Canada Maintains Most Tariffs On US Goods, Countering Oxford Analysis

Table of Contents

Specific Canadian Tariffs on US Goods Remain High

Contrary to the Oxford study's findings, several categories of US goods continue to face substantial Canadian import tariffs. Understanding the "tariff rates Canada" applies is crucial for a realistic assessment of Canada-US trade. Examining the "US goods tariffs" levied by Canada reveals a complex picture far removed from free trade. These trade barriers Canada US imposes significantly impact various sectors.

- Dairy Products and Poultry: Canada's supply management system maintains high tariffs and quotas on dairy and poultry imports from the US, resulting in significantly higher prices for American producers and limiting market access. These tariffs represent a major point of contention in Canada-US trade relations.

- Softwood Lumber: The long-standing dispute over softwood lumber tariffs continues to generate friction between the two countries. While there have been periods of negotiated agreements, these tariffs remain a substantial "trade barrier Canada US" businesses face.

- Manufactured Goods: Tariffs on certain manufactured goods, including steel and aluminum, have fluctuated based on various trade agreements and political considerations. However, tariffs in these sectors frequently remain considerably higher than the Oxford study suggested.

- Impact on US Businesses and Consumers: These high "Canadian import tariffs" directly translate to higher prices for American consumers and reduced competitiveness for US businesses in the Canadian market. This restricts market access and limits the potential benefits of free trade.

The Nuances of Canadian Tariff Policy Overlooked by Oxford

The Oxford analysis appears to have overlooked several key nuances within Canada's trade policy, leading to an incomplete and potentially misleading assessment of "Canada's tariffs on US goods." These factors significantly complicate the straightforward narrative of decreasing tariffs.

- Exceptions and Exemptions: The Canadian tariff system includes various exceptions and exemptions that are not always transparent or easily captured in broad-based studies. These complexities were seemingly ignored in the Oxford analysis.

- Supply Management: The role of supply management in sectors like dairy and poultry, which heavily restricts imports, significantly distorts the impact of "tariff rates Canada" reports might suggest. This system adds another layer of non-tariff barriers to market entry for US producers.

- Provincial Regulations: Provincial regulations often add to the overall tariff burden, introducing a level of complexity absent from the Oxford study's methodology. These provincial factors further restrict the flow of goods.

- Non-Tariff Barriers: The study seemingly fails to account for significant non-tariff barriers, such as complex regulatory hurdles and labeling requirements, which add to the overall cost and difficulty for US businesses exporting to Canada.

Economic Impact of Continued Tariffs on Both Countries

The continued presence of significant "Canada's tariffs on US goods" has substantial economic consequences for both nations. The "economic impact of tariffs" extends beyond simple numbers and deeply impacts both countries' businesses and consumers.

- Impact on Specific Industries: Industries in both countries are differentially affected, with some experiencing job losses and decreased profitability due to restricted market access.

- Potential for Retaliatory Measures: The persistence of these tariffs creates the potential for retaliatory measures from the US, escalating trade tensions and further harming economic growth on both sides of the border. A deterioration in "bilateral trade relations" could have significant consequences.

- Long-Term Effects on Trade Relations: The continued application of high tariffs could damage the long-term relationship between the two countries, hindering future opportunities for collaboration and economic integration. This impacts the overall "bilateral trade relations" and the potential for future growth. The "cost of tariffs" for both nations is multifaceted and requires further investigation.

Counterarguments to the Oxford Analysis and Methodology

The Oxford analysis's methodology presents several potential points of contention. Understanding the "Oxford Economics methodology" is vital to critically assess its findings.

- Data Sources and Potential Inaccuracies: The study's reliance on specific data sources may have introduced inaccuracies or biases into its findings. A thorough review of the source data is needed. Analysis of the "trade data analysis" applied is needed to assess the reliability of the findings.

- Oversimplification of the Canadian Tariff Structure: The complexity of the Canadian tariff system, including provincial regulations and supply management programs, was seemingly oversimplified in the Oxford analysis.

- Inadequate Consideration of Non-Tariff Barriers: As previously discussed, the Oxford study's failure to fully account for non-tariff barriers undermines its conclusions regarding the overall trade environment. A more comprehensive evaluation of "research limitations" is needed.

Conclusion: Understanding the Reality of Canada's Tariffs on US Goods

In conclusion, the reality on the ground contradicts the Oxford study's claims of decreasing tariffs. Canada maintains significant tariffs on many US goods, impacting various sectors and carrying substantial economic implications for both countries. Understanding the complexities of "Canada's tariffs on US goods" requires a nuanced approach that considers not only tariff rates but also supply management systems, provincial regulations, and non-tariff barriers. Further investigation into the complexities of Canada-US trade relations is crucial for a more accurate understanding of the true cost and impact of these tariffs. We encourage readers to explore resources from the Canadian government and independent research organizations to gain a deeper insight into Canadian trade policy and the ongoing debate surrounding "Canada maintains tariffs on US goods."

Featured Posts

-

Libraries Under Threat Staff Cuts And Service Reductions

May 19, 2025

Libraries Under Threat Staff Cuts And Service Reductions

May 19, 2025 -

Kypriako Kateynasmos I K Siloma Simaias I Dilosi Toy L Tzoymi

May 19, 2025

Kypriako Kateynasmos I K Siloma Simaias I Dilosi Toy L Tzoymi

May 19, 2025 -

Police Arrest Biological Parents In Dalfsen Amber Alert Case

May 19, 2025

Police Arrest Biological Parents In Dalfsen Amber Alert Case

May 19, 2025 -

Postoje Li Sanse Za Popravak Marka Bosnjaka Kladionice Ga Vide Zadnjeg

May 19, 2025

Postoje Li Sanse Za Popravak Marka Bosnjaka Kladionice Ga Vide Zadnjeg

May 19, 2025 -

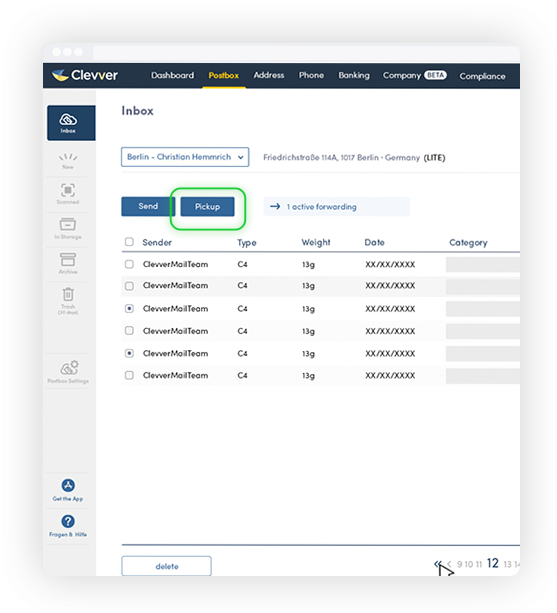

Going Green Royal Mail Introduces Solar Powered Digital Postboxes

May 19, 2025

Going Green Royal Mail Introduces Solar Powered Digital Postboxes

May 19, 2025