Canadian Homebuyers Hesitant Amidst Recession Fears: New BMO Data

Table of Contents

Rising Interest Rates Dampen Buyer Confidence

The most significant factor impacting Canadian homebuyers is the sharp increase in interest rates. This has a dual effect: directly impacting affordability and negatively affecting buyer sentiment.

Impact of increased borrowing costs on affordability

- Increased Mortgage Payments: Higher interest rates translate directly into significantly larger monthly mortgage payments. A modest increase in rates can add hundreds, even thousands, of dollars to a buyer's monthly expenses, dramatically reducing affordability. For example, according to recent BMO reports, a 1% increase in mortgage rates can lead to a X% increase in monthly payments for a typical Canadian mortgage. This is exacerbating the existing housing market affordability crisis.

- Reduced Purchasing Power: With higher interest rates, potential buyers can afford less expensive homes, effectively shrinking their pool of viable options. This limits choices and reduces the overall number of transactions.

- Strain on household budgets: The increased cost of borrowing affects not only mortgages but also other forms of debt, putting a strain on household budgets and making homeownership seem less attainable.

Psychological impact of rising rates on buyer sentiment

Rising interest rates are not just a financial hurdle; they also significantly impact buyer sentiment.

- Decreased Confidence: The rapid increase in interest rates has eroded consumer confidence, leaving many potential buyers feeling uncertain about the future economic climate.

- Increased Uncertainty: Concerns about job security, inflation, and potential economic downturn are fueling hesitation among those considering a significant financial commitment like a mortgage. This uncertainty makes buyers more risk-averse and less likely to enter the market.

- Waiting for Market Corrections: Some potential buyers are adopting a "wait-and-see" approach, hoping for a market correction that could bring down home prices or interest rates.

Recessionary Fears Fueling Caution

Beyond rising interest rates, the looming threat of a recession is further dampening the enthusiasm of Canadian homebuyers.

Job security concerns and their influence on purchasing decisions

- Fear of Job Loss: The prospect of job loss or reduced income is a major deterrent for potential homebuyers. With a mortgage representing a significant long-term financial commitment, the fear of losing income makes many hesitate to take the plunge.

- Increased Risk Aversion: In uncertain economic times, risk aversion increases. Buying a home is a substantial financial risk, and the fear of economic instability makes many Canadians more cautious.

- Impact on Employment Rate: Reports of slowing economic growth and potential job losses impact buyer confidence and reduce the number of individuals who feel financially secure enough to purchase a home.

Impact of potential wage stagnation or decline on purchasing power

Even if job security isn't a direct concern, the impact of inflation and potential wage stagnation or decline significantly reduces purchasing power.

- Inflationary Pressures: Rising inflation erodes the value of savings, making it harder to save for a down payment and reducing the overall affordability of homes.

- Wage Growth Lagging Inflation: When wage growth lags behind inflation, potential buyers' real income decreases, making it even more challenging to afford a home.

- Reduced Disposable Income: Higher prices for essential goods and services reduce disposable income, making it difficult to save for a down payment or manage increased mortgage payments.

Inventory Levels and Pricing Dynamics

The interplay of housing inventory levels and price fluctuations further contributes to the hesitation among Canadian homebuyers.

Analysis of current inventory levels and their effect on buyer behavior

- Limited Inventory: Depending on the region, inventory levels may be relatively low, giving sellers more leverage and potentially pushing prices up. This can make buyers feel pressured to make quick decisions or even overpay.

- Market Supply and Demand: The balance between housing supply and demand directly impacts prices and buyer behavior. A shortage of homes for sale can lead to bidding wars and higher prices.

- Negotiating Power: In a buyer’s market with high inventory, buyers have greater negotiating power; however, a seller's market with low inventory puts buyers at a disadvantage.

Price fluctuations and their role in buyer hesitation

- Home Price Fluctuations: Uncertainty about future home price movements can cause buyers to hesitate. Will prices continue to rise, fall, or stagnate? This uncertainty makes it difficult to make a confident purchasing decision.

- Market Volatility: Volatile market conditions, characterized by unpredictable price swings, make potential buyers more hesitant.

- Real Estate Market Trends: Careful observation of real estate market trends, including price changes, sales volumes, and inventory levels, is essential for informed decision-making among Canadian homebuyers.

Conclusion

In summary, the hesitation among Canadian homebuyers is a complex issue driven by a combination of factors: rising interest rates significantly impacting affordability and buyer sentiment, recessionary fears fueling caution about job security and future income, and fluctuating inventory levels and prices creating uncertainty. Understanding these interconnected elements is crucial for navigating the current market.

Stay informed about the latest trends affecting Canadian homebuyers. For more detailed information, refer to recent reports from BMO and other reputable sources analyzing the Canadian housing market. Understanding the current climate for Canadian homebuyers is crucial for making informed decisions in this dynamic market.

Featured Posts

-

Omar Khans Comments On Wide Receiver George Pickens And His Steelers Future

May 07, 2025

Omar Khans Comments On Wide Receiver George Pickens And His Steelers Future

May 07, 2025 -

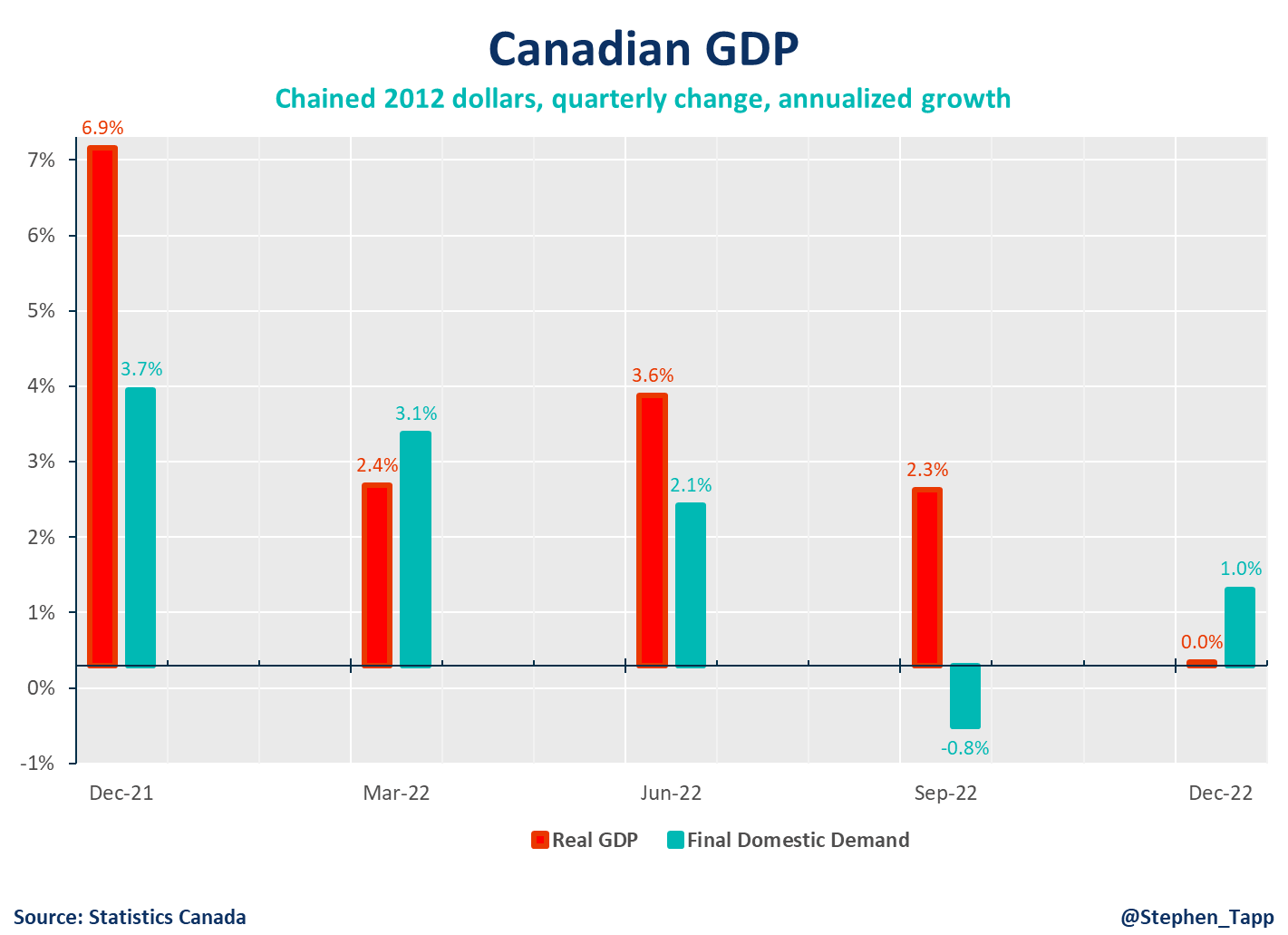

Ssc Chsl 2025 Final Result Declaration And Scorecard Download

May 07, 2025

Ssc Chsl 2025 Final Result Declaration And Scorecard Download

May 07, 2025 -

The Young And The Restless February 11th Recap Nicks Confrontation With Victor

May 07, 2025

The Young And The Restless February 11th Recap Nicks Confrontation With Victor

May 07, 2025 -

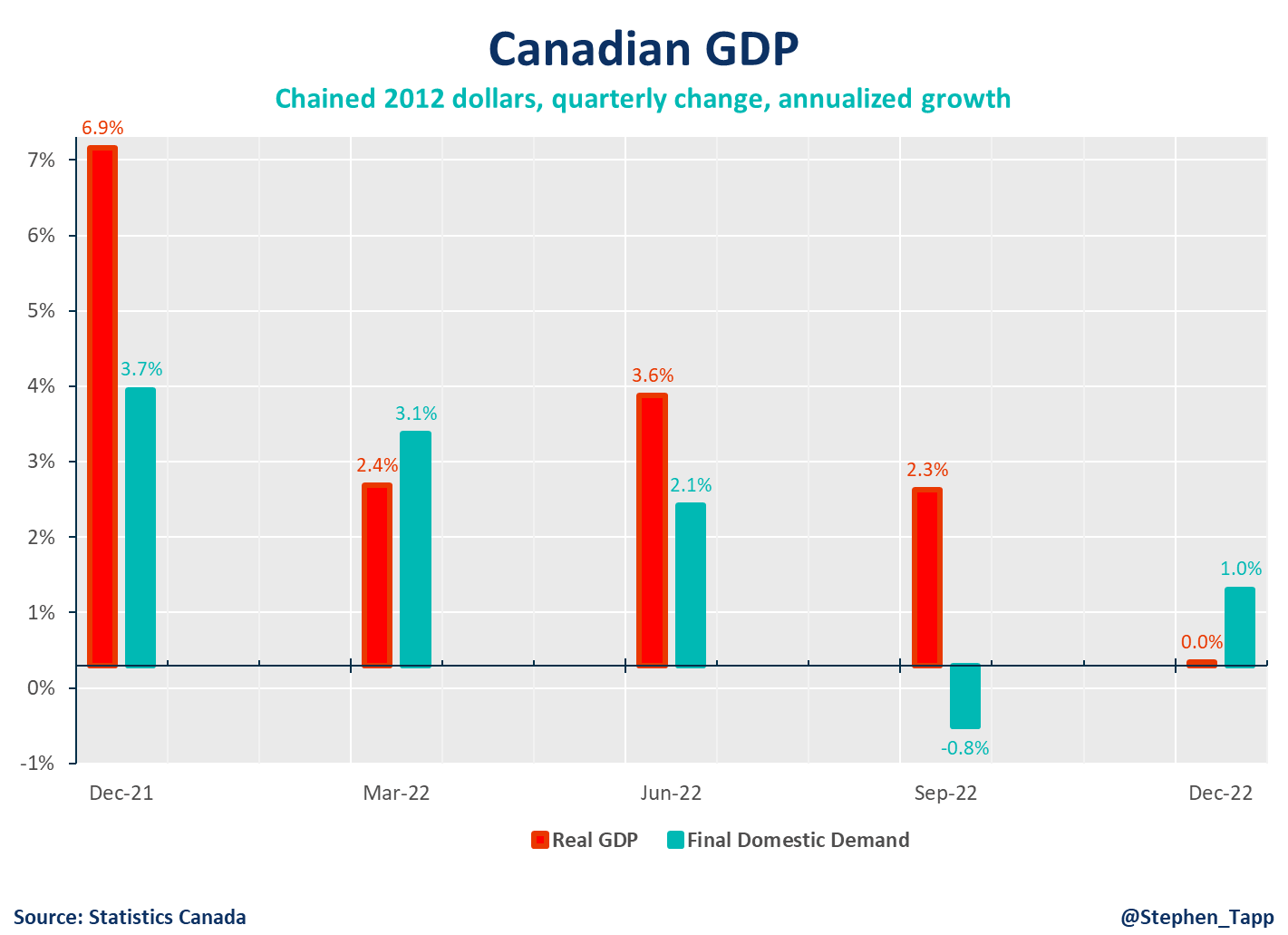

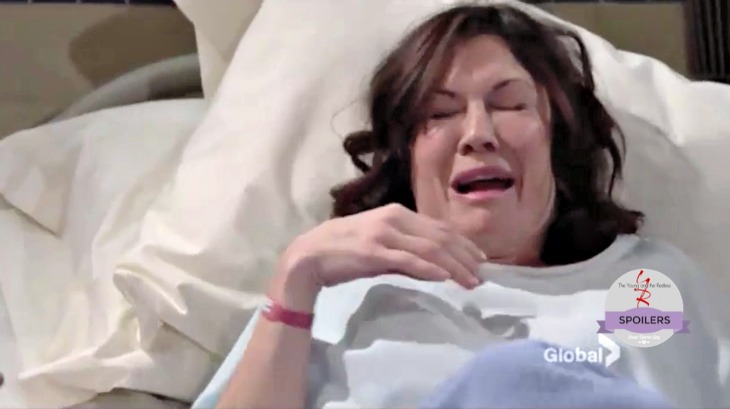

Ontarios Upcoming Budget Expanded Manufacturing Tax Credit Detailed

May 07, 2025

Ontarios Upcoming Budget Expanded Manufacturing Tax Credit Detailed

May 07, 2025 -

Prioritizing Marriage Learning From Ayesha Currys Perspective

May 07, 2025

Prioritizing Marriage Learning From Ayesha Currys Perspective

May 07, 2025