Canadian Dollar Overvalued: Economists Urge Swift Action

Table of Contents

Factors Contributing to Canadian Dollar Overvaluation

Several interconnected factors are driving the current debate around a potentially overvalued Canadian dollar. Understanding these is crucial to addressing the issue effectively.

High Commodity Prices and Exports

Canada's robust export sector, heavily reliant on commodities like oil and lumber, significantly impacts the CAD's value. High global demand for these resources inflates their prices, leading to increased Canadian dollar earnings.

- Increased demand for Canadian oil, driven by global energy needs, pushes up the price of oil, strengthening the CAD. The West Texas Intermediate (WTI) crude oil price index, for example, directly influences the CAD's value.

- Similarly, strong demand for Canadian lumber, particularly in the US housing market, contributes to higher export revenues, further strengthening the CAD. Monitoring indices like the Random Lengths Lumber Futures Contract helps gauge this impact.

- These high commodity prices attract foreign investment, increasing demand for the Canadian dollar and strengthening its value against other currencies.

Interest Rate Differentials

The Bank of Canada's monetary policy decisions play a critical role in influencing the CAD's exchange rate. Higher interest rates in Canada compared to other major economies, such as the US and Eurozone, attract foreign investment seeking higher returns.

- The Bank of Canada's recent interest rate hikes, aimed at curbing inflation, have made the CAD more attractive to international investors. This increased demand strengthens the currency.

- A comparison of Canadian interest rates with those in the US (Federal Funds Rate) and the Eurozone (ECB deposit facility rate) clearly demonstrates the relative attractiveness of Canadian investments.

- This inflow of foreign capital increases the demand for Canadian dollars, pushing its value upwards.

Safe Haven Status

The Canadian dollar often benefits from its perceived status as a relatively safe haven currency during periods of global economic uncertainty or geopolitical instability.

- Investors often seek refuge in stable currencies like the CAD during times of market volatility, increasing demand and strengthening its value.

- Geopolitical events, such as international conflicts or political instability, can trigger a flight to safety, pushing up the value of the CAD.

- This "safe haven" effect adds to the upward pressure on the Canadian dollar, potentially exacerbating the overvaluation issue.

Economic Consequences of an Overvalued Canadian Dollar

An overvalued CAD, while appearing beneficial at first glance, has several detrimental consequences for the Canadian economy.

Impact on Exports

An overvalued CAD makes Canadian goods and services more expensive for international buyers, significantly reducing their competitiveness in the global marketplace.

- Canadian manufacturers, particularly those exporting to the US, face a significant challenge as their products become less price-competitive.

- This reduced competitiveness can lead to decreased export volumes, impacting revenues and potentially leading to job losses across various sectors, including manufacturing and agriculture.

- A weaker CAD, conversely, would boost export competitiveness, stimulating economic growth.

Inflationary Pressures

While a strong CAD can lead to lower import prices, potentially reducing inflationary pressures, the impact is complex and not always straightforward.

- Cheaper imports can indeed lower the cost of goods and services for Canadian consumers, but this effect is often offset by other factors.

- The impact of cheaper imports on overall inflation depends on various other economic factors, including supply chain disruptions and domestic demand.

- An overvalued CAD could lead to a situation where imported inflation is negated by the lower prices of imports, creating a complex interplay of economic forces.

Impact on Tourism

An overvalued CAD discourages foreign tourism, impacting various industries reliant on tourist spending.

- International travelers find it more expensive to visit Canada when the CAD is strong, leading to a reduction in tourist arrivals.

- This decreased tourism negatively affects businesses in the hospitality sector, such as hotels, restaurants, and tour operators, leading to potential revenue losses and job reductions.

- A weaker CAD would make Canada a more attractive and affordable destination for international tourists, boosting the tourism sector.

Economists' Proposed Solutions and Urgent Actions

Addressing the potential overvaluation of the Canadian dollar requires a multi-pronged approach involving monetary and fiscal policy adjustments, as well as long-term economic diversification.

Monetary Policy Adjustments

The Bank of Canada might consider adjusting interest rates to weaken the CAD, although this carries both risks and benefits.

- Lowering interest rates could reduce the attractiveness of Canadian investments, potentially weakening the CAD. However, this could also fuel inflation.

- Economists hold differing views on the efficacy and risks associated with this approach, highlighting the complexities involved in managing the CAD's value.

- Careful consideration of the potential inflationary consequences is crucial before implementing any interest rate adjustments.

Fiscal Policy Interventions

Government interventions, such as tax incentives or subsidies for specific export-oriented industries, could help mitigate the negative impacts of the strong CAD.

- Targeted government support for struggling sectors can help them remain competitive in the global market, despite the strong CAD.

- These interventions could include tax breaks, subsidies, or other forms of financial assistance aimed at bolstering export competitiveness.

- However, the effectiveness and potential unintended consequences of such interventions need careful evaluation.

Diversification of the Economy

Reducing Canada's reliance on commodities and diversifying the economy is a long-term strategy crucial for mitigating the risks associated with fluctuations in commodity prices and the CAD's value.

- Investments in innovation and technology, along with support for high-growth sectors, are vital to building a more resilient and diversified economy.

- This diversification would reduce the vulnerability of the Canadian economy to swings in commodity prices and consequently to fluctuations in the CAD's exchange rate.

- Developing a robust and diversified economy is key to long-term economic health and stability.

Conclusion: Addressing the Overvalued Canadian Dollar – A Call to Action

The factors contributing to the perceived overvaluation of the Canadian dollar – high commodity prices, interest rate differentials, and its safe-haven status – are causing significant economic consequences, including reduced export competitiveness, complex inflationary pressures, and a negative impact on tourism. Economists urge swift action, including monetary policy adjustments, fiscal policy interventions, and long-term economic diversification strategies to manage the CAD's value and ensure the overall health of the Canadian economy. We encourage readers to engage in the discussion, contact their elected representatives, and follow further developments in economic policy to ensure a sustainable and robust Canadian economy. Understanding how to manage the CAD's value effectively is crucial for Canada's future prosperity. For more information, consult resources from the Bank of Canada and Statistics Canada.

Featured Posts

-

Actor Reveals Surprising Thoughts On Popular Rogue One Character

May 08, 2025

Actor Reveals Surprising Thoughts On Popular Rogue One Character

May 08, 2025 -

Toronto Real Estate Market Update Sales Down 23 Prices Dip 4

May 08, 2025

Toronto Real Estate Market Update Sales Down 23 Prices Dip 4

May 08, 2025 -

Este Betis Historico Analisis De Una Temporada Epica

May 08, 2025

Este Betis Historico Analisis De Una Temporada Epica

May 08, 2025 -

The Conclave Begins Electing The Next Pope

May 08, 2025

The Conclave Begins Electing The Next Pope

May 08, 2025 -

De Andre Jordans Milestone A Historic Game For The Nuggets

May 08, 2025

De Andre Jordans Milestone A Historic Game For The Nuggets

May 08, 2025

Latest Posts

-

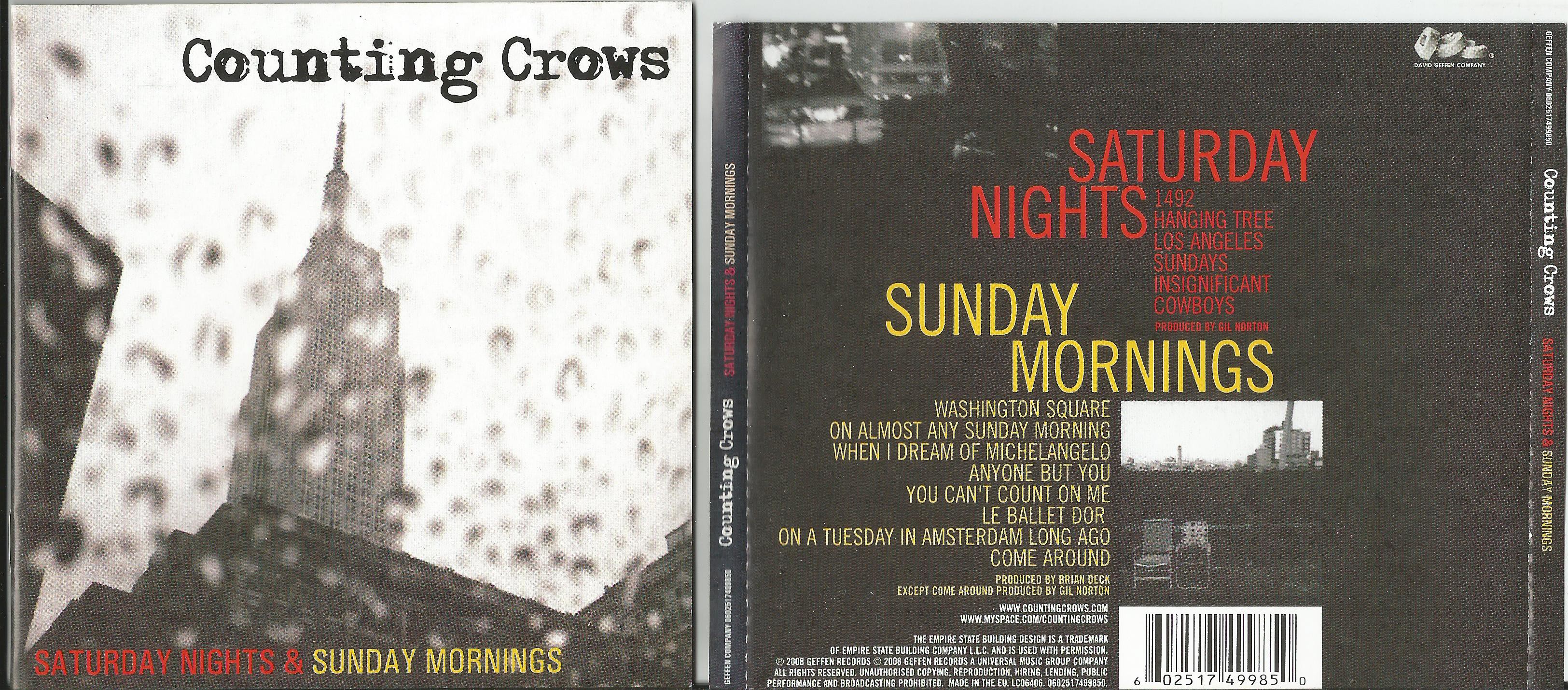

Saturday Night Live And Counting Crows A Career Defining Moment

May 08, 2025

Saturday Night Live And Counting Crows A Career Defining Moment

May 08, 2025 -

The Unexpected Rise Of Counting Crows After Saturday Night Live

May 08, 2025

The Unexpected Rise Of Counting Crows After Saturday Night Live

May 08, 2025 -

Counting Crows The Saturday Night Live Effect

May 08, 2025

Counting Crows The Saturday Night Live Effect

May 08, 2025 -

Saturday Night Live And Counting Crows A Defining Moment

May 08, 2025

Saturday Night Live And Counting Crows A Defining Moment

May 08, 2025 -

The Unexpected Rise Of Counting Crows The Snl Factor

May 08, 2025

The Unexpected Rise Of Counting Crows The Snl Factor

May 08, 2025