Canada's Fiscal Health: How Responsible Spending Can Secure Our Future

Table of Contents

Fiscal health, in the Canadian context, refers to the government's ability to manage its revenues and expenditures effectively to achieve sustainable economic growth and provide essential public services. This involves balancing the budget, managing debt levels responsibly, and ensuring that public funds are allocated efficiently and transparently. Responsible spending is crucial for securing Canada's long-term economic prosperity and social well-being.

The Current State of Canada's Finances

Canada's fiscal outlook is complex. While the country has historically demonstrated fiscal resilience, recent years have presented challenges. We've seen fluctuating budget deficits and surpluses, largely influenced by global economic conditions and government policy decisions. Significant portions of the budget are allocated to key areas: healthcare, education, infrastructure, and various social programs. However, factors like an aging population, the increasing costs associated with climate change mitigation and adaptation, and global economic uncertainties exert significant pressure on the fiscal outlook.

- Current National Debt: As of [Insert most up-to-date figure], Canada's national debt stands at approximately [Insert most up-to-date figure].

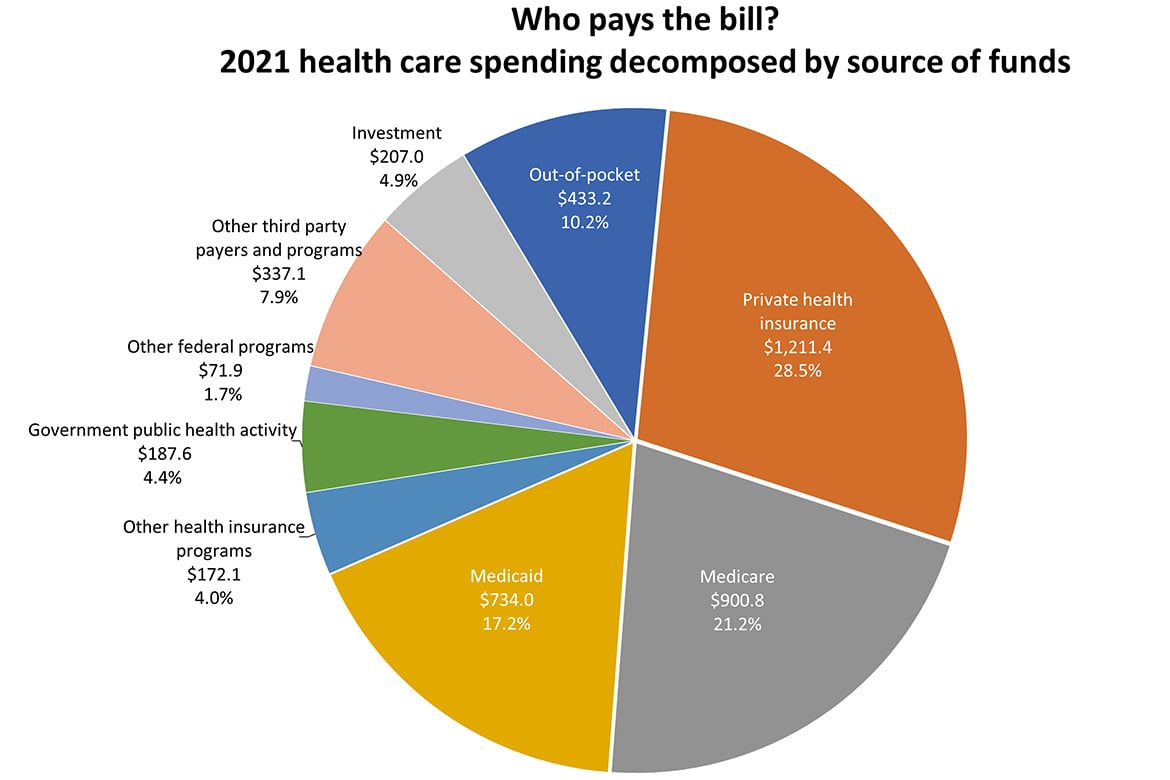

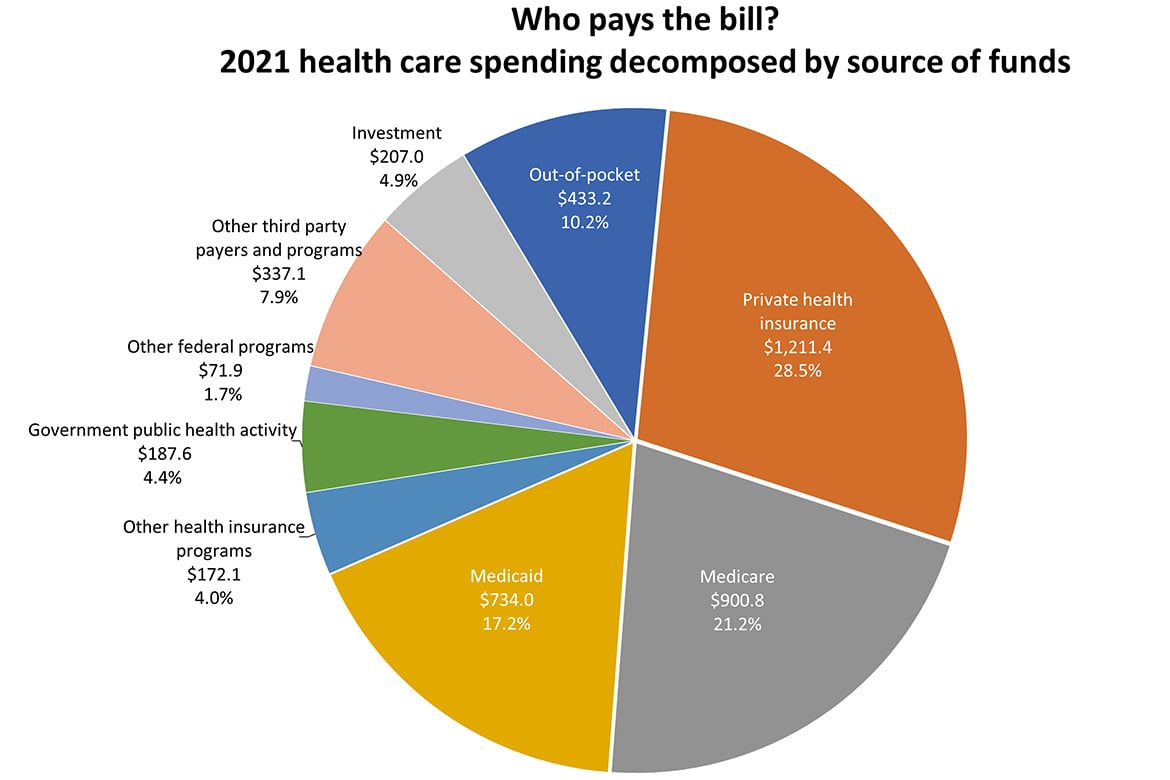

- GDP Allocation: A substantial percentage of Canada's GDP is dedicated to healthcare (approximately [Insert percentage]), education ([Insert percentage]), and social security programs ([Insert percentage]). Infrastructure spending constitutes [Insert percentage].

- Key Economic Challenges: The rising cost of healthcare, climate change-related expenditures, and potential economic downturns pose significant risks to Canada's fiscal health.

The Importance of Responsible Government Spending

Responsible spending is not merely about cutting costs; it's about making strategic investments that drive long-term economic growth and improve the quality of life for Canadians. Investing in infrastructure projects, for example, creates jobs, stimulates economic activity, and improves productivity. Similarly, investments in education and healthcare yield significant returns by creating a more skilled workforce and a healthier population.

- Successful Infrastructure Projects: The construction of the Trans Canada Highway and various provincial highway projects significantly boosted economic activity and facilitated trade.

- Return on Investment: Studies have consistently shown that investments in education and healthcare lead to higher earning potential, increased productivity, and reduced healthcare costs in the long run.

- Risks of Unsustainable Debt: High levels of unsustainable debt can lead to increased interest payments, reduced government spending in other crucial areas, and potentially, a sovereign debt crisis.

Strategies for Promoting Responsible Spending in Canada

Achieving fiscal sustainability requires a multi-pronged approach. This includes carefully considering tax policy and revenue generation, enhancing government efficiency, and prioritizing spending based on societal needs. Tax reforms, such as closing tax loopholes and broadening the tax base, could significantly increase government revenue. Simultaneously, improving government efficiency and reducing administrative costs could free up resources for crucial programs.

- Tax Reforms: Implementing a carbon tax and adjusting corporate tax rates could generate substantial additional revenue.

- Government Efficiency: Streamlining bureaucratic processes, reducing overlapping programs, and leveraging technology can lead to significant cost savings.

- Cost-Saving Initiatives: Adopting best practices from other countries with strong fiscal management records can be beneficial.

- Prioritization Frameworks: Implementing evidence-based decision-making and cost-benefit analyses can help prioritize government spending based on the greatest societal need.

The Role of Citizens in Ensuring Fiscal Responsibility

Informed civic engagement is crucial for ensuring responsible spending. Citizens must actively participate in political discourse, hold elected officials accountable, and demand transparency in government finances. Understanding the budget, participating in public consultations, and voting for candidates who prioritize responsible fiscal management are all vital steps.

- Accessing Budget Documents: Government websites provide detailed information on budget allocations and spending plans.

- Public Consultations: Engage in public consultations to share your views on budget priorities and government spending.

- Voting: Support candidates with a proven track record of fiscal responsibility and sustainable fiscal management.

Conclusion: Securing Canada's Future Through Responsible Spending

Responsible spending is not a luxury; it's a necessity for Canada's long-term economic and social well-being. By implementing strategic tax reforms, improving government efficiency, prioritizing spending based on societal needs, and engaging in informed civic participation, Canada can achieve fiscal sustainability. Citizens have a critical role to play in demanding prudent budgeting and holding their elected officials accountable for responsible fiscal management. Learn more about Canada's budget, participate in discussions about fiscal policy, and demand responsible spending from your elected officials. Let's work together to secure a prosperous future for Canada through sustainable fiscal management and fiscal responsibility.

Featured Posts

-

Ohio Train Derailment Assessing The Long Term Effects Of Toxic Chemical Exposure In Buildings

Apr 24, 2025

Ohio Train Derailment Assessing The Long Term Effects Of Toxic Chemical Exposure In Buildings

Apr 24, 2025 -

Nba 3 Point Contest Herro Triumphs Over Hield In Miami

Apr 24, 2025

Nba 3 Point Contest Herro Triumphs Over Hield In Miami

Apr 24, 2025 -

The Bold And The Beautiful Wednesday April 16 Recap Liams Strange Behavior And Bridgets Stunning Discovery

Apr 24, 2025

The Bold And The Beautiful Wednesday April 16 Recap Liams Strange Behavior And Bridgets Stunning Discovery

Apr 24, 2025 -

Extreme Price Increase For V Mware At And Ts Reaction To Broadcoms Proposal

Apr 24, 2025

Extreme Price Increase For V Mware At And Ts Reaction To Broadcoms Proposal

Apr 24, 2025 -

John Travoltas Miami Steak Dinner A Pulp Fiction Tribute

Apr 24, 2025

John Travoltas Miami Steak Dinner A Pulp Fiction Tribute

Apr 24, 2025