Canadian Dollar Forecast: Minority Government Risk

Table of Contents

Political Instability and its Impact on the Canadian Dollar

Minority governments, by their very nature, often lead to political instability. The need for compromise and the potential for frequent elections introduce a considerable degree of uncertainty into the legislative process. This translates directly into economic uncertainty, impacting the CAD exchange rate. The potential for policy gridlock and unpredictable legislative agendas creates a higher degree of political risk, influencing investor sentiment and, ultimately, the value of the Canadian dollar.

-

Examples of past minority government scenarios and their effects on the CAD: Historical data reveals periods of increased CAD volatility during past minority governments in Canada, particularly when key economic policies faced delays or revisions due to political negotiations.

-

Potential delays or cancellations of key economic policies: Uncertainty surrounding the implementation of crucial fiscal or monetary policies can deter investment and negatively affect the Canadian Dollar Forecast.

-

Increased volatility in the currency markets due to uncertainty: The inherent unpredictability associated with minority governments translates to increased volatility in the foreign exchange market, making it challenging for businesses and individuals to plan effectively. This volatility directly impacts the CAD exchange rate. Understanding this "minority government Canada" context is critical for navigating the currency markets.

Economic Growth Projections Under a Minority Government

Political uncertainty significantly impacts economic growth forecasts. Investor confidence, a key driver of economic activity and the CAD, is particularly sensitive to political instability. A minority government's potential for policy gridlock and unpredictable legislative agendas can erode this confidence.

-

How political instability might affect foreign direct investment (FDI): Businesses are less likely to invest in a country with a high degree of political risk, potentially reducing FDI flows into Canada and negatively influencing the CAD forecast.

-

Potential impact on consumer and business confidence: Uncertainty about future government policies can lead to decreased consumer spending and business investment, further hindering economic growth and putting downward pressure on the Canadian dollar.

-

The relationship between economic growth and the Canadian dollar's value: Strong economic growth typically strengthens a country's currency. Conversely, weak growth is usually associated with currency depreciation. Therefore, the Canadian Dollar Forecast is intrinsically linked to the health of the Canadian economy. The "economic growth Canada" metric is a vital element in any accurate CAD forecast.

Key Sectors Vulnerable to Minority Government Uncertainty

Certain sectors of the Canadian economy are inherently more vulnerable to policy changes and political instability than others. The energy sector, finance, and real estate are particularly sensitive.

-

Specific examples of how policies might affect each sector: Changes in environmental regulations could significantly impact the energy sector; modifications to banking regulations could affect the financial markets; and shifts in housing policies would ripple through the real estate sector.

-

Potential consequences for employment and investment in these sectors: Uncertainty can lead to decreased investment and job losses in these key sectors, indirectly affecting the broader Canadian economy and the CAD.

-

The ripple effect on the broader Canadian economy and the CAD: Negative impacts on these vital sectors have far-reaching implications for the overall Canadian economy, impacting the Canadian Dollar Forecast. The "Canadian economy" is intricately connected to these sectors' performance.

Alternative Scenarios and Potential CAD Outcomes

To fully understand the Canadian Dollar Forecast, it's crucial to consider various potential scenarios arising from different levels of political cooperation and policy outcomes.

-

Scenario 1 (e.g., high cooperation, strong economic growth, positive CAD forecast): If the minority government can effectively navigate political challenges and implement pro-growth policies, investor confidence would likely rise, leading to strong economic growth and an appreciation of the CAD.

-

Scenario 2 (e.g., low cooperation, weak growth, negative CAD forecast): Conversely, a scenario of persistent political gridlock and failed policy initiatives could lead to weak economic growth and a depreciation of the CAD.

-

Quantitative analysis and data to support the different scenarios: Economic modeling and historical data can be used to support these scenarios and provide a more nuanced "CAD exchange rate forecast." A thorough "Canadian dollar prediction" requires careful consideration of these variables.

Understanding the Risks and Preparing for the Future: Your Canadian Dollar Forecast Strategy

In conclusion, the Canadian Dollar Forecast under a minority government presents a complex picture fraught with uncertainty. The potential for political instability, its impact on economic growth, and the resulting effects on specific sectors all contribute to a volatile environment for the CAD. Monitoring political developments and key economic indicators is crucial.

For individuals and businesses, effective strategies include:

- Hedging strategies: Implementing hedging techniques to mitigate the risks associated with CAD fluctuations.

- Diversification: Diversifying investments to minimize exposure to CAD volatility.

Staying informed about the "Canadian Dollar Forecast" is vital. Follow our updates for further analysis and insights into the Canadian currency forecast and CAD outlook, empowering you to navigate this dynamic landscape with confidence. Understanding "Canadian dollar predictions" will allow you to make informed decisions in this uncertain market.

Featured Posts

-

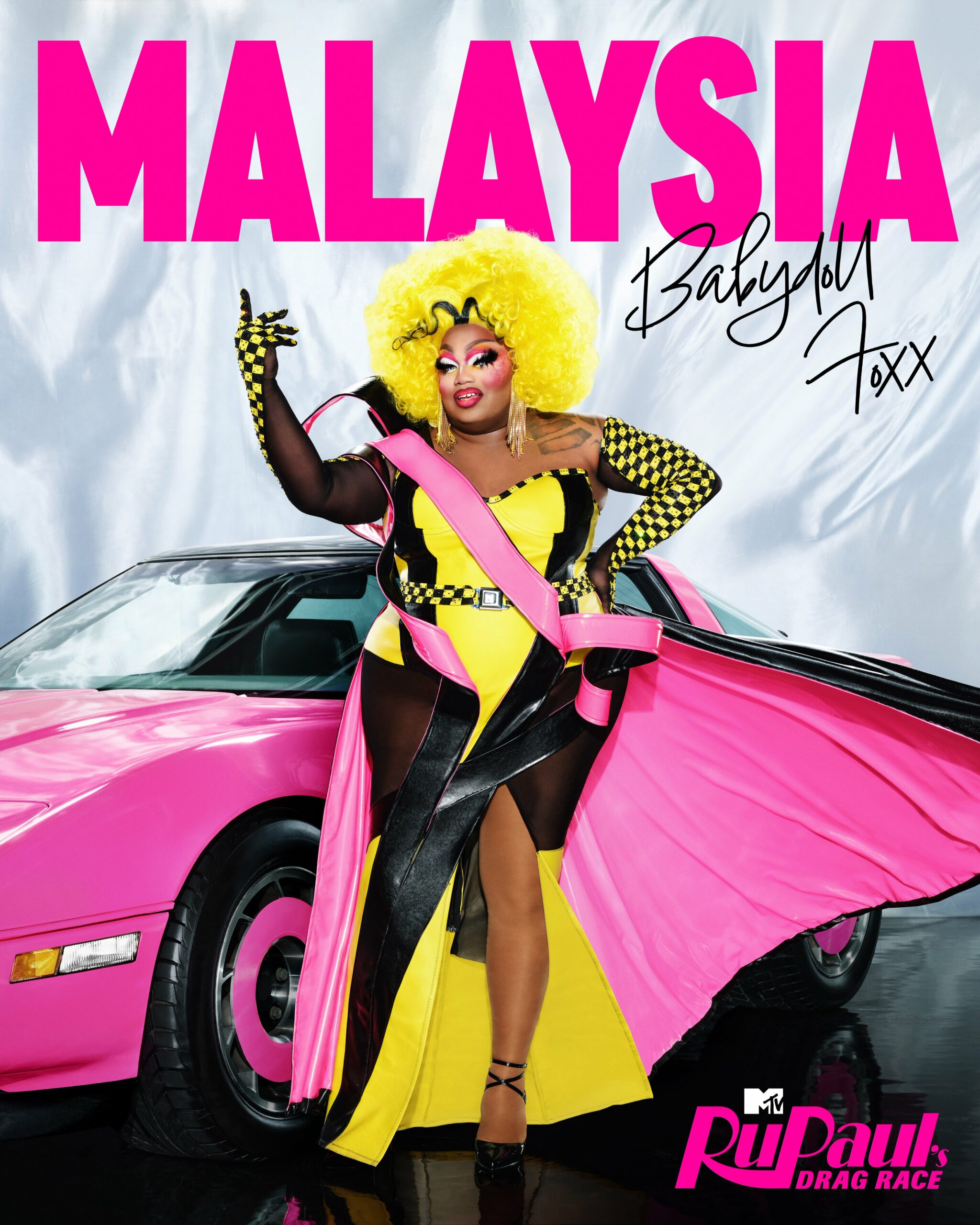

Ru Pauls Drag Race Uncovering An Nba Legends Secret Paternity

Apr 30, 2025

Ru Pauls Drag Race Uncovering An Nba Legends Secret Paternity

Apr 30, 2025 -

State Of Emergency Kentucky Braces For Catastrophic Flooding From Heavy Rainfall

Apr 30, 2025

State Of Emergency Kentucky Braces For Catastrophic Flooding From Heavy Rainfall

Apr 30, 2025 -

Find Untucked Ru Pauls Drag Race Season 17 Episode 6 Free Streaming Guide

Apr 30, 2025

Find Untucked Ru Pauls Drag Race Season 17 Episode 6 Free Streaming Guide

Apr 30, 2025 -

Ryan Coogler Un Reboot De X Files En Preparation

Apr 30, 2025

Ryan Coogler Un Reboot De X Files En Preparation

Apr 30, 2025 -

Hugh Jackmans Easter Movie Back In The Spotlight Netflix Top 10 Success

Apr 30, 2025

Hugh Jackmans Easter Movie Back In The Spotlight Netflix Top 10 Success

Apr 30, 2025