Canadian Dollar Forecast: Minority Government's Impact

Table of Contents

Political Instability and Investor Sentiment

Minority governments are inherently prone to instability. The need for constant negotiation and compromise can lead to unpredictable policy changes and budget difficulties, directly affecting investor sentiment. This uncertainty translates into increased risk for foreign investors considering Canada.

- Increased political risk impacting investor confidence: Frequent shifts in policy can erode investor confidence, leading to capital flight and a weakening Canadian dollar. Uncertainty surrounding future legislation and regulatory changes makes long-term investment planning challenging.

- Potential for gridlock and delayed economic decisions: Reaching consensus on crucial economic policies can be time-consuming, potentially delaying important decisions regarding infrastructure spending, tax reforms, and trade agreements. This delay can negatively impact economic growth and the CAD.

- Volatility in the stock market potentially affecting CAD exchange rates: Political instability often translates to increased stock market volatility. This volatility can indirectly affect the Canadian dollar, as investors react to perceived risk by shifting their investments.

- Difficulty in implementing long-term economic strategies: The short-term nature of minority governments often hinders the implementation of comprehensive long-term economic strategies. Lack of consistent policy direction makes it difficult for businesses to plan for the future, further affecting investment and potentially weakening the CAD.

This political risk directly impacts foreign direct investment (FDI), a crucial factor influencing CAD valuation. Reduced FDI flows can negatively influence the Canadian dollar's exchange rate.

Impact on Key Economic Sectors

Canada's economy is heavily reliant on its natural resources. A minority government's policies significantly influence key sectors, impacting the Canadian dollar forecast.

Energy Sector

The Canadian economy, and by extension the CAD, is significantly tied to the performance of its energy sector.

- Dependence of CAD on energy exports: Oil and gas exports are a major contributor to Canada's GDP and a key driver of the Canadian dollar. Fluctuations in global oil prices directly impact the CAD.

- Government regulations affecting oil production and exports: Government policies on pipelines, environmental regulations, and taxation of oil companies can all influence production levels and export volumes, ultimately affecting the CAD.

- Impact of fluctuating oil prices on the Canadian dollar: A rise in global oil prices generally strengthens the CAD, while a decline weakens it. A minority government's ability to navigate fluctuating oil prices and maintain a stable energy sector is crucial for CAD stability.

- Potential government support for renewable energy influencing the energy sector’s outlook: A shift towards renewable energy sources, while positive for long-term environmental sustainability, can create short-term economic uncertainty in the energy sector, potentially impacting the CAD in the short term.

Natural Resources

Beyond energy, Canada's natural resources—including mining, forestry, and agriculture—play a substantial role in the economy.

- Global demand for natural resources and their influence on the CAD: Global demand for Canadian resources directly influences export revenues and therefore, the CAD.

- Government regulations and environmental policies affecting resource extraction: Environmental regulations and permitting processes can affect the efficiency and profitability of resource extraction, impacting the CAD.

- Impact of trade agreements on resource exports: Trade agreements significantly influence the export of Canadian resources. Uncertainty surrounding trade negotiations under a minority government can create volatility in the CAD.

Fiscal Policy and Interest Rates

A minority government faces challenges in balancing its budget. This directly impacts fiscal policy and, consequently, interest rates set by the Bank of Canada (BoC).

- Minority government's challenges in balancing budget deficits: Negotiating budget compromises can lead to difficulties in controlling government spending and deficits. Large deficits can negatively affect investor confidence and weaken the CAD.

- The BoC's response to economic uncertainty and inflation: The BoC responds to economic conditions by adjusting interest rates. Political uncertainty and potential fiscal mismanagement can force the BoC to raise interest rates to combat inflation, potentially harming economic growth and the CAD.

- Impact of interest rate changes on the CAD value: Higher interest rates generally attract foreign investment, strengthening the CAD. Conversely, lower rates can weaken the currency.

- Potential for increased government debt affecting investor confidence in the CAD: Increased government debt due to budget deficits can erode investor confidence, leading to a weaker CAD.

Trade Relations and Global Economic Factors

Canada's economic health is intertwined with global economic conditions and its trade relationships, particularly with the United States.

- Influence of the US dollar on the CAD exchange rate: The Canadian dollar is closely linked to the US dollar. Fluctuations in the USD directly impact the CAD.

- Impact of global economic growth or recession on the Canadian economy and currency: Global economic downturns can negatively impact Canadian exports and weaken the CAD.

- Potential trade disputes affecting Canadian exports and the CAD: Trade disputes with major trading partners can disrupt exports and negatively impact the CAD. The stability of trade agreements like CUSMA (Canada-United States-Mexico Agreement) is crucial for the Canadian dollar forecast.

Conclusion

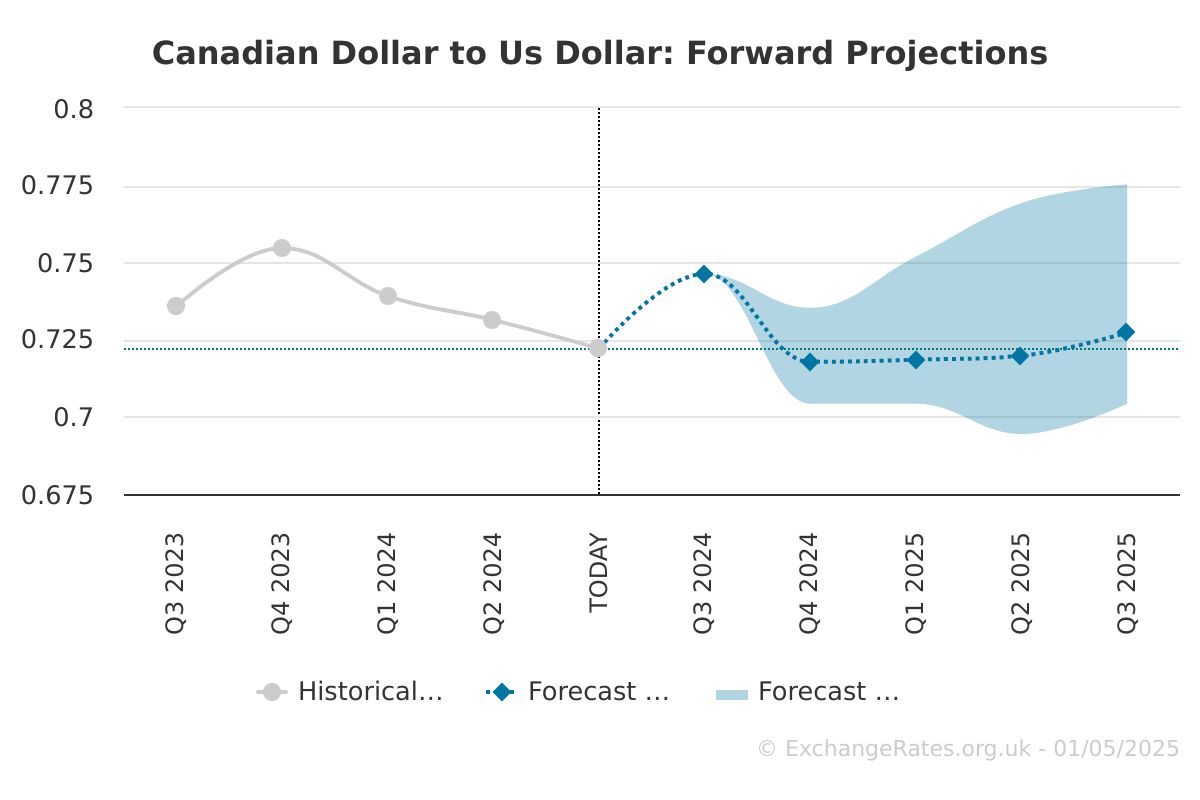

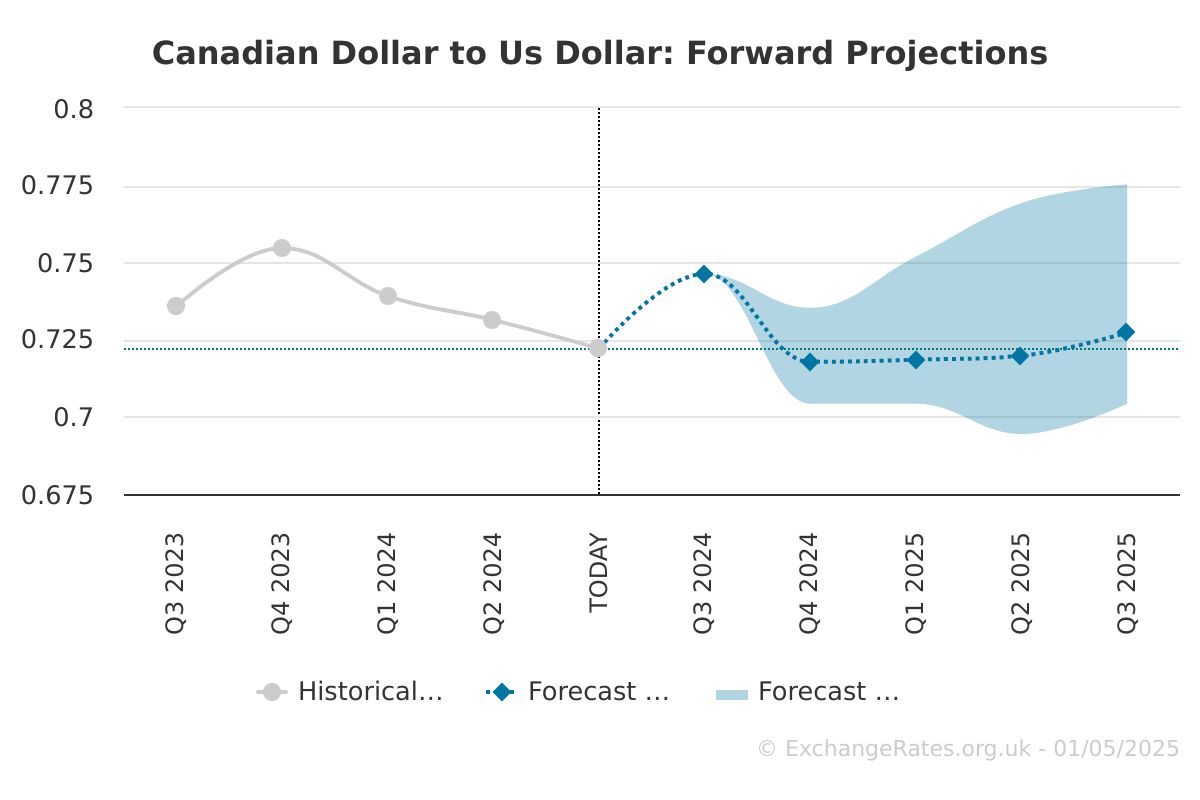

The Canadian dollar forecast under a minority government presents a complex picture. While the inherent political instability can create volatility, the resilience of the Canadian economy and the Bank of Canada’s actions will play a crucial role in determining the CAD's future value. Closely monitoring key economic indicators, such as interest rates, oil prices, and investor sentiment, is crucial for navigating this uncertain environment. Stay informed about the latest developments in Canadian politics and economics to make sound decisions related to your Canadian dollar forecast and trading strategies. Understanding the nuances of the Canadian Dollar Forecast is key to making informed financial choices.

Featured Posts

-

Italy Vs France Duponts Impact In Frances Win

May 01, 2025

Italy Vs France Duponts Impact In Frances Win

May 01, 2025 -

Celtics Defeat Cavaliers 4 Key Takeaways From Derrick Whites Stellar Performance

May 01, 2025

Celtics Defeat Cavaliers 4 Key Takeaways From Derrick Whites Stellar Performance

May 01, 2025 -

Priscilla Pointer Amy Irvings Mother And Actress In Carrie Dead At 100

May 01, 2025

Priscilla Pointer Amy Irvings Mother And Actress In Carrie Dead At 100

May 01, 2025 -

000 Euro Di Risarcimento Per Becciu La Decisione Del Tribunale

May 01, 2025

000 Euro Di Risarcimento Per Becciu La Decisione Del Tribunale

May 01, 2025 -

A New X Files Era Gillian Anderson And Chris Carter On A Ryan Coogler Project

May 01, 2025

A New X Files Era Gillian Anderson And Chris Carter On A Ryan Coogler Project

May 01, 2025