tariffs on specific imports, while simultaneously engaging in intensive diplomatic efforts to negotiate a resolution through existing international trade agreements like CUSMA/USMCA. These negotiations are crucial for mitigating the negative impacts of the ruling.

- Government statements and press releases: Official communication channels provide valuable insight into the government’s strategy and planned interventions.

- New trade negotiations or initiatives: The government might initiate new trade talks with affected countries to secure better terms or explore new trade partnerships.

- Support programs for affected industries: Financial aid, tax breaks, or other support programs might be implemented to cushion the blow for vulnerable industries.

- Public opinion and political responses: Public sentiment and political discourse surrounding the Global Tariff Ruling will significantly influence the government’s response and policy adjustments.

The success of these responses will depend on both domestic policy and international cooperation.

Long-Term Effects and Future Outlook for Canadian Businesses

The long-term effects of the Global Tariff Ruling will require a significant adaptation by Canadian businesses. While the immediate impacts are likely negative, the situation also presents opportunities for innovation and diversification. Canadian companies must focus on enhancing efficiency, exploring new markets, and strengthening their supply chains. Investment in automation and technology will be crucial for improving competitiveness. This period of uncertainty encourages companies to develop more resilient and adaptable business models.

- Investment strategies for Canadian companies: Strategic investment in technology, automation, and research & development is vital for boosting productivity and competitiveness.

- Supply chain adjustments and diversification: Reducing reliance on single-source suppliers and diversifying supply chains to mitigate future disruptions is critical.

- Opportunities for growth in new sectors: The ruling might inadvertently open up opportunities in sectors less reliant on international trade.

- The role of technology and automation: Implementing technology to optimize processes, improve efficiency, and reduce reliance on imported goods can enhance competitiveness.

Canadian businesses that can adapt quickly and proactively will be best positioned to navigate the long-term consequences of the Global Tariff Ruling.

The Impact on Specific Canadian Industries

The agriculture sector, particularly producers of [mention specific products, e.g., wheat, canola], faces significant challenges due to reduced export demand and increased competition. The manufacturing sector, especially those reliant on imported components, will likely face increased costs and reduced profitability. The technology sector, while potentially less directly affected, could experience indirect consequences through supply chain disruptions. A detailed analysis of each sector's unique vulnerability is crucial for targeted support measures.

Understanding and Adapting to the Global Tariff Ruling in Canada

The Global Tariff Ruling presents significant challenges for the Canadian economy, impacting various sectors and necessitating a comprehensive and adaptable response. The most significant consequences include decreased GDP growth, potential job losses, and inflationary pressures. The Canadian government's proactive measures, including trade negotiations and support programs for affected industries, will be critical in mitigating these effects. Canadian businesses must prioritize innovation, diversification, and supply chain resilience to navigate this evolving landscape.

To stay informed about the ongoing developments and the impact of the Global Tariff Ruling on your business, consult government resources such as [insert links to relevant government websites, e.g., Global Affairs Canada, Innovation, Science and Economic Development Canada] and industry associations relevant to your sector. Proactive adaptation and strategic planning are essential for surviving and thriving in this new environment. Understanding the implications of this Global Tariff Ruling is vital for the long-term health of the Canadian economy.

Featured Posts

-

End Of The World Miley Cyrus Releases New Music Video

May 31, 2025

End Of The World Miley Cyrus Releases New Music Video

May 31, 2025 -

Guelsen Bubikoglu Nun Son Hali Yesilcam Guezeli Hayranlarini Bueyueledi Mine Tugay Dan Da Tepki Geldi

May 31, 2025

Guelsen Bubikoglu Nun Son Hali Yesilcam Guezeli Hayranlarini Bueyueledi Mine Tugay Dan Da Tepki Geldi

May 31, 2025 -

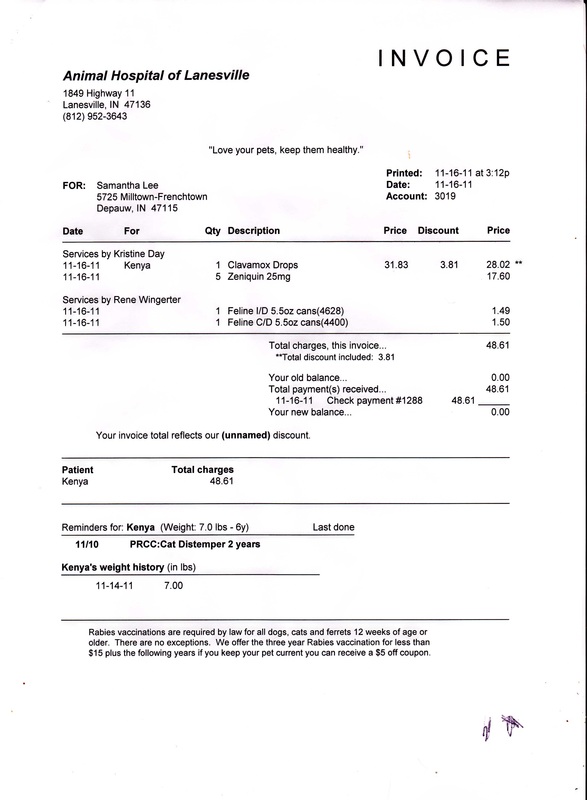

Rising Uk Pet Bills The Impact Of Corporate Veterinary Targets

May 31, 2025

Rising Uk Pet Bills The Impact Of Corporate Veterinary Targets

May 31, 2025 -

Table Tennis Worlds Wang Sun Secure Third Straight Mixed Doubles Gold

May 31, 2025

Table Tennis Worlds Wang Sun Secure Third Straight Mixed Doubles Gold

May 31, 2025 -

Finding A Banksy Your Guide To Next Steps

May 31, 2025

Finding A Banksy Your Guide To Next Steps

May 31, 2025